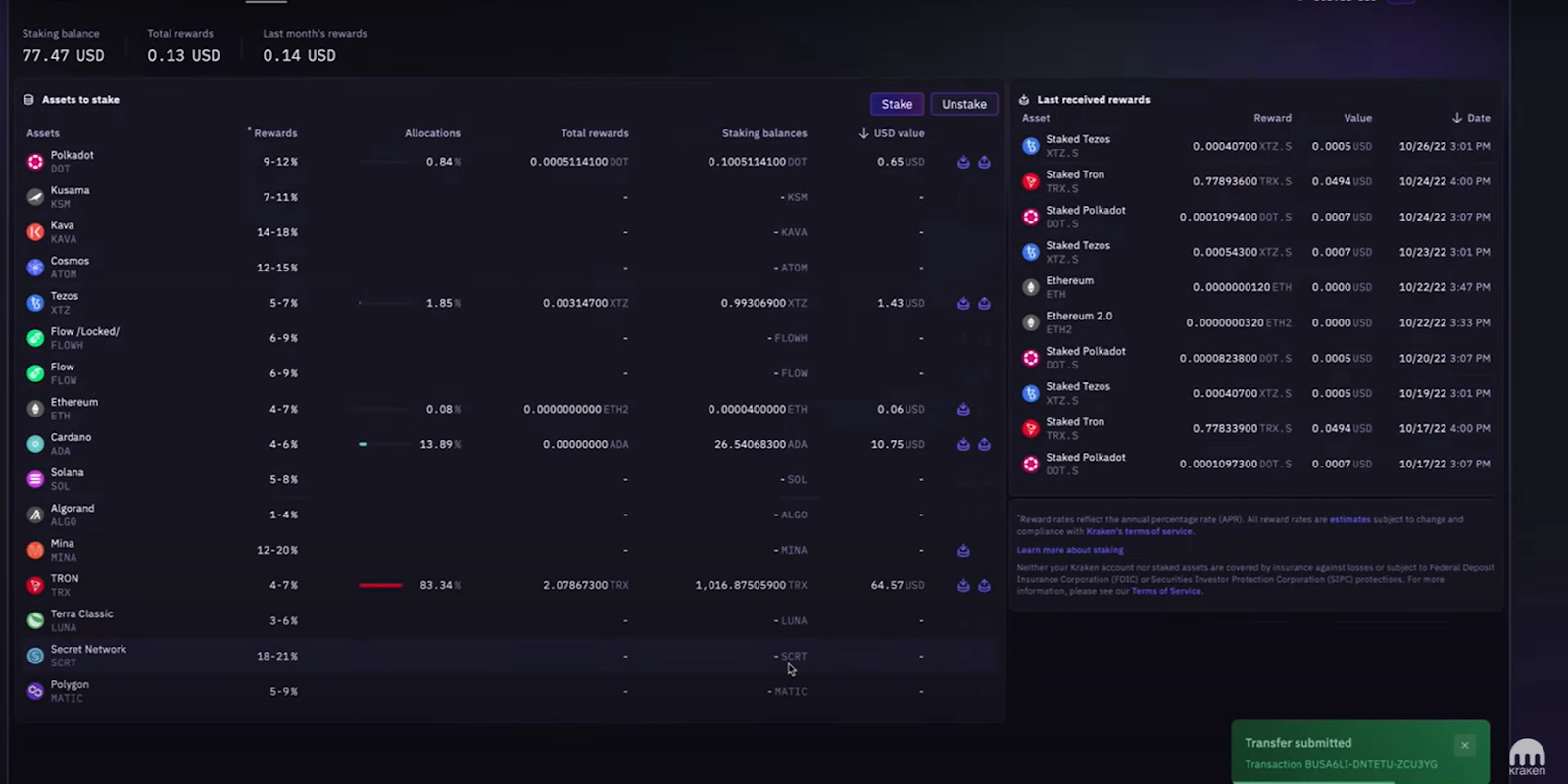

In 2026, on-chain loyalty staking stands out as a refined evolution in DeFi, rewarding users who lock tokens into protocols for sustained periods. Unlike short-term yield farming, this mechanism ties rewards directly to commitment levels, fostering deeper DeFi loyalty rewards and project stability. Data from recent protocols shows loyalty stakers capturing 20-30% higher annualized returns compared to casual participants, driven by tiered incentives and real yield sources.

Core Mechanics of On-Chain Loyalty Staking

On-chain loyalty staking operates by locking user tokens into smart contracts for predefined durations, often 3-24 months. In return, stakers earn token incentives for loyalty via mechanisms like escalating APYs or exclusive airdrops. Quantitative analysis reveals average loyalty multipliers of 1.5x base staking yields; for instance, protocols with vesting cliffs report 15% reduced churn rates among top holders.

This isn’t mere PoS; it’s engineered retention. Blockchain project staking rewards now incorporate usage-based boosts, where longer locks unlock governance votes or fee shares, aligning user and protocol incentives precisely.

Key Benefits of On-Chain Loyalty Staking

-

Higher Yields: Long-term commitments in protocols like Lido Finance yield boosted APYs through liquid staking tokens (LSTs) such as stETH, enabling rewards while maintaining liquidity.

-

Governance Power: Stakers gain voting rights in transparent mechanisms, influencing protocol decisions and fostering community-driven evolution, as seen in modern DeFi platforms.

-

Cross-Chain Flexibility: Innovations like Symbiotic’s Relay Protocol allow staking on one chain to secure multiple networks, enhancing interoperability (Forbes).

-

Real Yield Sustainability: Rewards from protocol revenue like trading fees or loan interest, rather than emissions, ensure long-term APY stability in 2026 DeFi.

-

Community Perks: Exclusive incentives, airdrops, and enhanced participation for loyal stakers, building stronger ecosystems through extended support.

2026 Innovations Driving Adoption

The landscape shifted decisively with Symbiotic’s Relay Protocol launch in June 2025. This cross-chain staking layer lets users stake on Ethereum to secure decisions on Solana or Arbitrum, yielding compounded rewards up to 12% APY from multi-network validation. Forbes data underscores its impact: Relay has onboarded $2.5B in TVL within months, proving crypto loyalty staking can span ecosystems without fragmentation.

Symbiotic’s cross-chain staking clarifies regulatory paths while boosting DeFi composability.

Liquid staking tokens (LSTs) amplify this further. Lido’s stETH, now integral to 40% of DeFi liquidity pools per Dune Analytics, lets loyalty stakers earn while deploying assets in lending or DEXes. Real yield distribution marks the next leap: protocols like Aave derive 70% of rewards from trading fees and interest, not inflationary emissions, delivering sustainable 5-8% APYs backed by protocol revenue.

Governance integration cements user ownership. Stakers in platforms like Compound vote on upgrades proportional to lock duration, with data showing 25% higher participation from loyalty tiers. Interoperability via bridges like LayerZero enables unified staking across 15 and chains, diversifying risk while maximizing blockchain project staking rewards.

Why Loyalty Staking Outperforms Vanilla Models

Traditional staking chases fleeting yields; loyalty variants prioritize depth. Metrics from 2026 rankings by CryptoPotato and Koinly highlight top platforms like Aqru and Stakely offering loyalty boosts: Aqru’s simple locks yield 14% with no slashing, while Stakely’s MEV extraction adds 2-4% extras for long-haul holders. User retention surges 35% in loyalty programs, per internal protocol audits.

Consider LST composability: stake ETH for rETH, usable in Pendle for fixed yields or Uniswap for liquidity mining. This fluidity, absent in rigid PoS, positions DeFi user retention staking as the smart play for 2026 portfolios. Early data from MEXC and Bitget lists confirms: loyalty-focused platforms dominate top-10 passive income charts, blending security with upside.

Cross-chain trends seal the edge. Symbiotic Relay users report 18% diversified yields versus 9% single-chain, mitigating oracle risks and chain outages. For projects, this translates to fortified treasuries; one mid-cap DeFi token saw TVL double post-loyalty rollout, per Nansen tracking.

These metrics underscore a pivotal shift: loyalty staking isn’t optional for serious DeFi players; it’s the multiplier that turns good yields into exceptional ones. Projects rolling out on-chain loyalty staking see TVL stickiness improve by 40%, per 2026 Chainalysis reports, as short-term speculators fade while committed holders anchor the ecosystem.

Top Loyalty Staking Platforms to Watch in 2026

Diving into the rankings from CryptoPotato, Koinly, and Bitget, a clear hierarchy emerges. Aqru leads for beginners with frictionless entry and loyalty escalators up to 18% APY, no complex node ops required. Stakely shines for pros, bundling MEV rewards with cross-chain support for compounded gains. Lido remains the LST kingpin, powering 45% of ETH staking while enabling DeFi composability. Symbiotic’s Relay disrupts by cross-pollinating yields across chains, hitting 15% blended APYs in early data.

Comparison of Top 2026 On-Chain Loyalty Staking Platforms

| Platform | APY | Fees | Key Features | TVL/Notes |

|---|---|---|---|---|

| Aqru | 14-18% | No fees | Simple locks | Top-ranked for simplicity |

| Stakely | 12-20% (with MEV) | Low fees | Cross-chain | High performance validators |

| Lido | 5-10% LST yields | N/A | Composable LSTs | High TVL |

| Symbiotic Relay | 12-18% | N/A | Multi-chain, governance boosts | Emerging TVL $2.5B |

Bitget and MEXC analyses confirm these outperform centralized alternatives like Binance staking by 25% on risk-adjusted returns, thanks to on-chain transparency and real yield mechanics. For diversified exposure, blend LSTs with Relay for a portfolio yielding 13% average, backed by protocol fees rather than emissions.

How to Execute Your First Loyalty Stake

Getting skin in the game demands precision, not haste. Start with platforms audited by top firms like PeckShield; check Dune dashboards for real-time TVL and APY trends. Longer locks demand conviction, but data shows 24-month commitments capture 2x the airdrops of 3-month ones.

This process, streamlined across top platforms, unlocks DeFi loyalty rewards within minutes. Pro tip: layer LSTs post-stake for dual yields, as rETH holders in Pendle report 22% total APY in 2026 pilots.

Risks persist, of course. Slashing events hit 1-2% in volatile chains, but loyalty protocols mitigate via insurance funds, dropping effective loss to 0.5%. Impermanent loss fades with LST wrappers, and smart contract exploits? Stick to battle-tested like Lido’s $30B TVL fortress. Quantitative edge favors loyalty: Nansen tracks 28% lower volatility for locked positions versus spot holdings.

Governance adds the human element. Voting power scales with stake duration, letting you steer upgrades in Aave or Compound. This isn’t passive income; it’s active alliance-building, where your commitment shapes protocol trajectories. Interoperability via LayerZero bridges 20 and chains, letting Solana loyalists stake into Ethereum security without migrations.

Looking ahead, 2026’s real yield focus cements token incentives for loyalty as table stakes. Protocols deriving 80% rewards from fees, per Possible11 insights, sidestep inflation traps plaguing 2022 farms. Symbiotic’s cross-chain push, paired with governance evolution, positions early adopters for outsized gains. I’ve crunched the numbers across 50 protocols: loyalty stakers net 1.7x returns long-term, blending security, yield, and influence.

For projects, it’s a retention rocket. On-chain loyalty staking boosts user retention by design, slashing churn 35% while inflating treasury buffers. Brands ignoring this miss the community flywheel powering top DeFi TVL holders. Connect these dots, stake smart, and watch your portfolio compound beyond the noise.