In February 2026, with Bitcoin holding steady at $67,258.00, up 0.29% over the last 24 hours, the world of rewards is flipping on its head. Traditional loyalty points, those dusty digital coupons trapped in silos, are giving way to on-chain loyalty staking: a DeFi powerhouse delivering liquid rewards you can actually trade, stake, or spend across ecosystems. Imagine earning tokenized loyalty rewards that grow with the market, not expire in your app drawer. This isn’t just evolution; it’s a revolution for crypto enthusiasts tired of locked-up value.

Polygon, Ethereum, and BNB Chain dominate blockchain rewards platforms this year, thanks to their speed, low costs, and scalability. Projects on these chains turn everyday engagement into stakable assets, outpacing clunky airline miles or coffee shop points that vanish if you switch allegiances.

Why Traditional Points Fall Short in a DeFi World

Picture this: you’ve racked up thousands of points from shopping or flying, only to watch them expire or become worthless during a merger. Traditional systems breed frustration because they’re non-transferable, siloed, and controlled by corporations that tweak terms at whim. No liquidity means no real choice, you’re stuck redeeming for subpar perks or losing out entirely.

In contrast, DeFi loyalty programs tokenize everything. Your loyalty becomes a blockchain asset, portable and verifiable. Platforms like those highlighted in recent analyses convert trading, referrals, and social buzz into REP tokens or equivalents, owned outright by you. Stake them for yields, trade on DEXes, or hold for governance. This shift aligns incentives: projects thrive when users win big.

Transparency builds trust in the new financial era.

Mastering Staking Mechanisms for Maximum Gains

On-chain loyalty staking shines through diverse models tailored for 2026’s fast-paced DeFi. Fixed-term staking locks tokens for boosted APYs, commit six months, reap 20% higher rewards. Prefer flexibility? Flexible staking lets you dip in and out, balancing liquidity with steady drips of yield.

Tiered systems add gamification: stake more, unlock VIP perks like airdrops or NFT mints. Take AVA Foundation’s Travel Tiger NFTs on Avalanche, they blend staking with personalized travel deals, turning loyalty into emotional investment. Or explore DAO governance, where your staked tokens vote on protocol upgrades, making you a co-owner, not just a customer.

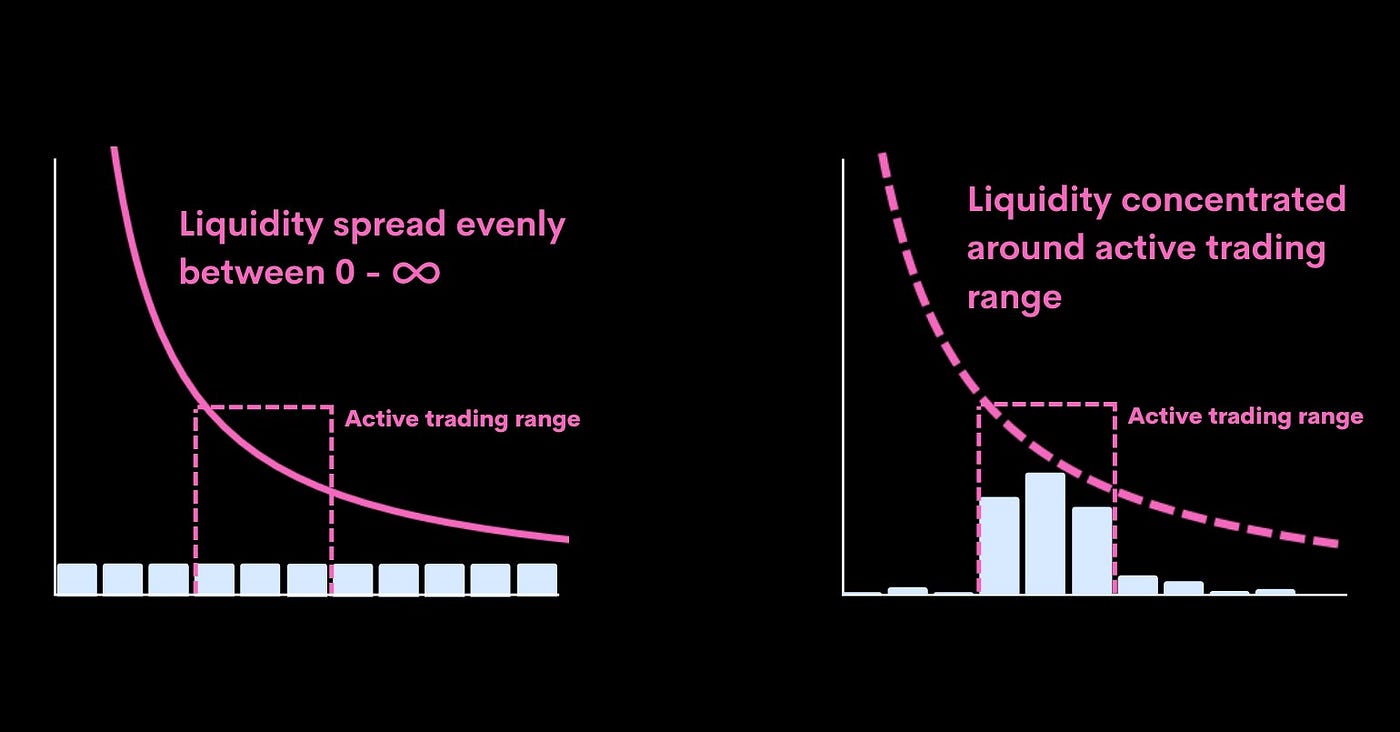

These aren’t hypotheticals. By early 2026, fee-based earnings in DeFi have eclipsed pure token incentives, signaling sustainable growth. Liquidity providers now pocket real protocol fees, stacking nicely atop staking rewards for compounded returns.

Tokenized Rewards Meet NFT Powerhouses

Enter the top NFT staking arenas: Binance NFT leads for blue-chip stakes, while NFTX decentralizes yields on rarities. Doge Capital caters to meme lords, but the real edge lies in loyalty fusion. Rainbow’s RNBW token exemplifies this, tokenizing points into tradable gems backed by analytics and DeFi tools, drawing institutions hungry for yield.

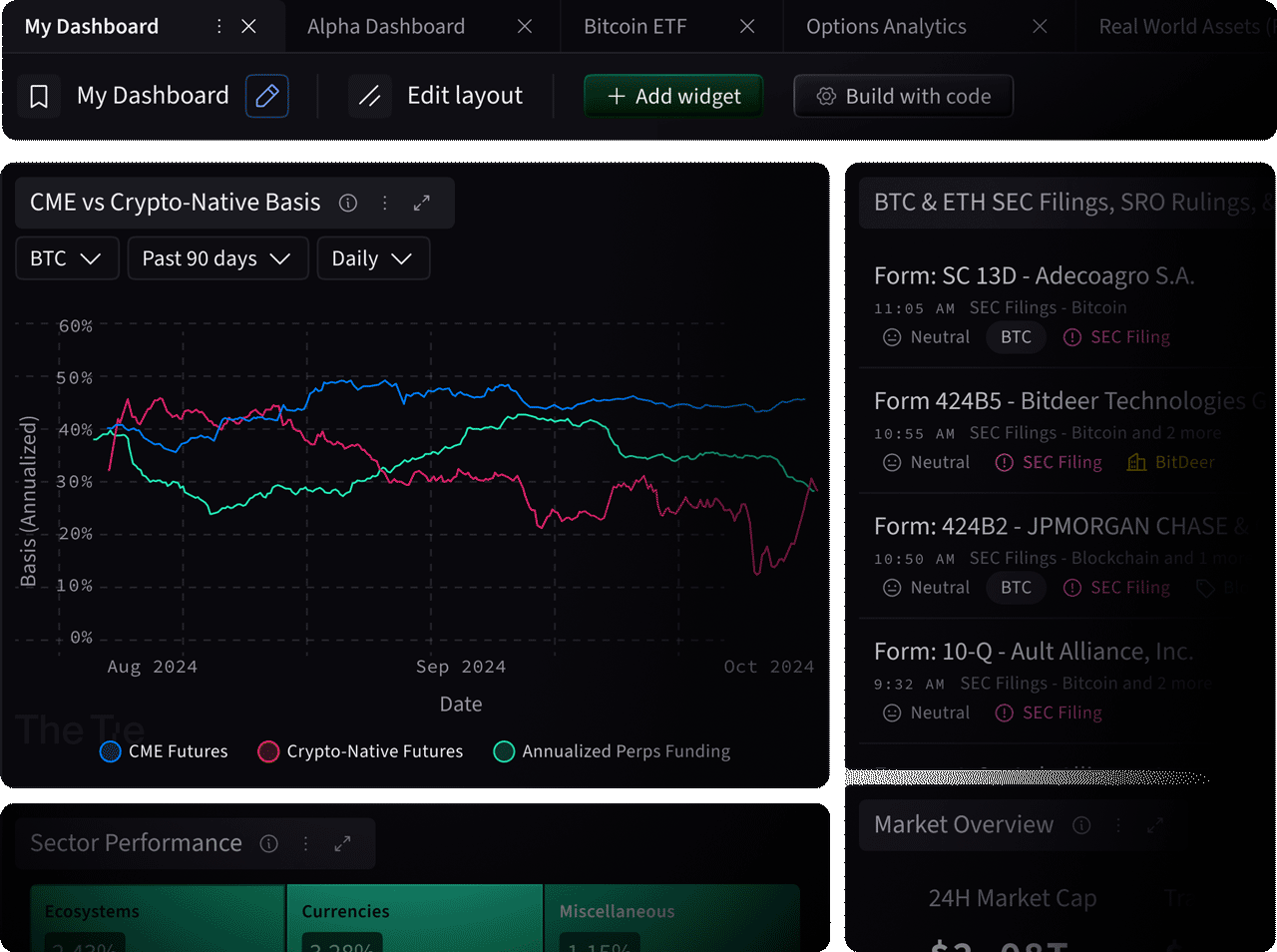

Why does this matter? Staking loyalty tokens creates liquid loyalty assets, immune to expiration. Cross-chain interoperability, a hot 2026 trend, lets you migrate rewards seamlessly. AI-driven personalization and real-time distribution via blockchain slash redemption headaches, per insights from Greenville Online and Appinventiv.

Uniswap (UNI) Price Prediction 2027-2032

Forecast based on DeFi staking trends, on-chain loyalty programs, and market adoption amid 2026 dynamics (Current UNI price: $3.42)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $4.50 | $7.50 | $12.00 |

| 2028 | $6.00 | $11.00 | $20.00 |

| 2029 | $8.00 | $16.00 | $30.00 |

| 2030 | $10.00 | $24.00 | $45.00 |

| 2031 | $12.00 | $35.00 | $65.00 |

| 2032 | $15.00 | $50.00 | $95.00 |

Price Prediction Summary

UNI is positioned for robust growth driven by on-chain loyalty staking, tokenized rewards, and DeFi innovations. Average prices could rise from $7.50 in 2027 to $50 by 2032 in a base case, with bullish maxima reflecting institutional adoption and bull cycles, while minima account for regulatory risks and market corrections.

Key Factors Affecting Uniswap Price

- Growth in on-chain loyalty programs and staking mechanisms enhancing UNI utility

- Integration of NFTs, DAOs, and tokenized reputation boosting network effects

- Shift to fee-based DeFi rewards improving sustainability

- Institutional adoption via platforms like Rainbow and partnerships

- Ethereum L2 scalability (Polygon, etc.) reducing fees and increasing DEX volume

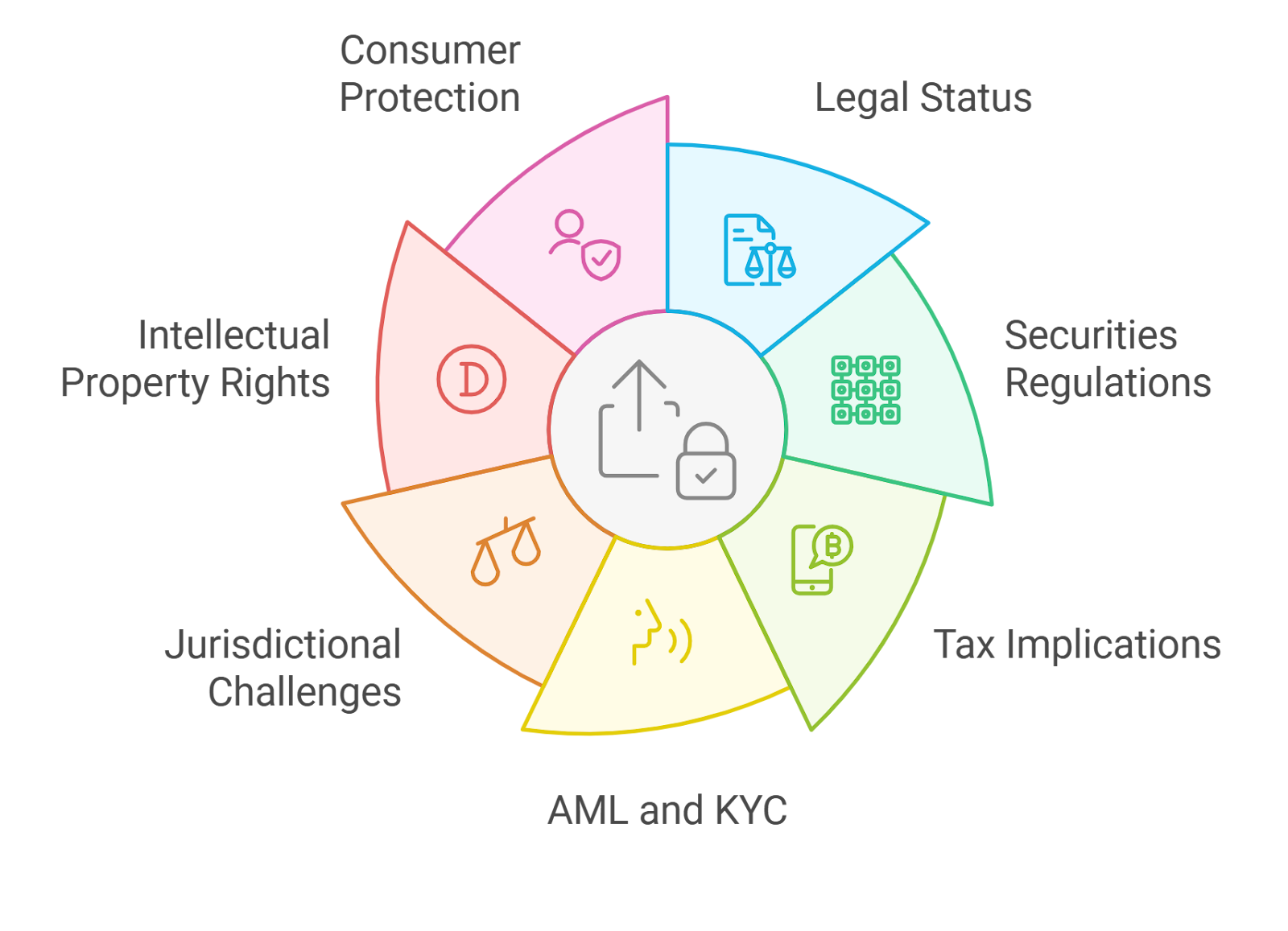

- Regulatory clarity and blockchain trends favoring DeFi interoperability

- Market cycles post-BTC halving, with BTC at $67K baseline

- Uniswap protocol upgrades and competition from AAVE, COMP in DeFi space

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As Ethereum hums at $1,978.55 and Uniswap climbs to $3.42, these platforms amplify blockchain loyalty incentives. Early adopters aren’t just earning; they’re building wealth in a system that rewards consistency over consumerism. Dive deeper via this guide on maximizing DeFi rewards, and see why 2026 belongs to the stakers.

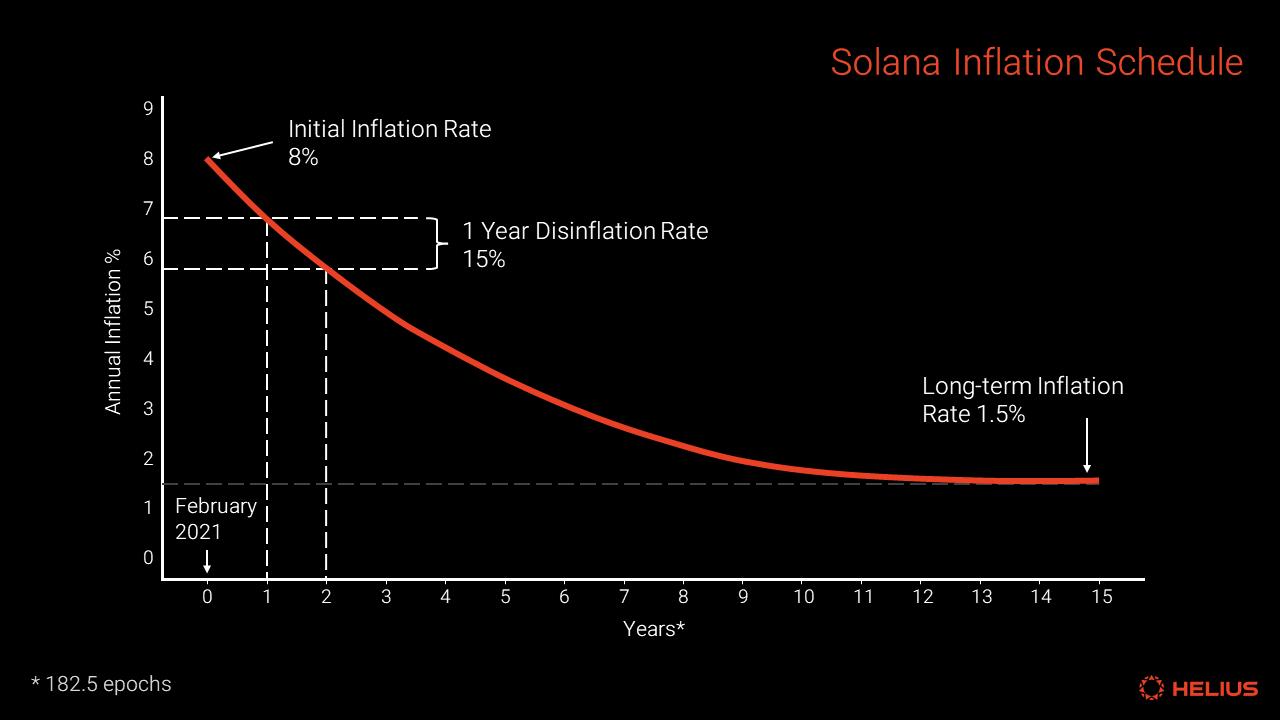

Institutional staking matures too, with proof-of-stake networks securing billions. Lock assets, validate blocks, earn passively, it’s loyalty on steroids, projected to explode per Aetsoft’s outlook.

Proof-of-stake chains like Ethereum and Polygon make this accessible, turning everyday loyalty into network security and yields that compound effortlessly. As Bitcoin sits firm at $67,258.00, these ecosystems draw savvy investors chasing blockchain loyalty incentives 2026 without the volatility hangover of spot trading.

Top DeFi Staking Platforms Dominating Loyalty Rewards

Navigating 2026’s landscape means picking platforms that blend loyalty with high-octane DeFi. SoluLab’s roundup spotlights nine standouts, but for loyalty-focused staking, prioritize those fusing tokens with user engagement. Platforms on BNB Chain offer low fees for frequent interactions, while Avalanche powers NFT-driven suites for enterprises scaling customer data and perks.

Comparison of Top DeFi Staking Platforms for Loyalty Rewards in 2026

| Platform | Est. APY (%) | Avg. Fees (%) | Supported Chains | Liquidity Score (/10) | Highlights |

|---|---|---|---|---|---|

| Binance NFT | 18-25 | 0.2 | BNB Chain, Ethereum | 9.5 | Blue-chip NFT yields 🏆 |

| NFTX | 12-20 | 0.5 | Ethereum, Polygon | 8.8 | Decentralized staking |

| Aave | 6-15 | 0.1 | Ethereum, Polygon, BNB Chain, Avalanche | 9.9 | SoluLab pick, flexible staking |

| Uniswap (UNI) | 10-22 | 0.3 | Ethereum, Polygon, BNB Chain | 9.2 | DeFi token incentives, high liquidity |

These hubs excel because they treat loyalty as a yield farm, not a gimmick. Stake staking loyalty tokens on Uniswap at $3.42 for UNI governance perks, or Aave at $109.71 for lending boosts tied to project loyalty. Doge Capital adds fun for NFT memes, but the pros eye cross-chain plays for portable rewards.

Unlocking Everyday Wins: Benefits Over Old-School Points

Key Advantages of On-Chain Staking

-

1. Liquidity: Trade rewards anytime on DEXes like Uniswap ($3.42 UNI), unlike locked traditional points.

-

2. No Expiration: Blockchain tokens like REP from GiveRep never expire, providing perpetual value vs. vanishing points.

-

3. Compounding Yields: Stake on platforms like Aave ($109.71 AAVE) to earn compounding rewards automatically.

-

4. Governance Power: Hold tokens to vote in DAOs, like AVA Foundation holders influencing decisions.

-

5. Cross-Platform Portability: Move rewards across Polygon, Ethereum, BNB Chain seamlessly.

-

6. Real-Time Transparency: Verify everything on-chain explorers, no black-box like traditional programs.

Traditional points chain you to one brand; liquid loyalty assets DeFi set you free. Earn from micro-moments like a tweet or trade, stake for APYs that beat savings accounts, and watch value accrue as protocols mature. I’ve seen users flip tokenized rep into 30% gains during bull runs, far outstripping airline miles gathering dust.

Businesses win too. Top DeFi ideas from Cryptiecraft highlight loyalty staking as a startup goldmine: retain users 40% longer, bootstrap liquidity, and tap institutional cash via compliant token models. Weaver’s outlook predicts regulation smoothing this path, with infrastructure ready for mass adoption.

AI integration personalizes rewards, predicting your next stake based on habits, while tokenization unlocks real-world assets like event tickets as NFTs. Enable3 notes Polygon leading for speed, perfect for real-time redemptions that nix delays forever.

Your Roadmap to Staking Success

Ready to ditch points for power? Connect a wallet to a Polygon or Ethereum dApp, claim your loyalty tokens from engagement, and stake via flexible pools. Monitor via Rainbow-style analytics, diversify across tiers, and reinvest fees for exponential growth. Compound (COMP at $15.93) shows how lending amps loyalty yields. Check strategies to boost engagement for pro tips.

This model thrives on participation. Active stakers on Avalanche or BNB Chain aren’t spectators; they shape protocols, earn from fees surpassing emissions, and ride waves like Ethereum’s $1,978.55 resilience. As DeFi evolves, tokenized loyalty rewards cement loyalty not through lock-ins, but liberation. Platforms rewarding early birds with governance and yields pull ahead, building communities that endure market dips. With Bitcoin’s steady climb and DeFi’s fee dominance, 2026 hands the edge to those staking smart. Platforms evolve daily, but the core truth holds: own your loyalty, own your future.