In the maturing DeFi landscape of 2025, where users shelled out a record $9.7 billion in onchain fees during the first half alone – a 41% jump year-over-year – savvy participants are turning to on-chain loyalty staking referrals to capture a slice of that action. These programs flip the script on traditional affiliate models by embedding revenue shares directly into smart contracts, letting you earn up to 50% of staking rewards fees from users you bring in, all while they lock up assets like Polygon (POL) for steady yields.

This isn’t just hype; it’s a structural shift. Centralized exchanges like Coinbase offer up to 50% on trading fees, but on-chain versions automate everything via blockchain. No middlemen, instant payouts in native tokens, and transparency you can verify on explorers. As someone who’s traded derivatives through crypto bull and bear cycles, I view these as elegant volatility hedges – passive income streams that compound without lifting a finger post-referral.

Why On-Chain Referral Programs Outpace Legacy Affiliates

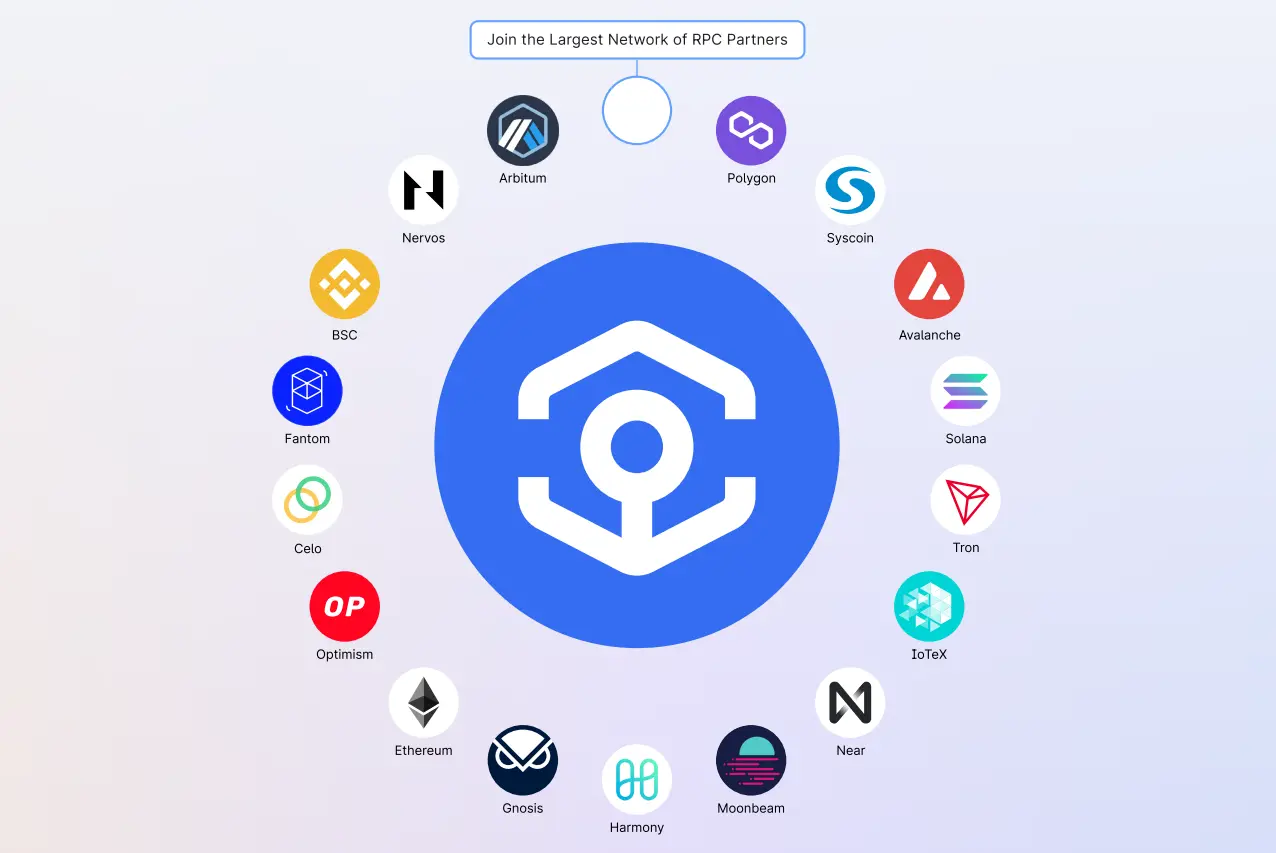

Centralized crypto affiliates, from Kraken’s 20% trading commissions to NiceHash’s mining cuts, rely on opaque dashboards and delayed settlements. Contrast that with DeFi staking revenue share mechanisms: smart contracts track referrals, tally fees from staking activities, and distribute cuts on-chain. Platforms like Chainspot exemplify this, tiering payouts from 30% for Carbon Members to a juicy 50% for Gold NFT holders, earned via XP from platform use.

The 1kx report underscores the stakes – onchain revenue maturing beyond 2021 mania peaks. Staking dominates, with top DeFi platforms boasting high APYs and liquid options. Referral programs supercharge this by virally expanding TVL; your referrals stake, generate fees, and you skim loyalty staking passive income indefinitely.

Key Features

-

Tiered NFT Levels: Advance via XP to unlock higher rewards with NFTs like Carbon (30%), Bronze (35%), Silver (40%), Gold (50%) in Chainspot.

-

Instant Smart Contract Payouts: Automated, transparent claims in native coin after referral transactions, handled fully on-chain without moderation in programs like Chainspot.

-

Multilevel Structures: Commissions from direct referrals and their recruits, e.g., Honee tiers from 10% to 1% across levels.

-

Staking Service Integration: Direct ties to staking platforms; Ankr allocates 50% of rewards fees based on referred TVL.

Dissecting the Top On-Chain Loyalty Staking Referral Platforms

Chainspot leads with its family loyalty program: refer users, earn 30-50% of their fees based on your NFT tier. Climb levels by grinding XP – simple, gamified progression. Ankr takes a partner angle, handing 50% of liquid staking rewards fees tied to your referred TVL. Honee adds multilevel depth, cascading 10% down to 1% across referral trees. Even HashStaking keeps it straightforward at 5% on profits.

Mechanics of Tiered Revenue Shares and Smart Contract Magic

At the core, blockchain referral programs crypto leverage immutable ledgers. A referral links via unique code or wallet param; their stake triggers fees (say, on Polygon for efficiency). Contracts snapshot the share – 50% for elites – and airdrop claims in POL or ETH equivalents. No KYC snags, no disputes; Etherscan proves it.

Tiering adds nuance. Chainspot’s Bronze at 35%, Silver 40%, Gold 50% – unlock via XP from queries or stakes. This mirrors volatility smiles in options: higher loyalty, fatter tail rewards. Multilevel like Honee creates network effects, your downline fueling exponential staking rewards affiliate 2025 potential. Rock’n’Block notes smart contracts handle tracking, verification, distribution – full automation fostering Web3 partnerships.

Imagine referring a whale who stakes $100,000 in POL at 8% APY; their fees alone could net you thousands annually at 50% share, all claimable instantly. That’s the power of DeFi staking revenue share, turning one-time intros into perpetual cash flow. But execution matters – focus on networks like Polygon for low fees and high liquidity, as Cryptomus highlights its 2025 efficiency.

Earnings Potential for Amplifying Referral Revenue 📈💰 (Polygon Example)

| Referral Volume 📈 | Monthly Fees Generated 💰 | 50% Share (Gold Tier) | Est. Annual Payout 💰 |

|---|---|---|---|

| $10K TVL | $500 | $250 | $3,000 |

| $100K TVL | $5,000 | $2,500 | $30,000 |

Leverage multilevels wisely; Honee’s cascade means nurturing your network’s network multiplies returns exponentially. Track via dashboards, but verify on-chain for trust. Pair with content marketing – blogs on maximizing loyalty staking rewards draw engaged users primed to stake. In my experience, this beats spot trading theta decay hands down.

Community matters too. Discord AMAs or Farcaster frames showcasing payouts build social proof. Platforms reward active referrers with XP boosts, accelerating tiers. Avoid spam; authentic endorsements convert at 5x rates per affiliate benchmarks from Koinly and CoinGape.

Navigating Risks in Blockchain Referral Programs

No free lunch in DeFi. Smart contract bugs lurk, though audited platforms like Chainspot mitigate via oracles and multisigs. Impermanent loss? Minimal in pure staking referrals. Regulatory haze persists – treat earnings as taxable events, logging claims meticulously. Gas wars during peaks nibble edges, favoring L2s like Polygon.

Competition heats up; 2025’s top affiliate lists from Stoic AI and ChangeNOW flood inboxes with CEX alternatives. Differentiate with on-chain purity: no clawbacks, verifiable forever. Diversify across Chainspot, Ankr, Honee – basket your referrals like a hedged portfolio. Monitor TVL shifts; 99Bitcoins notes liquid staking’s rise demands agility.

Yet the upside dwarfs pitfalls. On-chain revenue’s 41% YoY surge signals sustained growth, per 1kx. Referral programs aren’t gambles; they’re engineered flywheels amplifying loyalty staking passive income. As Rock’n’Block outlines, automation births sticky partnerships, echoing DeFi’s ethos.

Scale thoughtfully: automate tweets, nurture downlines, audit contracts. In 2025’s maturing chain, those wielding on-chain loyalty staking referrals don’t chase pumps – they harvest the ecosystem’s steady bleed. Position now, compound quietly, and watch your stack appreciate amid the noise.