On-chain loyalty staking is rapidly transforming the DeFi landscape, emerging as a game-changer for user retention and engagement. In a market where users have endless options and attention spans are fleeting, DeFi projects must innovate to keep their communities active and loyal. Enter loyalty staking: a mechanism that rewards users not just for participating, but for sticking around and supporting the ecosystem over time.

![]()

Why User Retention Is the New Alpha in DeFi

With capital flowing across protocols at lightning speed, user retention has become the ultimate metric for sustainable growth. Yield chasers may pump short-term TVL numbers, but only sticky users drive long-term protocol health and innovation. On-chain loyalty staking directly addresses this challenge by aligning user incentives with platform growth.

Current market data shows that platforms like Compound and PancakeSwap have leveraged incentive programs to create lasting engagement. For example, BNB Chain’s TVL Incentive Program, with a prize pool of up to $300,000, demonstrates how strategic token rewards can boost both stablecoin retention and overall network activity.

Core Mechanisms: How On-Chain Loyalty Staking Works

The power of on-chain loyalty staking lies in its multifaceted approach:

Top Mechanisms Powering On-Chain Loyalty Staking

-

Token-Backed Rewards & Utility: DeFi platforms like PancakeSwap and Compound enable users to stake native tokens in exchange for tangible rewards—such as additional tokens, governance rights, or exclusive feature access—deepening user commitment and platform engagement.

-

Collaborative Yield Farming Campaigns: Platforms launch yield farming initiatives that reward users for ecosystem-positive actions, like providing liquidity or voting in governance. BNB Chain’s TVL Incentive Program is a prime example, offering up to $300,000 in prizes to boost stablecoin and BNB staking.

-

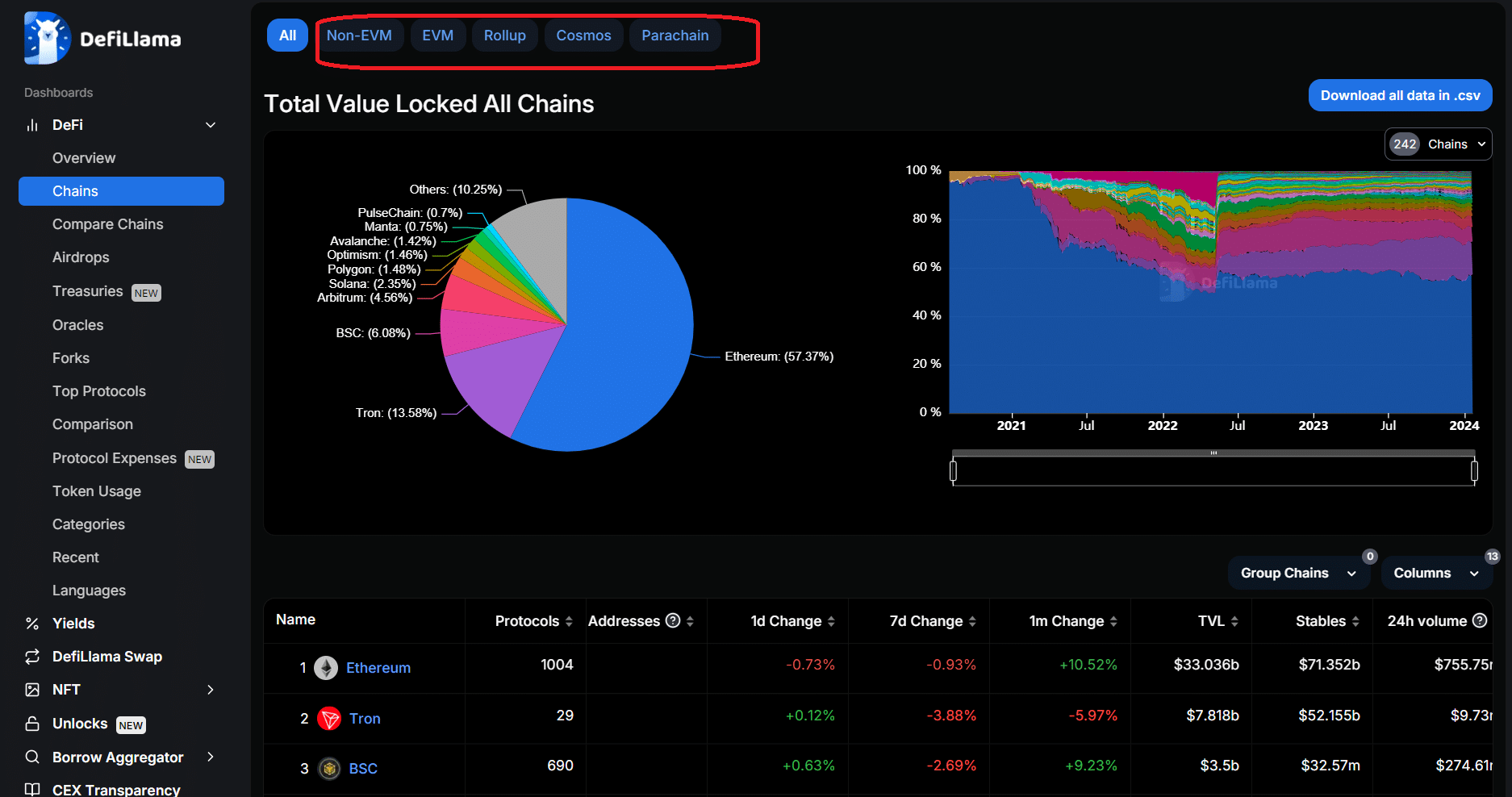

Integration with DeFi Aggregators & Wallet Tools: By connecting with major aggregators such as DeFiLlama and DappRadar, projects increase transparency, allowing users to track TVL and staking activity, which builds trust and encourages long-term loyalty.

- Token-Backed Rewards: Users stake native tokens to earn more tokens or unlock governance rights. This deepens commitment and encourages token holding rather than dumping.

- Collaborative Yield Farming: Campaigns incentivize productive actions like providing liquidity or voting in governance. These activities grow the ecosystem while rewarding engaged users.

- Aggregator Integration: Listing on platforms like DeFiLlama or DappRadar boosts transparency and credibility, making it easier for users to track rewards and stay invested long-term.

This multi-pronged strategy ensures that every action – from staking to governance participation – feeds back into user engagement loops.

Loyalty Staking in Action: Real-World Case Studies

The impact of these mechanisms is evident across leading DeFi projects:

- PancakeSwap: By offering yield farming alongside CAKE token staking, PancakeSwap keeps its community active while driving up token utility. The result? Higher user retention rates compared to competitors without robust loyalty programs.

- BNB Chain: Its $300,000 TVL Incentive Program has not only boosted stablecoin deposits but also fostered deeper integration with partner projects, proving that big incentives can reshape user behavior at scale.

If you want a deeper dive into how these strategies drive engagement across other platforms, check out our analysis here: How On-Chain Loyalty Staking Drives User Engagement in DeFi Platforms.

On-chain loyalty staking is more than a passing trend, it’s a paradigm shift in how DeFi projects cultivate and reward their most valuable asset: loyal users. By creating a system where engagement directly translates to tangible rewards, protocols are seeing measurable improvements in user retention, capital efficiency, and protocol security. The data doesn’t lie: platforms that deploy well-structured loyalty staking programs consistently outperform those that rely on short-term incentives or hype cycles.

Unlocking the Full Potential of Staking Mechanisms for Loyalty

What sets on-chain loyalty staking apart from traditional rewards schemes is its transparency and composability. All transactions are verifiable on the blockchain, ensuring trustless distribution of rewards. Users know exactly what they’re earning, when, and why, eliminating the opacity that plagues legacy loyalty systems. This radical transparency builds trust and keeps users coming back.

Furthermore, staking mechanisms for loyalty are highly customizable. Projects can tailor reward structures to promote specific behaviors, whether that’s providing liquidity during volatile periods, voting in governance proposals, or referring new users. Tiered rewards systems and time-locked bonuses give power users even more reason to stay engaged for the long haul.

5 Ways DeFi Loyalty Staking Drives Long-Term Engagement

-

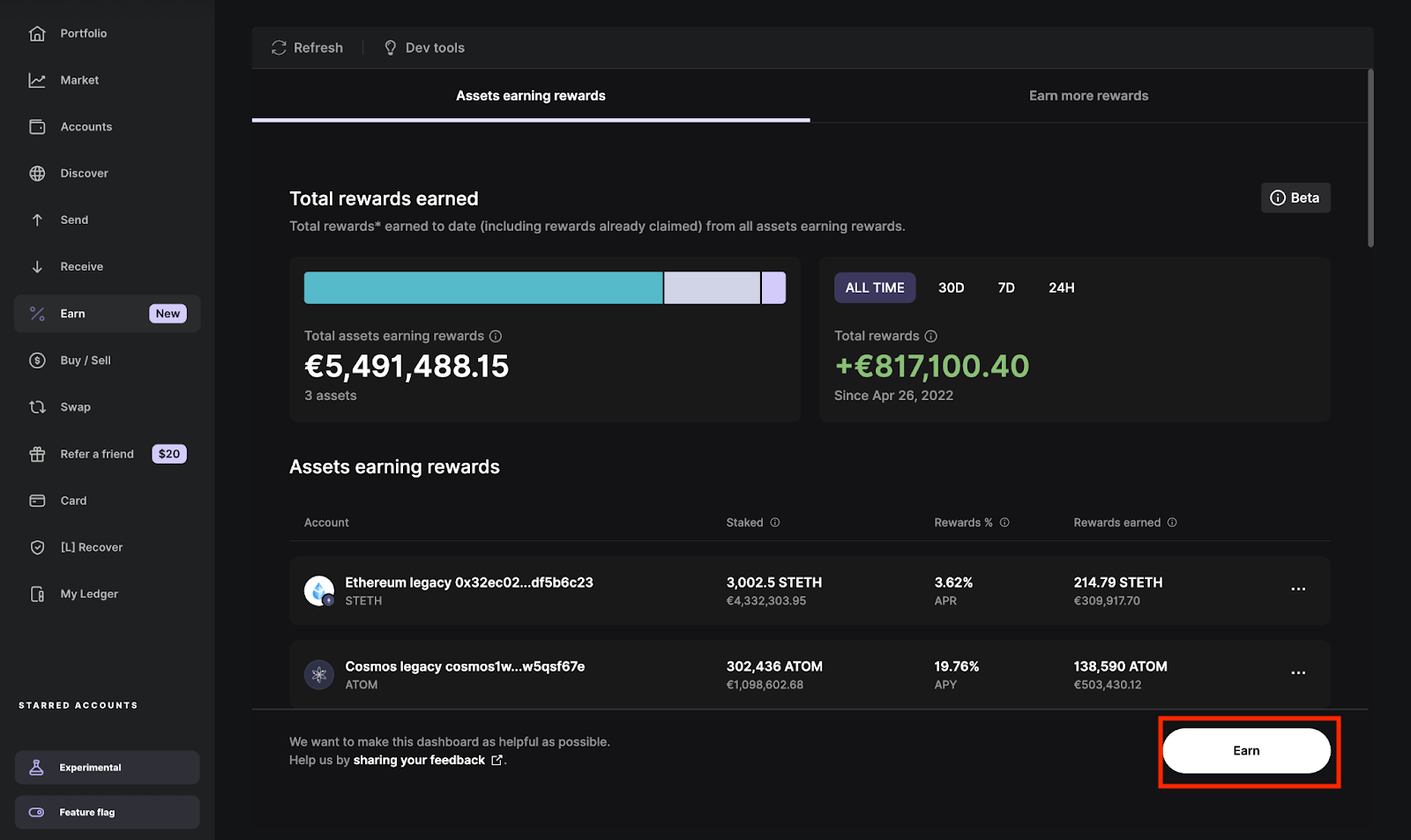

Token-Backed Rewards & Utility: Users who stake native tokens on platforms like Compound or PancakeSwap earn tangible rewards—such as additional tokens, governance rights, or exclusive feature access—deepening their commitment and incentivizing long-term participation.

-

Collaborative Yield Farming Campaigns: Projects like PancakeSwap and BNB Chain run yield farming campaigns that reward users for providing liquidity or participating in governance, aligning incentives with productive ecosystem growth and sustained user activity.

-

Integration with DeFi Aggregators & Wallets: By connecting with platforms such as DeFiLlama and DappRadar, DeFi projects give users transparent access to key metrics like Total Value Locked (TVL), boosting trust and encouraging ongoing engagement.

-

Tiered Loyalty Programs & Referral Bonuses: DeFi wallets and platforms (e.g., MetaMask, Trust Wallet) use tiered rewards and referral incentives to motivate users to increase transaction volume and invite others, creating a compounding effect on user retention.

-

Enhanced Security & Platform Stability: Higher levels of token staking on protocols like BNB Chain directly contribute to network security and stability, giving users confidence to remain active and committed for the long term.

Another major advantage? Composability across protocols. Users can often leverage staked assets in multiple DeFi applications simultaneously, maximizing yield without sacrificing liquidity or flexibility. This interoperability supercharges both individual returns and ecosystem growth.

The Future of Blockchain User Engagement

Looking ahead, expect on-chain loyalty staking to become even more sophisticated as DeFi matures. Dynamic reward curves, cross-platform integrations, and NFT-based incentives are already being tested by forward-thinking projects. As competition heats up, only those platforms with robust retention strategies will thrive.

For teams building in this space, it’s clear: DeFi user retention isn’t just about numbers, it’s about creating real value for your community through transparent incentives and continuous innovation. Whether you’re an investor hunting for sustainable yields or a project aiming to build a sticky user base, on-chain loyalty staking is the lever you can’t afford to ignore.

Loyalty isn’t bought, it’s earned through consistent value delivery and aligned incentives. On-chain staking mechanisms are finally making this possible at scale.

If you’re ready to explore deeper strategies for growing your DeFi community with these tools, don’t miss our advanced guide: How On-Chain Loyalty Staking Drives Community Engagement in DeFi Projects.