Picture this: your ASTER tokens working tirelessly in the background, earning up to 20% APR while you sleep, all secured on the blockchain with transparent smart contracts. On-chain loyalty staking flips the script on traditional holding, turning patient Aster DEX users into rewarded ecosystem pillars. This isn’t just passive income; it’s a strategic play for long-term DeFi loyalty rewards that boost token stability and user retention.

Aster DEX’s fresh program shines here, offering flexible and fixed pools where locking ASTER unlocks base yields plus bonus multipliers for sustained commitment. Traders and holders alike flock to it, blending staking loyalty bonuses with seamless DEX action. Current yields hover around 19-20%, outpacing many DeFi options, and sources whisper of peaks over 30% in hot pools.

Unraveling the Mechanics of On-Chain Loyalty Staking

At its core, on-chain loyalty staking deploys your tokens directly into blockchain smart contracts, fueling network security in Proof-of-Stake setups while dispensing rewards. Unlike off-chain custodial models, everything lives transparently on-chain-no middlemen skimming fees. For Aster DEX users, this means locking ASTER provides voting power to validators, earns newly minted tokens or fees, and layers on loyalty perks like escalating APRs for longer locks.

Visualize a chart where the reward curve steepens over time: short-term stakers get baseline 15%, but hit six months and bonuses kick in, pushing toward that 20% sweet spot. It’s DeFi’s way of saying, ‘Stick around, and we’ll make it worth your while. ‘ This setup strengthens token economics, curbs sell pressure, and fosters long-term token holder rewards, much like Ethereum’s model but tuned for DEX loyalty.

Staking turns idle tokens into active contributors, securing the chain and padding your wallet in one elegant move.

Aster DEX Stands Out in the Loyalty Game

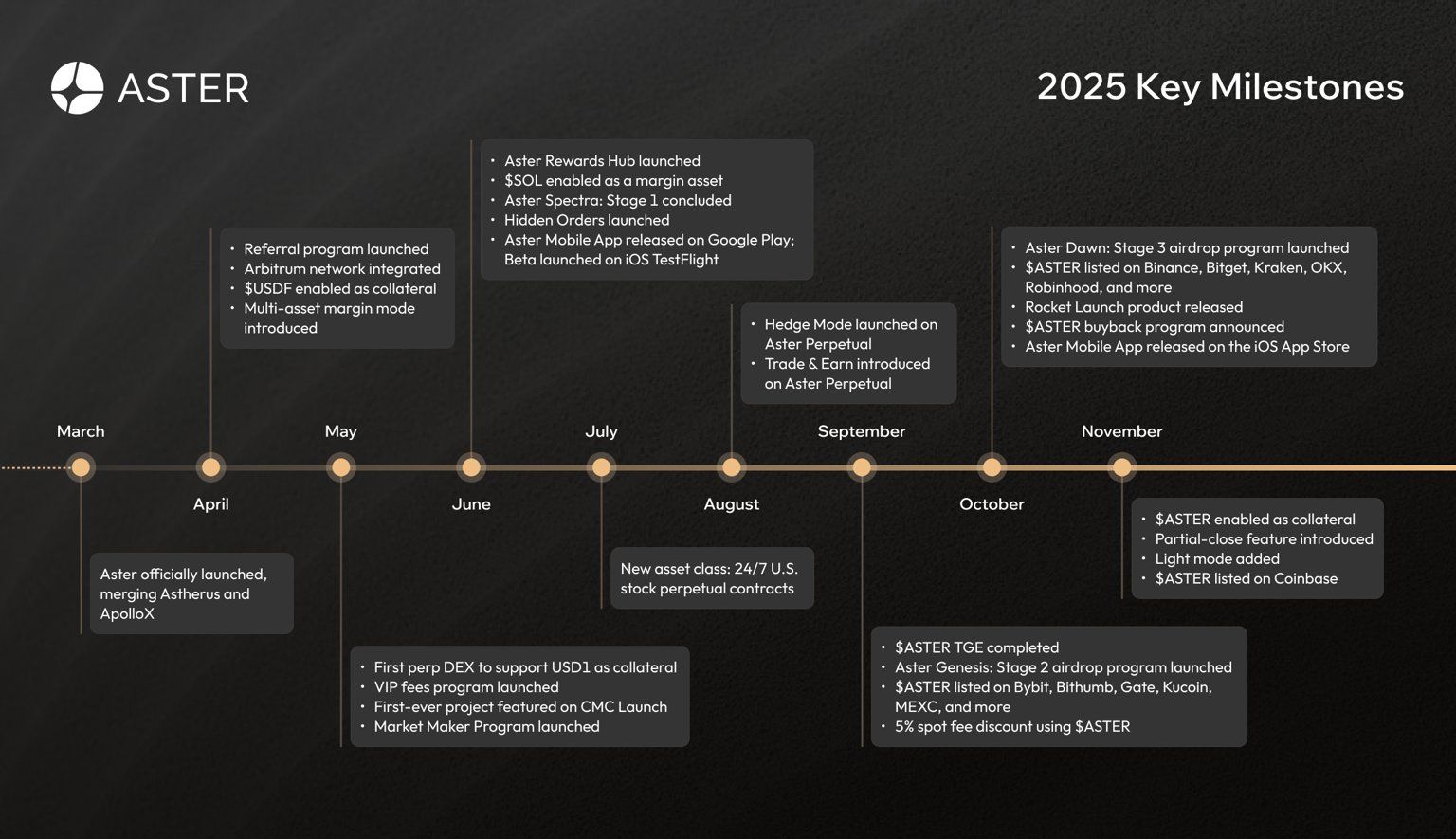

Aster DEX isn’t your average swap platform; it’s a hub buzzing with trade-to-earn mechanics and now this powerhouse loyalty staking. Users lock ASTER via AsterEarn for yields, use liquid staking derivatives like asBNB for collateralized trading, or dive into USDF stablecoins that accrue interest on the fly. The new on-chain program sweetens it with tiered pools: flexible for quick access, fixed for max rewards, complete with Aster DEX loyalty drops for veterans.

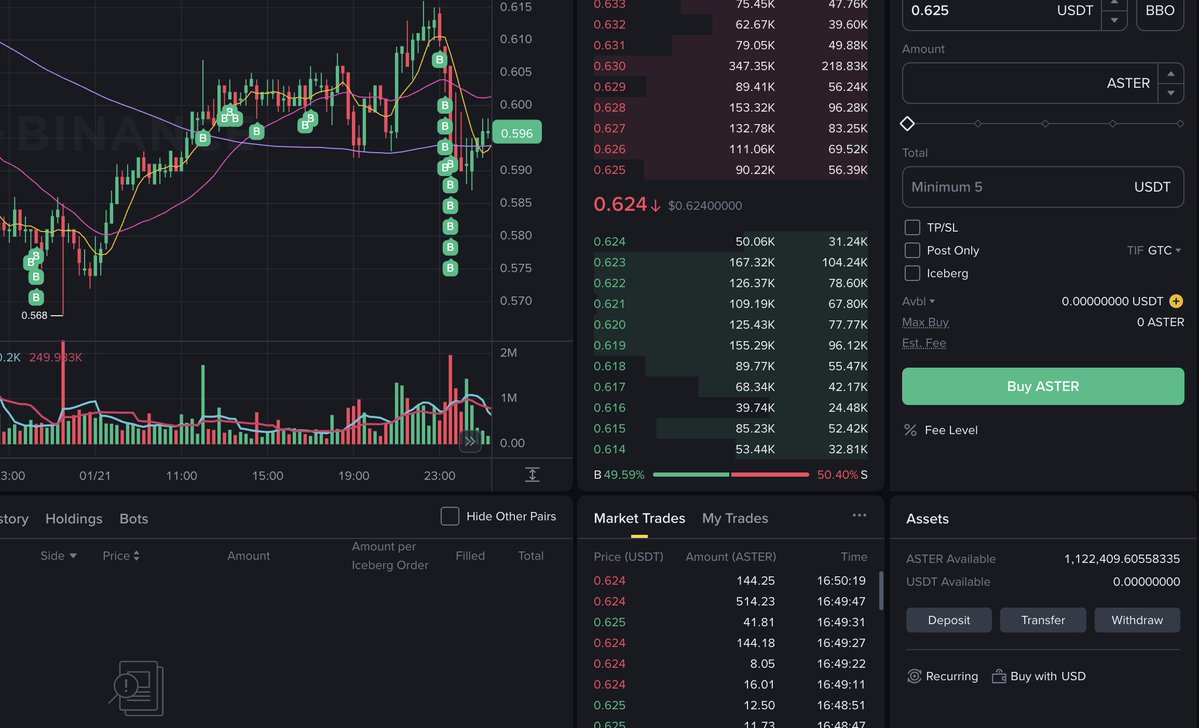

Stake today, and you’re not just earning; you’re anchoring price stability at ASTR’s current $0.0102 level, down a slight 0.1243% in 24 hours from a high of $0.0116. Long-term holders see this dip as a buy signal, knowing loyalty staking cushions volatility with compounding gains. Platforms like Super report 19% APR pools drawing crowds, while Reddit threads dissect how on-chain validation power translates to real economic muscle.

This targeted approach maximizes DeFi user retention staking, rewarding consistency over churn. Dive deeper into how on-chain loyalty staking maximizes rewards for DeFi users, and you’ll spot why projects like Aster lead the pack.

Why Loyalty Bonuses Trump Vanilla Staking

Standard staking? Solid, but loyalty staking adds narrative flair. Base rewards come from network fees and emissions, yet Aster layers gamified bonuses: extra ASTER drops for milestones, boosted APRs for multi-pool participation. It’s visual poetry on the dashboard-your stake bar fills with color-coded progress, multipliers glowing brighter with time.

Consider the data: flexible pools suit swing traders eyeing quick yields, fixed ones lock in premiums for HODLers betting on Aster’s growth. Sources from Chainalysis and LimeChain highlight how these mechanics secure PoS chains while slashing idle capital waste. For Aster fans, it’s personal; your stake votes on DEX upgrades, earning you a slice of the pie. And with yields sometimes eclipsing 30%, the math compels commitment.

Envision compounding at 20% on a modest stack: that visual upward trajectory on your portfolio chart tells its own success story. Pair it with trade-to-earn, and you’re building a flywheel of DeFi loyalty rewards.

Aster (ASTER) Price Prediction 2027-2032

Projections Incorporating On-Chain Loyalty Staking Yields (up to 20% APR) and DeFi Market Trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.007 | $0.015 | $0.028 | +50% |

| 2028 | $0.012 | $0.025 | $0.045 | +67% |

| 2029 | $0.018 | $0.038 | $0.065 | +52% |

| 2030 | $0.025 | $0.055 | $0.095 | +45% |

| 2031 | $0.022 | $0.048 | $0.085 | -13% |

| 2032 | $0.030 | $0.072 | $0.130 | +50% |

Price Prediction Summary

ASTER token is forecasted to experience steady growth driven by its on-chain loyalty staking program offering 19-30% APR, which encourages long-term holding and reduces circulating supply. Average prices are expected to rise progressively through DeFi adoption and market cycles, with bearish mins reflecting potential downturns and bullish maxes capturing high adoption scenarios from current $0.010 baseline.

Key Factors Affecting Aster Price

- High staking yields (19-30% APR) incentivizing loyalty and price stability

- Aster DEX user growth and trading volume increases

- Crypto market cycles aligned with Bitcoin halvings

- Regulatory developments favoring DeFi and staking

- Technological enhancements like liquid staking (asBNB) and yield-bearing assets

- Competition from other DEXs and broader PoS ecosystem adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ready to chart your course? The first half sets the stage; next, we’ll map exact steps to stake and stack those bonuses.

Let’s dive into the practical side, where charts meet action. Aster DEX makes entry straightforward, with a dashboard that visualizes your potential yields in real-time graphs-up to 20% APR base, plus loyalty multipliers that curve upward like a bullish candlestick pattern.

Step-by-Step: Launching Your On-Chain Loyalty Stake

Picture your wallet connected, tokens flowing into a secure pool, rewards accruing block by block. Here’s how Aster DEX streamlines it for seamless on-chain loyalty staking.

Once staked, monitor that progress bar filling with green hues for each loyalty milestone. Flexible pools let you unstake anytime with minimal penalties, ideal if ASTR at $0.0102 feels like a pivot point. Fixed ones demand commitment but deliver those peak yields, rewarding long-term token holder rewards with compounding magic.

I favor fixed for the multiplier edge; it’s like spotting a head-and-shoulders bottom early and positioning for the breakout. Data from asterdex. com-stake. app confirms pools tailored for this, blending security with upside.

Visualizing Rewards: The Loyalty Multiplier Effect

Key Benefits of Aster DEX Staking

-

Higher APRs for long locks: Earn up to 20% APR on ASTER with fixed staking pools.

-

Bonus ASTER drops: Extra rewards for extended participation in loyalty staking.

-

Network security: Staking ASTER helps validate transactions and secure the blockchain.

-

Price stability support: Strengthens ASTER economy and aids token price stability.

-

DeFi retention perks: Rewards long-term holders, boosting user engagement on Aster DEX.

These aren’t abstract perks; they’re plotted on your staking interface as layered charts. Short locks yield steady 15-19%, but extend to 180 days, and bonuses stack, visualizing a reward trajectory that outpaces vanilla DeFi. At current ASTR levels-$0.0102 after dipping 0.1243% in 24 hours from $0.0116-this cushions downside while amplifying upside.

Opinion: Aster’s model smartly counters sell-offs common in DEX tokens. By tying loyalty to escalating staking loyalty bonuses, it creates a virtuous cycle-traders earn from volume, stakers from commitment, ecosystem thrives.

Lock in loyalty, unlock exponential gains; the blockchain ledger never lies.

Compare to Ethereum staking: there, rewards mix emissions and fees, but Aster adds DEX-specific drops, making it a hybrid powerhouse for active users.

Navigating Risks in the Loyalty Stake Arena

No chart lacks volatility shadows. Impermanent loss lurks if using staked tokens in liquidity pools, slashing risks smart contracts mitigate via audited code. Lockups tie capital, yet Aster’s flexible options balance this. Yields fluctuate-19% today, 30% peaks per CoinCodex-but loyalty tiers provide downside protection.

Visual tip: Overlay your stake APR against ASTR’s $0.0102 price chart; correlation strengthens as holder base grows, stabilizing that 24-hour low of $0.0101.

For risk-averse chartists, start small, scale with conviction. This setup excels in DeFi user retention staking, turning holders into advocates.

Your Loyalty Playbook Answered

Answering these demystifies the path. Minimums stay accessible, claims auto-compound or manual, flexible suits agility while fixed maximizes Aster DEX loyalty drops. Yields factor principal, time, bonuses-math that charts predictably.

Pro move: Pair staking with trade-to-earn for dual streams, your portfolio resembling a multi-timeframe bull flag. Explore how on-chain loyalty staking boosts user retention in DeFi projects to see ecosystem parallels.

As ASTR holds $0.0102 amid minor pullback, loyalty stakers position for rebound. Your tokens secure the chain, earn yields, and etch your story in the blockchain. Stake smart, hold visual, reap DeFi’s loyal future.