In today’s DeFi landscape, on-chain loyalty staking stands out as a game-changer for investors chasing superior yields. By committing assets to long lockups, users tap into tiered rewards that platforms like Nexo and Rocket Pool design to favor steadfast holders. This approach not only boosts annual percentage yields through bonuses and multipliers but also aligns participant interests with network longevity, fostering deeper DeFi loyalty rewards. As protocols innovate amid the 2025 staking boom, strategies emphasizing extended commitments deliver compounded gains while mitigating short-term volatility risks.

Recent market insights underscore this shift. Platforms reward prolonged stakes with elevated APYs; for instance, Nexo’s loyalty tiers add bonuses atop base rates for ETH and BTC. Rocket Pool’s liquid staking tokens enable seamless compounding during ETH’s staking surge, while restaking leaders like EigenLayer layer on points-based incentives. These mechanics turn idle assets into revenue-sharing powerhouses, as noted in Galaxy’s on-chain yield reports, where proof-of-stake tokens become productive stakes securing networks.

Maximize Tiered Loyalty Rewards on Nexo

Nexo’s model exemplifies long lockup staking yields through its Platinum tier, achievable by locking ETH or BTC for 12 and months. Base ETH staking hovers at 4-6% APY, but loyalists snag an extra 2% bonus, pushing effective returns higher. This setup incentivizes retention, much like on-chain loyalty programs that prioritize enduring holders. Users ascend tiers by maintaining balances and lockups, unlocking not just yields but priority access to new listings. In a volatile market, this stability premium proves invaluable, echoing MoonPay’s guidance that duration directly amplifies rewards.

Leverage Rocket Pool’s rETH for Compounding Lockups

Rocket Pool transforms ETH staking with rETH, a liquid derivative that accrues rewards continuously. Holding rETH over extended periods positions holders for protocol loyalty airdrops, capitalizing on the 2025 ETH staking boom highlighted by AMBCrypto. Unlike rigid locks, rETH’s liquidity allows DeFi composability; stake it elsewhere while it compounds base yields. This strategy suits those balancing commitment with flexibility, yielding superior blockchain loyalty programs outcomes. Long-term holders benefit from network effects, as larger staked shares enhance security and validator revenue shares.

6 Top On-Chain Loyalty Staking Strategies

-

1. Maximize Tiered Loyalty Rewards on Nexo: Lock ETH or BTC for 12+ months to reach Platinum tier, unlocking up to 2% bonus APY on top of base staking yields (current ETH APY ~4-6%).

-

2. Utilize Rocket Pool rETH for Liquid Long Lockups: Stake ETH to receive rETH, hold for extended periods to compound rewards and qualify for protocol loyalty airdrops amid 2025 ETH staking boom.

-

3. Layer Yields with EigenLayer Restaking: Restake LSTs like stETH or rETH for 6-24 month terms, earning points-based loyalty rewards equivalent to 10-20% additional APR in current restaking meta.

-

4. Lockup LSTs in Pendle Fixed-Yield Markets: Sell fixed-rate yields on long-duration staked positions (e.g., 1-year stETH) for stable 8-12% APYs plus loyalty token accruals.

-

5. Engage Lido veLDO Voting Locks: Stake ETH for stETH and lock veLDO governance tokens long-term to boost staking multipliers and access exclusive loyalty distributions.

-

6. Diversify into Symbiotic Multi-Asset Restaking Pools: Commit to 12-36 month lockups across ETH, BTC wrappers for diversified loyalty yields, mitigating concentration risks highlighted in 2025 DeFi reports.

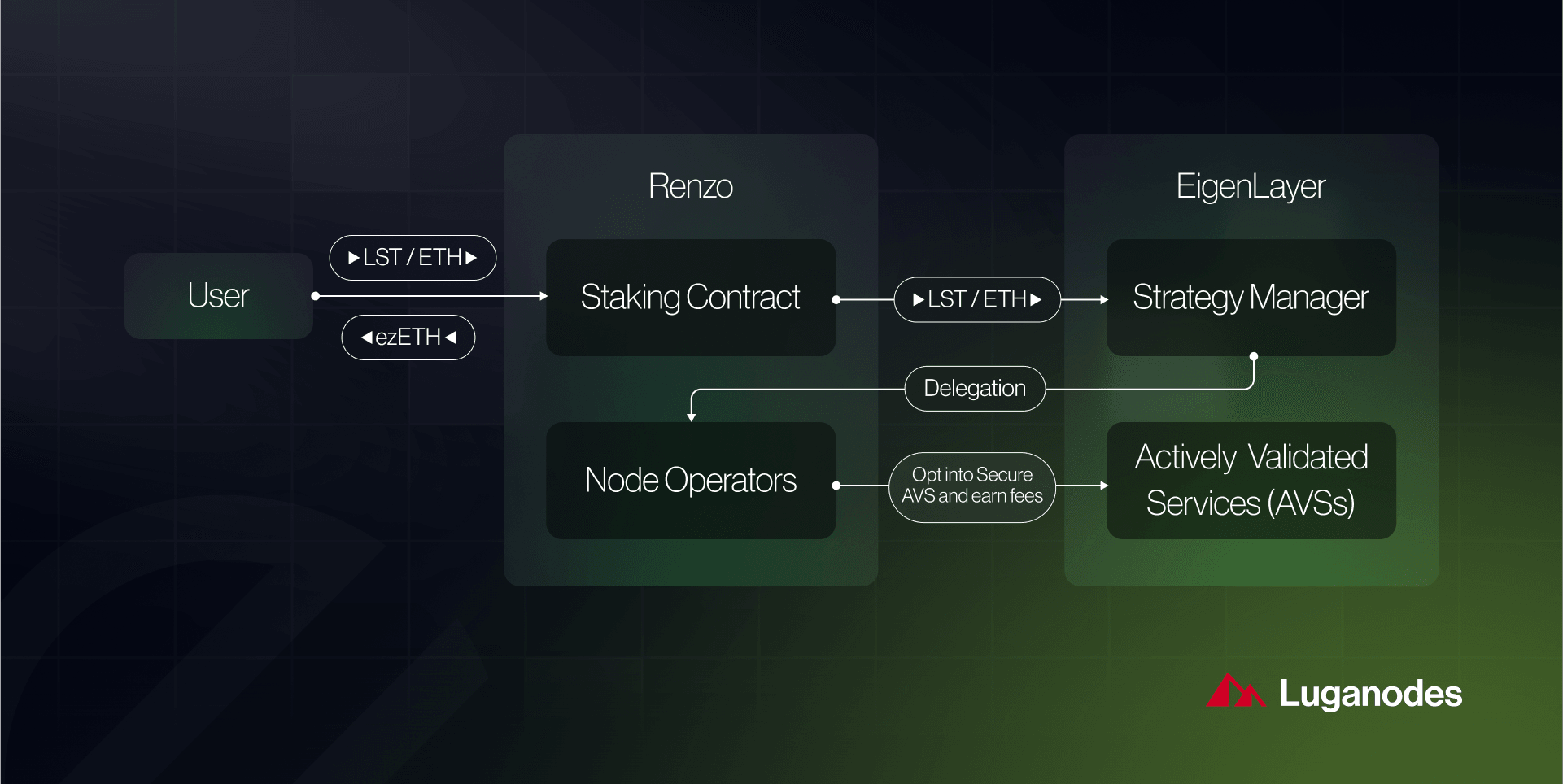

Supercharge Gains via EigenLayer Restaking

EigenLayer elevates yields by restaking liquid staking tokens like stETH or rETH for 6-24 month terms. Participants earn points translating to 10-20% additional APR equivalents in the restaking meta, per current trends. This layered approach extracts maximum value from initial stakes, rewarding long lockups with loyalty multipliers that secure Actively Validated Services. As Rapid Innovation notes, such platforms offer passive income surpassing traditional finance, but demand vigilance against slashing risks. For diversified portfolios, blending EigenLayer with base staking creates robust staking for user retention dynamics.

These initial strategies reveal how on-chain loyalty staking protocols craft incentives for endurance. Nexo’s tiers provide straightforward bonuses, Rocket Pool adds liquidity, and EigenLayer introduces restaking depth. Yet, the full arsenal includes Pendle’s fixed-yield innovations and beyond, each building on long lockup principles to outpace standard DeFi yields.

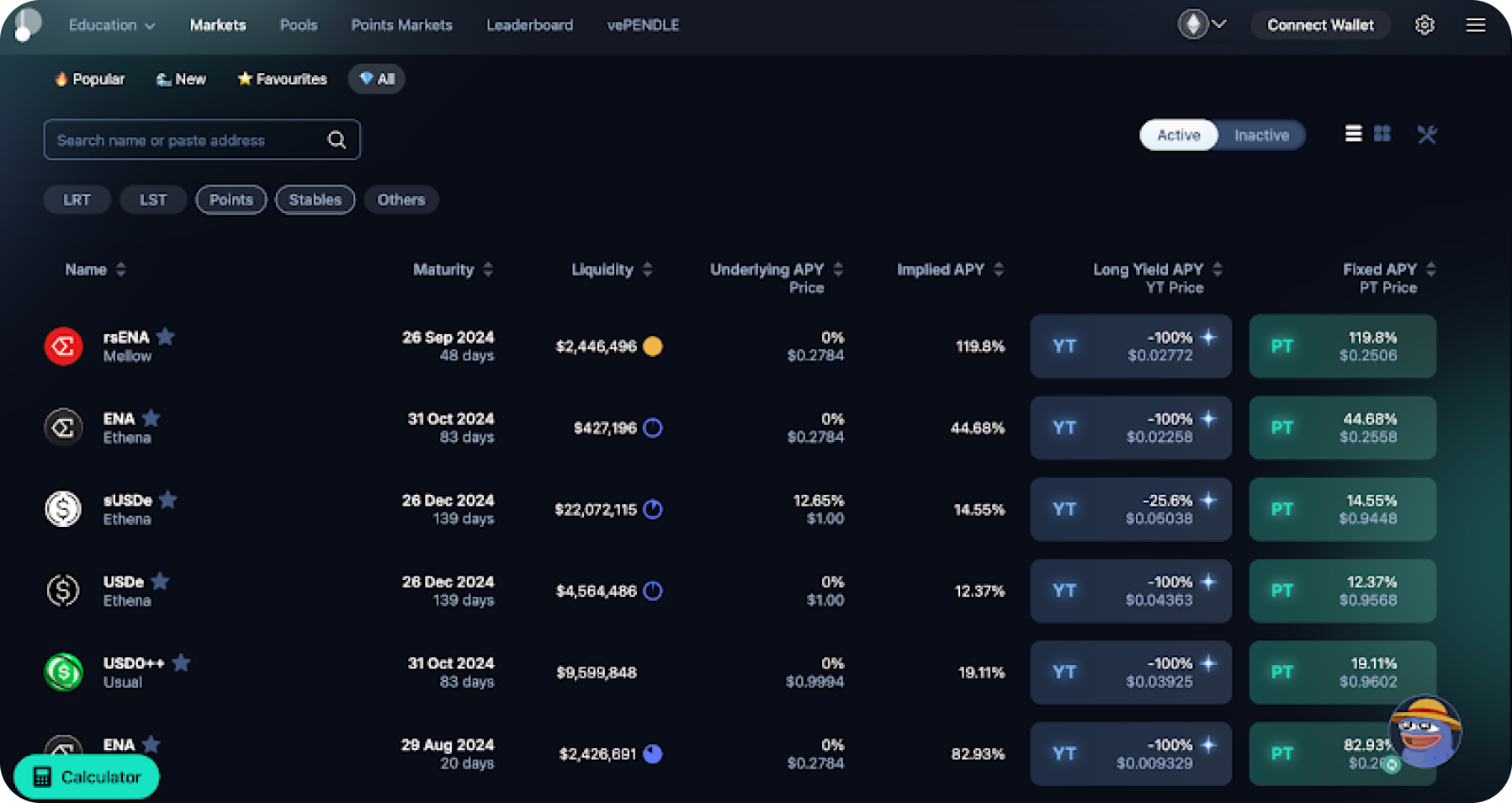

Building on these foundations, Pendle’s fixed-yield markets offer a sophisticated twist for those willing to commit LSTs long-term.

Lock LSTs in Pendle Fixed-Yield Markets

Selling fixed-rate yields on positions like 1-year stETH locks delivers stable 8-12% APYs, complemented by loyalty token accruals that reward duration. This strategy shines in uncertain markets, locking in returns upfront while accruing protocol incentives, much like the compounding mechanics in PixelPlex’s wallet rewards programs. Pendle empowers users to trade yield exposure, turning long lockups into predictable income streams that outperform volatile spot staking. I favor this for conservative yield farmers, as it decouples returns from short-term price swings, aligning perfectly with DeFi loyalty rewards that value foresight over frenzy.

APY Comparisons and Lockup Durations for On-Chain Loyalty Staking Strategies

| # | Strategy | Lockup Duration | APY Range (%) | Key Features |

|---|---|---|---|---|

| 1 | Maximize Tiered Loyalty Rewards on Nexo | 12+ months | 6-8% | Lock ETH or BTC for Platinum tier, unlocking up to 2% bonus APY on base staking yields |

| 2 | Utilize Rocket Pool rETH for Liquid Long Lockups | Flexible long holds | 4-6% + compounding | Hold to compound rewards and qualify for protocol loyalty airdrops |

| 3 | Layer Yields with EigenLayer Restaking | 6-24 months | 10-20% additional | Restake LSTs for points-based loyalty rewards |

| 4 | Lockup LSTs in Pendle Fixed-Yield Markets | 1 year | 8-12% | Sell fixed-rate yields on staked positions plus loyalty token accruals |

| 5 | Engage Lido veLDO Voting Locks | Long-term | Variable + multipliers | Boost staking multipliers and access exclusive loyalty distributions |

| 6 | Diversify into Symbiotic Multi-Asset Restaking Pools | 12-36 months | Variable diversified | Commit across ETH, BTC wrappers to mitigate risks |

Boost Multipliers with Lido veLDO Voting Locks

Lido’s ecosystem rewards governance commitment: stake ETH for stETH, then lock veLDO tokens long-term to amplify staking multipliers and tap exclusive distributions. This ve-model, inspired by Curve’s success, grants voting power alongside boosted yields, fostering staking for user retention. Long lockups here aren’t just passive; they shape protocol evolution, as holders influence upgrades amid ETH’s proof-of-stake maturity. For engaged DeFi natives, veLDO locks represent the pinnacle of aligned incentives, where loyalty translates directly to outsized rewards and network influence.

Diversify Risks in Symbiotic Multi-Asset Pools

Symbiotic takes diversification to new heights with 12-36 month lockups across ETH derivatives and BTC wrappers, spreading loyalty yields while curbing concentration pitfalls flagged in 2025 DeFi reports. By pooling multi-asset restaking, users access blended APYs that buffer against single-chain downturns, echoing Webisoft’s protocol-hopping tactics but with deeper commitments. This approach suits portfolios chasing resilience, as Symbiotic’s infrastructure rewards steadfast allocators with governance perks and escalating bonuses. In my view, it’s the smart capstone for any long lockup staking yields playbook, balancing ambition with prudence.

Integrating these six strategies, Nexo’s tiers, Rocket Pool’s liquidity, EigenLayer’s restaking, Pendle’s fixes, Lido’s votes, and Symbiotic’s pools, unlocks a yield engine far surpassing vanilla staking. Platforms like PAID Network echo this trend, tiering APRs for extended holds to bolster security and growth. Yet success hinges on risk calibration: prolonged lockups amplify illiquidity exposure and volatility drags, as Reddit threads warn of supply concentration skews. Start small, layer gradually, and prioritize protocols with proven audits.

For crypto enthusiasts eyeing 2026 horizons, on-chain loyalty staking redefines commitment as capital. By embracing long lockups, you not only harvest superior yields but also propel DeFi’s maturation, turning holdings into stakes with real protocol sway. The curious will thrive here, where endurance meets innovation.