On-chain loyalty staking is rapidly redefining the NFT landscape, offering holders more than just speculative value or digital bragging rights. By locking NFTs into decentralized protocols, users unlock new layers of utility: passive income streams, exclusive airdrops, and access to gated experiences that deepen their connection with Web3 communities. This evolution marks a strategic shift from static collectibles to dynamic financial assets and loyalty instruments.

Unlocking Passive Income for NFT Holders

The core appeal of on-chain loyalty staking lies in its ability to transform NFTs into revenue-generating assets. Rather than selling prized digital art or rare collectibles, users can stake their NFTs on secure DeFi platforms and earn regular rewards. These incentives are typically distributed as additional tokens, governance rights, or even new NFTs, creating a compounding effect for long-term holders.

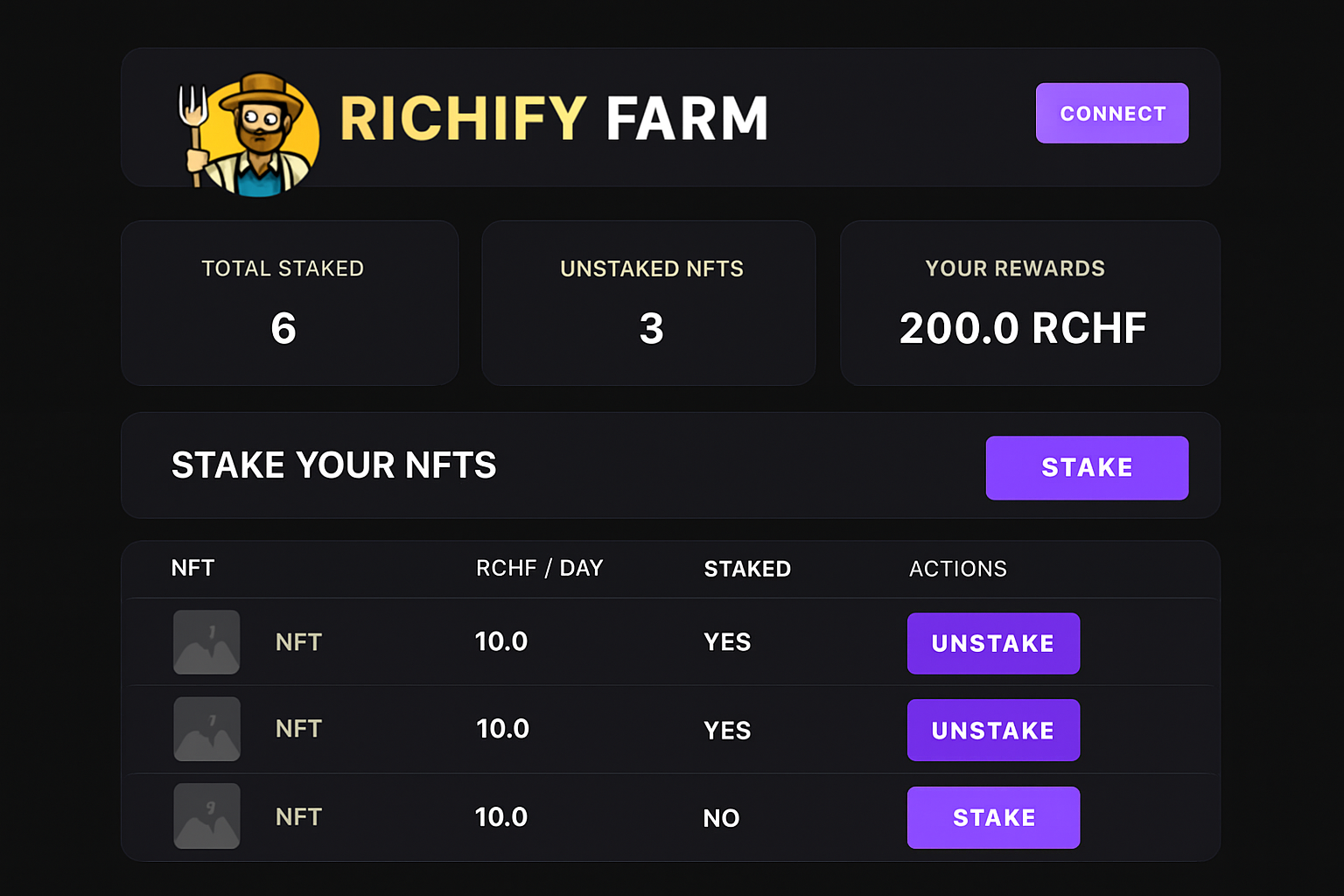

The mechanism is straightforward yet powerful: by committing their NFTs for a specified period, users help strengthen the ecosystem while receiving compensation based on factors like duration staked and rarity tier. For example, platforms such as Richify Farm offer flexible pools where short-term stakes yield modest returns (e. g. , 5% APY for 30 days), while longer commitments unlock higher APYs (up to 30%) and VIP privileges. This approach not only incentivizes holding but also aligns user interests with project growth.

Exclusive Airdrops and Gated Community Rewards

Beyond passive income, NFT staking rewards often include highly sought-after perks that go far beyond simple token payouts. Stakers can receive exclusive airdrops of new tokens or limited-edition NFTs, rewards designed to recognize and incentivize community loyalty. These benefits may also extend to early access for upcoming mints, participation in special events, or entry into private Discord groups reserved for top supporters.

This model mirrors successful strategies used by leading DeFi projects: rewarding loyal users with tangible value while driving sustained engagement. For instance, the Anyone Network increases reward tiers over time, granting larger airdrops and sweepstakes entries the longer users stake their assets. Such programs reinforce positive feedback loops within the community and encourage deeper participation in decentralized ecosystems.

Enhancing NFT Utility Through Decentralized Loyalty Programs

The transition from static ownership to active participation is at the heart of decentralized loyalty programs. By integrating staking directly into NFT projects or marketplaces, creators empower holders with meaningful roles in governance and platform development. Many protocols now enable stakers to vote on future features or distribution models, further blurring the line between user and stakeholder.

This participatory approach not only boosts retention but also transforms NFTs into vehicles for ongoing engagement. Projects like One-Out allow creators to establish custom staking farms where buyers earn rewards simply by holding onto their assets, enhancing both liquidity and desirability in secondary markets without requiring sales activity.

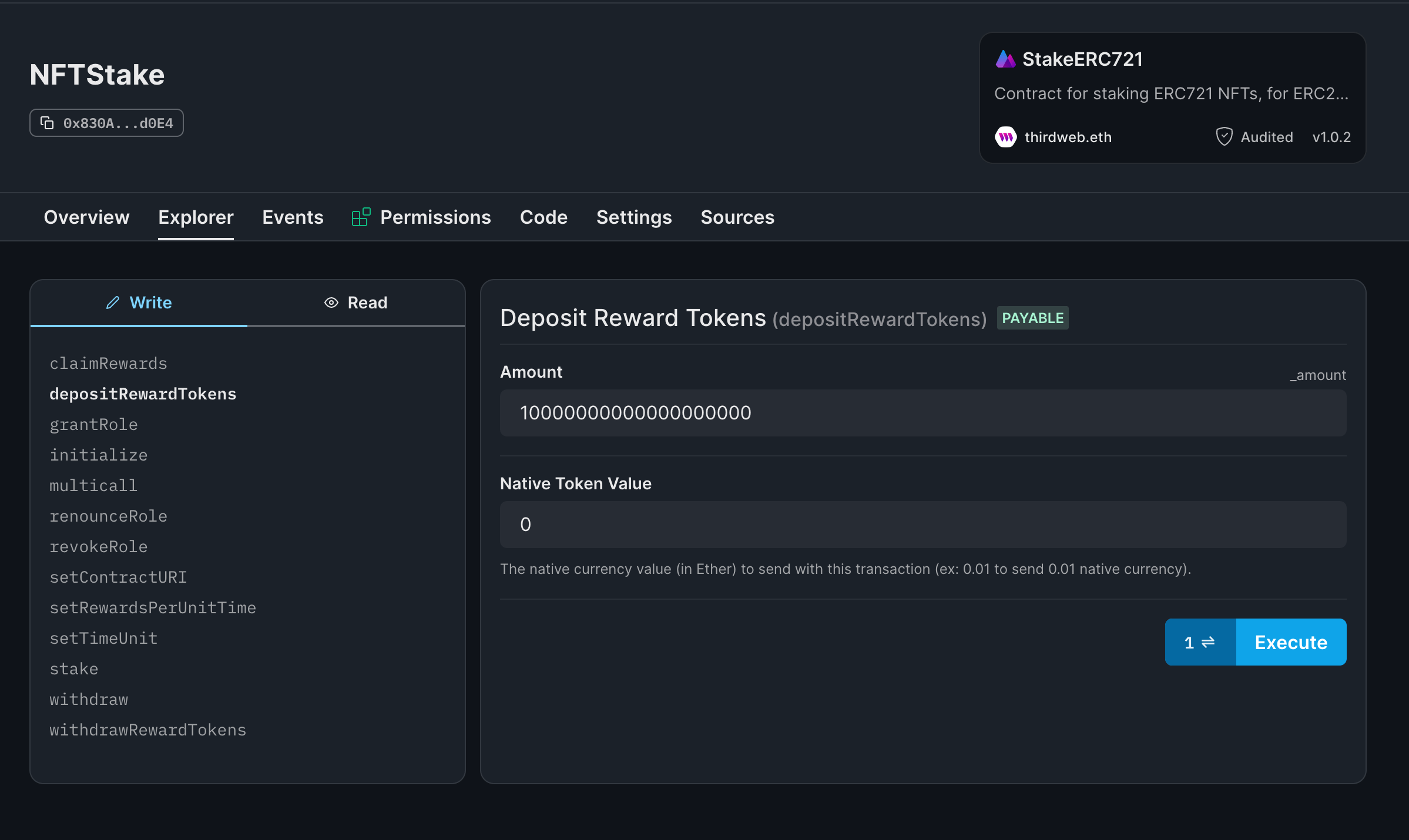

Security and transparency are central to the success of on-chain loyalty staking. Smart contracts automate reward distribution and enforce staking terms, reducing counterparty risk and enabling real-time auditing by the community. However, users must remain vigilant: verifying platform credibility, understanding contract mechanics, and keeping abreast of security audits are all essential steps before committing high-value NFTs.

Market volatility also plays a significant role in the overall returns from NFT staking. The value of both staked NFTs and distributed rewards can fluctuate rapidly, especially in emerging DeFi ecosystems. For risk-conscious participants, platforms offering flexible withdrawal terms or diversified reward options provide a buffer against sudden downturns. Reviewing each platform’s APY structure and early withdrawal penalties is critical for aligning staking strategies with individual risk profiles.

Strategies for Maximizing NFT Staking Rewards

To optimize passive income and exclusive perks, experienced NFT holders employ several strategic approaches:

Top Strategies to Maximize NFT Staking Rewards

-

Choose High-APY Staking Platforms: Select reputable platforms like Richify Farm, which offers tiered staking pools with APYs ranging from 5% for 30 days to 30% for 365 days. Longer commitments often unlock VIP perks and governance power.

-

Leverage Loyalty Programs for Extra Benefits: Platforms such as Anyone Network reward long-term holders with increasing passive income, exclusive airdrops, and entry into sweepstakes. The longer you stake, the greater your rewards.

-

Stake NFTs on Creator-Driven Platforms: Use solutions like One-Out’s NFT Staking, where NFT authors create custom staking farms. This enables buyers to earn rewards directly from the NFT’s ecosystem, boosting both value and utility.

-

Participate in Governance for Added Influence: Many staking platforms grant voting rights to stakers. By actively participating in governance (e.g., on Richify Farm), you can help shape project direction while earning additional incentives.

-

Stay Updated on Exclusive Airdrops and Whitelists: Staking NFTs can provide early access to new releases, whitelist spots for upcoming mints, and exclusive airdrops. Monitor platform announcements to capitalize on these time-sensitive opportunities.

Diversification across multiple staking pools can balance risk and enhance total yield. Engaging with platforms that offer tiered reward systems or compounding incentives allows users to steadily grow their holdings without overexposing themselves to a single project’s volatility.

Staking rare or high-utility NFTs often unlocks superior rewards compared to common assets. Many protocols assign higher weightings or bonus multipliers to scarce collectibles, making rarity a key consideration in any staking strategy.

Community engagement is another lever: active participation in governance votes or promotional campaigns can result in additional bonuses or priority access to new features. Stakers who contribute feedback or help shape project direction are frequently rewarded through enhanced loyalty tiers.

The Future of On-Chain Loyalty Staking for NFT Holders

The next wave of decentralized loyalty programs is poised to further blur the boundaries between digital ownership, community engagement, and financial opportunity. As more projects integrate NFT staking mechanisms, expect to see expanded cross-platform collaborations, enabling holders to earn rewards across multiple ecosystems simultaneously.

This trend will likely accelerate the adoption of passive income NFTs as core portfolio assets among both retail investors and institutional participants. By providing transparent, automated pathways to earn yield while supporting favorite projects, on-chain loyalty staking cements itself as a cornerstone of Web3 community building.

Ultimately, as protocols evolve and competition intensifies, user-centric innovation will drive the next generation of NFT staking rewards. The result? A thriving landscape where every NFT holder has the tools not just to participate, but to prosper, within decentralized economies.