In the fast-evolving world of decentralized finance, user retention is the holy grail for any project seeking sustainable growth. Traditional loyalty programs have long been a staple in Web2, but now, on-chain loyalty staking is rewriting the rulebook for DeFi. By blending staking incentives with blockchain-based loyalty programs, projects are discovering new ways to keep users engaged, invested, and coming back for more.

What Is On-Chain Loyalty Staking?

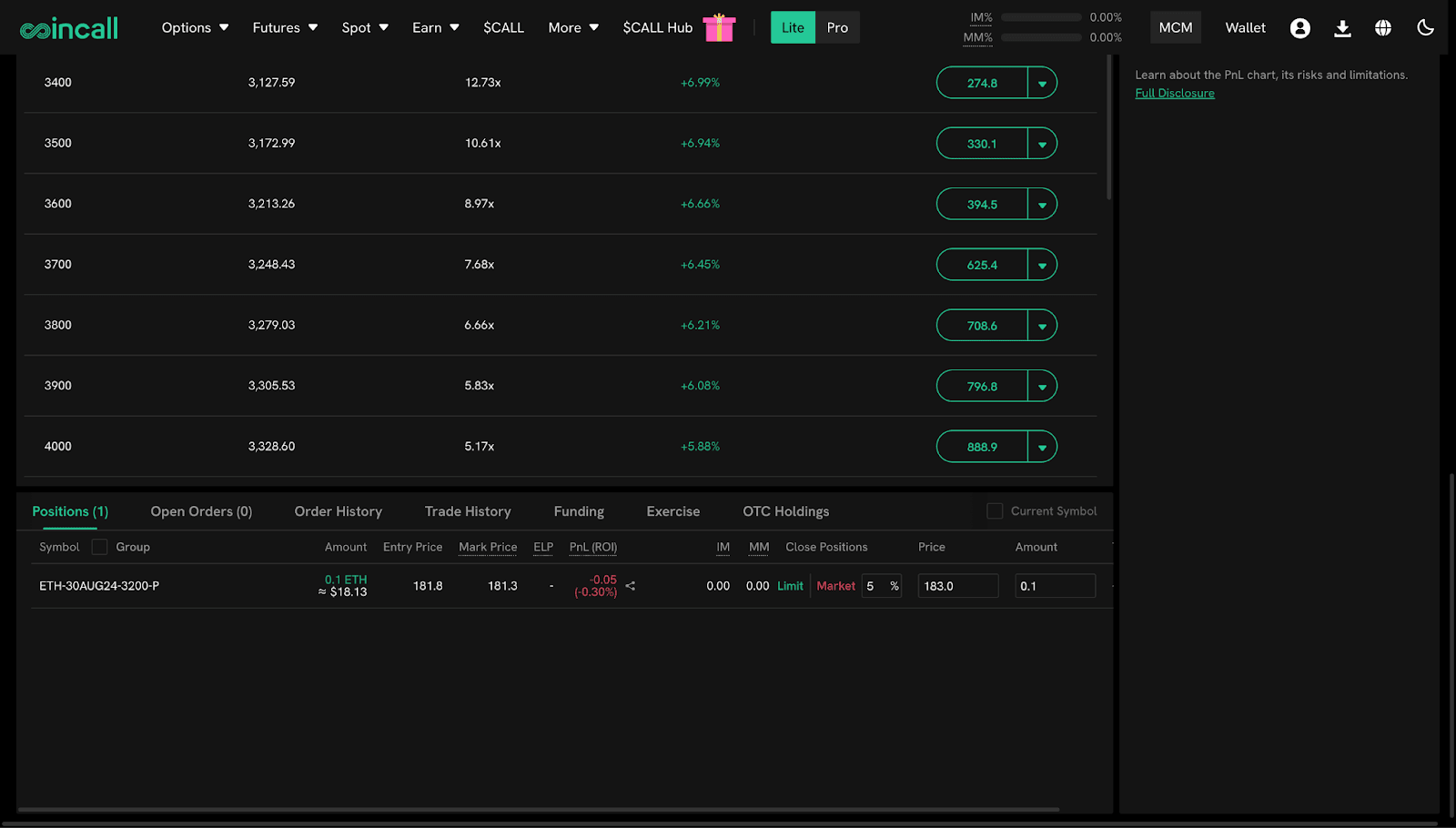

On-chain loyalty staking is more than just locking up tokens for yield. It’s a dynamic mechanism where users commit their assets within a protocol and, in return, unlock a suite of rewards, ranging from governance rights and exclusive NFTs to boosted yields and early access to features. This transforms passive holders into active participants, aligning their interests with the platform’s long-term success.

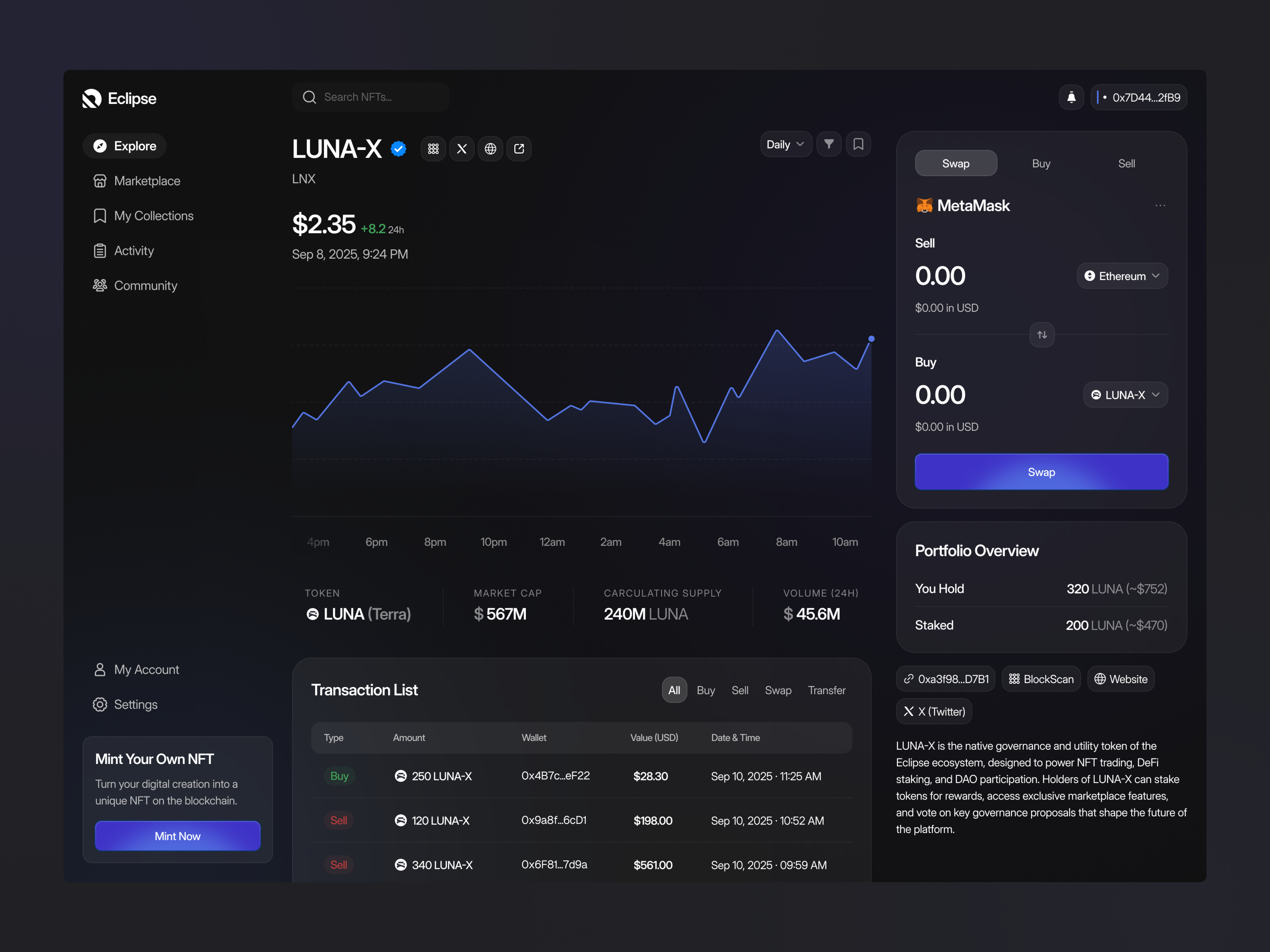

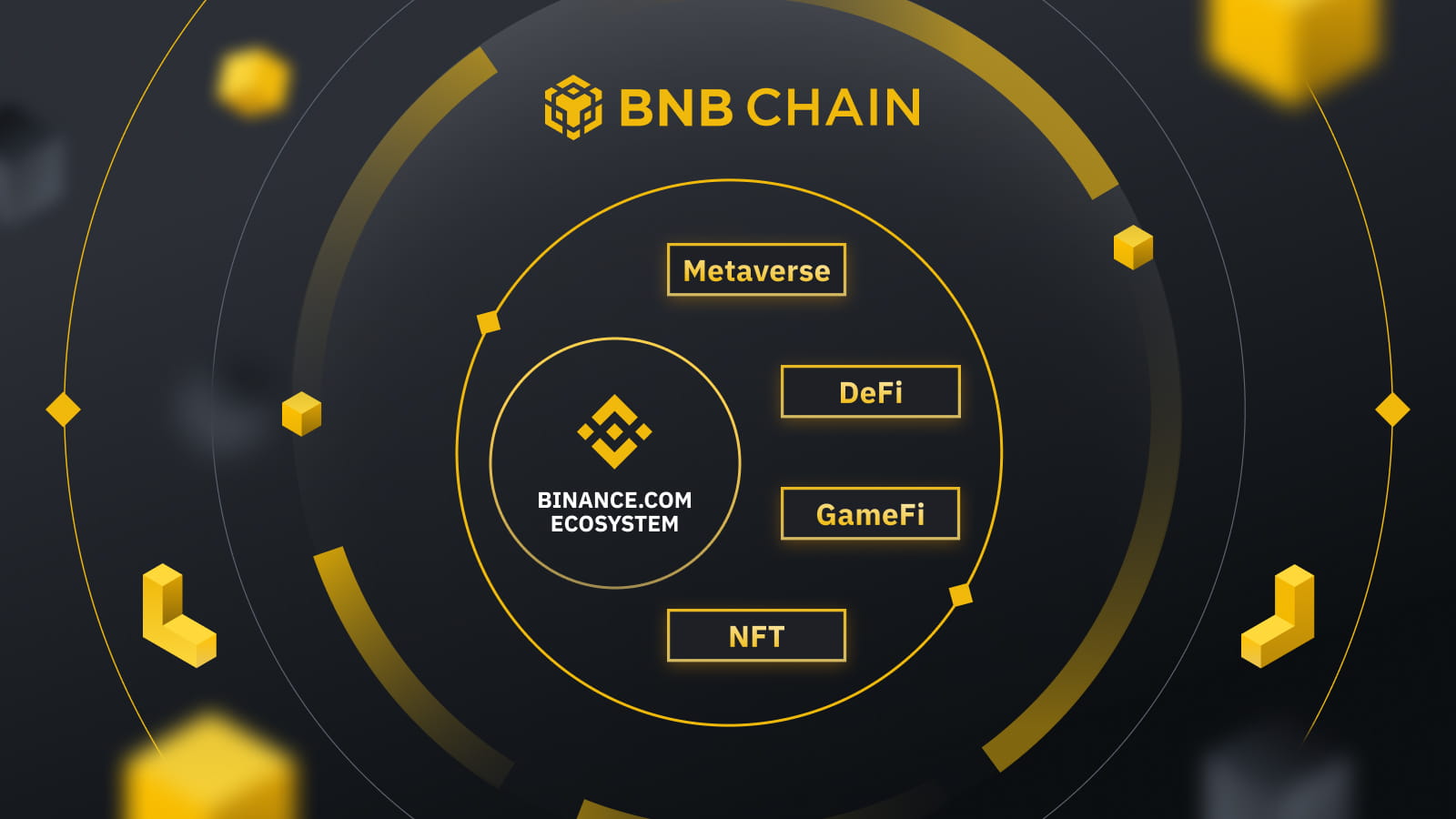

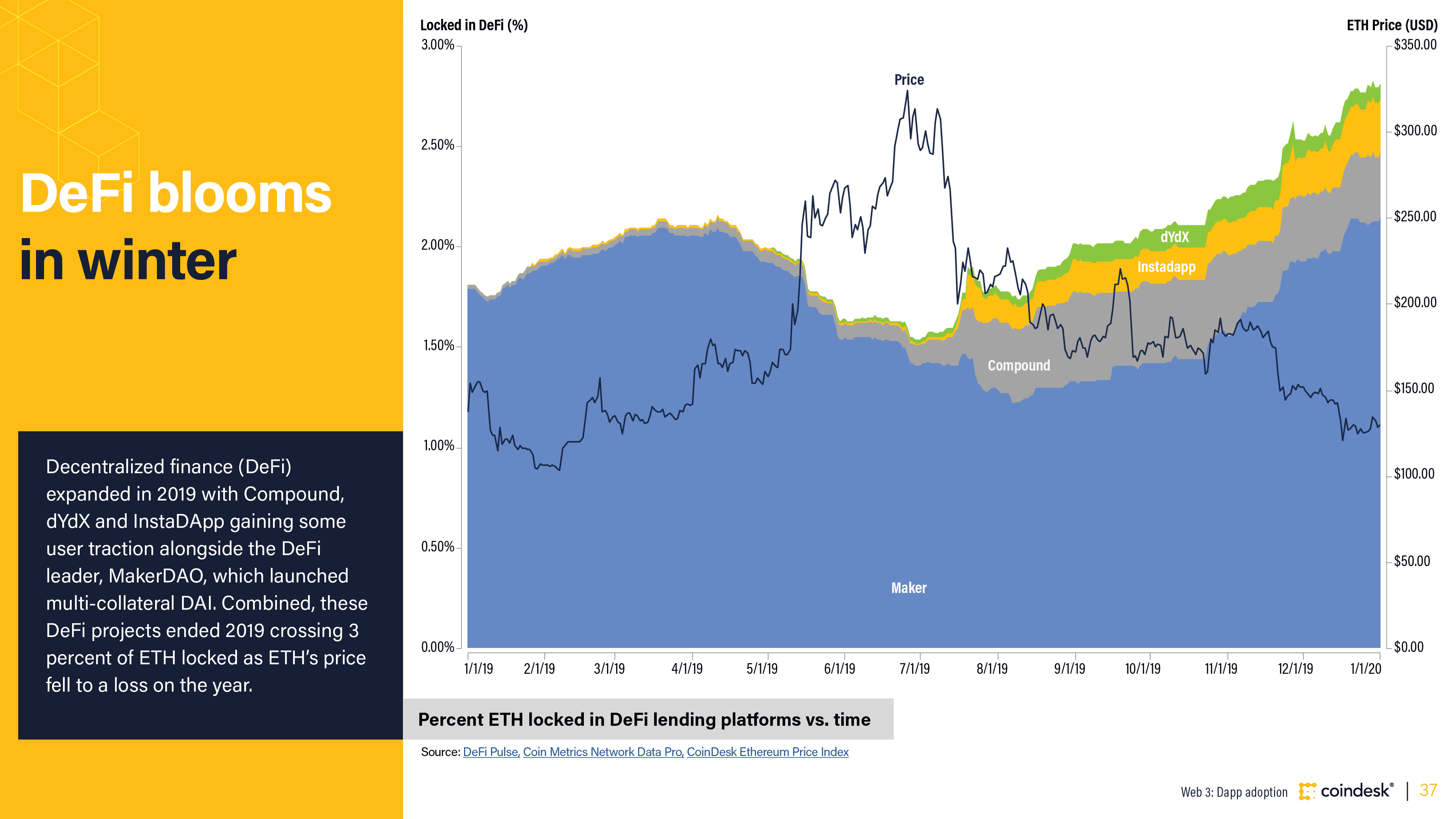

Unlike basic staking, which simply offers token rewards for securing a network, loyalty staking weaves in gamified elements and community recognition. For example, platforms like Lens Protocol reward users with NFTs and reputation scores for social contributions, while BNB Chain’s Gas-Free Campaign eliminates transaction fees for stablecoin transfers to encourage users to keep assets within its ecosystem.

The Power of Staking Incentives for DeFi User Retention

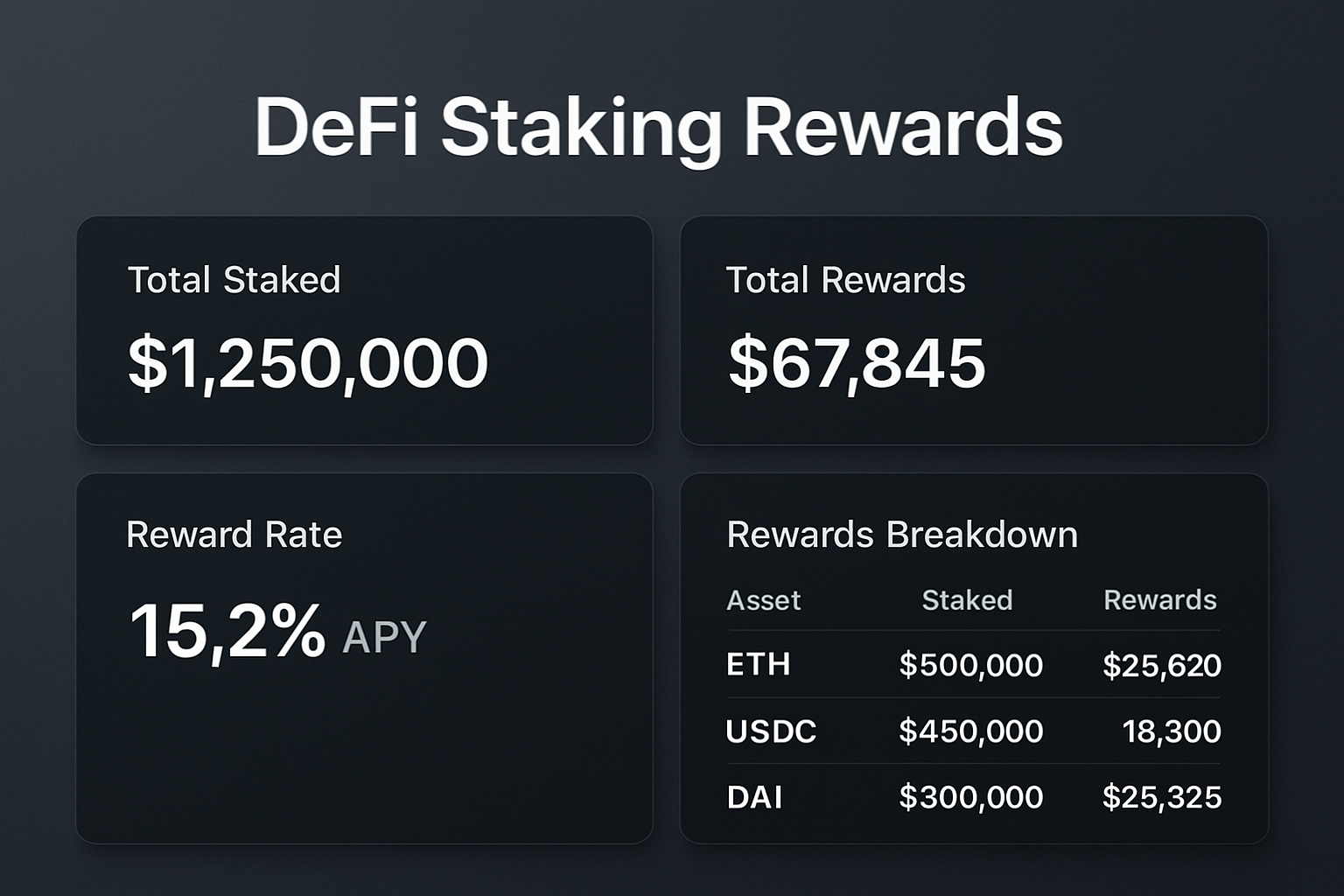

The numbers speak for themselves: DeFi platforms that offer meaningful staking incentives consistently see higher user retention rates than those that don’t. Here’s why:

Key Ways On-Chain Loyalty Staking Boosts DeFi User Retention

-

Tangible Rewards Incentivize Long-Term Participation: On-chain loyalty staking lets users earn real, on-chain rewards such as additional tokens, governance rights, or exclusive NFTs, directly incentivizing them to stay active on the platform.

-

Encourages Deeper Platform Engagement: Staking mechanisms require users to monitor, manage, and sometimes interact with their staked assets, fostering frequent platform visits and ongoing engagement.

-

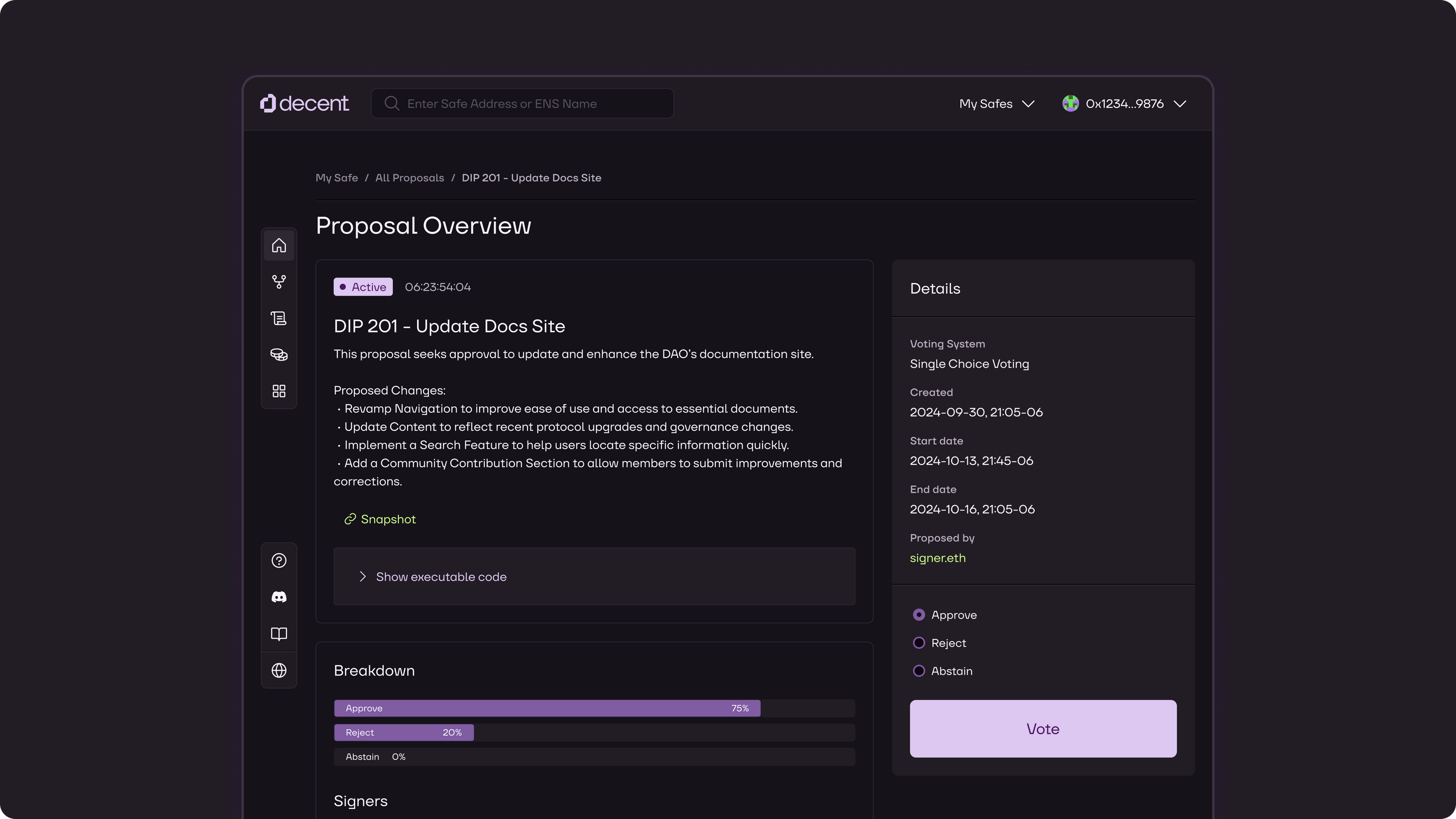

Builds Community Through Governance: Many DeFi protocols grant governance voting rights to stakers, empowering users to shape platform decisions and strengthening their sense of ownership and community.

-

Supports User Retention With Cost-Saving Initiatives: Programs like BNB Chain’s Gas-Free Campaign eliminate transaction fees for certain activities, making it more cost-effective for users to keep assets within the ecosystem.

-

Promotes Loyalty With Cross-Platform Credentials: Platforms such as Lens Protocol reward user activity with NFTs and reputation scores that serve as loyalty credentials, usable across the broader ecosystem.

-

Aligns User Success With Platform Growth: Staking often ties user rewards to platform health (e.g., BNB Chain’s TVL Incentive Program), encouraging users to contribute to the ecosystem’s growth and stability.

-

Provides Passive Income Opportunities: By locking tokens, users can earn passive yield through staking rewards, making continued participation financially attractive.

-

Facilitates Interoperability and Expanded Utility: Tokenized loyalty rewards can interact with other DeFi protocols, letting users earn additional yield or benefits beyond the original platform.

-

Reduces Churn Through Lock-Up Periods: Staking often requires users to lock tokens for set periods, naturally reducing short-term churn and encouraging longer-term retention.

-

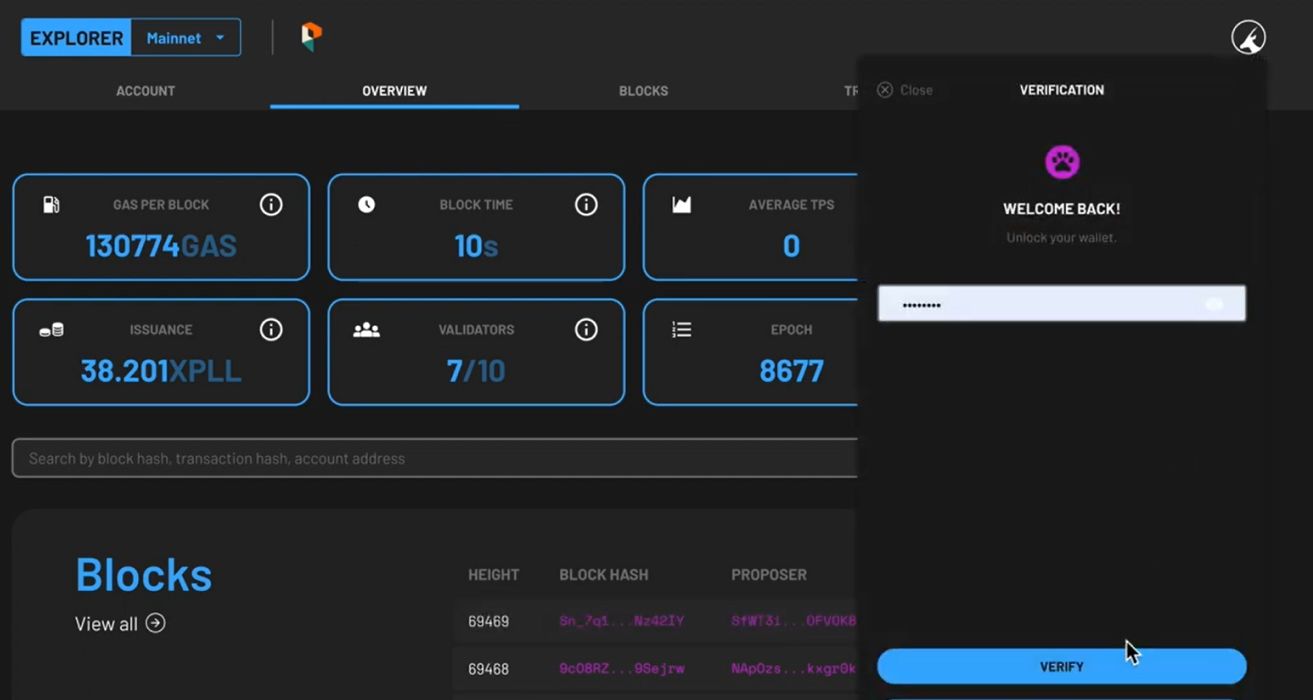

Enhances Trust With Transparent, On-Chain Records: All staking transactions and rewards are recorded on-chain, providing transparency and verifiability that build user confidence.

1. Tangible Rewards Foster Loyalty: When users see real value accruing from their participation, whether through additional tokens, yield boosts, or exclusive privileges, they’re far more likely to stick around.

2. Community Engagement Drives Growth: Staking programs often include governance rights or social recognition, making users feel like stakeholders rather than mere customers.

3. Long-Term Commitment Is Built In: By requiring assets to be locked for set periods, platforms naturally encourage longer user lifecycles and discourage short-term speculation.

Case Studies: Real-World Successes in Blockchain Loyalty Programs

Let’s look at how leading DeFi projects are leveraging on-chain loyalty staking to supercharge user engagement:

- Lens Protocol: By rewarding users with NFTs and reputation scores for content creation and interaction, Lens turns social activity into lasting loyalty credentials that can be used across its ecosystem.

- BNB Chain’s TVL Incentive Program: With up to $300,000 in rewards for projects increasing their Total Value Locked (TVL), both projects and users are incentivized to contribute more assets and remain active on the platform.

- Gas-Free Campaigns: By waiving transaction fees for certain activities, platforms like BNB Chain lower barriers for entry and retention, making it more attractive for users to keep their funds on-chain.

Navigating the Challenges of On-Chain Loyalty Staking

No system is without its hurdles. Security remains paramount, users need assurance that staked assets are protected from exploits and smart contract vulnerabilities. Liquidity constraints also pose a challenge; while locked tokens drive commitment, they can deter those who value instant access to funds.

Finally, regulatory uncertainty continues to shape how staking programs are designed and marketed across different jurisdictions. The most successful projects are those that combine robust security practices with flexible program structures that adapt to evolving compliance requirements.

The rapid adoption of on-chain loyalty staking signals a paradigm shift in how DeFi projects approach user retention and community building. By offering more than just financial incentives, think social status, governance power, and cross-platform recognition, these programs create a virtuous cycle of engagement that benefits both users and protocols alike.

As the DeFi landscape matures, users are no longer satisfied with basic yield farming or passive token holding. On-chain loyalty staking meets this demand for deeper involvement, transforming the user journey from transactional to relational. The result? Platforms see not only higher retention, but also more vibrant, self-sustaining communities where users are motivated to contribute ideas, provide liquidity, and evangelize their favorite protocols.

What sets blockchain loyalty programs apart is their transparency and interoperability. Unlike traditional reward systems, on-chain rewards are visible, verifiable, and portable across ecosystems. For example, NFTs earned on one platform can serve as credentials or unlock benefits on another, while governance tokens give users a direct voice in shaping the protocol’s future. This level of empowerment is a key driver behind the stickiness of top DeFi projects.

Best Practices for Implementing Loyalty Staking

To maximize the impact of staking incentives on user retention, leading protocols adopt several best practices:

Best Practices for Launching On-Chain Loyalty Staking

-

Design Clear and Transparent Reward Structures: Clearly outline the staking rewards, lock-up periods, and eligibility criteria. Transparency builds user trust and encourages participation. For example, BNB Chain’s TVL Incentive Program publicizes its prize pool and requirements for DeFi projects.

-

Integrate Flexible Staking Options: Offer users a range of staking durations and reward tiers. This flexibility accommodates different risk appetites and liquidity needs, as seen on platforms like Ethereum’s liquid staking protocols (e.g., Lido).

-

Enhance Security with Audited Smart Contracts: Ensure all staking contracts undergo thorough security audits by reputable firms. Highlight audit results to reassure users, as practiced by leading DeFi protocols like Aave and Compound.

-

Incorporate Community Governance: Empower stakers with governance rights, allowing them to vote on protocol upgrades or reward adjustments. This approach, used by Uniswap and Curve, fosters a sense of ownership and loyalty.

-

Offer Multi-Utility Loyalty Tokens: Design loyalty tokens that provide multiple benefits, such as fee discounts, priority access, or cross-platform interoperability. Lens Protocol uses NFTs and reputation scores as loyalty credentials across its ecosystem.

-

Communicate Regularly and Educate Users: Provide ongoing updates, tutorials, and transparent reporting on staking program performance. Platforms like Binance and Coinbase excel at user education and communication.

-

Ensure Regulatory Compliance: Stay updated with local and international regulations affecting staking programs. Leading platforms like Kraken have adapted their offerings to comply with evolving legal requirements.

-

Minimize User Friction with Seamless UX: Design intuitive interfaces and smooth onboarding processes to make staking accessible for all users. Rocket Pool and Coinbase are recognized for their user-friendly staking flows.

-

Incentivize Long-Term Participation: Implement bonus rewards or tiered benefits for users who stake over extended periods, similar to Curve’s veCRV model that boosts rewards for longer lock-ups.

-

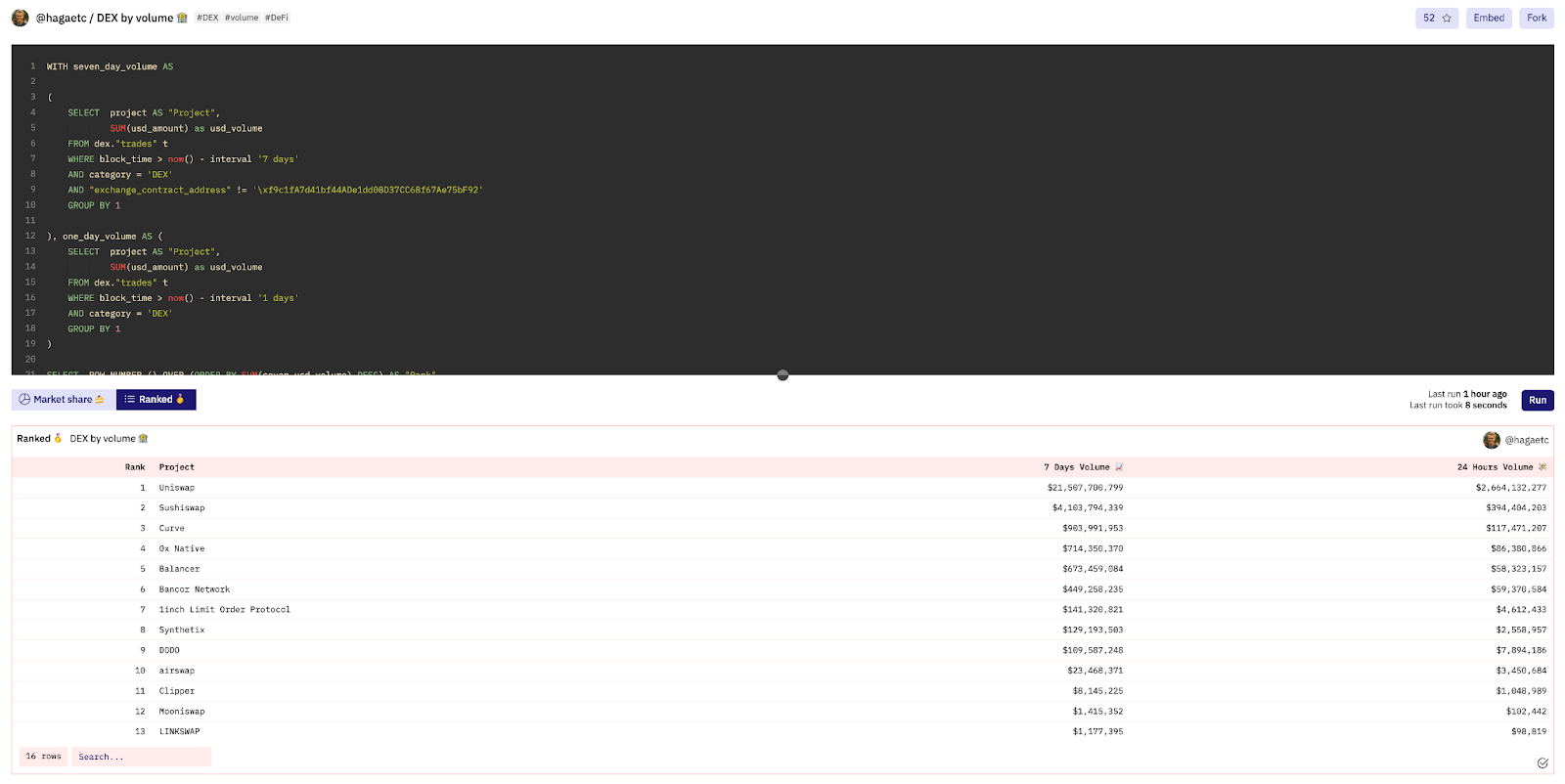

Monitor and Optimize with On-Chain Analytics: Leverage analytics tools to track user behavior, retention rates, and program effectiveness. Platforms like Dune Analytics and Nansen provide actionable insights for continuous improvement.

1. Gamification and Tiered Rewards: Introducing levels, badges, or milestone-based bonuses keeps users engaged over time and encourages friendly competition within the community.

2. Flexible Lock-Up Options: Allowing users to select different staking durations or withdrawal terms caters to diverse risk appetites and liquidity needs, reducing friction for newcomers while rewarding long-term commitment.

3. Interoperable Loyalty Tokens: Designing rewards that can be used across multiple DeFi platforms amplifies their utility and appeal, further anchoring users in the ecosystem.

The growing sophistication of analytics tools also helps platforms fine-tune their loyalty programs. By tracking user behaviors, such as re-staking rates or cross-platform activity, teams can identify what truly resonates with their audience and iterate quickly to stay ahead of the curve.

The Future of Crypto Community Engagement

The next wave of DeFi growth will be defined by how well projects can foster genuine loyalty and participation. On-chain loyalty staking is already demonstrating its power to turn fleeting users into passionate advocates, driving not just TVL but also innovation and resilience in the face of market volatility.

As more platforms embrace tokenized rewards and interoperable incentives, expect to see even greater collaboration between protocols and communities. This evolution will unlock new opportunities for users to earn, contribute, and belong – all while retaining full ownership of their assets and identities.

If you’re eager to explore more strategies for building engagement in decentralized finance, check out our in-depth guide on how on-chain loyalty staking drives community engagement in DeFi projects.