On-chain loyalty staking platforms are rapidly reshaping the landscape of decentralized finance (DeFi) by harnessing the power of token incentives to cultivate vibrant, engaged communities. Unlike traditional loyalty programs, which rely on opaque point systems and centralized oversight, on-chain models leverage blockchain’s transparency and programmability to align incentives between users and projects. The result? A new era of community rewards on blockchain that is both participatory and sustainable.

Why Token Incentives Are the Engine of Community Growth

Token incentives are not just a marketing gimmick – they are foundational to the security and utility of major blockchains like Bitcoin, Ethereum, and Solana. In the context of on-chain loyalty staking, these incentives become powerful tools for driving user engagement. By providing tangible rewards for activities such as staking, trading, or participating in governance, platforms can foster a deep sense of ownership among users.

Recent examples underscore this trend. Radix’s Token Trek platform has committed over $120,000 in rewards for users who complete on-chain tasks, creating a strong pull for both new and existing participants to engage with their ecosystem. These structured prize flows in DeFi not only boost activity but also encourage long-term commitment through mechanisms like HODLing rewards programs.

Gamification: Making Engagement Addictive

The integration of gamified mechanics is taking staking engagement strategies to new heights. Platforms now deploy tiered reward systems where benefits scale with both the amount staked and the duration. This multi-layered incentive system in DeFi ensures that users who show greater loyalty are rewarded accordingly, a win-win scenario that increases retention while supporting protocol stability.

For example, NFT staking platforms often employ tier-based bonuses: stake your NFT longer or refer more friends, and you unlock higher-tier rewards. This approach appeals to both casual participants seeking quick wins and dedicated community members aiming for exclusive perks.

Top Gamification Features in On-Chain Loyalty Staking

-

Tiered Staking Rewards: Platforms like Radix’s Token Trek offer escalating rewards based on staking duration and amount, motivating users to commit tokens for longer periods and unlock higher returns.

-

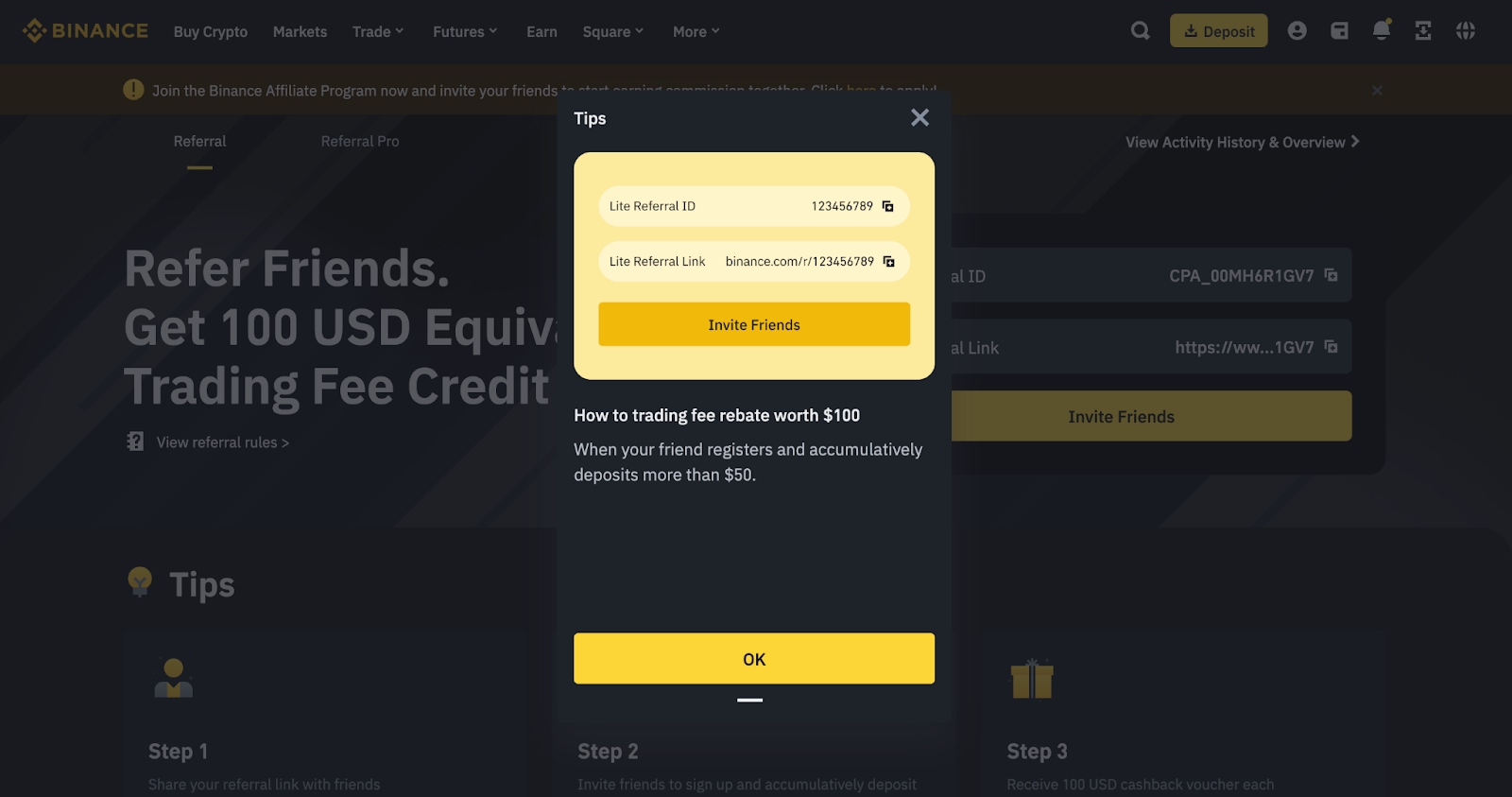

Referral and Social Sharing Programs: Many platforms, including Binance, incentivize users to invite friends by offering bonus tokens for successful referrals, amplifying organic community growth through social engagement.

-

NFT-Integrated Loyalty Perks: The AVA Foundation uses Travel Tiger NFTs to grant holders exclusive benefits, such as privileged access and personalized rewards, adding a collectible and interactive dimension to loyalty programs.

-

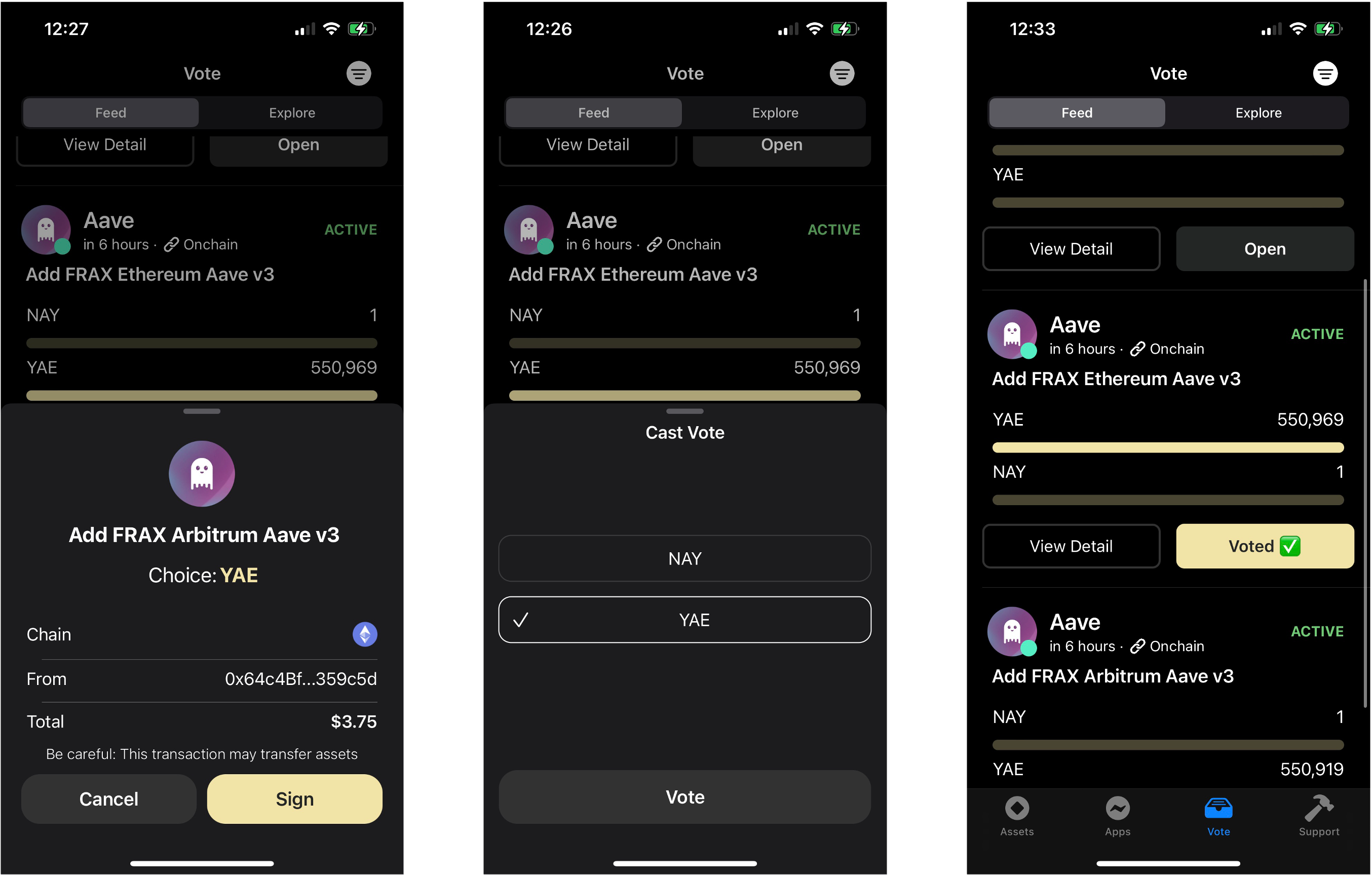

On-Chain Task and Quest Systems: Platforms like Radix Token Trek and Galxe engage users with quests and missions, rewarding on-chain actions (e.g., trading, voting) to drive active participation and ecosystem growth.

-

DAO-Based Community Governance: Projects such as Constellation Network empower token holders to vote on protocol upgrades, reward structures, and platform features, fostering ownership and long-term engagement through decentralized decision-making.

-

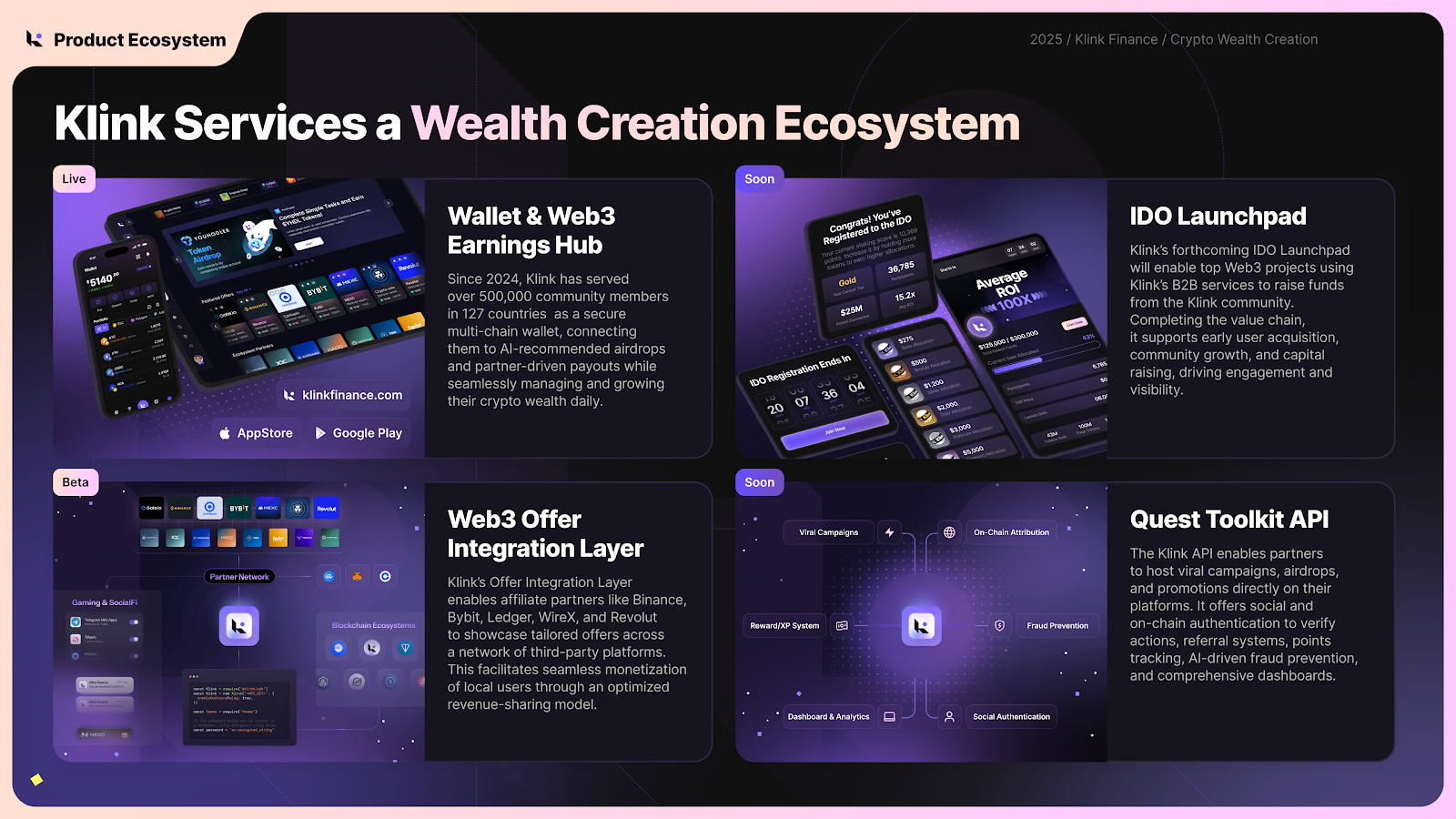

AI-Driven Personalization: Klink Finance leverages AI to analyze user behavior and recommend tailored earning opportunities, increasing user retention by making engagement more relevant and rewarding.

NFTs: The Next Level of Loyalty Rewards

The integration of NFTs into loyalty programs is adding an entirely new dimension to user engagement. No longer limited to fungible tokens, these programs now offer unique digital assets that can represent status, grant privileged access, or even unlock special governance rights within a project’s ecosystem. The AVA Foundation’s Travel Tiger NFTs illustrate this evolution perfectly – holders gain exclusive benefits within their travel-focused network.

This NFT-driven approach personalizes the experience while making participation feel more like collecting rare badges than simply accumulating points. It also enables projects to build deeper emotional connections with their communities, a critical advantage in today’s competitive Web3 landscape.

DAOs and AI-Driven Personalization: Empowering Communities Further

On-chain loyalty staking platforms don’t stop at static reward structures; many incorporate Decentralized Autonomous Organizations (DAOs) to give token holders real influence over protocol decisions. Through governance voting on reward rates or new features, users become co-architects of their ecosystem’s future.

Meanwhile, AI-driven personalization is emerging as a force multiplier for user retention. By analyzing wallet activity and past behaviors, AI can recommend tailored earning opportunities or automate reward tracking, ensuring every participant stays engaged without feeling overwhelmed by complexity.

If you’re interested in how these innovations maximize DeFi rewards for core community members through transparent incentive structures, check out our coverage at this detailed guide.

As the DeFi ecosystem matures, the most successful platforms are those that transcend simple airdrops or one-off giveaways. Instead, they cultivate multi-layered incentive systems designed to reward not just initial participation, but sustained engagement and advocacy. The shift towards dynamic, on-chain loyalty staking is apparent: projects now understand that true community growth hinges on fostering an environment where users feel empowered, recognized, and rewarded for their ongoing contributions.

One of the defining advantages of these systems is their ability to create a feedback loop between platform health and user rewards. As more users stake tokens or participate in governance, the protocol becomes more robust and decentralized. In turn, this stability allows projects to offer richer rewards, such as enhanced yields, exclusive NFT drops, or even voting power in DAOs, further incentivizing deeper involvement.

The Role of Structured Prize Flows in DeFi Loyalty

Structured prize flows are emerging as a cornerstone of effective staking engagement strategies. Rather than relying on ad hoc bonuses, top platforms deploy predictable reward schedules that encourage both short-term activity and long-term commitment. This clarity is key: when users know exactly how their actions translate into tangible returns, such as Radix’s transparent $120,000 reward pool, they’re far more likely to stay invested for the long haul.

Top DeFi Loyalty Programs With Structured Prize Flows

-

Radix Token Trek: Radix incentivizes users with over $120,000 in rewards for completing on-chain tasks. The program features structured prize flows for various activities, including trading and interacting with DApps, to boost user engagement and ecosystem growth.

-

COTI Loyalty Program: COTI’s program distributes 12.5 million COTI tokens through daily on-chain drops. The tiered structure rewards users based on activity and staking duration, encouraging both frequent participation and long-term commitment.

-

AVA Foundation Travel Tiger NFTs: Holders of Travel Tiger NFTs are granted access to exclusive loyalty benefits and tiered rewards within the AVA ecosystem. The program integrates NFTs to provide privileged access and personalized experiences for loyal users.

-

Constellation Network Loyal Metagraph: The $LOYAL token powers a tiered incentive system that recognizes and rewards active participation across the Constellation ecosystem. Users can earn higher rewards by engaging more deeply and staking for longer periods.

-

Klink Finance: Klink Finance aggregates earning opportunities across multiple chains and uses AI-driven personalization to recommend tailored rewards. Its structured prize flows and tiered incentives are designed to maximize user retention and engagement.

The result is a thriving ecosystem where participants are motivated not just by speculation, but by consistent value creation and shared success. These mechanics also mitigate issues like mercenary farming or rapid sell-offs after an airdrop, a problem that plagued earlier token-only incentive models.

Real Ownership Through Decentralization

Decentralized ownership is not just a buzzword in this context; it’s a practical lever for engagement. By integrating DAOs into their loyalty frameworks, platforms give users direct agency over everything from protocol upgrades to the allocation of future rewards. This sense of ownership transforms passive holders into active stewards, a dynamic that dramatically increases both retention and advocacy within communities.

A recent industry poll showed that over 70% of users are more likely to remain loyal to protocols where they have real governance influence. This participatory approach doesn’t just drive higher staking rates; it also builds trust through transparency and shared decision-making power.

Which on-chain loyalty feature matters most to you?

On-chain loyalty staking platforms now offer a range of features to boost community engagement, from token rewards and gamified tiers to NFT perks and community governance. Which feature do you value most when participating in these programs?

AI Personalization: Keeping Engagement Fresh

The next frontier in community rewards blockchain innovation is AI-driven personalization. Platforms like Klink Finance use machine learning algorithms to analyze user behavior across chains and recommend bespoke earning opportunities, from flash staking events to time-limited NFT unlocks, tailored specifically for each wallet holder. This ensures engagement remains high even as user preferences evolve over time.

The synergy between AI recommendation engines and transparent blockchain records creates an experience where every user feels seen, and every action can be meaningfully rewarded without overwhelming manual tracking or management.

Looking Forward: The Future of On-Chain Loyalty Staking

The trajectory is clear: as competition intensifies across Web3 verticals, only those platforms offering truly compelling loyalty experiences will retain top contributors. Expect further convergence between NFTs, DAOs, AI analytics, and traditional DeFi products as projects seek ever-more creative ways to drive value back to their communities.

If you’re eager for deeper dives into how these trends are reshaping user engagement at every level, from casual holders to power stakers, explore our related analysis at this resource on engagement strategies.