In the fast-evolving world of DeFi and blockchain loyalty programs, finding undervalued on-chain staking gems can feel like panning for gold in a digital river. Yet, 2024 is shaping up to be a breakout year for projects that not only offer robust staking rewards but also double down on user engagement and innovative tokenomics. If you’re hunting for high-upside crypto loyalty rewards and want to support projects with real traction, you’re in the right place.

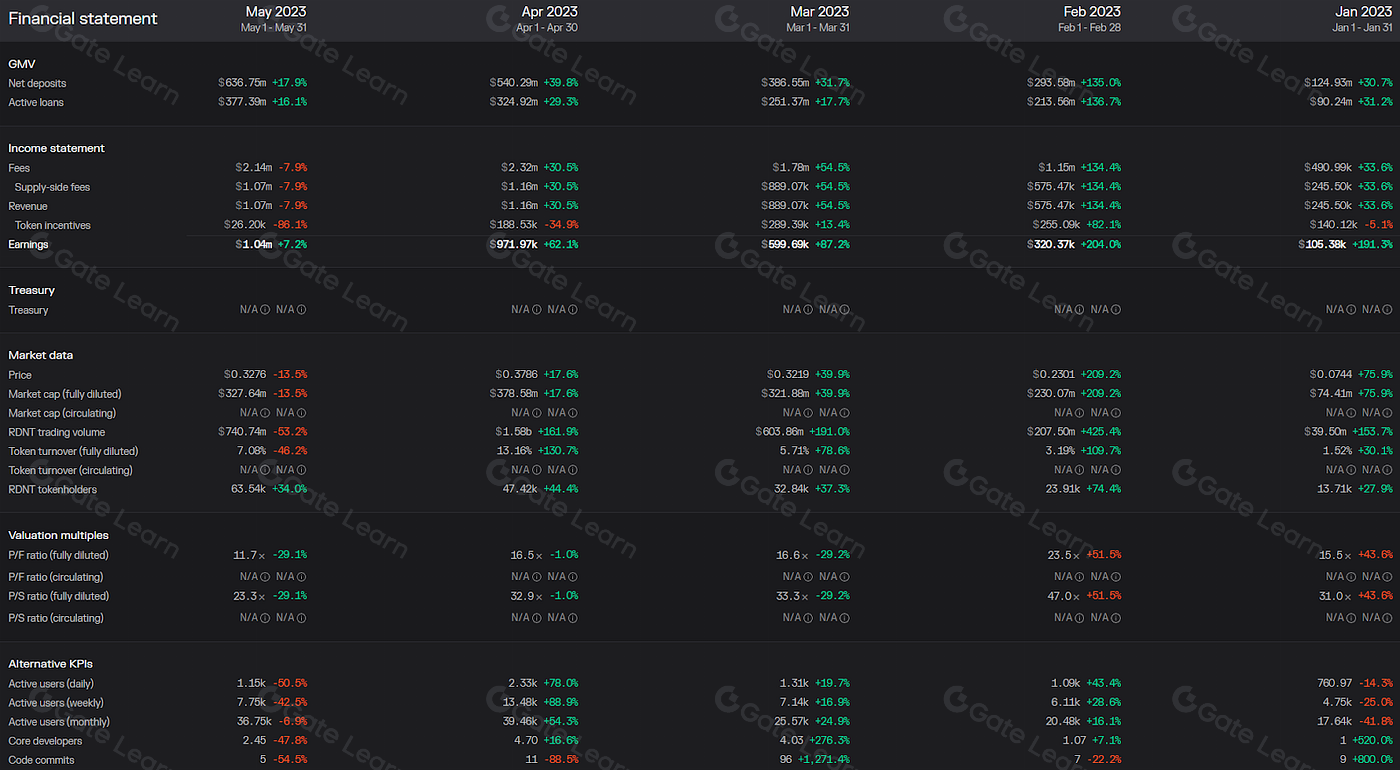

Radiant Capital (RDNT): Cross-Chain Lending With Serious Upside

Radiant Capital (RDNT) is quickly earning a reputation as one of the most undervalued DeFi coins offering staking rewards in 2024. As a cross-chain lending protocol, Radiant enables users to deposit assets and earn yields across multiple blockchains – think Ethereum, BNB Chain, Arbitrum, and beyond. The real kicker? APYs can reach up to 30%, thanks to efficient capital utilization and aggressive token incentives.

What sets RDNT apart is its strong tokenomics. Rewards aren’t just handed out willy-nilly; they’re structured to encourage long-term participation and loyalty. This makes Radiant a magnet for both yield farmers looking for consistent returns and DeFi die-hards seeking sustainable growth over hype cycles. If you want a full breakdown of why analysts are bullish on RDNT’s future, check out this deep dive from veritasgeneral. org.

Gala (GALA): Where NFT Gaming Meets Loyalty Staking

The NFT gaming sector has exploded recently – but Gala (GALA) stands out by merging play-to-earn mechanics with passive income via staking. Gala’s ecosystem lets users stake GALA tokens or in-game NFT assets directly within its games. This means players aren’t just earning tokens from gameplay; they’re also stacking up extra rewards by supporting the network’s security and liquidity.

The real magic? Gala empowers its community through governance votes on platform upgrades, game launches, and reward structures. This hands-on approach fuels loyalty that goes beyond speculation – it’s about building an active tribe around digital ownership. For those tired of generic DeFi platforms, Gala offers something refreshingly interactive with genuine upside potential.

Top 5 Undervalued On-Chain Loyalty Staking Projects (2024)

-

Radiant Capital (RDNT): A cross-chain lending protocol offering staking APYs up to 30% and robust tokenomics. Radiant Capital enables users to earn rewards by supplying liquidity across multiple blockchains, making it a standout for DeFi enthusiasts seeking high-yield opportunities.

-

Gala (GALA): Known for its play-to-earn gaming ecosystem, Gala lets users stake GALA tokens to support in-game NFT assets and earn rewards. Its combination of gaming and DeFi staking makes it a unique contender in the loyalty rewards space.

-

Mina Protocol (MINA): The world’s lightest blockchain, Mina Protocol offers staking rewards while maintaining a minimal blockchain size. Its innovative approach to decentralization and security attracts users looking for efficient, on-chain loyalty programs.

-

Stargate Finance (STG): As a cross-chain liquidity transfer protocol, Stargate Finance allows users to stake STG tokens and earn rewards for facilitating seamless asset movement between blockchains. Its utility in DeFi makes it a practical choice for loyalty staking.

-

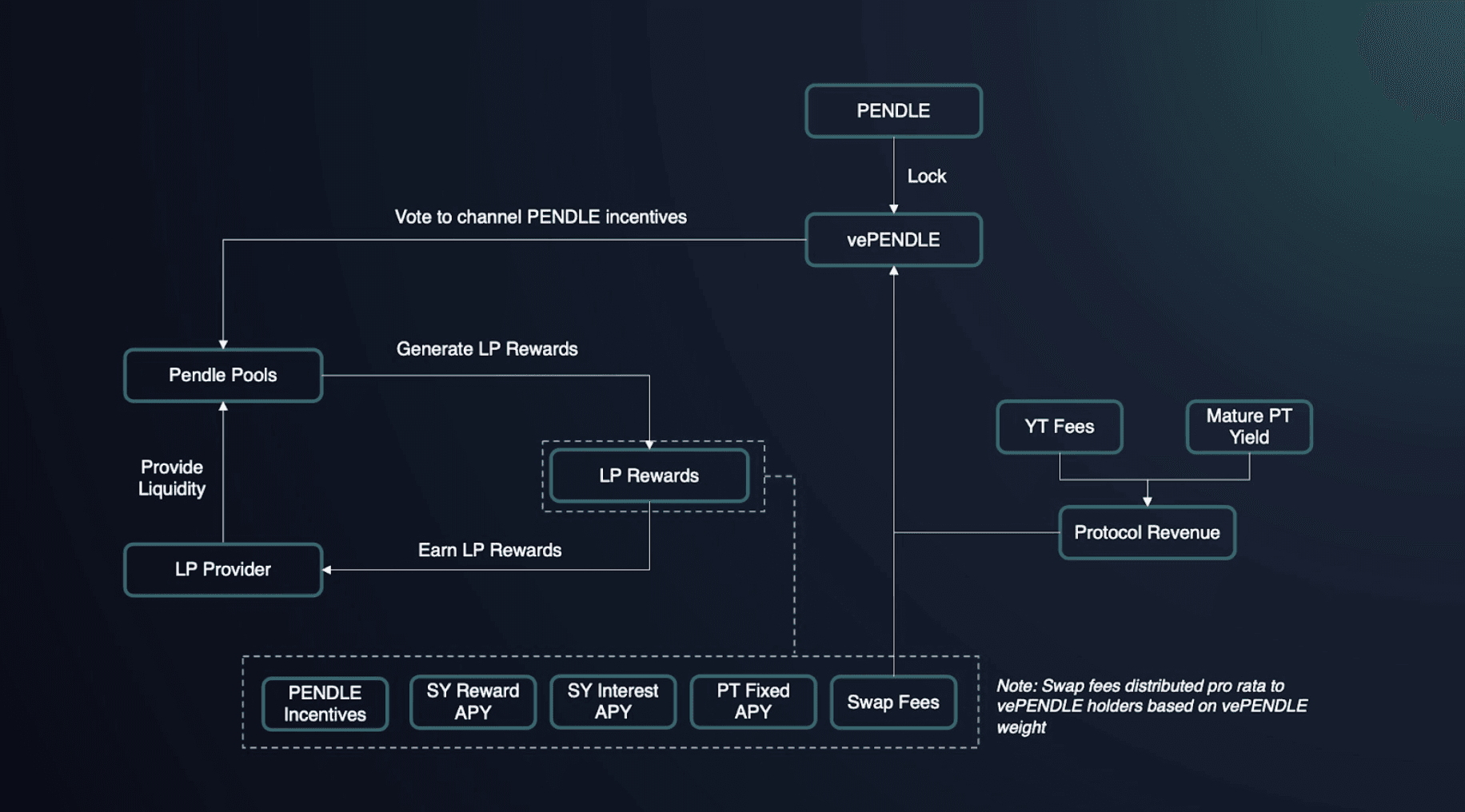

Pendle Finance (PENDLE): Pendle lets users tokenize and trade future yield, unlocking new possibilities for DeFi staking. By staking PENDLE, users can maximize returns and participate in a rapidly growing yield market.

Mina Protocol (MINA): Ultra-Light Blockchain With Heavyweight Potential

Mina Protocol (MINA) takes a radically different approach to blockchain design: keep things ultra-lightweight so anyone can run a node or verify transactions from their phone or laptop. But don’t let its small footprint fool you – MINA’s staking model is robust.

Stakers help secure the network while earning competitive yields on their MINA holdings. What really makes Mina undervalued right now is its combination of scalability (thanks to zero-knowledge proofs) and accessibility for everyday users. As more dApps launch atop Mina’s privacy-centric infrastructure in 2024, early stakers could see both price appreciation and outsized engagement rewards.

If you’re serious about maximizing your exposure to next-gen blockchain engagement, these three projects are must-watch contenders this year.

Stargate Finance (STG): Omnichain Liquidity and Seamless Staking

Stargate Finance (STG) has quietly become a backbone of cross-chain DeFi, connecting liquidity pools across major blockchains. What sets Stargate apart is its ability to facilitate true omnichain interoperability, so users can stake, swap, and bridge assets with minimal friction. The protocol’s single-sided staking model means you can earn yield on your STG without worrying about impermanent loss or complex LP positions. For loyalty stakers, the project’s rewards structure is designed to encourage long-term holding and governance participation, which helps keep the ecosystem sticky and engaged.

In 2024, Stargate’s focus on user-friendly staking and reliable cross-chain bridging is gaining traction among DeFi power users and newcomers alike. As more protocols build integrations with Stargate, demand for STG staking is only set to rise, making it a strong candidate for those seeking undervalued on-chain staking opportunities.

Pendle Finance (PENDLE): Yield Trading Meets Loyalty Innovation

If you’re looking for a project that takes yield farming to the next level, Pendle Finance (PENDLE) deserves your attention. Pendle introduces an entirely new DeFi primitive: tokenized future yield. Users can split their staked assets into principal and yield components, then trade or stake those independently for maximum flexibility.

This opens up creative strategies for loyalty-minded investors: lock in guaranteed returns by selling future yield upfront or speculate on higher yields by buying discounted tokens from others. Pendle’s innovative approach not only increases capital efficiency but also creates a vibrant marketplace for staking rewards, a game-changer in the loyalty rewards space.

With its rapidly growing TVL, expanding protocol integrations, and active governance community, PENDLE sits at the intersection of experimental DeFi and practical crypto loyalty rewards. Early adopters willing to navigate this new landscape could be handsomely rewarded as the market matures.

Pendle Finance Technical Analysis Chart

Analysis by Miles Beckett | Symbol: BINANCE:PENDLEUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

Draw a major horizontal support line at $4.80 and another at $4.60, with a strong resistance at $5.20. Add an aggressive uptrend line starting from the $4.60 area on September 7, 2025, rising to $5.40 on September 18, 2025. Overlay a downward trend line from the peak near $6.40 on August 22, 2025, down to the local low at $4.60 on September 7, 2025. Use rectangles to highlight the consolidation zone between $4.80 and $5.20 from September 10–19, 2025. Mark entry zones around $4.80 with a long position tool and set an aggressive profit target near $5.40. Place stop-loss levels just below $4.60. Use arrow markers to note the recent rejection at $5.20 and highlight the volume spike areas with callouts if visible.

Risk Assessment: high

Analysis: We’re at a key inflection point—tight range, aggressive reversals, and strong DeFi narrative. If $4.80 holds, risk/reward is exceptional for a breakout play. However, a loss of $4.60 could trigger accelerated downside. High volatility, high reward, but stops must be respected.

Miles Beckett’s Recommendation: I’m positioning long on a $4.80 retest with a stop below $4.60, targeting $5.20 and $5.40. Fortune favors the bold—but only when the data stacks the odds. Watch for volume confirmation and be ready to cut losses quickly if support fails.

Key Support & Resistance Levels

📈 Support Levels:

-

$4.8 – Key horizontal support, tested multiple times in September 2025.

strong -

$4.6 – Major swing low and critical support for bullish structure.

strong

📉 Resistance Levels:

-

$5.2 – Key resistance and recent rejection zone.

strong -

$5.4 – Next resistance on upside breakout.

moderate

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$4.8 – Aggressive long entry on support retest, tight stop below $4.60.

medium risk

🚪 Exit Zones:

-

$5.2 – Partial profit at resistance; watch for breakout.

💰 profit target -

$4.6 – Stop loss in case of support failure.

🛡️ stop loss -

$5.4 – Aggressive profit target if breakout occurs.

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume analysis not visible in chart provided; if volume spikes at support or resistance, highlight with callout.

Look for volume confirmation on support bounces or resistance breaks.

📈 MACD Analysis:

Signal: MACD not shown; watch for bullish crossover near $4.80 for confirmation.

MACD bullish cross near support would add conviction to long setup.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Miles Beckett is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Key Takeaways: Why These Projects Stand Out

- Radiant Capital (RDNT): High APYs up to 30%, cross-chain lending utility, robust tokenomics favoring loyal stakers.

- Gala (GALA): Unique blend of NFT gaming and staking rewards; empowers community through governance.

- Mina Protocol (MINA): Ultra-light blockchain with scalable privacy tech; accessible node operation fuels grassroots engagement.

- Stargate Finance (STG): Omnichain liquidity hub with seamless single-sided staking; growing ecosystem adoption.

- Pendle Finance (PENDLE): Pioneering tokenized future yield; advanced strategies for maximizing crypto loyalty rewards.

The bottom line? The next wave of value in DeFi isn’t just about chasing unsustainable yields, it’s about finding projects that reward your commitment while building real utility. Whether you’re an NFT gamer stacking GALA or a cross-chain strategist leveraging RDNT or STG, these platforms offer practical ways to grow your stack while supporting innovation at the heart of Web3.