DeFi loyalty programs are getting a major upgrade, and it’s happening right before our eyes. The catalyst? Liquid Staking Tokens (LSTs). With Ethereum (ETH) currently trading at $4,113.04, the appetite for maximizing yield without locking up liquidity has never been stronger. LSTs are not just a technical evolution – they’re a game-changer for on-chain loyalty staking, opening new doors for DeFi enthusiasts, investors, and projects alike.

Unlocking Liquidity: The LST Advantage in DeFi Loyalty

Traditionally, staking on proof-of-stake (PoS) networks meant your assets were locked, sidelined from the rest of the DeFi ecosystem. Enter liquid staking tokens: platforms like Lido issue stETH in exchange for staked ETH, allowing users to earn staking rewards without sacrificing liquidity. This means you can put your staked assets to work in lending, borrowing, and yield farming protocols, all while continuing to rack up staking rewards. The result? Enhanced capital efficiency and a new level of composability for DeFi loyalty programs.

Take a look at how LSTs are reshaping the DeFi landscape:

Top Use Cases for LSTs in DeFi Loyalty Programs

-

Boosting DeFi Rewards with Lido’s stETH: Lido’s stETH lets users earn Ethereum staking rewards while using their staked ETH in DeFi apps for extra yield—think lending, liquidity mining, or participating in loyalty programs without sacrificing rewards.

-

Collateralizing Loans with Rocket Pool’s rETH: Rocket Pool’s rETH can be used as collateral on lending platforms like Aave, letting users borrow stablecoins or other assets while still accruing staking rewards—perfect for loyalty programs that incentivize borrowing or holding.

-

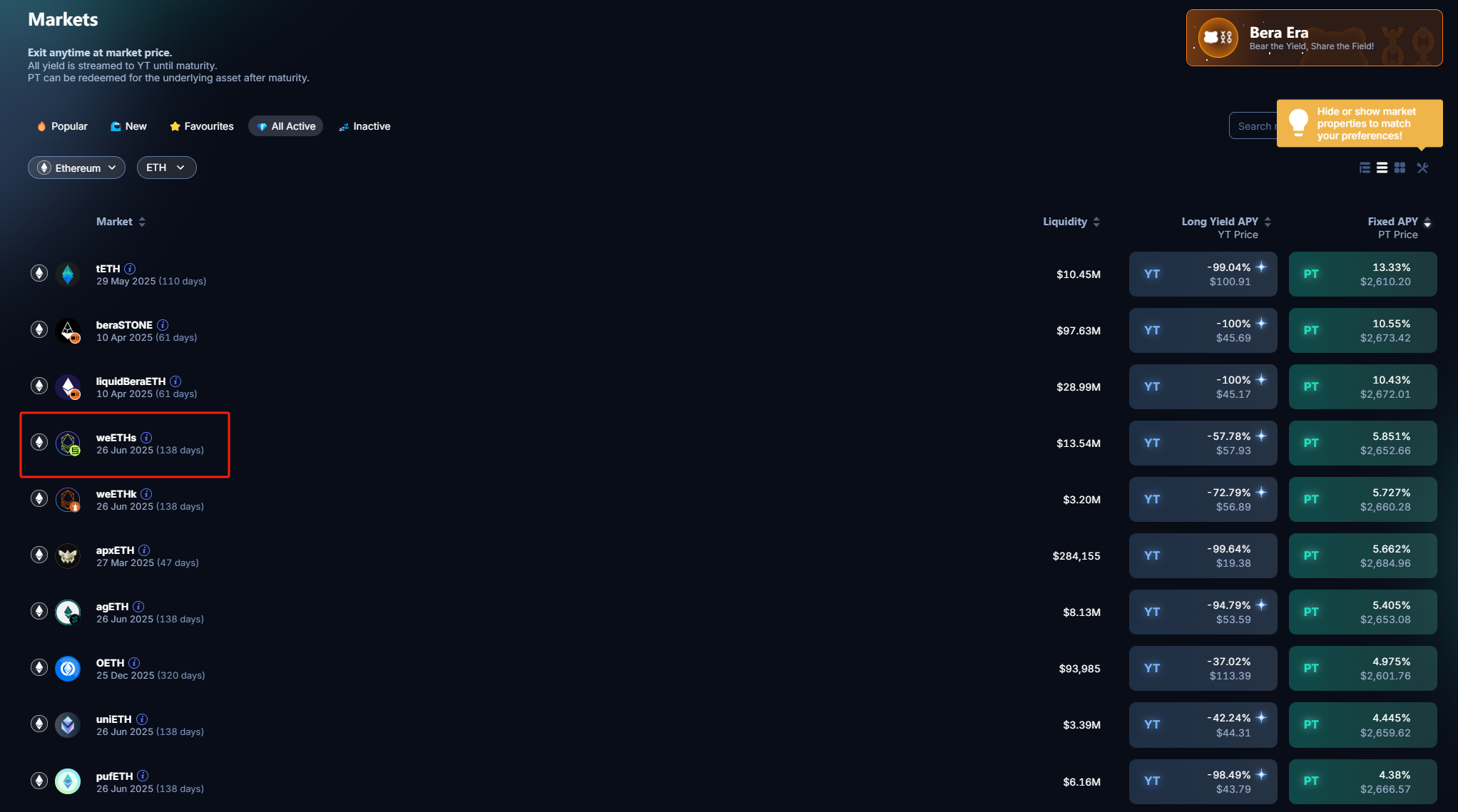

Stacking Yields with EtherFi’s eETH and weETH: EtherFi’s eETH and weETH combine Ethereum staking rewards with additional yields from restaking protocols like EigenLayer, letting users earn layered incentives in loyalty programs and maximize capital efficiency.

-

Regulated Loyalty Participation with Liquid Collective’s LsETH: Liquid Collective’s LsETH is designed for compliance and security, making it ideal for institutional-grade loyalty programs that require KYC/AML and robust risk controls.

-

Composability in DeFi with Frax Ether (frxETH): Frax Ether (frxETH) offers a liquid staking solution that integrates seamlessly with major DeFi protocols, enabling users to participate in loyalty programs, liquidity pools, and yield strategies while earning staking rewards.

By letting users deploy their LSTs across various protocols, DeFi loyalty programs can now offer more attractive, flexible, and sticky incentives. Imagine earning loyalty rewards not just for staking, but for actively using your assets across the ecosystem – that’s the power of LSTs.

The LST Flywheel: Compounding Rewards and User Engagement

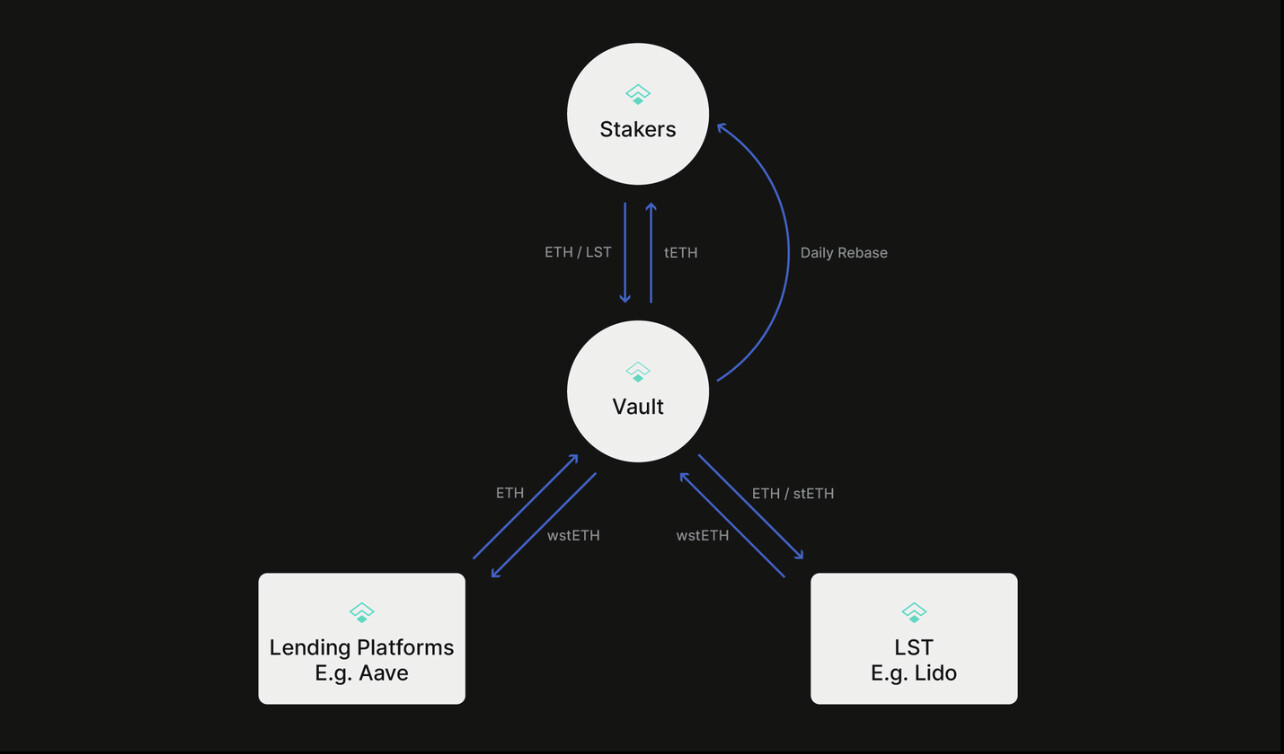

The magic of LSTs doesn’t stop at liquidity. Their composable nature creates what’s known as the LST flywheel: stake your ETH, receive stETH, use stETH as collateral or in yield strategies, and earn multiple layers of rewards. This flywheel turbocharges user engagement, as participants are incentivized to keep their capital active and circulating within on-chain loyalty programs.

Platforms like EtherFi are taking this a step further. Their eETH and weETH not only provide standard staking rewards but also tap into additional yields from restaking protocols like EigenLayer. The numbers speak for themselves: as of 2025, EtherFi’s total value locked has rocketed past $30 billion, a testament to the institutional and retail appetite for LST-driven strategies. (pinkbrains. io)

Let’s visualize how the LST flywheel amplifies returns and loyalty:

Security, Compliance, and Institutional Confidence

With innovation comes responsibility. As LSTs gain traction, security and compliance are taking center stage. Platforms like Liquid Collective are setting new standards by offering LSTs such as LsETH, which are designed to meet rigorous regulatory requirements. This includes mandatory KYC/AML for operators and robust security protocols, giving both individual and institutional users peace of mind. (liquidcollective. io)

Regulatory clarity is also fueling adoption. The SEC’s recent stance has cleared the path for services like Lido and Jito to issue receipt tokens without being classified as securities – a major win for DeFi and Ethereum ETFs. This regulatory green light is pivotal for the continued growth and legitimacy of on-chain loyalty staking powered by LSTs.

As LSTs continue to evolve, their role in shaping DeFi loyalty programs is only getting stronger. In the next section, we’ll dive deeper into the strategies, risks, and future trends driving this transformative movement.

For users and projects alike, the practical benefits of liquid staking tokens go far beyond earning yield. LST DeFi strategies are unlocking new forms of engagement and retention, making on-chain loyalty staking both more lucrative and more dynamic. With Ethereum’s price at $4,113.04, the value proposition is crystal clear: keep your assets productive while being rewarded for your loyalty across the DeFi spectrum.

Strategies for Maximizing LST-Driven Loyalty Rewards

So how can you put LSTs to work in your own DeFi journey? It starts with understanding the core strategies that power today’s most effective on-chain loyalty programs:

Advanced LST Strategies for Maximizing DeFi Loyalty Rewards

-

Leveraging Lido’s stETH in Multi-Protocol Yield Farming: Use stETH, which represents staked Ethereum, across leading DeFi platforms like Aave and Curve to earn both staking and liquidity provider rewards, compounding your loyalty benefits.

-

Restaking with EtherFi’s eETH and EigenLayer: Stake ETH via EtherFi to receive eETH, then restake on EigenLayer to unlock additional protocol rewards and loyalty incentives on top of standard staking yields.

-

Using Liquid Collective’s LsETH for Regulatory-Compliant DeFi Participation: Holders of LsETH can access DeFi loyalty programs while benefiting from enhanced security and compliance features, appealing to both individuals and institutions seeking regulated exposure.

-

Stacking Loyalty Rewards with Rocket Pool’s rETH: Earn native staking rewards plus bonus incentives from DeFi protocols that support rETH, maximizing your loyalty yield through multi-layered reward structures.

By leveraging these approaches, users can stack multiple reward streams – from base staking yields to additional platform incentives and governance perks. Projects, meanwhile, can design tiered loyalty programs that reward not just the act of staking but the holistic participation in their ecosystem. The result is a sticky, mutually beneficial relationship between protocols and their communities.

But let’s not ignore the risks. While LSTs amplify opportunity, they also introduce new layers of smart contract risk, dependency on protocol security, and potential depegging events if underlying assets diverge in value. Disciplined risk management is essential – always research platforms’ security audits and compliance measures before deploying significant capital.

The Road Ahead: Future Trends in On-Chain Loyalty Staking

The LST flywheel is spinning faster than ever, but where does it go from here? Expect several trends to define the next wave of innovation:

- Programmable Loyalty: Protocols will introduce more granular and customizable reward structures using smart contracts that respond to user behaviors across multiple DeFi products.

- Cross-Chain LSTs: As interoperability grows, staked assets from one chain will be usable as collateral or liquidity on others, broadening the scope of on-chain loyalty programs.

- Institutional-Grade Products: Enhanced compliance and security frameworks will draw more institutional capital into LST-powered DeFi loyalty strategies.

- Real-Time Analytics: Users will gain access to dashboards that track not only yields but also loyalty points, engagement metrics, and risk exposure in real time.

If you’re looking to ride this wave, keep a close eye on regulatory developments and evolving platform features. The recent SEC guidance has removed a major overhang from the sector – now it’s up to protocols and users to push the boundaries responsibly.

The bottom line? Liquid staking tokens have injected a powerful dose of liquidity, composability, and transparency into on-chain loyalty programs. For those willing to embrace disciplined experimentation and continuous learning, the era of staking rewards liquidity is just getting started.