In the volatile world of crypto, where HODLing often feels like a passive grind, on-chain loyalty staking flips the script. This DeFi innovation rewards long-term supporters with passive yields tied directly to project loyalty, blending staking security with gamified incentives. Forget idle tokens in your wallet; stake them to earn boosted APYs, exclusive airdrops, and governance perks while bolstering the networks you believe in.

Projects are waking up to the power of retention. Traditional staking locks yield basic rewards from network inflation, but on-chain loyalty staking layers in time-based multipliers and engagement bonuses. Chainlink’s recent ‘Chainlink Rewards’ program exemplifies this: LINK stakers now snag native tokens from Build projects, ramping up ecosystem participation. Magic Eden takes it further with gamified $ME staking, where lock-up duration amps your ‘staking power’ for ranked rewards every 90 days.

Unlocking DeFi Loyalty Rewards Through Smart Contracts

At its core, DeFi loyalty rewards run on transparent smart contracts that track your commitment. Stake your tokens, and protocols calculate yields based on duration and consistency, not just principal. Crypto. com’s on-chain staking for CRO, SOL, and others offers flexibility with no-lockup penalties beyond network unbonding, while Huobi’s HClaimer simplifies multi-pool reward grabs.

This isn’t just yield farming; it’s building alpha through aligned incentives. Long-term holders secure networks and unlock tiers that short-term flippers miss.

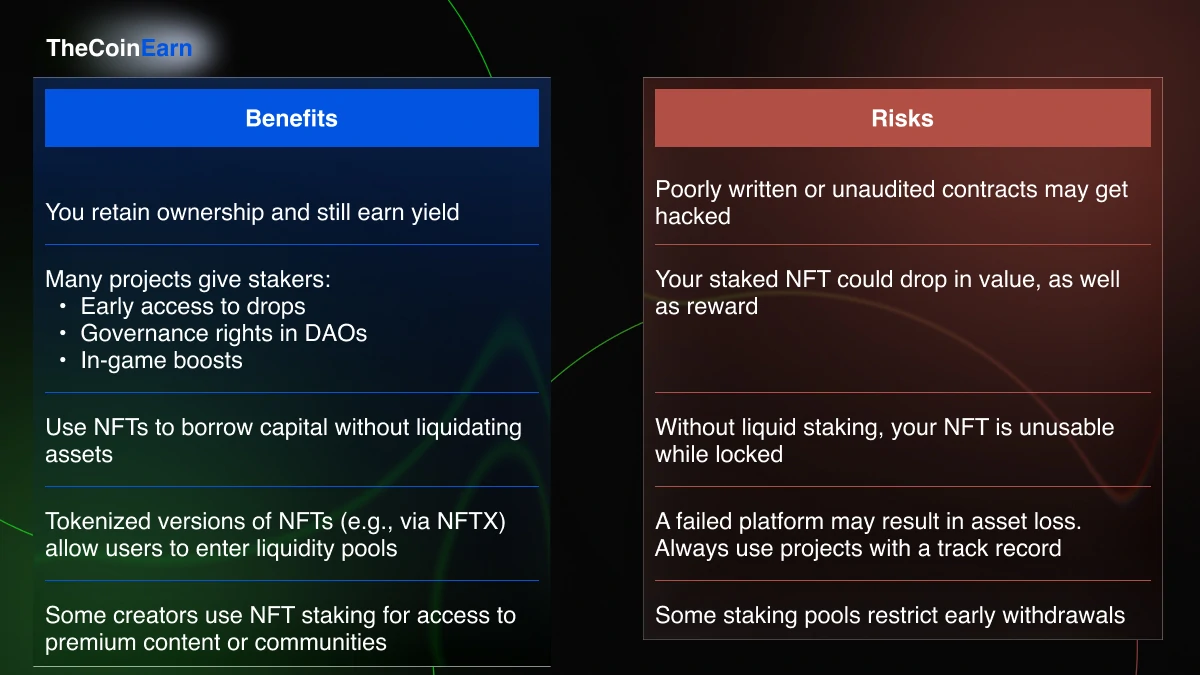

Risks? Sure, smart contract bugs and inflation dilution loom, but audited protocols like these minimize exposure. Reddit threads highlight inflation’s bite-6% APY might evaporate value if supply balloons-yet loyalty mechanics counter this with deflationary burns or ve-token models.

Crypto Project Staking Incentives That Drive Real Engagement

Why settle for generic staking when crypto project staking incentives personalize rewards? Platforms prioritize on-chain control for liquidity and flexibility, outpacing custodial options. Figment targets institutions with secure, high-uptime staking, but retail thrives on DeFi’s permissionless access.

Top 5 Loyalty Staking Wins

-

Tiered APYs boost for long locks, like Magic Eden‘s duration-based staking power.

-

Exclusive NFT drops for dedicated stakers in NFT ecosystems like Magic Eden.

-

Governance voting power via staked assets on Crypto.com for SOL, DOT.

-

Community airdrops reward holders, as in Chainlink Rewards for LINK stakers.

-

Reduced sell pressure from locks & burns, stabilizing tokenomics long-term.

Imagine staking ETH for base yields, then layering loyalty points for project-specific boosts. PixelPlex notes wallet programs using staking as a foundation: lock assets, climb tiers, access premium rewards. This fosters blockchain loyalty programs that turn users into evangelists.

Top platforms in 2026-AMBCrypto’s list-spotlights this shift: some chase simplicity, others DeFi’s liquid staking derivatives (LSDs) for compounded gains. Ventureburn pegs passive income as the hook; keep tokens staked, collect periodic payouts in native crypto.

Passive Staking Yields for the Alpha Hunter

As a high-frequency trader who’s danced through crypto’s wild swings, I live for edges like passive staking yields. On-chain loyalty staking delivers: no active management, just set-it-and-forget-it alpha. CoinLedger’s best staking cryptos guide points to high real rates, but loyalty amps them-1000% APYs in early DeFi? Possible, if you back winners early.

Track rewards meticulously-Onchain Accounting stresses this for tax compliance and growth. Institutional plays via Aetsoft lock assets into PoS chains for network security; retail mirrors this with loyalty twists. Check how on-chain loyalty staking drives community engagement in DeFi projects for deeper dives.

Changelly demystifies DeFi staking: lock into protocols, earn from fees and emissions. But loyalty elevates it-bond longer, earn multipliers rivaling veCRV’s glory days. Onesafe. io warns of vulnerabilities; DYOR, audit trails matter.

Token loyalty mechanisms are the secret sauce here, evolving staking from mere PoS validation into a retention engine. Stake consistently, and protocols like Magic Eden’s $ME system rank you for chapter-end payouts, blending gamification with real yields. This isn’t HODLing; it’s strategic alignment for outsized returns.

Long-Term Holder Rewards That Outpace Inflation

Long-term holder rewards tackle staking’s Achilles heel: inflation. Reddit’s CryptoTechnology dives deep-most yields stem from token mints, eroding value over time. Loyalty staking counters with burns, buybacks, or tiered emissions that favor veterans. Figment’s institutional staking puts idle bags to work securely, but DeFi’s edge lies in composability: stake, lend derivatives, compound without custody risks.

PixelPlex outlines wallet rewards stacking base APY on locks for tier unlocks-high-value holders dominate leaderboards. Ventureburn’s 2025 platforms highlight highest APYs via periodic native payouts; hold staked, watch yields accrue. Aetsoft breaks institutional flows: lock PoS assets, secure chains, earn validator cuts. Retail apes this with loyalty boosters.

Why grind volatility when passive staking yields print money on autopilot? As someone who’s algo-traded through 2022’s bloodbath, I stake loyally in vetted projects for that steady drip. CoinLedger ranks top stakeable coins by real rates-post-inflation. The Business of Business flags 1000% APYs in nascent DeFi; hunt them early, lock long.

Top 5 On-Chain Loyalty Staking Platforms

-

Chainlink Rewards: LINK stakers earn native tokens from Build projects via community program like Season Genesis pilot with Space and Time.

-

Magic Eden $ME: Gamified staking with quests, ranks by stake amount & lock-up; rewards in 90-day Chapters.

-

Crypto.com On-Chain: Stake CRO, SOL, ETH & more directly on-chain; flexible unstake with network unbonding periods.

-

Huobi HClaimer: One-click multi-pool claims across DeFi staking projects for seamless rewards.

-

Figment Pools: Institutional-grade staking for long-term holders; secure, high-yield token rewards.

Navigating Risks in Blockchain Loyalty Programs

Volatility chaser that I am, I respect the downside. Smart contract exploits, slashing penalties, impermanent loss in LSDs-all real. Onesafe. io flags regulatory haze; US/EU probes could crimp yields. Mitigate with audits (look for Certik/Quantstamp), diversify pools, use hardware wallets. Track via Onchain Accounting: log rewards, tally taxes, optimize rotations.

Crypto. com’s guide shines: stake on-chain for CRO/SOL/ETH/AVAX/DOT, unstake flexibly post-unbonding. Huobi’s one-click HClaimer slashes claim friction across DeFi. Chainlink’s Genesis season pilots SXT drops to LINK holders-boost engagement without dilution.

AMBCrypto’s top 6 platforms split custodial ease from DeFi liquidity; pick on-chain for sovereignty. Changelly nails DeFi basics: protocol locks yield fees/emissions. Layer loyalty, and you’re golden.

Adapt or perish-this mantra fuels my edge. On-chain loyalty staking weaponizes commitment, turning supporters into stakeholders with alpha multipliers. Back projects aligning incentives, stake long, reap tiers others chase. Check how on-chain loyalty staking boosts user retention in DeFi projects or how on-chain loyalty staking rewards early supporters with enhanced token incentives to level up. Your portfolio demands it; idle tokens don’t.