As Solana’s DeFi ecosystem surges forward in 2026, with Binance-Peg SOL trading at $86.24 after a minor 24-hour dip of $2.15, on-chain loyalty staking emerges as a game-changer. This innovative fusion of staking rewards, cashback mechanisms, and token incentives isn’t just about securing the network; it’s a strategic play to lock in user loyalty amid fierce competition for DeFi capital. Platforms are leveraging Solana’s high-speed blockchain to deliver yields that blend traditional staking APRs of 5-7% with real-world perks like cashback on spends, turning passive holders into active participants.

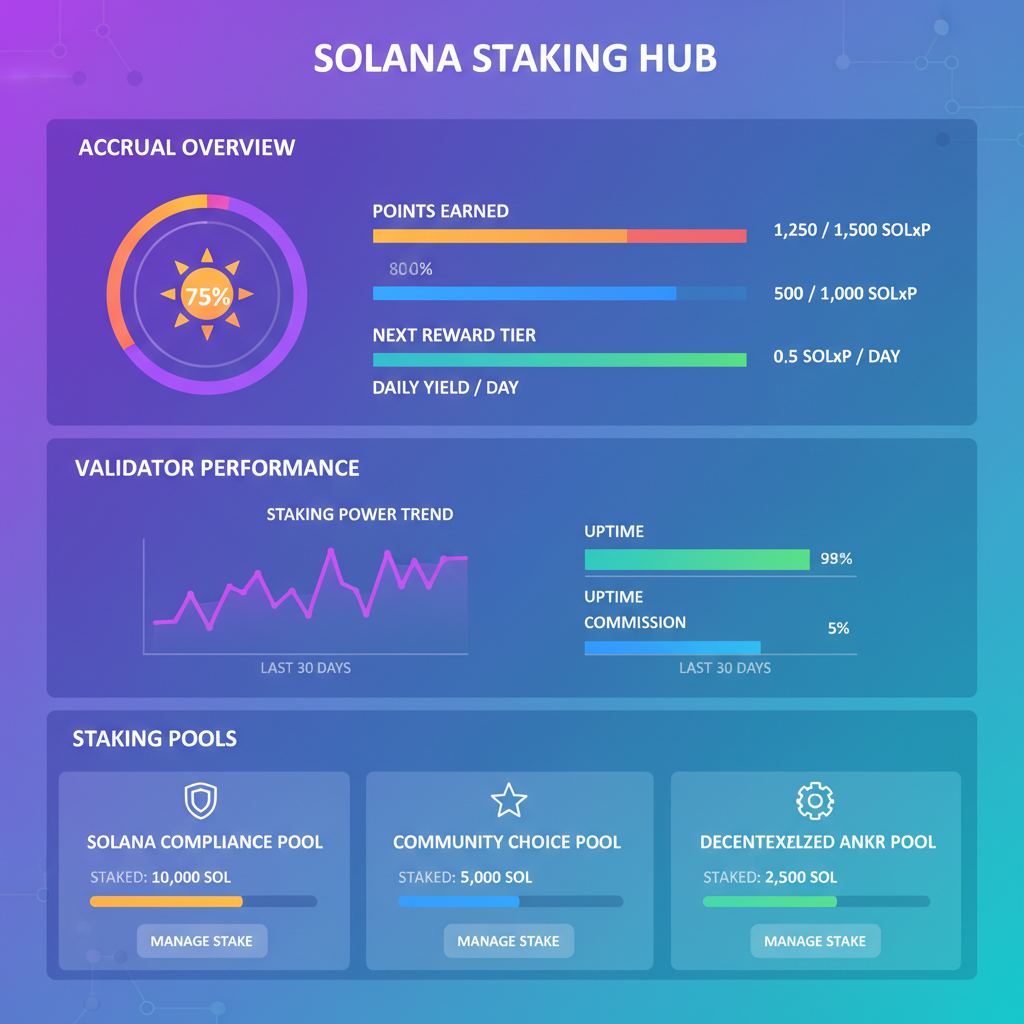

Solana’s native staking already offers validators robust returns, but on-chain loyalty programs elevate this by layering dynamic incentives. Imagine staking SOL or liquid staking tokens (LSTs) like hubSOL, earning base rewards while accumulating points for seasonal distributions of SOL and partner tokens. This model, pioneered by initiatives like SolanaHub’s Loyalty League, proportionalizes rewards to stake size and duration, with boosts for DAO engagement. It’s a masterstroke in retention, as projects reward consistency over speculation.

Solana Loyalty League: Dynamic Points for Long-Term Stakers

SolanaHub’s Loyalty League stands out in the crowded field of on-chain loyalty staking Solana. Over three-month seasons, participants rack up points based on staked amounts and holding periods. Use LSTs or interact with ecosystem DAOs, and you unlock multipliers that amplify distributions. At current SOL prices around $86.24, even modest stakes compound impressively when paired with these incentives. I’ve analyzed similar setups across chains, and Solana’s low fees make this frictionless, positioning it ahead of Ethereum’s gas-heavy alternatives.

This isn’t mere yield farming; it’s ecosystem alignment. Stakers contribute to network security while projects gain committed liquidity. For DeFi investors eyeing 2026, Loyalty League exemplifies how Solana DeFi cashback rewards and token drops can sustain participation through volatility.

Gemini’s Solana Credit Card: Cashback Meets Auto-Staking

Bridging Web3 and fiat spending, Gemini’s October 2025 launch of the Solana-themed credit card delivers up to 4% SOL cashback on fuel and EV charges, scaling to 6.77% staking yield. Auto-stake earnings with flexible unstaking, zero annual fees, and it integrates seamlessly into daily life. Cardholders at $86.24 SOL levels can stack rewards efficiently, converting purchases into compounded positions.

In my eight years tracking cross-asset trends, this hybrid model disrupts traditional loyalty programs. Unlike generic crypto cards offering flat cashback, Gemini ties rewards to Solana staking, enhancing network decentralization. Pair it with on-chain platforms, and you’re not just spending; you’re strategically positioning for DeFi upside. This approach merits attention for anyone building loyalty token staking incentives.

Solana (SOL) Price Prediction 2027-2032

Factoring Loyalty Staking Yields, On-Chain Rewards, and DeFi Ecosystem Growth from 2026 Baseline ($86.24)

| Year | Minimum Price | Average Price | Maximum Price | YoY Avg Change % |

|---|---|---|---|---|

| 2027 | $75.00 | $140.00 | $250.00 | +62.8% |

| 2028 | $110.00 | $220.00 | $420.00 | +57.1% |

| 2029 | $160.00 | $340.00 | $650.00 | +54.5% |

| 2030 | $220.00 | $500.00 | $950.00 | +47.1% |

| 2031 | $320.00 | $720.00 | $1,300.00 | +44.0% |

| 2032 | $420.00 | $950.00 | $1,700.00 | +31.9% |

Price Prediction Summary

Solana (SOL) is forecasted to experience robust growth from 2027-2032, driven by on-chain loyalty staking, cashback rewards, and DeFi innovations. Average prices are projected to rise progressively from $140 to $950, reflecting bullish adoption trends tempered by market cycles, with min/max capturing bearish corrections and peak bull runs.

Key Factors Affecting Solana Price

- Expansion of loyalty staking programs like Loyalty League and STKESOL, boosting yields to 5-15% APR

- DeFi TVL growth via liquid staking (LSTs/LRTs) and integrations with Kamino, enhancing liquidity and participation

- Real-world utility from products like Gemini Solana Credit Card offering 4-6.77% SOL rewards on spending

- Market cycle recovery post-2026, with Solana capturing share in high-speed blockchain competition

- Regulatory tailwinds for staking/DeFi and technological upgrades improving scalability

- Potential risks: competition from Ethereum L2s, macroeconomic downturns, and network congestion events

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Beyond cards, liquid staking derivatives like SOL Strategies’ STKESOL, backed by over 500,000 SOL, enable DeFi composability. Holders earn staking rewards while deploying in lending protocols on Kamino or Loopscale. It’s liquidity without sacrifice, critical as Solana TVL climbs. Similarly, Fragmetric’s liquid restaking protocol issues LRTs for multi-yield strategies, distributing rewards in real-time under the FRAG-22 standard.

StakePoint Pools: High-APR Flexibility for Stablecoin Stakers

StakePoint diversifies with pools boasting 15% APR on USDC and USDT, no lockups, and transparent yields. This appeals to conservative players wary of SOL’s $86.24 volatility, blending stability with loyalty perks. No gimmicks, just sustainable returns that fund further DeFi project loyalty programs. In a macro environment favoring yield over hype, these pools offer a bulwark.

Strategically, on-chain loyalty staking on Solana reframes user engagement. Projects like these don’t just incentivize deposits; they foster habits that weather bear markets. As an analyst bridging forex and crypto, I see parallels to carry trades: lock capital, harvest yields, adapt to shifts. With Solana’s speed enabling instant claims, 2026 shapes up as the year these mechanisms dominate DeFi retention.

These pools exemplify how Solana staking deposit bonuses can anchor capital without rigidity, a tactic I’ve seen outperform rigid lockups in volatile cycles. Yet, the true edge lies in composability: pair StakePoint yields with restaking on Fragmetric for layered returns, all while SOL hovers at $86.24.

Layered Yields: Restaking and LSTs Supercharge Loyalty

Fragmetric’s protocol transforms base staking into a yield engine. Deposit SOL or LSTs, receive LRTs for DeFi plays, and tap modular sources like validator commissions plus partner incentives. Real-time distributions sidestep claim delays plaguing slower chains. At today’s price, a $10,000 stake could net base 5-7% plus restaking premiums, outpacing vanilla validators. SOL Strategies’ STKESOL adds firepower, its 500,000 and SOL backing ensuring deep liquidity for Kamino borrows or Loopscale farms. This isn’t speculation; it’s engineered asymmetry, rewarding loyalty with optionality.

Opinion: In a DeFi landscape bloated with short-term farms, these tools demand discipline. I’ve traded forex pairs through rate hikes; similarly, Solana’s loyalty staking thrives on sustained exposure, not flips. Projects embedding loyalty token staking incentives here gain moats against capital flight.

Comparison of Top Solana Loyalty Programs

| Program | Key Features | Est. APR | Liquidity Type |

|---|---|---|---|

| Loyalty League | Points system, LST boosts (hubSOL), seasonal SOL/partner rewards | ~5-7% + points boosts | Liquid Staking Tokens (LSTs) |

| Gemini Card | 4% SOL cashback (fuel/EV charging), auto-staking, no annual/foreign fees | 4% cashback + 6.77% yield | Flexible unstaking |

| STKESOL | Liquid staking backed by 500k+ SOL, DeFi collateral (Kamino/Loopscale) | ~5.88% (SOL staking) | Liquid Staking Token (LST) |

| Fragmetric | LRT restaking, multi-asset deposits, modular yield sourcing | Staking + restaking yields (~7%+ est.) | Liquid Restaking Tokens (LRTs) |

| StakePoint | Stablecoin pools (USDC/USDT), no minimums, transparent | 15% | Flexible |

Navigating these requires strategy. Prioritize platforms with audited contracts and proven TVL. Solana’s sub-second finality minimizes slippage, but always simulate unstakes during peaks. As Binance-Peg SOL dips fractionally to $86.24, entry points sharpen for long-haul plays.

Hands-On: Stake and Claim Rewards Seamlessly

Once staked, monitor via dashboards like Solana Compass for real-time APYs. Gemini card users link spends directly, auto-compounding cashback into stakes. This frictionless loop cements habits, much like automated forex position sizing I’ve relied on for eight years.

Zoom out: Solana’s ecosystem now rivals Ethereum in innovation, minus the fees. Loyalty League’s seasonal cadence mirrors forex rollover incentives, distributing alpha to holders. Fragmetric and STKESOL extend this to pros, enabling leveraged loyalty without liquidation risks. StakePoint’s stablecoin angle hedges SOL’s $86.24 swings, ideal for balanced portfolios. Collectively, they signal a maturation where DeFi project loyalty programs evolve from gimmicks to infrastructure.

For DeFi enthusiasts, the playbook is clear: diversify across loyalty vectors. Allocate 40% to base staking via Loyalty League, 30% to liquid restaking, 20% stablecoin pools, and 10% cashback cards. Rebalance quarterly on points snapshots. This hedges downside while capturing upside as Solana TVL swells.

Projects eyeing retention should integrate these natively; early adopters like SolanaHub prove the model. Check how on-chain loyalty staking maximizes rewards for DeFi enthusiasts for deeper tactics. With yields compounding atop $86.24 SOL, 2026 favors the committed. Adapt, stake strategically, and watch loyalty translate to lasting gains.