DeFi staking has come a long way from its early iterations, evolving from simple token lockups to sophisticated, multi-layered systems that reward users for genuine community engagement. In 2025, the spotlight is on multi-factor staking (MFS) models – a breakthrough approach that is fundamentally reshaping how on-chain loyalty rewards are structured and distributed. If you’re new to MFS, think of it as a blend of several staking mechanisms working together to maximize user incentives and create a more dynamic ecosystem.

What Makes Multi-Factor Staking Different?

Traditional DeFi staking typically revolves around locking up tokens in return for passive yield. While this remains attractive for many investors, the landscape is rapidly shifting toward models that prioritize active participation, cross-chain utility, and customizable reward structures. MFS crypto staking integrates multiple elements such as:

- Token staking: The classic approach – lock up your assets to earn yield.

- Cross-chain compatibility: Stake tokens across various blockchains like Ethereum 2.0, Polkadot, and Solana for broader exposure and optimized returns.

- Tiered rewards: Earn boosted staking rewards based on loyalty points, activity level, or holding duration.

- NFT integration: Use NFTs to represent unique stakes or unlock exclusive benefits within loyalty programs.

This multi-pronged strategy means users are no longer limited by single-protocol constraints or basic APY calculations. Instead, they can leverage a suite of tools designed for flexibility and personalization.

Pioneering Platforms Leading the MFS Revolution

The rise of MFS models is being championed by several innovative platforms:

Top DeFi Platforms Using Multi-Factor Staking in 2025

-

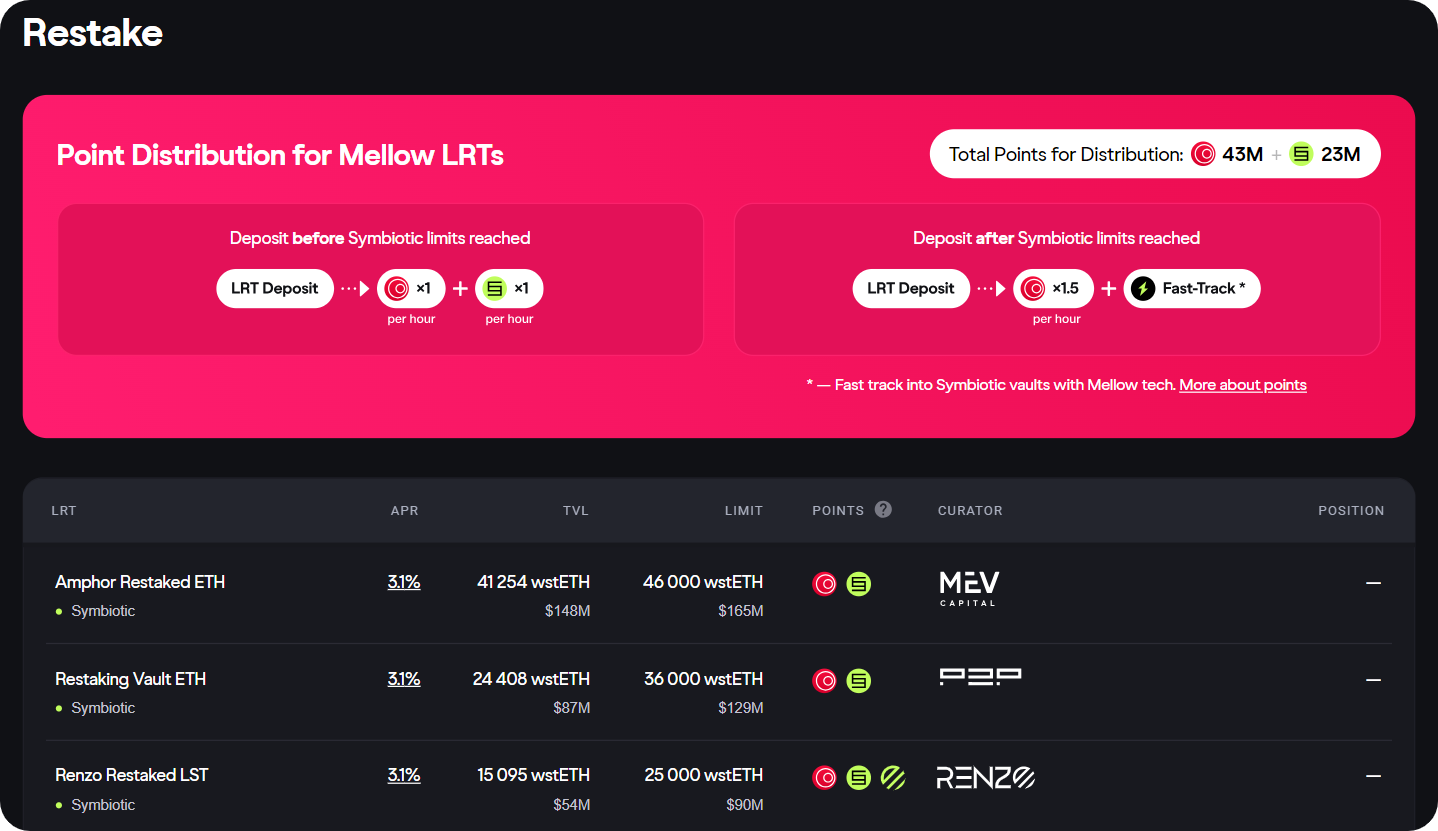

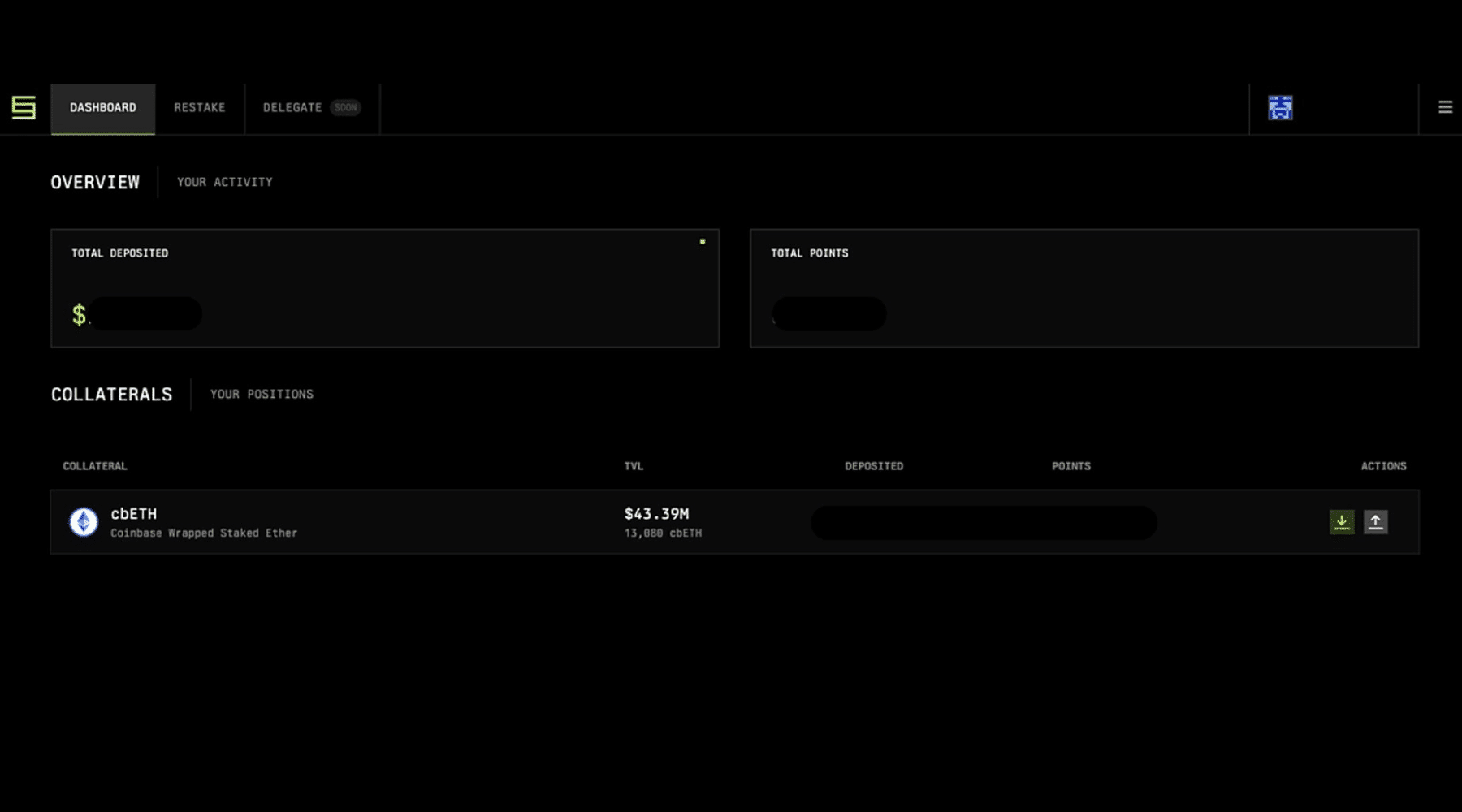

Symbiotic – Symbiotic’s External Rewards feature allows protocols to distribute their native tokens directly to stakers and node operators across eight partner networks. This multi-factor staking model combines native token incentives with Symbiotic Points, boosting both security and user rewards. Notable partners include Hyperlane, Cycle, and Tanssi.

-

OnStaking – OnStaking offers cross-chain staking across Ethereum 2.0, Polkadot, and Solana, enabling users to earn multi-asset rewards with smart contract automation. Its user-friendly dashboard supports both beginners and advanced users, making multi-factor staking accessible and efficient.

-

Strata Switch Layered Staking – This innovative architecture manages multi-tiered stake levels across distributed networks. It features independent processing layers, stake gateways, and cross-layer validators, allowing dynamic reward multipliers and enhanced scalability for DeFi protocols.

-

Smart Contract NFT Staking – DeFi protocols are integrating NFTs and smart contracts to represent staking positions. Users receive NFTs that track their stake and rewards, while smart contract wallets automate staking and unstaking, improving privacy and flexibility. This model is gaining traction for trustless, on-chain loyalty programs.

-

Lido Finance – Lido remains a leader in liquid staking, offering users stETH and other liquid tokens for staked assets. Its multi-factor approach includes governance token rewards, restaking options, and integration with DeFi protocols for compounded yields.

-

Rocket Pool – Rocket Pool’s decentralized staking protocol supports node operator incentives, rETH liquid staking, and a points-based loyalty system. Its multi-factor model encourages both individual and pooled staking participation.

-

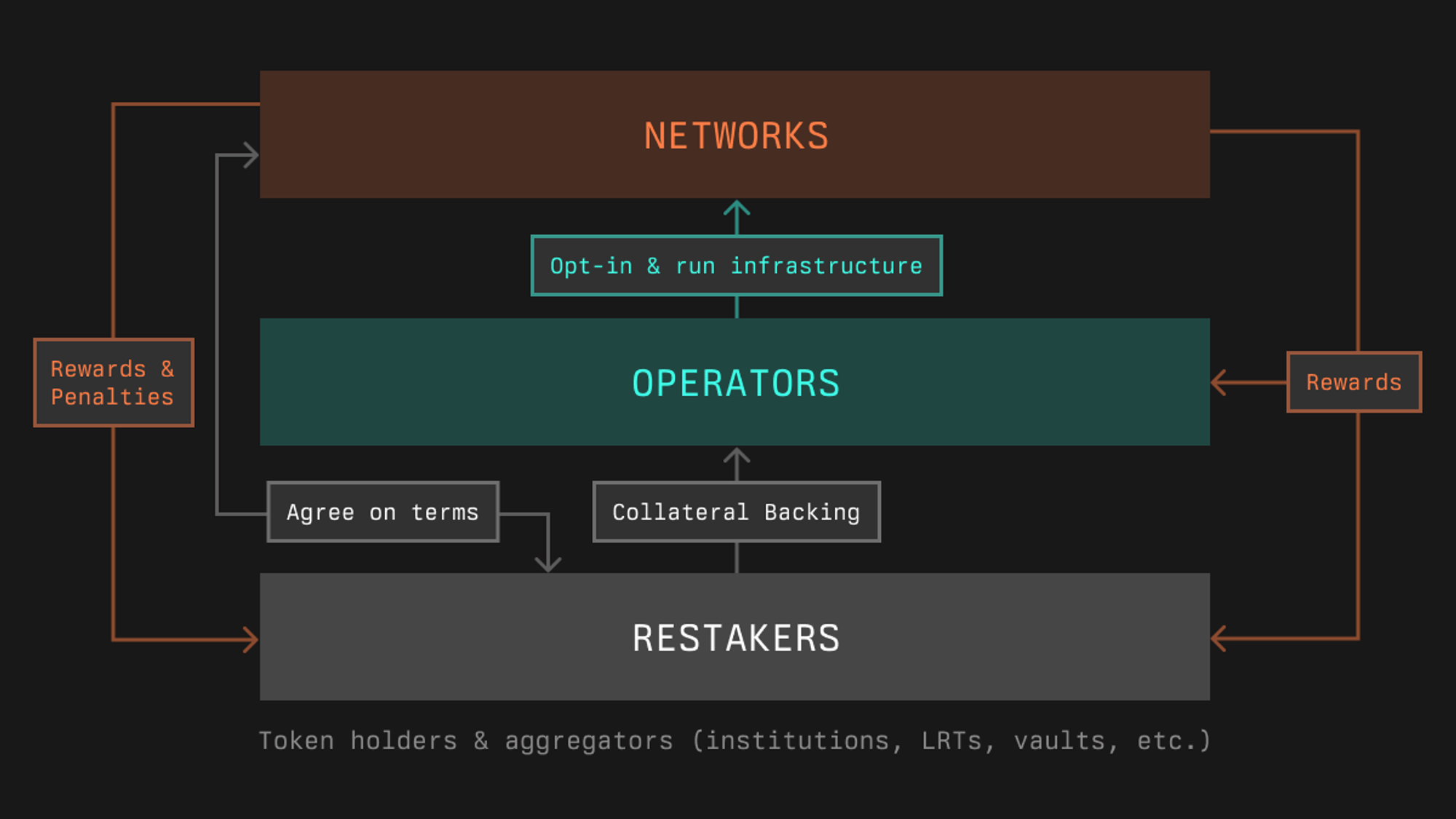

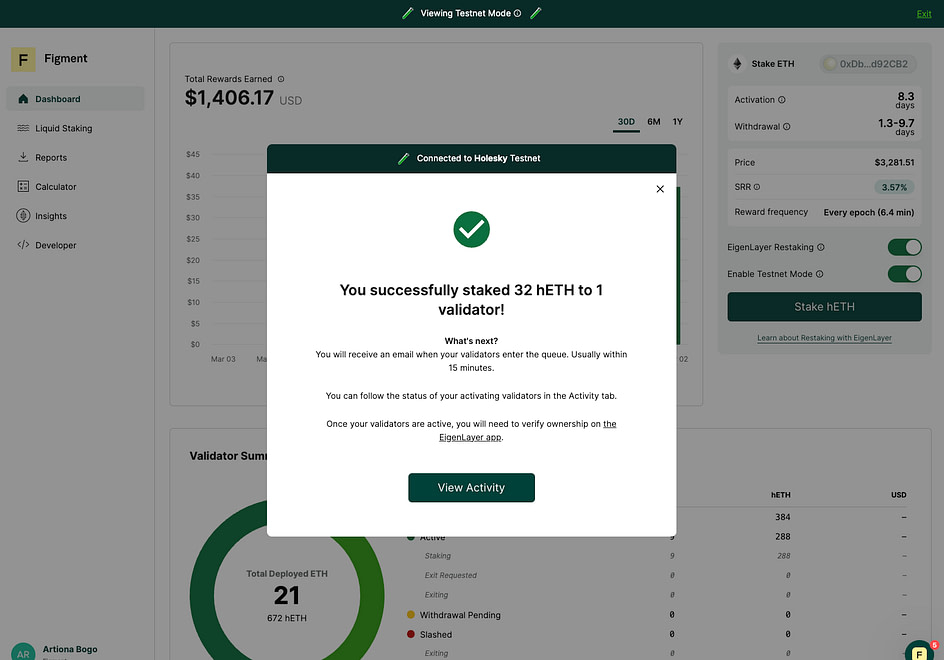

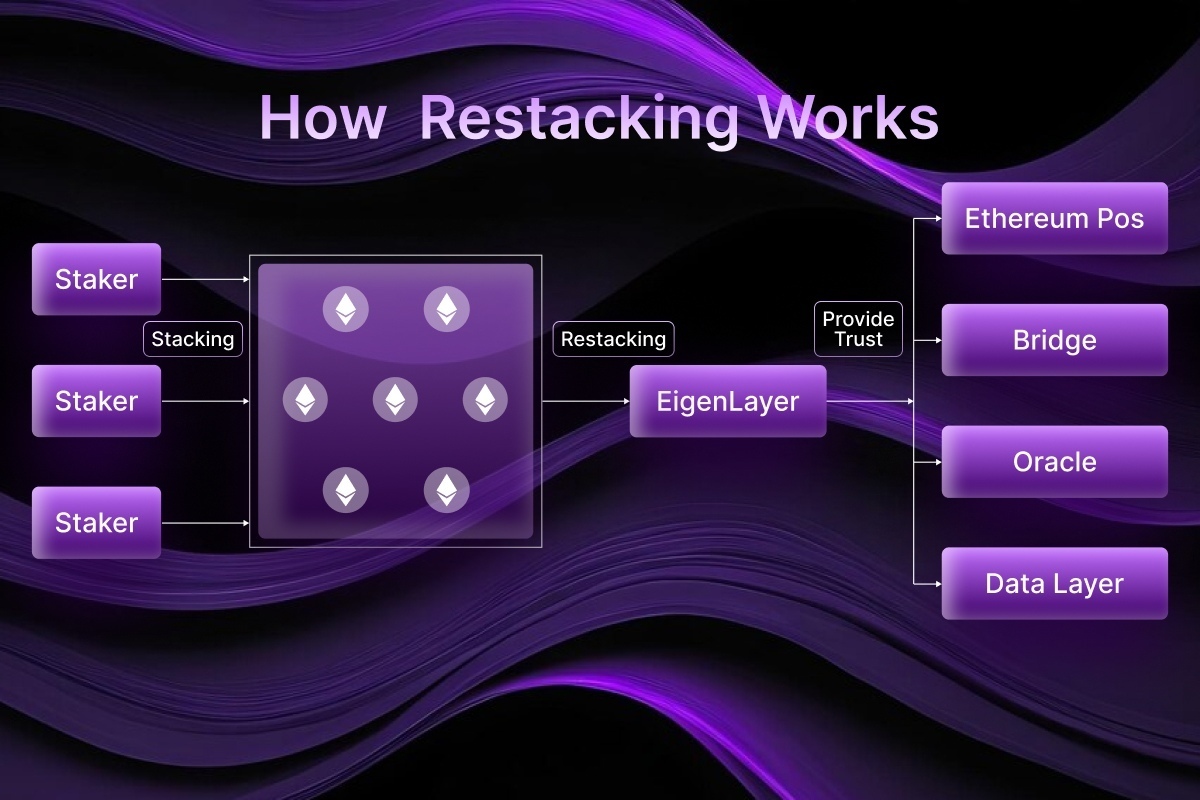

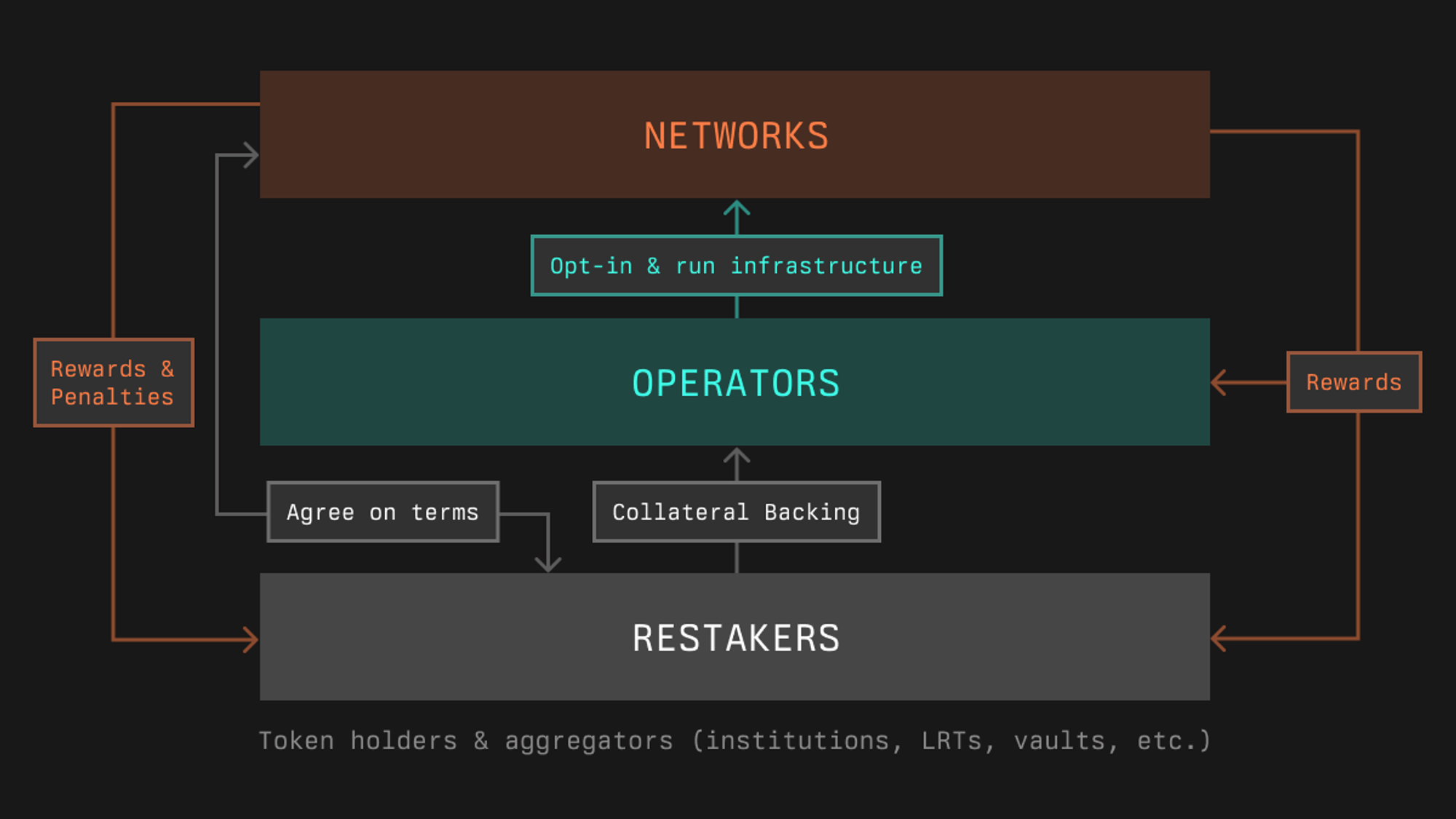

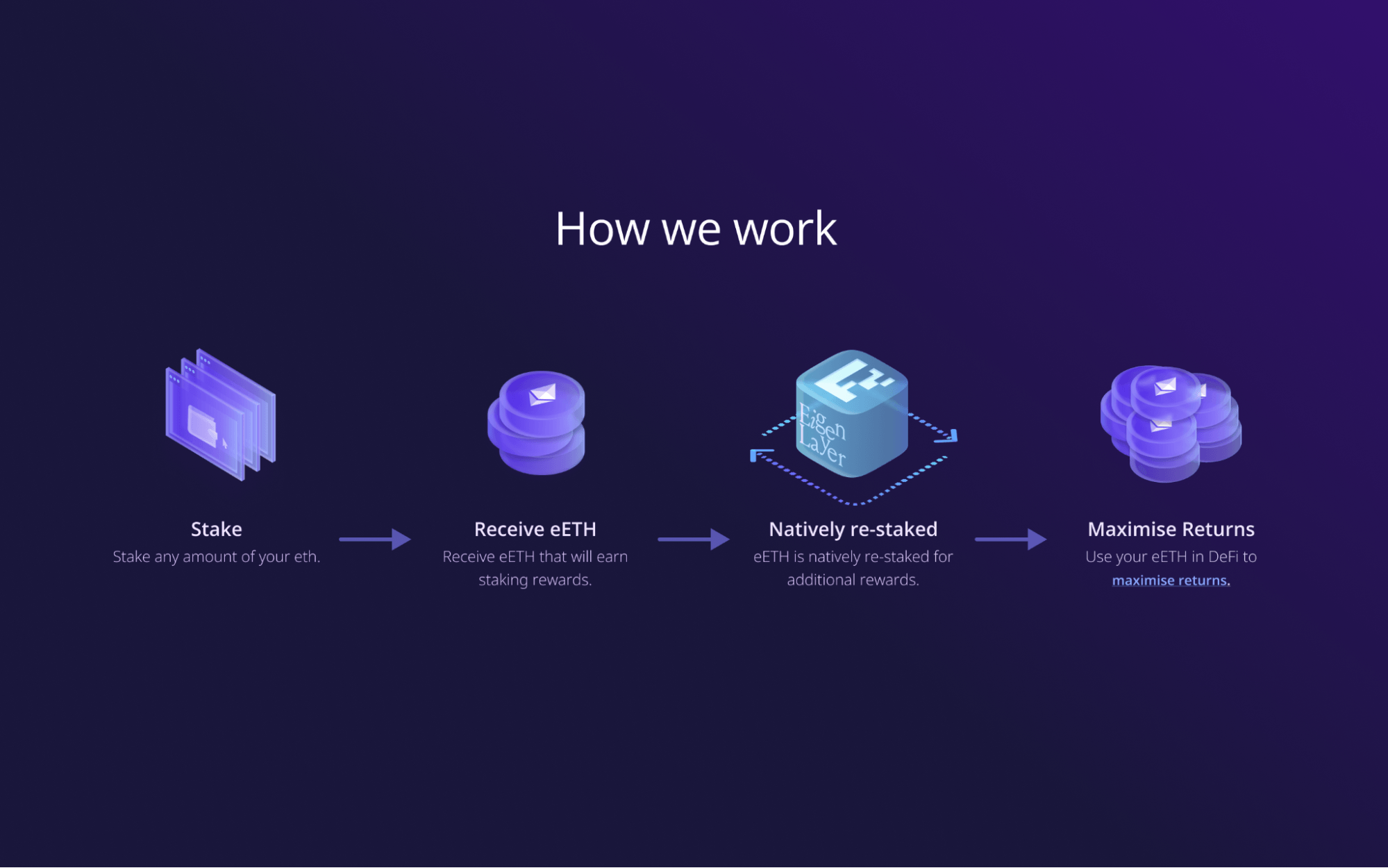

EigenLayer – EigenLayer introduces restaking, letting users leverage their staked ETH to secure multiple protocols and earn layered rewards. Its multi-factor staking model enhances both security and reward potential for participants.

-

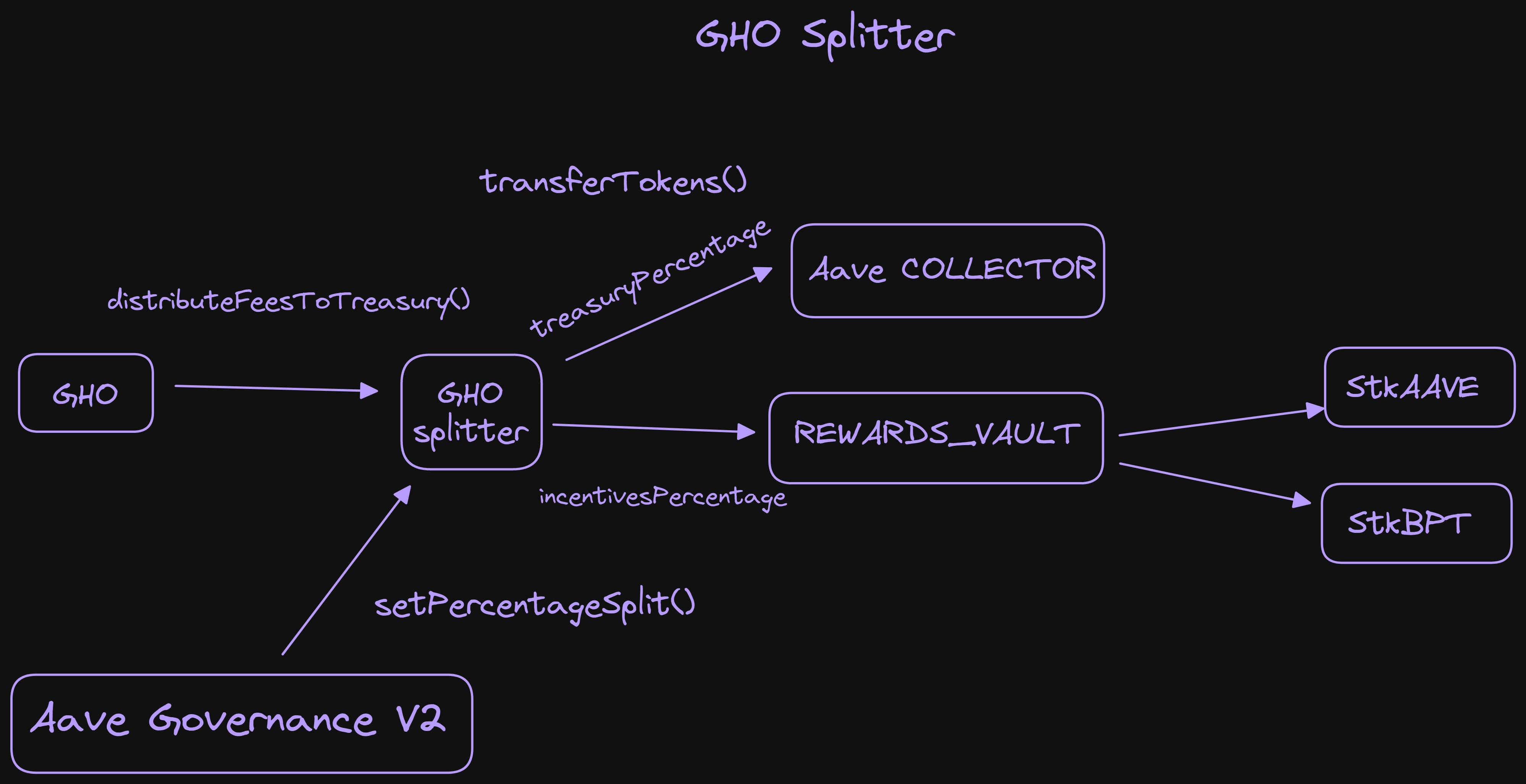

Aave – Aave’s safety module enables users to stake AAVE tokens, earning rewards and loyalty points while securing the protocol. Its multi-factor staking features include risk mitigation, governance participation, and tiered reward structures.

-

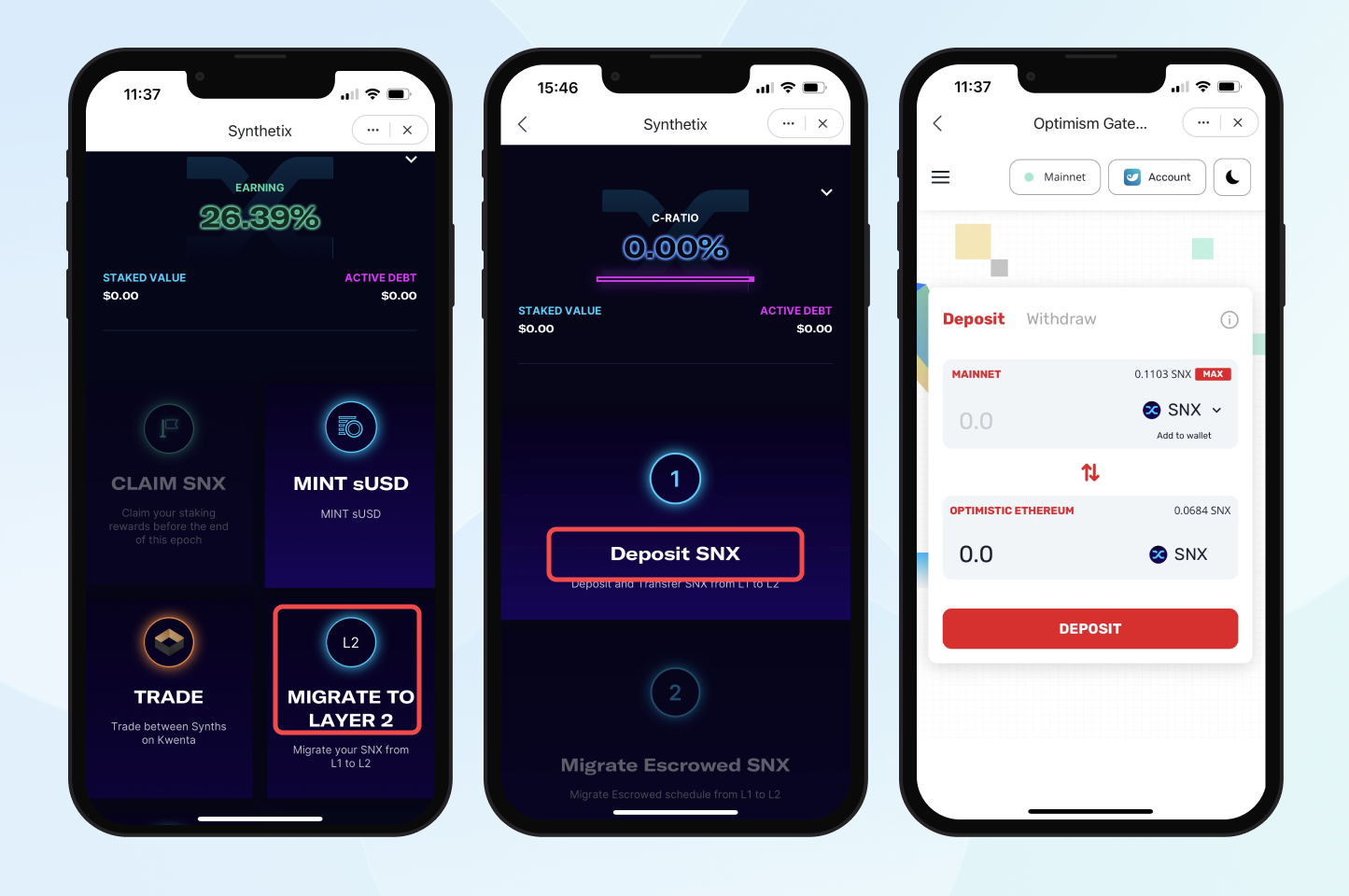

Synthetix – Synthetix offers multi-factor staking by rewarding users with SNX and sUSD, plus additional incentives for liquidity provision and governance. Its layered rewards system supports dynamic participation and loyalty bonuses.

-

Balancer – Balancer’s veBAL staking model combines governance, liquidity mining, and boosted rewards for long-term stakers. Its multi-factor approach incentivizes active participation and aligns user interests with protocol growth.

Symbiotic, for instance, has launched an ‘External Rewards’ feature that lets protocols distribute their native tokens directly to stakers across eight partner networks. This not only decentralizes security but also enables projects like Hyperlane and Cycle to incentivize users without building custom systems from scratch. Stakers benefit from both native token payouts and Symbiotic Points – creating layered value streams within a single interface.

OnStaking is another standout. With its intuitive dashboard, users can stake assets across multiple blockchains simultaneously, automating reward optimization through smart contracts. This cross-chain approach not only enhances yield opportunities but also brings much-needed simplicity for both newcomers and seasoned DeFi participants.

The Architecture Behind Layered Staking Models

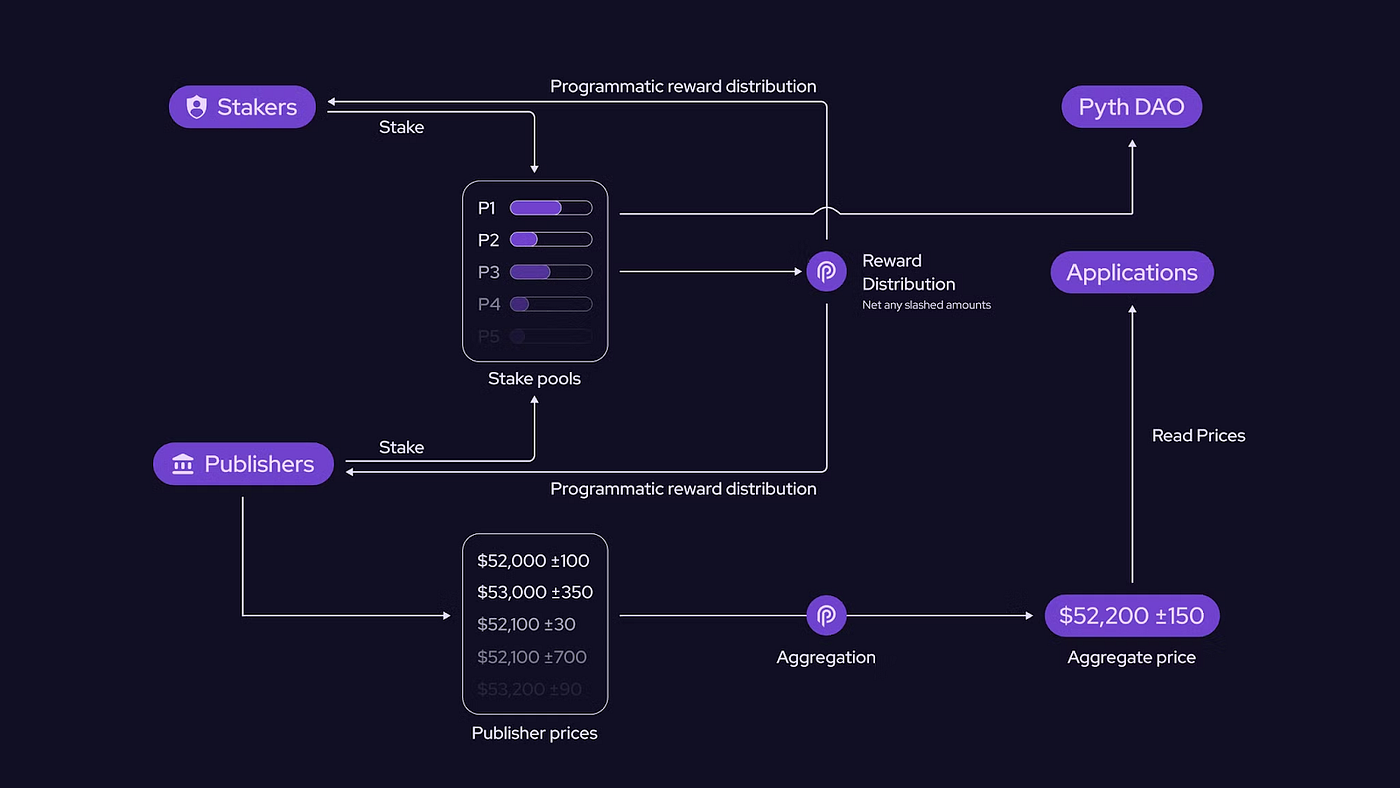

Diving deeper into the technology stack, modern MFS platforms employ what’s known as layered staking architectures. The ‘strata switch’ concept is especially notable here: it manages independent processing layers with unique stake requirements and reward multipliers. These layers are connected by gateways and validators that coordinate resource allocation while maintaining robust network security.

This modular design allows platforms to dynamically adjust thresholds in response to real-time demand or risk factors – ensuring stability even during periods of high volatility or network congestion. For users, this translates into more predictable returns and less exposure to systemic shocks often seen in single-layer protocols.

Layered staking models are also paving the way for creative integrations that blend DeFi with the broader Web3 landscape. One of the most exciting frontiers is the use of NFTs as staking receipts and loyalty boosters. By leveraging NFTs, projects can offer unique, tradable proof of stake positions that unlock premium rewards, access to governance, or even exclusive community perks. Smart contracts orchestrate this entire process trustlessly, ensuring fair and transparent reward distribution while minimizing manual intervention.

A recent study highlights how treasury contracts and validator smart contract wallets work together to automate staking flows. Depositors receive an NFT representing their position, which can be transferred or redeemed as needed. The treasury contract manages all NFT holders and orchestrates rewards payouts, while validator wallets stake on behalf of users, bringing efficiency and privacy into the heart of DeFi loyalty staking.

How Multi-Factor Staking Supercharges Community Engagement

What truly sets MFS apart is its ability to foster deep community engagement. By introducing multiple pathways for participation, be it through cross-chain activity, NFT-based incentives, or tiered loyalty programs, platforms are turning passive stakers into active ecosystem contributors. Users are not just earning yield; they’re helping secure networks, driving project adoption, and shaping governance decisions.

This shift is evident in the growing popularity of platforms offering compounding rewards and dynamic APY boosts tied to user activity. According to Symbiotic’s External Rewards, stakers now have a say in how protocols evolve, with real-time incentives that adjust based on network needs and user behavior. This creates a virtuous cycle: more engaged users mean stronger network effects and greater long-term value for everyone involved.

Key Benefits of Multi-Factor Staking Models in DeFi

-

Enhanced Reward Flexibility: Multi-factor staking models, like those on Symbiotic, allow protocols to distribute both native tokens and loyalty points, giving users access to multiple reward streams and boosting overall returns.

-

Cross-Chain Staking Opportunities: Platforms such as OnStaking support staking across Ethereum 2.0, Polkadot, and Solana, enabling users to diversify their assets and maximize yields from different blockchain networks.

-

Layered Security and Scalability: Advanced architectures like the strata switch introduce multi-tiered validation, strengthening network security and allowing for dynamic scaling as user participation grows.

-

Automated and User-Friendly Experience: Smart contract automation in MFS models streamlines staking, reward distribution, and unbonding, making participation accessible for both beginners and experienced users.

-

Integration of NFTs for Trustless Staking: Some MFS models use NFTs to represent staked positions, enabling trustless participation and flexible management of digital assets via treasury and validator smart contracts.

-

Customizable Reward Structures: Tiered reward matrices and adjustable stake thresholds empower protocols to tailor incentives, promoting long-term engagement and loyalty among users.

-

Greater Decentralization and Transparency: By combining multiple staking mechanisms and on-chain smart contracts, MFS models foster a more decentralized and transparent loyalty ecosystem.

-

Increased Capital Efficiency: Cross-chain and multi-asset staking options let users optimize capital allocation, compounding rewards without the need for constant asset management or trading.

-

Stronger Network Participation: Direct reward distribution to node operators and stakers, as seen with Symbiotic’s External Rewards, incentivizes active participation in securing and growing decentralized networks.

-

Future-Proofing User Engagement: The modular and adaptable nature of MFS architectures ensures that loyalty programs can evolve with new blockchain innovations and user needs.

Navigating Risks and Maximizing Rewards in MFS Crypto Staking

Of course, with greater flexibility comes new considerations around risk management. Multi-factor staking introduces variables such as cross-chain bridge security, smart contract vulnerabilities, and fluctuating reward multipliers. Leading platforms address these concerns through rigorous audits, transparent governance frameworks, and adaptive thresholds that respond to market conditions.

If you’re considering diving into MFS crypto staking:

As always in DeFi, due diligence is key. Platforms like OnStaking and Symbiotic provide detailed documentation on their layered architectures and risk controls, empowering users to make informed decisions before committing assets.

The Future of On-Chain Loyalty: Where MFS Models Are Headed Next

The momentum behind multi-factor staking is only accelerating as we move further into 2025. Expect to see deeper integrations between DeFi loyalty programs and real-world assets (RWAs), more seamless NFT utility within reward systems, and smarter automation via AI-powered smart contracts.

Ultimately, MFS models are democratizing access to on-chain loyalty rewards, making it possible for anyone with a wallet to participate meaningfully in their favorite blockchain communities. Whether you’re a casual user seeking passive income or an active participant shaping protocol evolution, the next generation of DeFi loyalty staking has something for everyone.