In the ever-evolving landscape of decentralized finance, on-chain loyalty staking emerges as a game-changer for crypto enthusiasts and project supporters alike. This mechanism goes beyond mere yield farming by tying rewards directly to community commitment, allowing users to lock native tokens and earn tiered incentives that reflect their dedication. As DeFi matures into 2026, platforms are leveraging blockchain’s transparency to foster genuine engagement, turning passive holders into active stakeholders who bolster network security while reaping substantial returns.

Consider the shift from traditional loyalty programs plagued by centralization and opacity. On-chain alternatives, inspired by models like Chainlink’s staking for cryptoeconomic security and Solana’s quest-based rewards, empower users with true ownership. Stakers not only secure the protocol but unlock escalating APYs, points systems, and even governance perks, as seen in recent Ethereum staking via Crypto. com’s DeFi Wallet with auto-compounded rewards.

Unpacking the Mechanics of On-Chain Loyalty Staking

At its core, on-chain loyalty staking involves depositing project tokens into smart contracts designed for loyalty incentives. Unlike generic staking, these pools prioritize long-term holders through mechanisms like time-weighted averages or escalating multipliers. For instance, users might start with a base APY, then climb tiers by maintaining stakes over epochs, mirroring points-based Web3 programs outlined by Defiprime.

Top Loyalty Staking Platforms

-

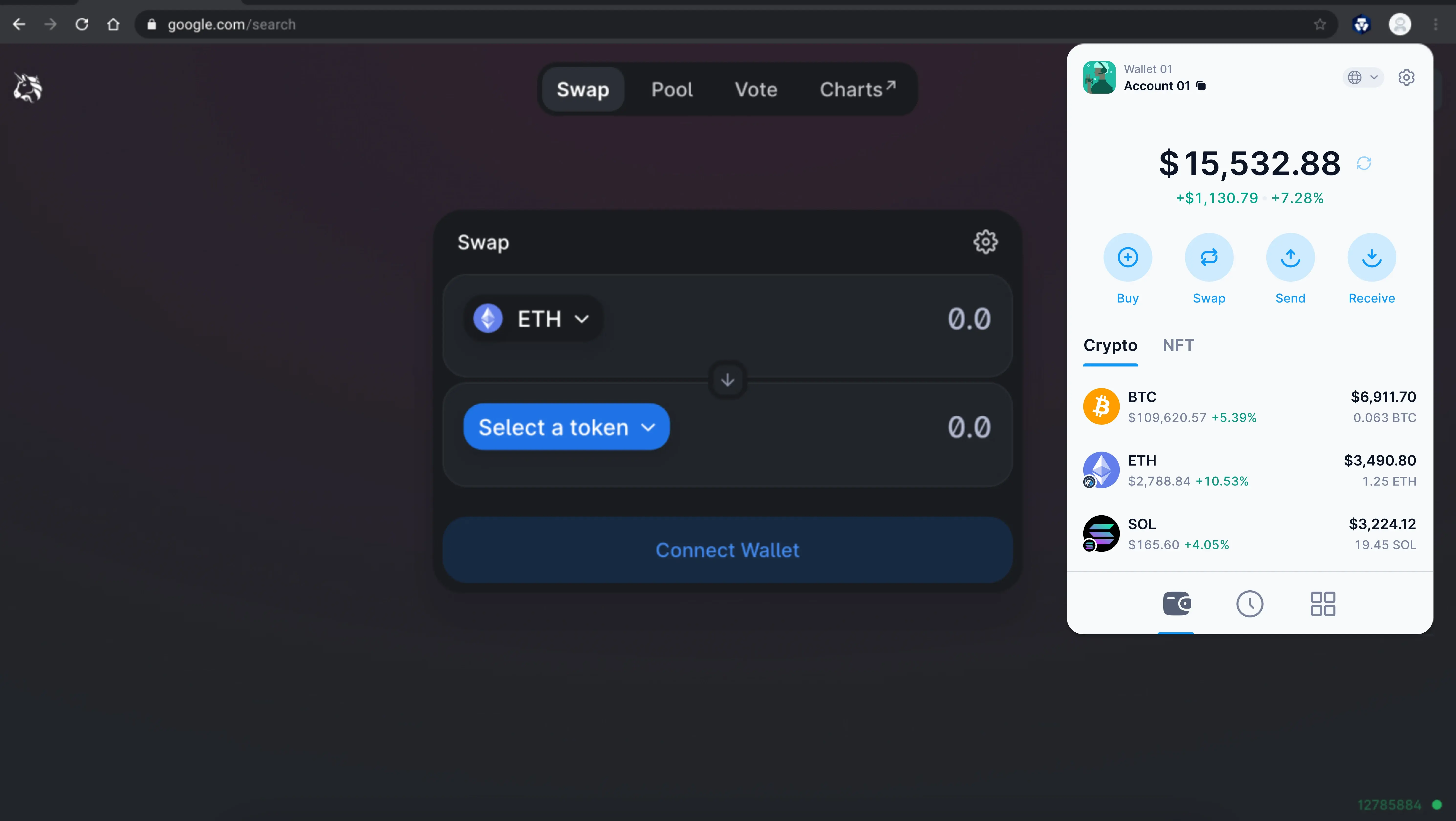

Crypto.com DeFi Wallet: Features auto-compounding ETH staking rewards directly from mobile devices, with flexible anytime unstaking for user convenience. Learn more

-

Chainlink Staking: Delivers staking rewards with tiered APYs for contributors securing the network via timely alerts, enhancing cryptoeconomic security. Learn more

-

Steakwallet: Offers an algorithmic multi-token rewards system across chains, providing high yields during low participation to incentivize loyalty. Learn more

-

ZetaChain: Supports community quests in its universal loyalty layer, enabling customized programs with points, tokens, and multi-chain PoS compatibility. Learn more

-

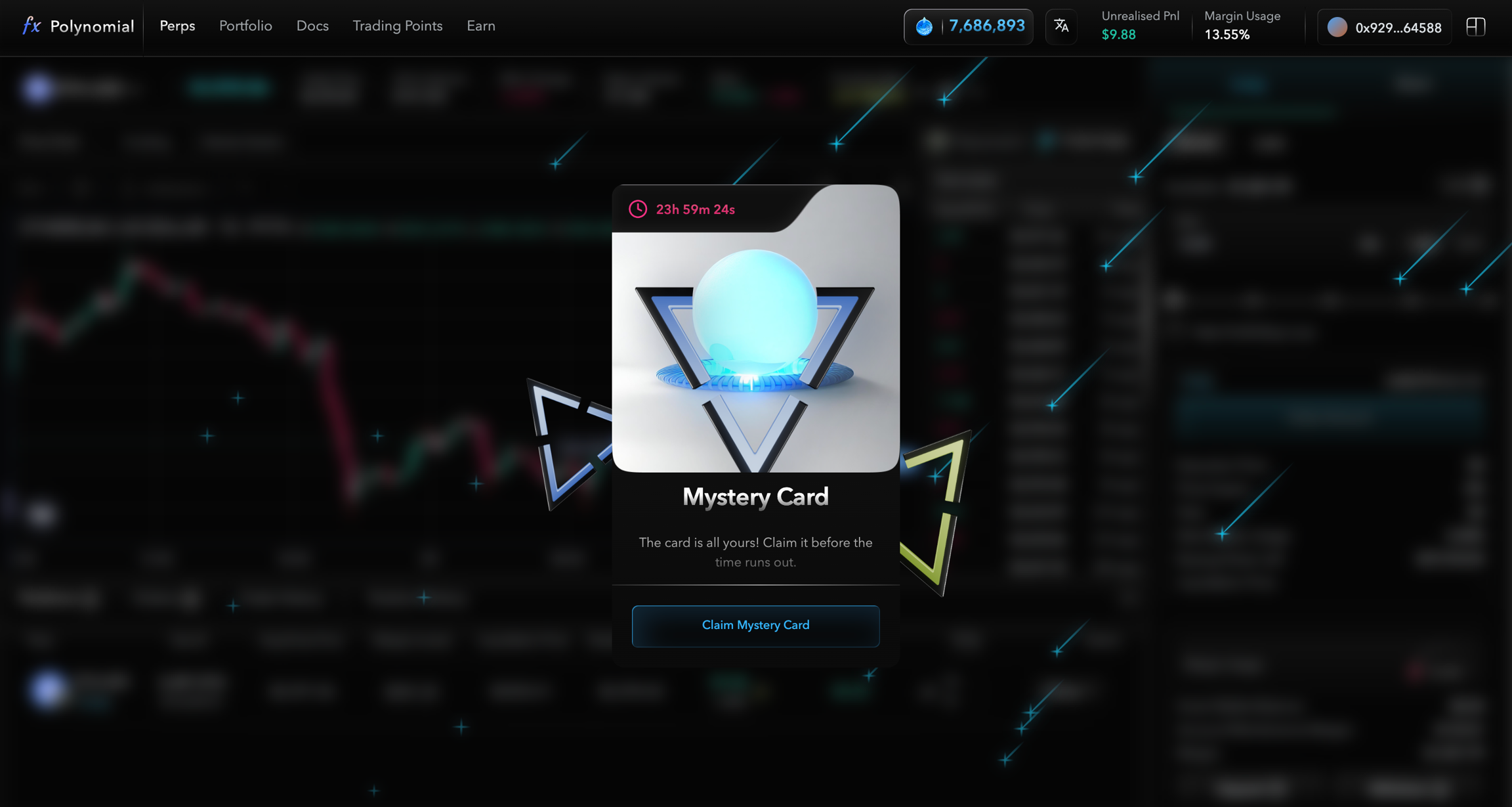

Polynomial: Includes referral-based community quests in staking, rewarding users for engaging others and growing the ecosystem. Learn more

This structure incentivizes consistency. Platforms like Staking Rewards offer comparisons across assets, revealing APYs up to 34% on select chains, while ZetaChain’s universal proof-of-stake hints at cross-chain loyalty layers. Projects integrate these to reward early supporters, enhancing tokenomics as detailed in Three Sigma’s DeFi analyses.

The Strategic Edge for DeFi Loyalty Rewards

DeFi projects deploy DeFi loyalty rewards to combat user churn, a persistent challenge in volatile markets. By staking, supporters contribute to stability, earning not just yields but exclusive airdrops or fee discounts. Recent innovations, such as Steakwallet’s $CUT algorithmic system, dynamically adjust rewards to balance inflation and participation, ensuring high yields during low-activity periods.

Decentralized systems give customers real ownership over their rewards, fostering large-scale community incentives.

This approach transforms loyalty into a quantifiable asset. Supporters of protocols like Polynomial gain referral bonuses, amplifying network effects. Yet, as Minds of Capital notes, incentives carry risks: impermanent loss, smart contract flaws, and regulatory haze demand vigilant participation. Savvy stakers mitigate these by selecting audited pools and diversifying across chains.

Read more on how on-chain loyalty staking maximizes DeFi rewards for top crypto community members.

Navigating Risks While Maximizing Gains in Loyalty Staking

While alluring, crypto project staking incentives require a measured approach. Slashing penalties, liquidity locks, and validator dependencies, as highlighted by Gate. com and Cube Exchange, underscore the need for due diligence. NFT staking adds volatility layers, per TheCoinEarn, blending art with yields but inviting platform risks.

Strategies from Shamlatech for stablecoin staking apply here: automate with safeguards, borrow judiciously, and monitor pools. Abbacus Technologies’ blueprints for staking platforms reveal on-chain reward calculus, enabling users to forecast earnings precisely. For institutions eyeing Bitcoin staking via Solv, Staking Rewards’ guides provide institutional-grade insights.

Ultimately, blockchain loyalty programs thrive on informed conviction. By aligning stakes with projects exhibiting robust tokenomics, supporters not only maximize returns but shape DeFi’s trajectory.

Token loyalty staking elevates this dynamic further, blending commitment with compounded gains. Platforms now automate reward distribution via smart contracts, as Abbacus Technologies outlines in their staking blueprints, ensuring precision in multi-token payouts and user journeys.

Step-by-Step Guide to Launching Your On-Chain Loyalty Stake

Once staked, track your position through dashboards like those on Staking Rewards, where institutional ratings help benchmark performance. This process, refined by Crypto. com’s mobile ETH staking, democratizes access, letting even retail supporters auto-compound without constant oversight. Diversify into stablecoin pools per Shamlatech’s tactics to buffer volatility, borrowing against stakes only after stress-testing leverage ratios.

In practice, projects like Polynomial layer referral mechanics atop staking, rewarding network builders with bonus yields. My analysis of DeFi cycles shows these hybrid models sustain engagement through bull and bear phases, far outpacing fleeting airdrops.

Rewards at a Glance: Top Platforms Compared

Comparison of Leading On-Chain Loyalty Staking Platforms

| Platform | Max APY | Supported Chains | Key Features | Risks |

|---|---|---|---|---|

| Crypto.com DeFi Wallet | Up to 34% | Ethereum | Auto-compound ✅, flexible unstaking, mobile staking | Slashing penalties, smart contract vulnerabilities, liquidity risks |

| Staking Rewards | Up to 34% (varies by asset) | Multi-chain | Yield comparisons, provider ratings, institutional tools | Third-party provider risks, market volatility, regulatory uncertainties |

| Chainlink | Variable rewards | Ethereum & compatible chains | Network security staking, valid alerts rewards, multi-rewards | Slashing for invalid alerts ⚠️, network vulnerabilities, token volatility |

| ZetaChain | Competitive PoS yields | Universal multi-chain | Universal loyalty rewards layer, quests, multi-rewards, chain integrations | Interoperability risks, emerging protocol bugs, regulatory issues |

| Steakwallet | High algorithmic (up to 34%) | Multi-chain | Algorithmic $CUT rewards, auto-adjusting yields, multi-rewards | Inflation risks (mitigated), platform dependency, low participation volatility |

This snapshot draws from 2025-2026 data, where APYs hit 34% peaks on high-demand chains, per MEXC insights. ZetaChain’s universal layer promises seamless cross-chain staking, mitigating silos that fragment loyalty efforts. Yet, Cube Exchange warns of yield traps: always verify on-chain mechanics before committing capital.

Opinionated take: Prioritize platforms with proven tokenomics, like those sharing protocol revenue, as Three Sigma dissects. Gate. com’s risk primer reinforces selecting validators with unblemished slashing records, especially for institutional flows into Bitcoin staking via Solv.

Web3 loyalty programs evolve rapidly, integrating quests from Solana Compass models with DeFi yields. TokenMinds highlights loyalty tokens feeding into lending protocols, creating yield-on-yield loops that amplify DeFi loyalty rewards. Risks persist, though; TheCoinEarn flags NFT staking pitfalls, from illiquidity to oracle failures, urging hybrid portfolios blending blue-chip stakes with speculative tiers.

Yield farming rewards incentivize users to generate value for an on-chain protocol, a timeless principle now supercharged by loyalty staking.

Read further on how on-chain loyalty staking boosts user retention for DeFi projects.

Forward-looking, algorithmic systems like Steakwallet’s $CUT adapt rewards dynamically, curbing inflation while spiking yields in lulls. As blockchain reshapes loyalty marketing, per Avax. network, true ownership emerges: stakers govern, earn, and endure. Projects ignoring these tools risk obsolescence in a retention-first DeFi arena.

For supporters, the path forward demands conviction rooted in fundamentals. Stake thoughtfully in audited pools, harness tools like Polynomial referrals, and view loyalty as a portfolio cornerstone. This not only secures personal gains but fortifies the ecosystems we champion, paving DeFi’s path to mainstream resilience.