In the fast-paced world of DeFi, where yields chase users like fireflies in the night, on-chain loyalty staking emerges as a beacon for those willing to commit long-term. Imagine locking your tokens not just for a quick APY bump, but for escalating rewards that grow with every renewal. This is the promise of staking renewal bonuses, a mechanism designed to reward patience and loyalty in an ecosystem often criticized for its short-termism. Protocols are waking up to the fact that retaining holders beats acquiring new ones every cycle, and on-chain mechanisms make it transparent and tamper-proof.

Traditional staking offers steady yields, but renewal bonuses supercharge that model. Drawing from recent innovations, like Magic Eden’s gamified locks on $ME tokens or FlexHype’s tiered system up to ‘Immortal’ status at 2160 days, these bonuses multiply staking power based on commitment duration. It’s no longer about passive holding; it’s active allegiance coded into the blockchain. As DeFi matures, DeFi loyalty rewards like these are reshaping how projects foster community, turning one-time stakers into lifelong advocates.

Decoding the Mechanics of Renewal Bonuses

At its core, on-chain loyalty staking renewal bonuses function through smart contracts that track lock-up history. When you renew your stake, the protocol evaluates your past behavior: consecutive renewals, total locked duration, even consistency across epochs. Rewards aren’t flat; they compound via multipliers. For instance, a basic 30-day lock might yield 1x power, but stack six months and you’re at 2x, scaling exponentially for years-long holders. This mirrors real-world loyalty programs, yet fully decentralized, with no central authority skimming points.

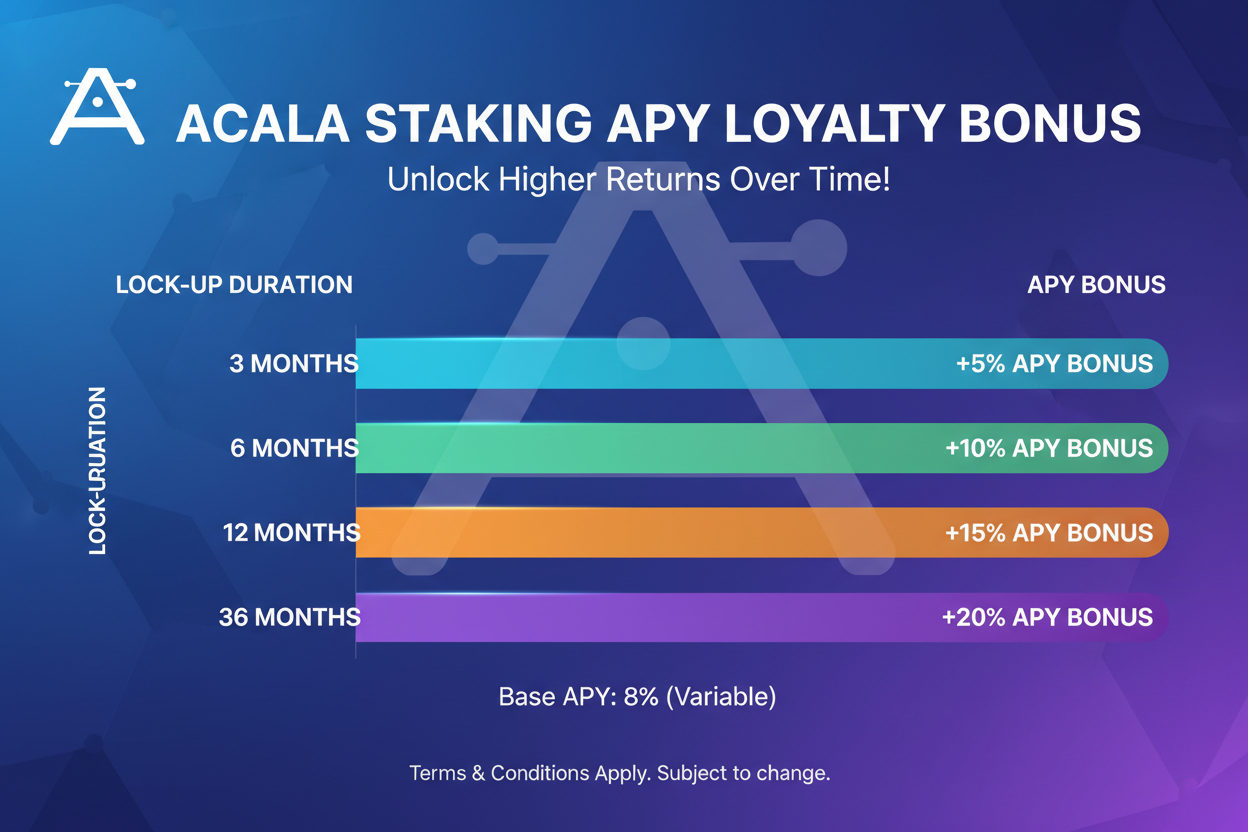

Take Acala’s approach: their dashboard flaunts real-time APY with loyalty boosts for veterans. Or consider how DeFi lending platforms like Aave integrate staking elements, where prolonged exposure unlocks bonus yields. The beauty lies in automation; rewards distribute on-chain, often daily or per block, eliminating manual claims. But it’s not without nuance. Renewal typically requires active re-staking at maturity, preventing indefinite locks while encouraging repeated engagement. This rhythm builds habit, aligning user incentives with protocol health.

Top 5 Renewal Bonus Benefits

-

Higher APYs for Long-Term Holders: Protocols like Acala offer loyalty bonuses that boost returns for sustained staking, rewarding commitment with enhanced yields.

-

Gamified Tiers for Engagement: Magic Eden’s system uses lock-up durations for multipliers, while FlexHype features tiers from ‘Basic Staker’ (30 days) to ‘Immortal’ (2160 days) with up to 1000% rewards.

-

Transparent On-Chain Tracking: All renewal bonuses are verifiable on the blockchain, ensuring trustless monitoring of staking progress and rewards.

-

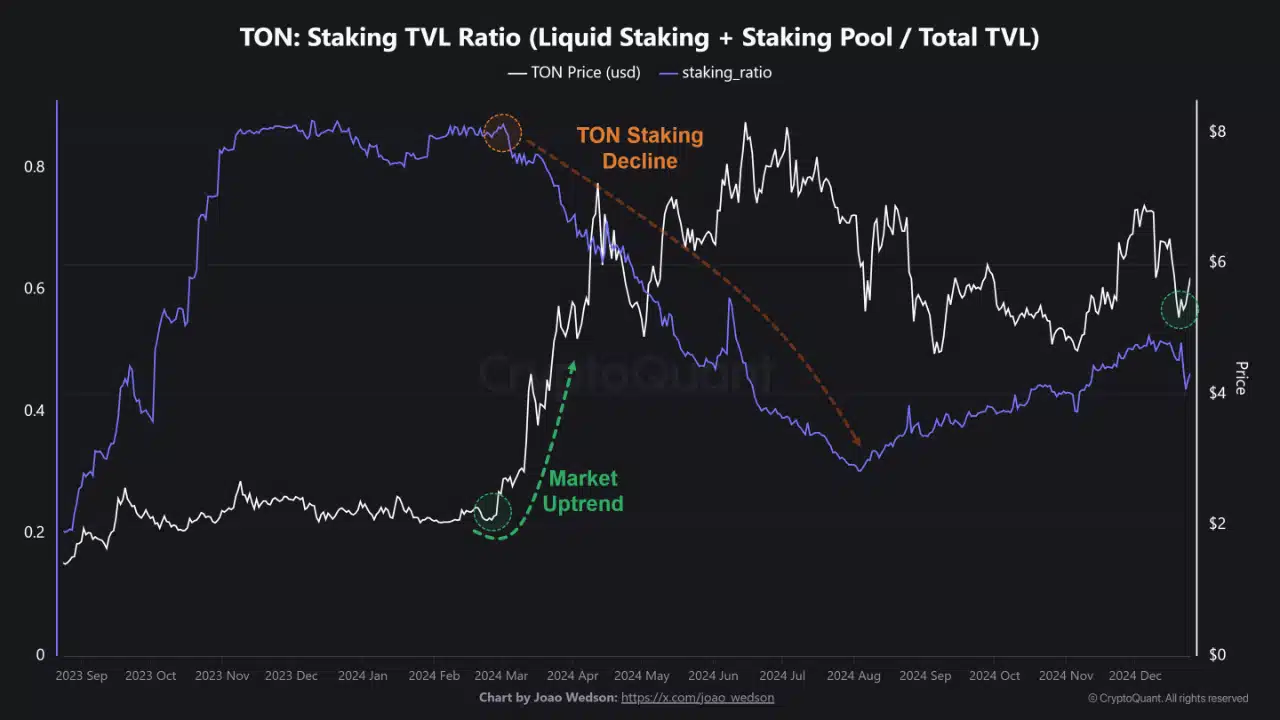

Reduced Sell Pressure: Longer lock-ups incentivize holding, stabilizing token prices and supporting protocol growth in DeFi ecosystems.

-

Compounded Rewards Over Time: Renewal bonuses enable automatic reinvestment, exponentially growing yields for dedicated holders in PoS networks.

Real-World Examples Driving the Trend

Magic Eden sets a compelling benchmark with its $ME token staking. Users choose lock periods from weeks to years, earning multipliers that amplify rewards. A 90-day lock might double your staking power; go annual, and it’s tripled. This gamification hooks users, as longer commitments unlock rarer badges or governance perks. FlexHype pushes further, with tiers from ‘Basic Staker’ (30 days, modest boost) to ‘Immortal’ (over five years, up to 1000% rewards). These aren’t hypotheticals; they’re live, pulling in holders weary of volatile farms.

Incentive programs like these have proven to drive user retention and long-term growth, as seen in various DeFi campaigns.

Such models echo broader Web3 loyalty programs, where long-term staking APY isn’t just higher, it’s personalized. Protocols analyze on-chain data – your wallet’s staking history, renewal frequency – to calibrate bonuses. This data-driven precision separates casual yield farmers from dedicated builders. Yet, opinion time: while flashy, these systems reward the patient precisely because they penalize flippers indirectly. Short-term stakers miss the compounding curve, creating a natural filter for committed capital.

Why Long-Term Holders Are Poised to Thrive

For the long-term DeFi holder, renewal bonuses transform staking from a side hustle into a wealth engine. Compounding loyalty staking means your principal generates not just base APY, but layered multipliers that snowball. Picture this: start with 10% base yield, renew thrice, hit 15% effective APY via bonuses. Over years, this edges out traditional CeFi yields, all while you support network security or liquidity pools.

Risks exist – impermanent loss in LP staking, smart contract vulnerabilities – but top platforms mitigate with audits and insurance. Platforms like those highlighted in recent guides prioritize user-friendly dashboards showing projected loyalty-adjusted returns. Holders benefit most because protocols prioritize them: reduced token dumps stabilize prices, funding more buybacks or developments. It’s symbiotic; your loyalty fuels growth, growth amplifies your rewards. As one Reddit thread quips, DeFi staking gets tricky with tracking, but renewal bonuses simplify via on-chain proofs.

Check out how on-chain loyalty staking boosts user retention for DeFi projects for deeper retention mechanics. This first wave of adopters – think early Aave or Acala stakers – are reaping outsized gains, proving the model’s viability.

Projects embedding staking renewal bonuses into their core tokenomics create self-sustaining ecosystems. Long-term holders provide stable liquidity, slashing volatility that plagues many DeFi tokens. In return, they capture premium yields unattainable by day traders. This dynamic is evident in how protocols like those from Formo’s analysis use incentives to spike retention rates, turning transient users into embedded stakeholders.

Navigating Risks in Loyalty Staking

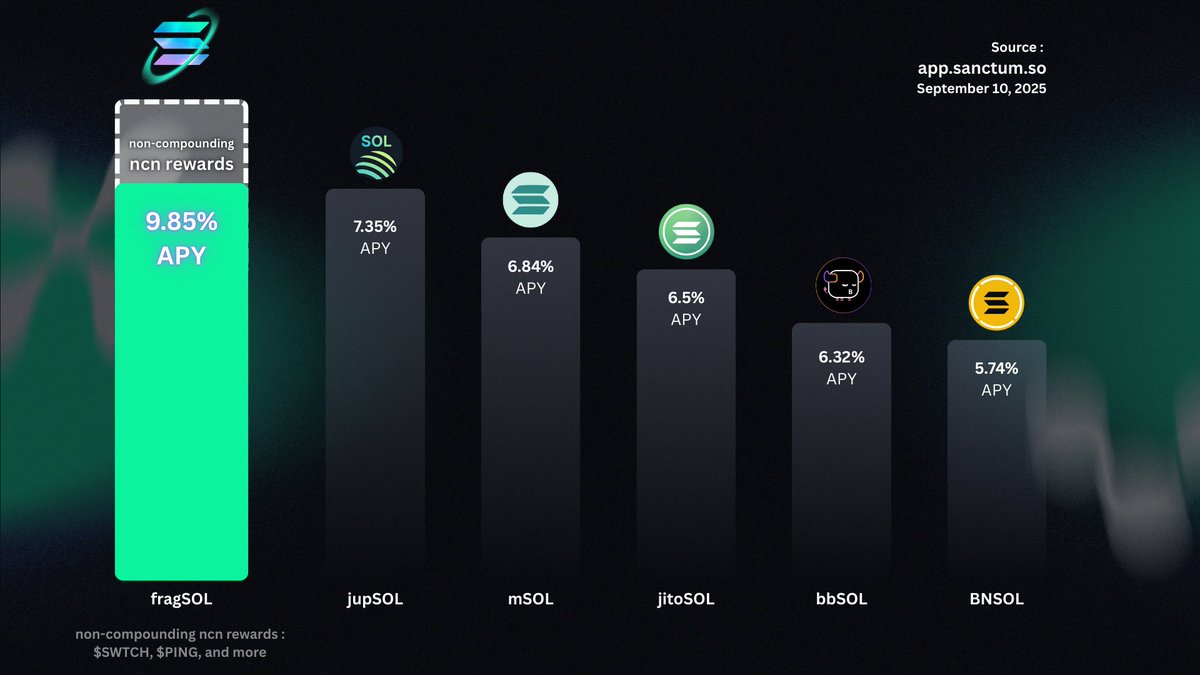

Smart contracts power these bonuses, but bugs lurk. Platforms counter with rigorous audits from firms like Hacken, which stress automatic reward distribution as a security boon. Impermanent loss hits liquidity providers hardest, yet renewal tiers often apply to single-asset staking, dodging that pitfall. Slashing risks in PoS? Minimal for DeFi wrappers. My take: the real edge goes to diversified stakers spreading across vetted protocols. Track everything on-chain; tools from Milk Road guides help verify APYs without double-counting rewards, as Reddit warns.

Loyalty Staking Tiers Comparison

| Platform | Tier/Lock-up Period | Bonus/Multiplier |

|---|---|---|

| Magic Eden | 90-day | 2x |

| Magic Eden | Annual | 3x |

| FlexHype | 30-day Basic | 1.5x |

| FlexHype | Immortal (2160-day) | 10x |

| Acala | Long-term | Enhanced APY boosts |

Web3 loyalty programs shine here, blending gamification with economics. Holders renew not from FOMO, but calculated upside. Protocols thrive too: lower churn means steadier TVL, fueling better rates for all.

Step-by-Step to Unlocking Renewal Rewards

Ready to dive in? The process demystifies DeFi’s complexity, putting compounding loyalty staking at your fingertips.

Post-stake, dashboards like Acala’s update live, projecting long-term staking APY with your loyalty factor. Renew seamlessly; most auto-compound options exist, though manual renews trigger fresh bonus calcs. Pro tip: ladder stakes across durations to harvest bonuses progressively, optimizing cash flow.

DeFi incentive programs shape onchain growth by prioritizing retention over hype.

Looking ahead, expect more protocols to layer AI-driven personalization atop these mechanics, tailoring bonuses to wallet behaviors. Cross-chain bridges will unify loyalty scores, letting you port commitment across ecosystems. For holders, this means portable prestige – stake on Ethereum, renew on Solana, keep the multiplier.

Explore further in how on-chain loyalty staking maximizes rewards for DeFi enthusiasts. As DeFi evolves, on-chain loyalty staking stands as the patient player’s ace, proving that in blockchain’s marathon, loyalty laps speed every time. Protocols rewarding renewals aren’t just innovative; they’re the blueprint for sustainable growth, drawing in builders who stick around to shape the future.