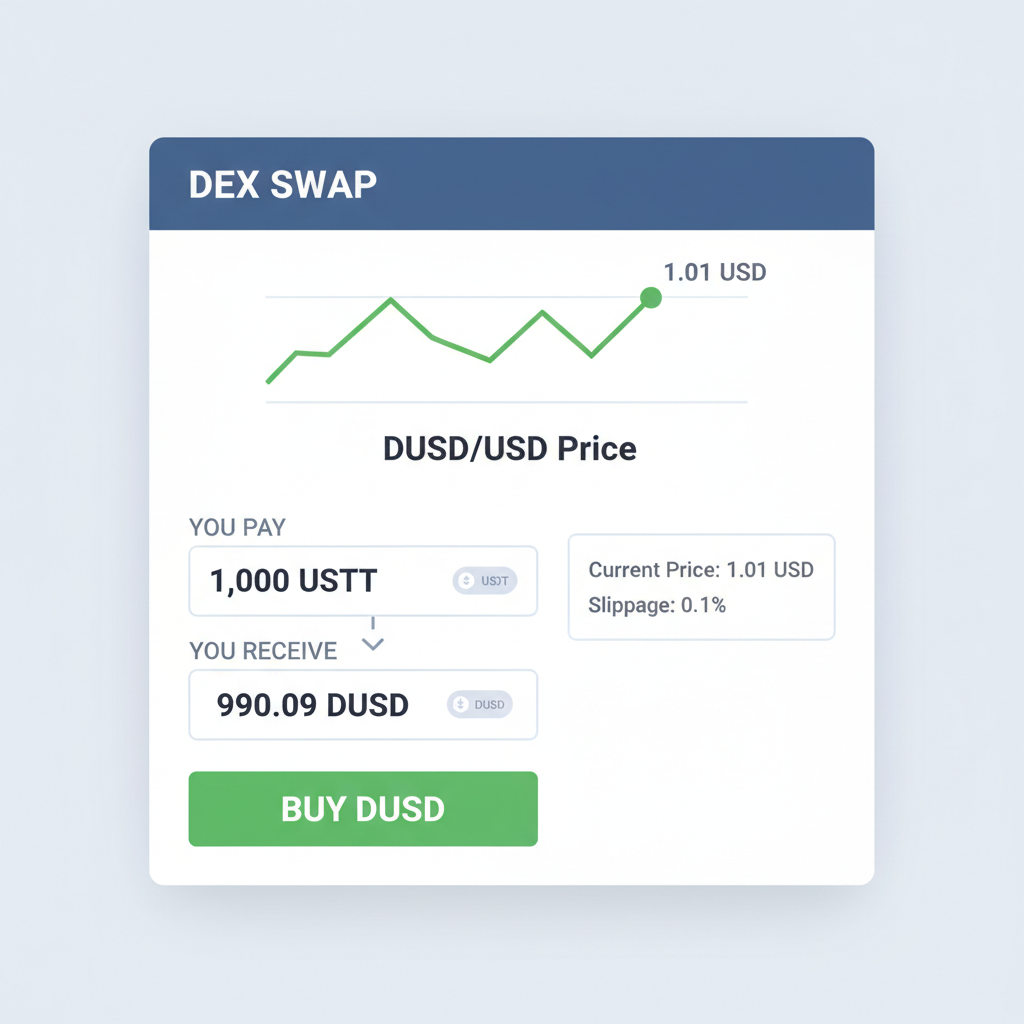

In the ever-evolving DeFi landscape of 2026, where Dialectic USD Vault (DUSD) trades steadily at $1.01 with a modest 24-hour dip of -0.002970%, on-chain loyalty staking emerges as a game-changer. This innovative mechanism delivers weekly token rewards without lockups, echoing the flexibility of DUSD while supercharging user engagement. Unlike rigid traditional staking that ties up capital, platforms now reward loyalty through seamless, liquid participation, blending blockchain token incentives with real utility for crypto enthusiasts.

Imagine earning attractive APYs on your holdings every week, without sacrificing liquidity or missing market opportunities. This is the promise of on-chain loyalty staking, a model gaining traction amid rising demands for DeFi loyalty rewards. As Sei Network highlights in its exploration of the best staking rewards crypto 2026, these systems leverage blockchain’s transparency to foster sustained participation, much like liquid staking derivatives on ether. fi, where users stake ETH for eETH and claim rewards effortlessly.

Breaking Free from Lockup Constraints in Modern DeFi

Traditional staking often demands prolonged commitments, exposing users to opportunity costs and impermanent loss risks. Yet, as detailed in analyses from Phemex on staking crypto in 2026, on-chain versus savings distinctions reveal a superior path: staking without lockups. Liquid staking protocols, such as those promising lower risk and flexibility per Internet Policy Review’s accountability protocols discussion, allow holders to maintain control while accruing yields. Enter on-chain loyalty staking, which amplifies this by distributing weekly token rewards tied directly to user consistency, not just balance size.

Consider FDUSD staking’s allure, boasting up to 91% APR as noted by experts like Michelle Orbiean; it underscores governance and security perks. On-chain loyalty variants build on this, creating value loops via tokenomics principles from ChainUp: staking drives ecosystem growth without enforced lockups, mirroring MarginFi’s YBX on Solana, backed by SOL derivatives for steady payouts.

Staking has evolved from an inflation subsidy to the anchor point of crypto assets, demanding smarter, user-centric designs.

This shift empowers DeFi investors to navigate 2026’s double-digit stablecoin yields, as Wajahat Mughal outlines, prioritizing DUSD loyalty yields and similar without capital immobilization.

Token Incentives That Reward True Loyalty

At its core, on-chain loyalty staking redefines retention through tailored blockchain token incentives 2026. Projects deploy weekly airdrops or boosts for active holders, fostering communities akin to Enable3’s blockchain loyalty programs. Unlike generic liquidity mining, these rewards scale with engagement metrics: hold duration, interaction frequency, even social contributions. This nuanced approach, inspired by LOOP staking APY boosts, ensures top participants reap outsized gains while newcomers ease in.

Three Sigma’s DeFi insurance insights reveal a key truth: pure staking yields nothing without added layers; loyalty staking integrates premiums and covers for sustainable revenue. Users earn 50% of protocol fees alongside tokens, creating symbiotic growth. For blockchain projects, this translates to higher retention, as on-chain loyalty staking boosts user retention for DeFi projects, turning one-time depositors into advocates.

AllinX’s medium piece on staking’s endgame captures it perfectly: it’s now the asset’s gravitational center, pulling in liquidity and loyalty. In 2026, with DUSD at $1.01 holding firm above $1.00 despite a 24-hour low of $1.01, such mechanisms prove resilient amid volatility.

Dialectic USD Vault (DUSD) Price Prediction 2027-2032

Forecasts incorporating on-chain loyalty staking trends, DeFi yield strategies, and stablecoin market dynamics as of 2026

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.98 | $1.01 | $1.04 | 0.0% |

| 2028 | $0.98 | $1.02 | $1.05 | +0.99% |

| 2029 | $0.99 | $1.02 | $1.06 | 0.0% |

| 2030 | $0.99 | $1.03 | $1.07 | +0.98% |

| 2031 | $1.00 | $1.03 | $1.08 | 0.0% |

| 2032 | $1.00 | $1.04 | $1.09 | +0.97% |

Price Prediction Summary

DUSD, as a yield-bearing stablecoin with innovative on-chain loyalty staking offering weekly rewards without lockups, is expected to maintain a tight peg around $1.00-$1.04 on average through 2032. Minimum prices reflect bearish depegging risks during market downturns, while maximums capture bullish premiums from high APR yields (potentially 20%+), DeFi adoption, and liquidity staking trends. Overall outlook is stable with gradual premium growth amid maturing DeFi ecosystems.

Key Factors Affecting Dialectic USD Vault Price

- Rising adoption of loyalty staking and liquid staking models (e.g., eETH, YBX) driving demand without lockup constraints

- DeFi yield strategies offering 20%+ APRs enhancing stablecoin premiums

- Regulatory clarity on stablecoins and staking rewards impacting accessibility

- Crypto market cycles: resilience in bears, premiums in bulls

- Technological advancements in scalability (e.g., Sei Network) and interoperability

- Competition from other staking reward cryptos and yield-bearing assets

- Tokenomics incentives like value loops from staking and liquidity mining boosting TVL and price stability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Real-World Mechanics: Liquid Staking Meets Loyalty Loops

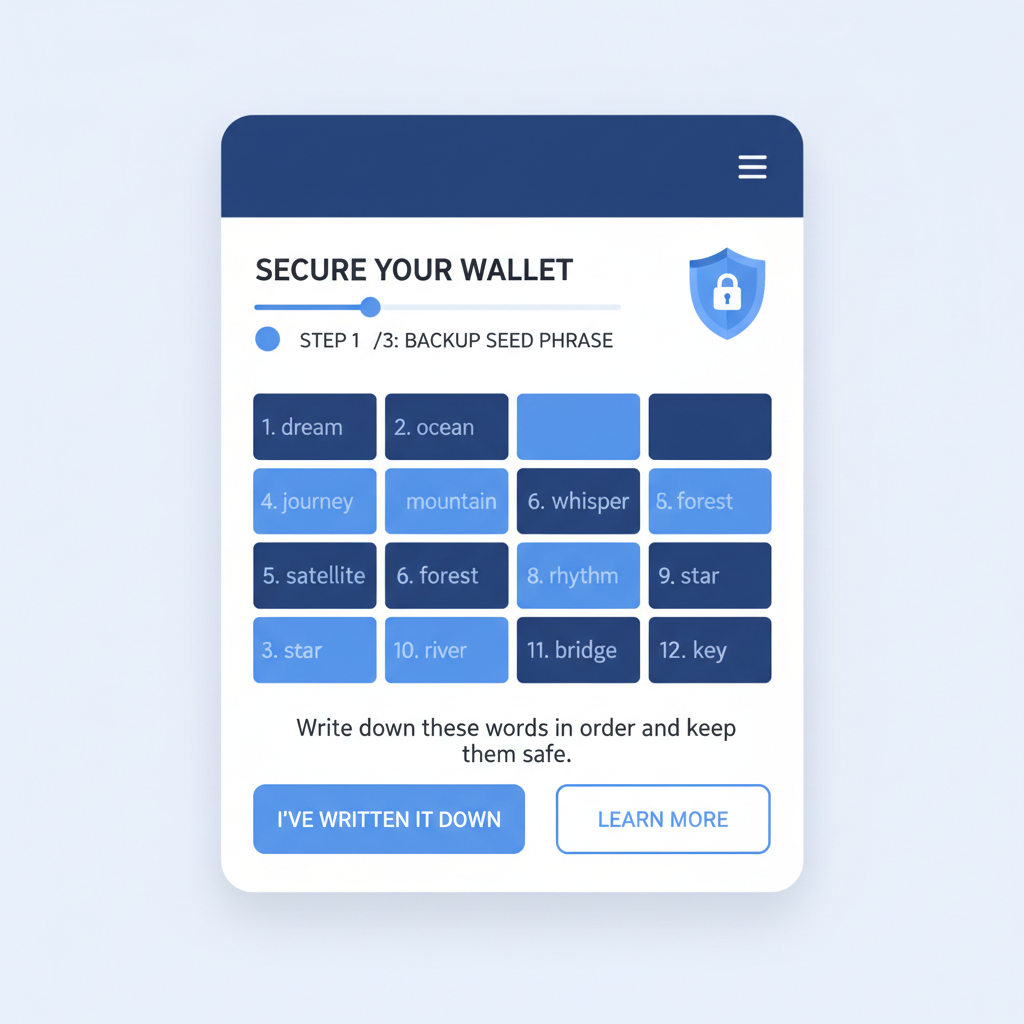

Deploying on-chain loyalty staking involves crafting tokens for staking, governance, and fees, per Blockchain App Factory’s 2026 guide. Platforms automate weekly distributions via smart contracts, verifiable on-chain. Users stake assets like stablecoins or LSTs, receiving loyalty points convertible to tokens sans lockups. Ether. fi’s eETH exemplifies this: stake ETH, get liquid tokens, earn rewards passively.

This model sidesteps DeFi’s pitfalls, offering DeFi loyalty rewards that adapt to market dynamics. As Sei Blog educates, top 2026 staking rewards prioritize networks with robust incentives, positioning loyalty staking as the frontrunner for passive income strategies.

These loyalty loops create self-reinforcing cycles, where rewards fuel further participation, echoing ChainUp’s tokenomics wisdom on value loops. In practice, users deposit into protocols offering staking without lockups, receiving liquid wrappers that preserve usability across DeFi apps. Weekly claims arrive automatically, calibrated to loyalty tiers: casual holders snag base APYs, while dedicated ones unlock LOOP staking APY boosts through compounded incentives.

Navigating Risks in Reward-Rich Environments

Flexibility comes with scrutiny. DeFi insurance protocols, as Three Sigma dissects, highlight that staking alone yields no rewards; external covers and premiums drive the economics. On-chain loyalty staking mitigates this by bundling native protections, sharing 50% of fees with stakers for a revenue moat. Smart contract audits and oracle redundancies further safeguard against exploits, a lesson from 2026’s matured ecosystem.

Volatility remains the wildcard. With DUSD at $1.01, dipping to a 24-hour low of $1.01 yet holding above par, loyalty programs shine in testing users’ conviction. Impermanent loss? Liquid staking derivatives like eETH or YBX minimize it via delta-neutral strategies. My view as a macro strategist: these mechanisms anchor assets during cycles, turning downturns into accumulation phases for the patient.

[youtube_video: 2026 DeFi Stablecoin Yield Strategies 20% and by Wajahat Mughal on double-digit yields without lockups]

Blockchain projects harness this for growth. Loyalty staking powers crypto giveaways and community rewards, elevating engagement beyond mere yields. Enable3’s blueprint for 2026 loyalty programs shows real-world wins: tokenized points redeemable for NFTs, exclusive access, or governance votes, transforming users into stakeholders.

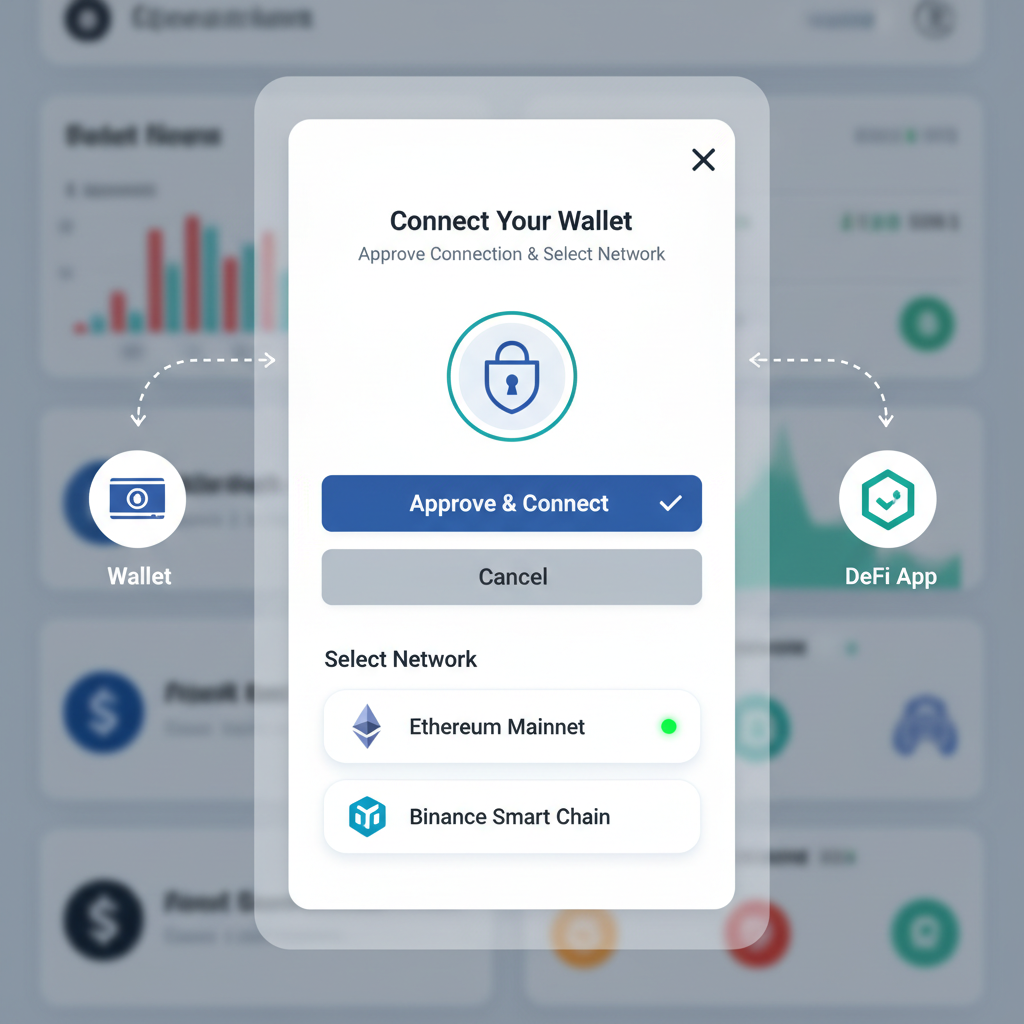

Getting Started: Your Path to Weekly DeFi Rewards

Once positioned, monitor dashboards for accrual snapshots. Platforms like those on Sei Network, touted for top staking rewards crypto 2026, integrate multi-chain support, letting you pivot seamlessly. Governance adds depth: stake to vote on reward pools, aligning incentives with community will.

This fusion of liquidity and loyalty redefines DeFi’s social contract. As AllinX posits, staking is crypto’s endgame anchor, and on-chain variants elevate it to loyalty’s vanguard. Projects rewarding early, consistent participants via on-chain loyalty staking rewards early, consistent, and active DeFi participants build moats against churn.

Looking ahead, expect proliferation. Yield-bearing stablecoins will standardize DUSD loyalty yields, with protocols layering social proofs and AI-driven personalization. For investors, it’s a conviction play: position in flexible staking to capture 2026’s blockchain token incentives 2026, where weekly drips compound into substantial edges.

Platforms maximizing on-chain loyalty staking maximizes rewards for DeFi enthusiasts will dominate, as user retention surges. In a market where DUSD clings to $1.01 amid flux, these tools offer stability’s illusion with growth’s thrill. Engage thoughtfully, stake with intent, and let loyalty compound your portfolio’s trajectory.