In the volatile DeFi arena, where Ethereum hovers at $2,956.31, on-chain loyalty staking emerges as a razor-sharp tool to sift genuine commitment from fleeting speculation. Platforms now quantify user dedication through lock-up durations and consistent participation, doling out DeFi loyalty rewards that eclipse vanilla staking yields. This isn’t just yield farming; it’s blockchain user engagement staking on steroids, turning holders into fortified ecosystem pillars.

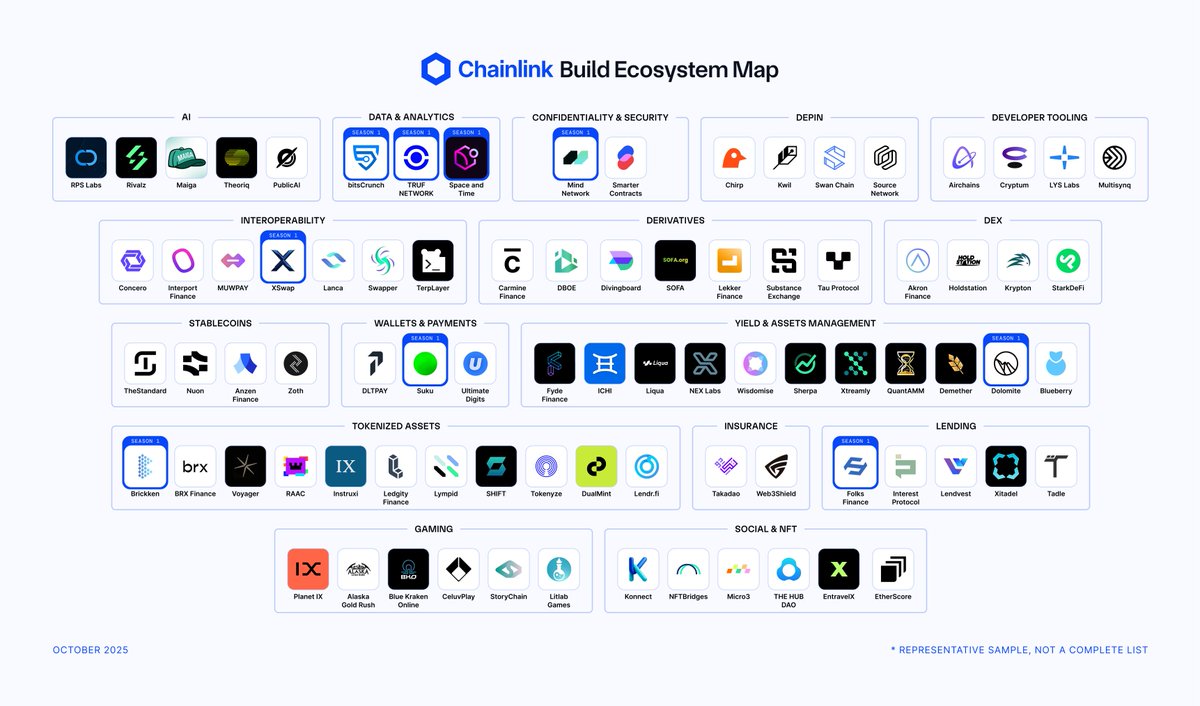

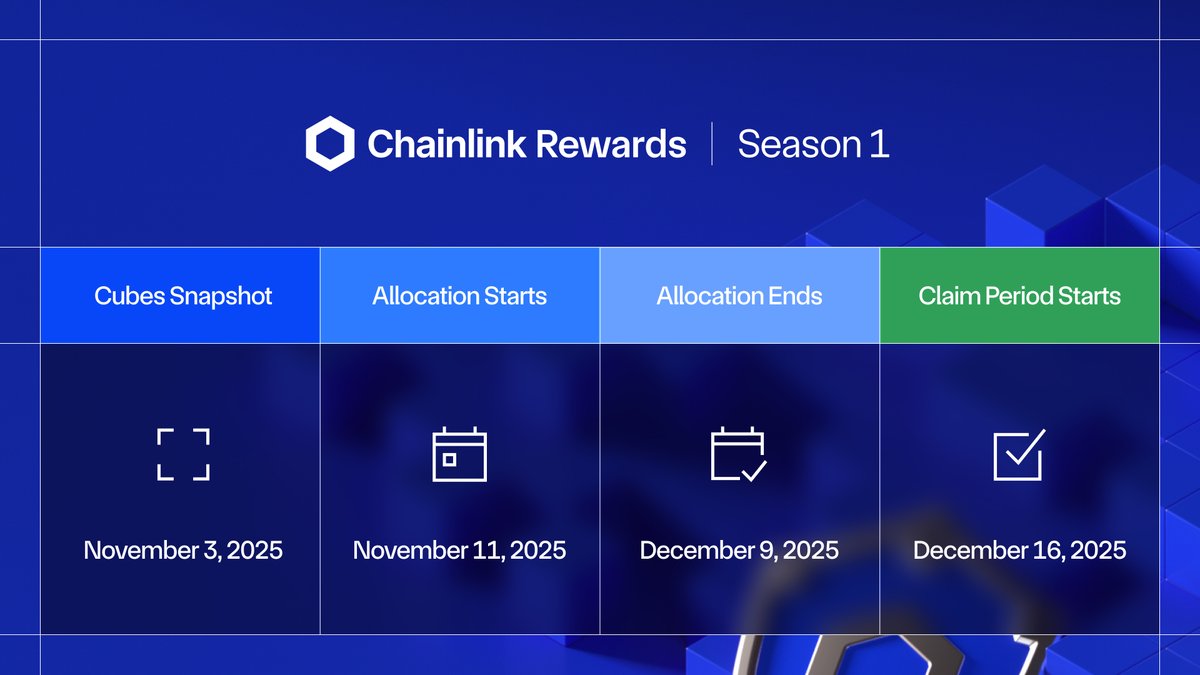

Traditional staking secures networks, but it falls short on loyalty metrics. Enter on-chain loyalty staking: smart contracts track stake size, tenure, and activity, birthing measurable on-chain reputation. Think points accrued trustlessly, redeemable for exclusive drops or boosted APYs. Crypto. com’s MATIC staking hits 6% with auto-compounding, while Chainlink’s Rewards program seeds active stakers with native tokens. Magic Eden gamifies it, amplifying staking power for longer locks. InfStones piles on loyalty points for EigenLayer delegators, bonusing duration and referrals. These moves signal DeFi’s pivot to long-term staking incentives, weeding out mercenaries.

Why Commitment Trumps Volume in Web3

Project loyalty in Web3 isn’t fluff; it’s alpha. Short-term holders dilute networks, but loyal stakers stabilize liquidity and governance. On-chain metrics expose true skin-in-the-game: a whale unstaking weekly? Noise. A retail user locking ETH for epochs? Gold. This data fuels targeted rewards, fostering sustained engagement that Blockchain App Factory dubs ‘holder staking’ for unbreakable participation.

Volatility lovers like me thrive on this. With ETH at $2,956.31, staking isn’t passive; it’s a commitment bet. Platforms leveraging on-chain points, as Binance explores, enable trustless composability – trade reputation scores or pledge them for loans. No more opaque loyalty programs; everything’s verifiable, slashing rug-pull risks.

Dissecting the Loyalty Staking Engine

At core, it’s Proof-of-Stake evolved. Users delegate tokens to validators or protocols, but loyalty layers add time-weighting. Stake 100 ETH for 30 days? Earn base and 1.5x multiplier. Extend to 90? 3x. Smart contracts emit points proportional to tvl-duration product, often with referral boosts. Unstaking penalties deter flips, while auto-compounders like Crypto. com’s turbo returns.

Ethereum (ETH) Price Prediction 2027-2032

Annual forecasts factoring on-chain loyalty staking, DeFi rewards, staking yields, and market cycles (baseline: 2026 avg ~$4,000)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $3,500 | $6,500 | $10,000 | +63% (from 2026) |

| 2028 | $5,000 | $9,000 | $14,000 | +38% |

| 2029 | $6,500 | $12,000 | $18,000 | +33% |

| 2030 | $8,000 | $16,000 | $24,000 | +33% |

| 2031 | $10,000 | $20,000 | $30,000 | +25% |

| 2032 | $12,000 | $25,000 | $38,000 | +25% |

Price Prediction Summary

ETH is forecasted to see robust growth from 2027-2032, driven by on-chain loyalty staking that locks supply and rewards commitment, alongside DeFi expansion. Average prices rise from $6,500 to $25,000 (CAGR ~31%), with bullish highs up to $38,000 amid adoption surges and tech upgrades; minima reflect potential bear markets or regulatory hurdles.

Key Factors Affecting Ethereum Price

- On-chain loyalty staking reducing circulating supply via prolonged locks

- DeFi platforms (e.g., Crypto.com, Chainlink) incentivizing long-term holding

- Institutional staking adoption boosting yields and security

- Ethereum scalability upgrades enhancing DeFi utility

- Regulatory developments impacting investor confidence

- Macro cycles, BTC correlation, and L2 competition

- Risks from market volatility and protocol exploits

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

DeFi protocols like those from Rapid Innovation embed unstaking cooldowns, governance votes tied to stake age. Risks? Impermanent loss in LP staking, slashing for downtime. Yet, upsides dominate: Webisoft notes hopping protocols maximizes yields, but loyalty programs lock in superior rates. Institutional players, per Aetsoft, eye this for 2026, blending custody with on-chain rep.

From Points to Power: Building On-Chain Rep[/h2>

On-chain points transcend gamification; they’re primitive assets. Stake consistently, rack up scores for airdrop priority or DAO influence. PixelPlex’s wallet rewards classify staking as yield king, but loyalty variants supercharge it. Changelly nails DeFi staking basics – lock assets, earn passively – yet loyalty staking adds behavioral scoring. BlockApps trends show adoption surging as investors shift from HODL to active commitment.

AdaPulse argues Web3 loyalty aids builders and users alike, curbing churn. On-Chain Loyalty Staking quantifies this, powering platforms to retain via precision incentives. As ETH steadies at $2,956.31, early adopters position for the loyalty boom.

Early movers in on-chain loyalty staking aren’t just earning; they’re forging verifiable track records that unlock DeFi’s next layer. Imagine pledging tokens with escalating multipliers, where your on-chain history dictates premium access to IDOs or reduced fees. This shifts power from whales to consistent players, a dynamic I exploit in high-frequency plays.

Maximizing Yields Through Loyalty Mechanics

Lockups aren’t punishments; they’re yield amplifiers. Crypto. com’s 6% MATIC rewards auto-compound, turning static stakes into compounding machines. Chainlink Rewards ties payouts to activity, ensuring stakers fuel oracle growth. Magic Eden’s tiered power scales with duration – stake $ME for months, dominate leaderboards. InfStones’ EigenLayer points reward delegation depth, with referral multipliers stacking alpha. These aren’t gimmicks; they’re DeFi loyalty rewards calibrated for retention, per recent trends from BlockApps and AdaPulse.

With Ethereum at $2,956.31, timing matters. Stake during dips, ride upswings with locked positions immune to FOMO sells. Smart contracts from Rapid Innovation enforce cooldowns, preventing knee-jerk exits that erode network health.

Risks, Rewards, and Real-World Edge

Volatility bites, but loyalty staking mitigates via penalties and incentives. Slashing risks downtime validators; impermanent loss haunts LPs. Webisoft flags protocol hopping yields, yet loyalty locks superior APYs. Institutions via Aetsoft prepare for 2026 custody integrations, blending off-chain security with on-chain rep. PixelPlex wallet programs highlight staking supremacy, but add loyalty for engagement spikes.

Top 5 On-Chain Loyalty Staking Wins

-

1. Higher APYs: Lock tokens longer for amplified yields—like Crypto.com‘s up to 6% on MATIC with auto-compounding to max returns. Details

-

2. Exclusive Perks: Unlock elite rewards for stakers, e.g., Chainlink Rewards ‘Season Genesis’ drops native tokens to active LINK holders. Details

-

3. Measurable Reputation: Build on-chain cred via staking duration/amount, like InfStones Loyalty Points on EigenLayer. Details

-

4. Referral Bonuses: Amplify rewards by inviting others—InfStones adds extra points for early referrals and delegation. Details

-

5. Gamified Progression: Level up with time-based staking power boosts, as in Magic Eden‘s $ME token system for deeper engagement. Details

Projects wielding this – check how on-chain loyalty staking boosts user retention for DeFi projects – see churn plummet. Binance’s on-chain points primitive composes seamlessly: collateralize scores for flash loans or trade them OTC. No trust needed; blockchain verifies all.

Your Playbook for Loyalty Alpha

Dive in selectively. Scout protocols with audited contracts, transparent point emissions. Start small: delegate ETH at $2,956.31 to EigenLayer via InfStones, accrue points. Extend locks for multipliers, refer allies for boosts. Monitor via Dune dashboards for stake age cohorts outperforming flippers. This isn’t HODLing; it’s engineered commitment yielding outsized returns in Web3’s loyalty economy.

DeFi evolves fast. Platforms ignoring blockchain user engagement staking fade; loyalty frontrunners capture mindshare. As adoption surges – Changelly basics meet advanced scoring – position now. Stake long, score big, dominate the chain.