Stablecoins have become a foundational element of DeFi, offering users the ability to transact, save, and earn yield without exposure to the volatility of traditional cryptocurrencies. Yet not all stablecoins are created equal when it comes to passing value back to holders. On-chain stablecoins like USPD are pioneering a new model by distributing staking rewards directly to users, creating a transparent and sustainable yield mechanism that stands apart from conventional interest-bearing stablecoins.

USPD’s Model: Turning Staked ETH Into Stablecoin Rewards

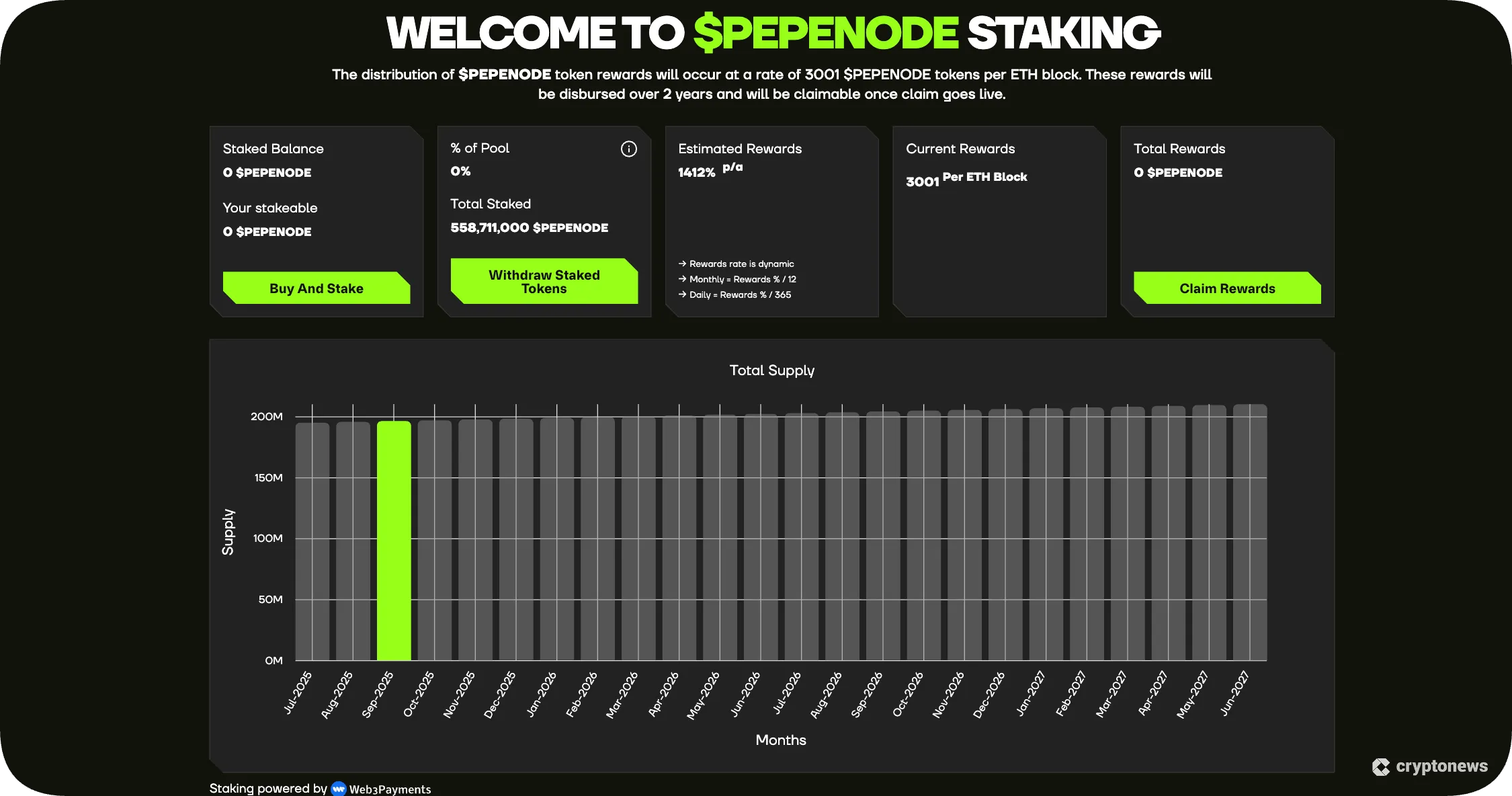

The heart of USPD’s approach lies in its smart contract architecture. When a user mints USPD, their deposited Ethereum (ETH) is automatically converted into liquid staked ETH (stETH). This stETH is not just a placeholder – it is an active asset generating staking rewards on the Ethereum network.

As staking rewards accrue to the stETH held as collateral, USPD’s protocol is designed to pass these earnings directly back to USPD holders. This means that simply by holding USPD, users see their position grow over time – with no need for manual claiming or complex DeFi maneuvers.

Key Advantages of On-Chain Stablecoin Rewards

-

Direct Access to Native Blockchain Yields: On-chain stablecoins like USPD use staked Ethereum (stETH) as collateral, passing real staking rewards directly to holders. This means your stablecoin holdings can grow automatically from Ethereum’s native yield, unlike traditional stablecoins that may not share underlying returns.

-

Transparent and Automated Reward Distribution: Rewards from stETH are distributed transparently via smart contracts, ensuring all holders receive their fair share without relying on centralized intermediaries. This reduces counterparty risk and increases trust in the reward process.

-

No Extra Steps or Lockups for Earning: With USPD and similar on-chain stablecoins, holders earn rewards simply by holding the token—no need to opt in, stake separately, or lock up funds, as is often required with traditional interest-bearing stablecoins like USDC on Coinbase or Kraken.

-

Enhanced Decentralization and Security: On-chain stablecoin rewards are managed by decentralized protocols, reducing reliance on centralized platforms that can freeze funds or change terms. This aligns with the ethos of DeFi and gives users greater control over their assets.

-

Potentially Higher and Sustainable Yields: By tapping directly into Ethereum staking yields (with ETH at $4,522.93 as of the latest data), on-chain stablecoins can offer competitive and sustainable returns compared to centralized platforms, which may adjust rates based on business needs rather than blockchain performance.

This mechanism offers several key advantages:

- Transparency: All collateral and reward flows are verifiable on-chain.

- Sustainability: Rewards come from native blockchain yields rather than opaque lending or riskier strategies.

- Simplicity: Holders benefit passively, with no extra steps required after minting or acquiring USPD.

If you’re seeking a deeper dive into how this works under the hood, you can review the protocol’s documentation at uspd.io.

The Broader Landscape: How Do Other Stablecoins Compare?

The concept of earning yield from stablecoins isn’t new – but most platforms implement this through centralized lending programs or DeFi vaults that require active participation. For example, holding USDC on Coinbase currently yields 4.10%, while Kraken offers up to 5.5% APY for users who opt in and stake their coins through the exchange’s custodial platform.

Other protocols like Origin’s OUSD or vaults integrated via Ledger Live x Kiln. fi allow users to deposit various stablecoins and earn yield sourced from multiple DeFi strategies. These approaches can offer attractive returns but often introduce additional risks related to smart contract complexity or counterparty exposure.

The Mechanics Behind On-Chain Stablecoin Rewards

What sets USPD apart is its direct integration with Ethereum staking yields at the protocol level. When you mint or acquire USPD, your backing collateral is already working for you by generating staking rewards via stETH. The increase in total value from these rewards is algorithmically distributed among all holders – meaning your balance grows proportionally as long as you hold the token.

This model minimizes reliance on external lending markets or off-chain intermediaries. Instead, it leverages Ethereum’s native security and consensus incentives while maintaining a robust peg to the dollar via overcollateralization and transparent smart contracts.

This innovative structure ensures that both individual users and institutions can participate in DeFi stablecoin loyalty programs without sacrificing security or composability. As more projects adopt similar models, we’re likely to see an evolution in how risk-averse DeFi participants approach earning passive income from their digital dollars.

The implications of this design reach far beyond simple yield generation. By anchoring rewards to Ethereum’s consensus layer, USPD and similar on-chain stablecoins create a more resilient ecosystem, one that is less exposed to the fragility of centralized platforms or third-party lending schemes. This is particularly relevant in light of recent volatility in both centralized exchanges and algorithmic stablecoins, which have underscored the importance of transparency and protocol-level guarantees for DeFi users.

Security, Composability, and User Experience

Security remains paramount. With USPD, the smart contract’s logic is open-source and auditable, allowing any user to verify how ETH is converted to stETH and how rewards are distributed. This stands in stark contrast to black-box lending models where users must trust opaque risk management practices.

Composability is another critical advantage. As an ERC-20 token, USPD can be integrated seamlessly across DeFi protocols, used as collateral in lending markets, provided as liquidity on DEXes, or even stacked with other yield strategies. The passive accrual of staking rewards continues regardless of these secondary uses, making USPD a flexible building block for advanced DeFi workflows.

From a user experience perspective, this model drastically reduces friction. There’s no need to research multiple platforms or manage complex staking positions; simply holding USPD is enough to participate in Ethereum’s staking economy.

What Does This Mean for Stablecoin Users?

For crypto investors seeking both stability and yield, the emergence of on-chain stablecoin rewards represents a significant shift. Rather than chasing APYs across fragmented platforms or assuming counterparty risk with centralized custodians, users can now access sustainable returns natively through their stablecoin holdings.

How USPD Stablecoin Staking Transforms Passive Income

-

Automatic Earning via stETH Collateralization: When you mint USPD by depositing ETH, your ETH is instantly converted to liquid staked ETH (stETH). This means staking rewards are generated automatically and passed on to you as a USPD holder, eliminating the need for manual staking or complex DeFi maneuvers.

-

Direct Growth of Stablecoin Holdings: Unlike traditional stablecoins, USPD holders see their balances grow over time as staking rewards accrue. This provides a transparent, on-chain way to earn passive income while maintaining the stability of a dollar-pegged asset.

-

Decentralized and Transparent Yield Distribution: All staking and reward distribution happens on-chain via smart contracts, ensuring transparency and removing the need for centralized intermediaries. This gives users full control and visibility over their earnings.

-

No Extra Steps or Lockups Required: With USPD, there’s no need to lock up your stablecoins or opt into special programs. Simply holding USPD is enough to receive staking rewards, making it ideal for passive income seekers who want a hassle-free experience.

-

Comparison with Other Stablecoin Reward Platforms: While platforms like Coinbase (offering 4.10% on USDC) and Kraken (up to 5.5% on USDC) provide yield, these typically require custodial arrangements or platform opt-ins. USPD delivers rewards natively and non-custodially, aligning with the ethos of decentralized finance.

This evolution aligns with broader trends in decentralized finance, where users demand not just higher yields but also greater control over their assets and improved risk transparency. It also opens new doors for DAOs, treasuries, and institutional players looking for reliable ways to earn on idle capital without compromising on decentralization or composability.

The Future: Expanding On-Chain Stablecoin Loyalty

Looking forward, we can expect further innovation at the intersection of staking yield stablecoins and DeFi loyalty programs. As protocols like USPD demonstrate the viability of automated reward distribution anchored in native blockchain incentives, more projects will likely follow suit, potentially integrating other proof-of-stake assets or expanding into multi-chain ecosystems.

The outcome? A more robust set of tools for both everyday users and sophisticated investors who want their digital dollars to work as hard as possible, with minimal risk exposure and maximum transparency.

If you’re interested in exploring this new paradigm or comparing current rates across platforms (with Ethereum currently priced at $4,522.93), resources like uspd.io, Kraken’s USDC Rewards, or Origin Protocol’s OUSD guides offer up-to-date information tailored to different risk appetites and technical preferences.