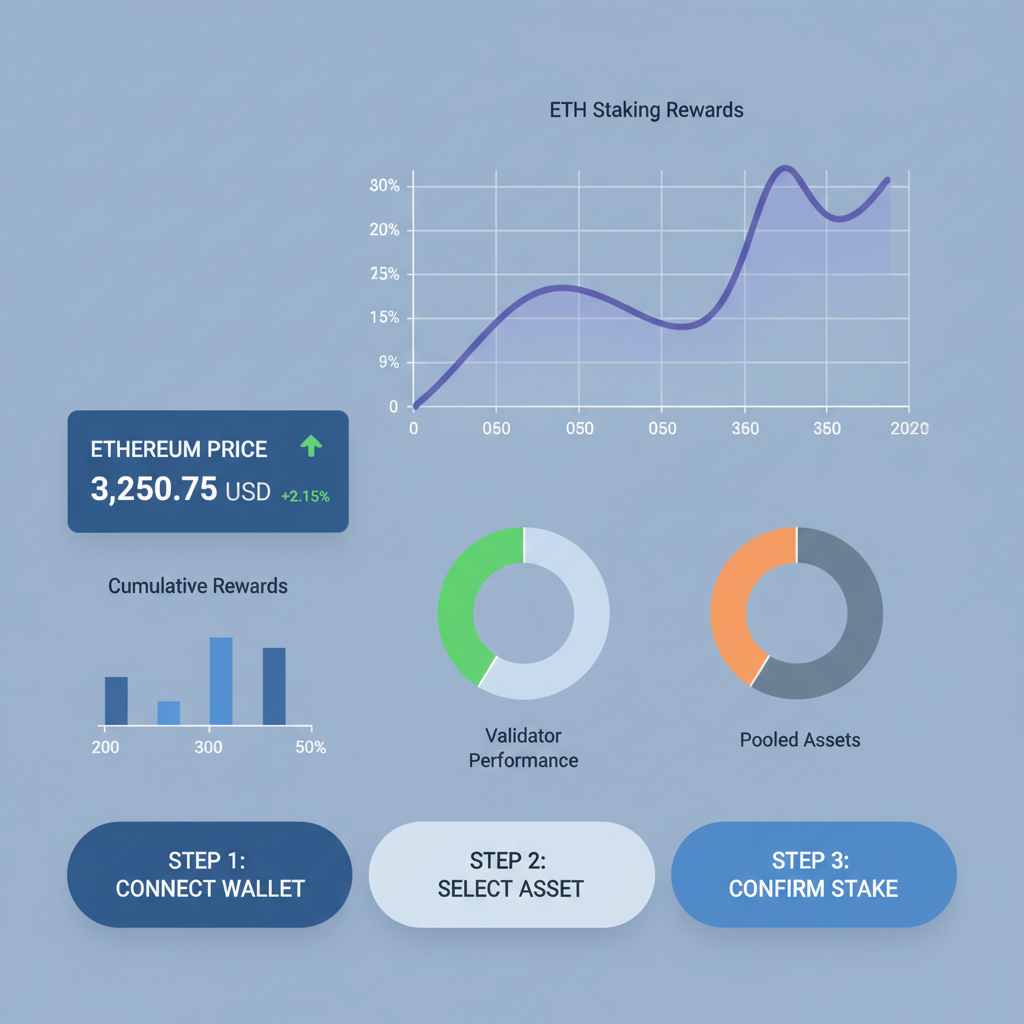

Native ETH staking is reshaping how blockchain loyalty programs reward dedicated users, blending the security of Ethereum’s proof-of-stake with non-custodial control. Providers like Validation Cloud make this accessible, delivering high yields on assets currently valued at $2,938.34 per ETH, all while institutions and DeFi projects maintain full ownership. This approach sidesteps the pitfalls of centralized custodians, aligning perfectly with on-chain loyalty staking DeFi mechanics that prioritize transparency and user sovereignty.

At its core, staking ETH natively means locking tokens to validate the network, earning rewards in return. For loyalty programs, this translates to tokenized incentives: users stake to support a project, accruing both network yields and program-specific bonuses. Validation Cloud elevates this with enterprise-grade infrastructure, handling billions in assets through SOC 2 Type II certified protocols. Their non-custodial staking-as-a-service ensures you set withdrawal addresses and retain keys, a critical edge in non-custodial ETH staking rewards.

Validation Cloud’s Edge in Institutional-Grade ETH Staking

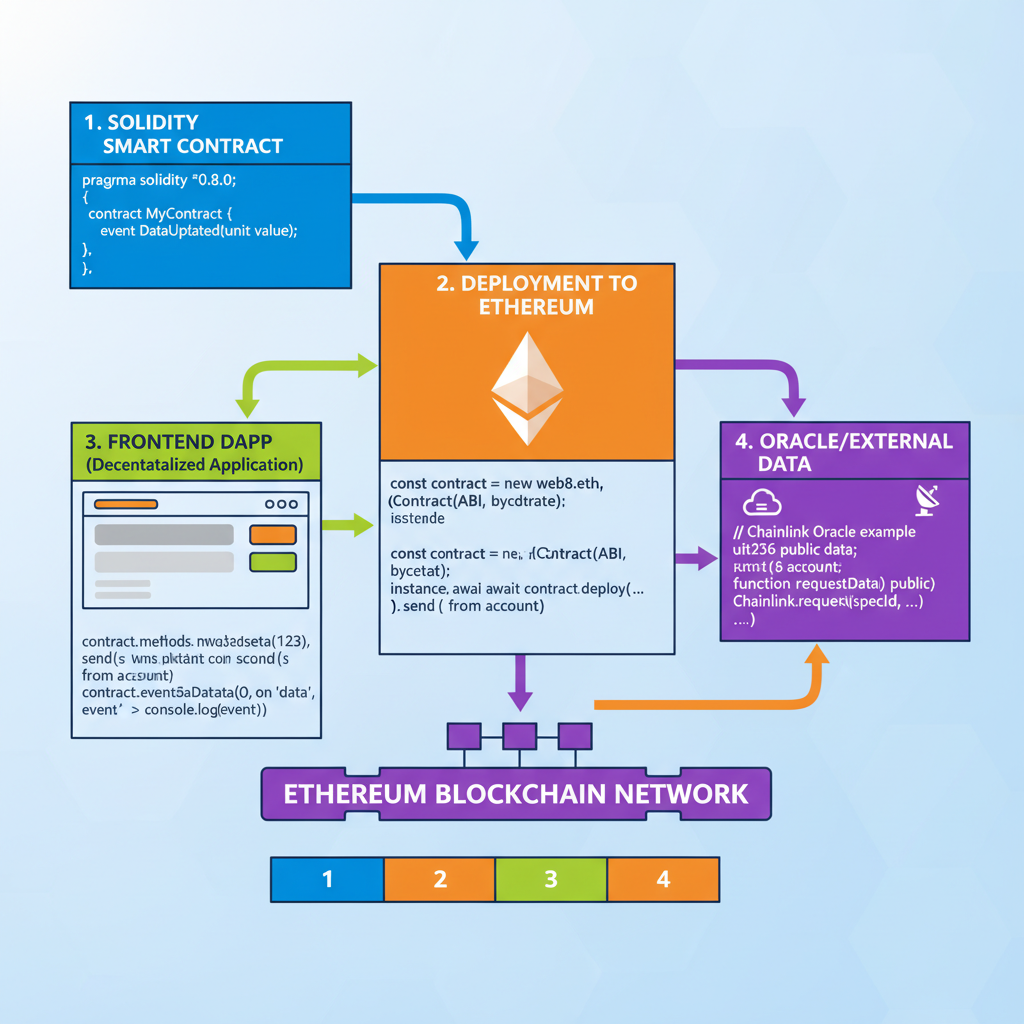

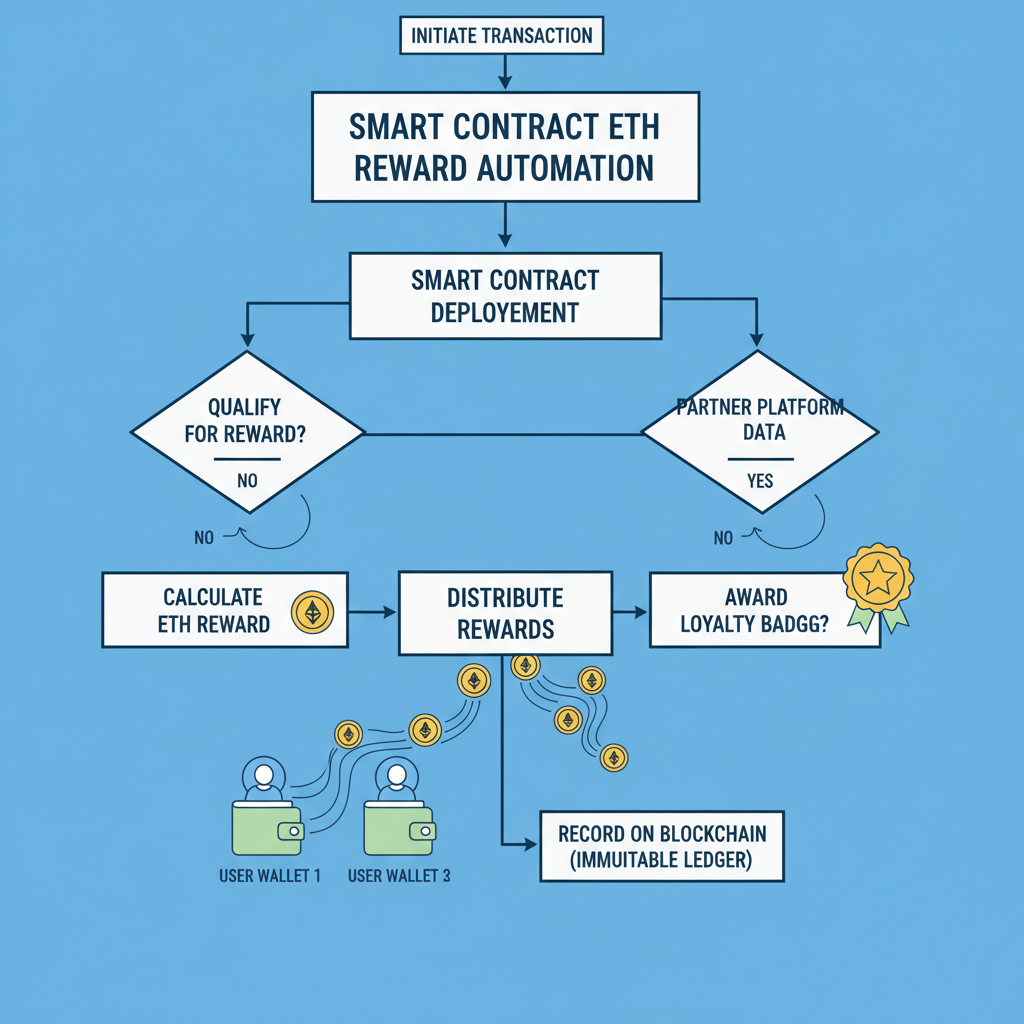

What sets Validation Cloud apart in Validation Cloud ETH staking is its focus on resilience and automation. Recent expansions include Distributed Validators via partnership with SSV, distributing risk across nodes for enhanced decentralization. Institutions can now deploy validators in bulk, automate reward distribution through smart contracts, and even tap into Starknet staking for diversified yields. This matters for loyalty programs, where consistent, boosted returns – think SSV token incentives atop ETH rewards – foster long-term engagement without liquidity locks.

SOC 2 Type II certification isn’t just a badge; it’s proof of rigorous security controls that institutional stakers demand in today’s regulatory landscape.

Contrast this with traditional liquid staking: while protocols like EtherFi or EigenLayer offer restaking for extra yields, they introduce smart contract risks. Validation Cloud’s model keeps it simple and secure, ideal for blockchain loyalty programs staking where projects reward holders directly on-chain. Ethereum’s upcoming Pectra upgrade further sweetens the deal, streamlining native staking to attract traditional finance capital, potentially amplifying rewards as more reserves flow in.

Building Loyalty with Non-Custodial Rewards Mechanisms

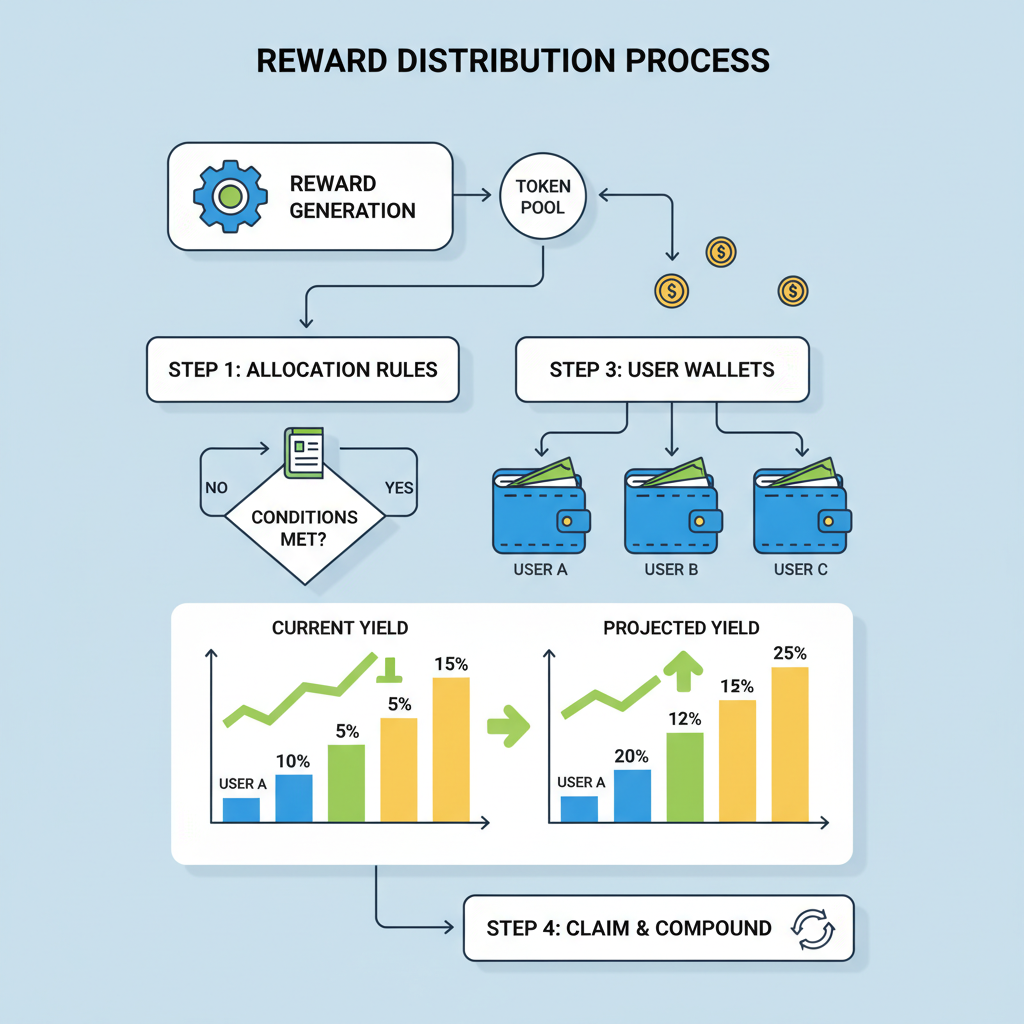

On-chain loyalty programs thrive when rewards feel permanent, not gimmicky. Enter native ETH staking loyalty: users stake ETH against a project’s smart contract, earning compounded yields that vest as loyalty tokens or governance rights. Validation Cloud powers the backend, verifying stakes non-custodially so participants avoid counterparty risk. This setup has proven effective for DeFi retention, as seen in mechanisms that privilege early and active stakers – check out how on-chain loyalty staking rewards early, consistent, and active DeFi participants.

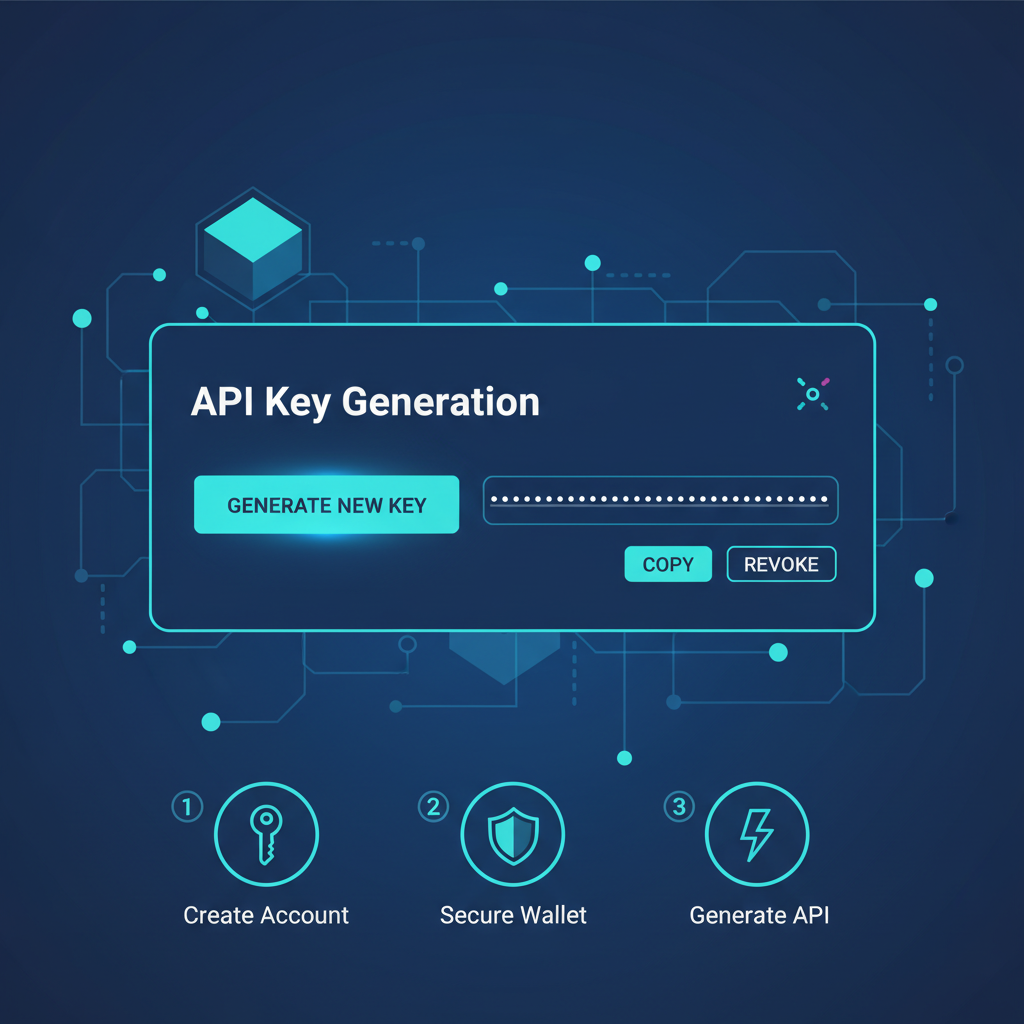

Rewards compound smartly here. At ETH’s current $2,938.34 price point, even modest APYs generate meaningful returns. Validation Cloud reports high yield generation, verified by Staking Rewards, with automated management minimizing operational drag. For projects, this means deploying loyalty staking without building from scratch: integrate their API, and users stake natively, boosting TVL while earning dual rewards.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts factoring in Pectra upgrade, staking yield enhancements, non-custodial institutional solutions like Validation Cloud, and market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $3,200 | $4,800 | $7,200 | +63% |

| 2028 | $4,000 | $6,500 | $10,500 | +35% |

| 2029 | $4,500 | $8,000 | $13,000 | +23% |

| 2030 | $5,500 | $10,000 | $16,000 | +25% |

| 2031 | $7,000 | $13,000 | $21,000 | +30% |

| 2032 | $9,000 | $16,500 | $26,000 | +27% |

Price Prediction Summary

Ethereum’s price is forecasted to experience strong upward trajectory from 2027-2032, supported by the Pectra upgrade enabling native staking for institutions, non-custodial platforms like Validation Cloud driving adoption, and staking yields. Average prices could climb from $4,800 to $16,500, with bullish maxima reflecting peak cycle highs and minima accounting for potential corrections.

Key Factors Affecting Ethereum Price

- Pectra upgrade boosting native ETH staking accessibility for traditional finance

- Validation Cloud’s SOC 2 Type II non-custodial staking and Distributed Validators via SSV partnership

- Regulatory clarity on staking (e.g., SEC views on non-custodial staking)

- Liquid restaking and protocols like EigenLayer increasing yields and utility

- Ethereum’s scalability improvements, institutional inflows, and dominance in DeFi/Web3

- Market cycles with potential bull runs post-2024/2028 halvings influencing ETH

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Risks and Regulatory Wins in ETH Loyalty Staking

Staking isn’t risk-free – slashing penalties and market volatility loom – but non-custodial providers like Validation Cloud mitigate these through distributed validation and robust reporting. The SEC’s recent stance clarifies that self-staking and non-custodial services often evade securities classification, opening doors for broader adoption in loyalty schemes. This regulatory green light empowers projects to innovate without fear, turning ETH at $2,938.34 into a loyalty engine.

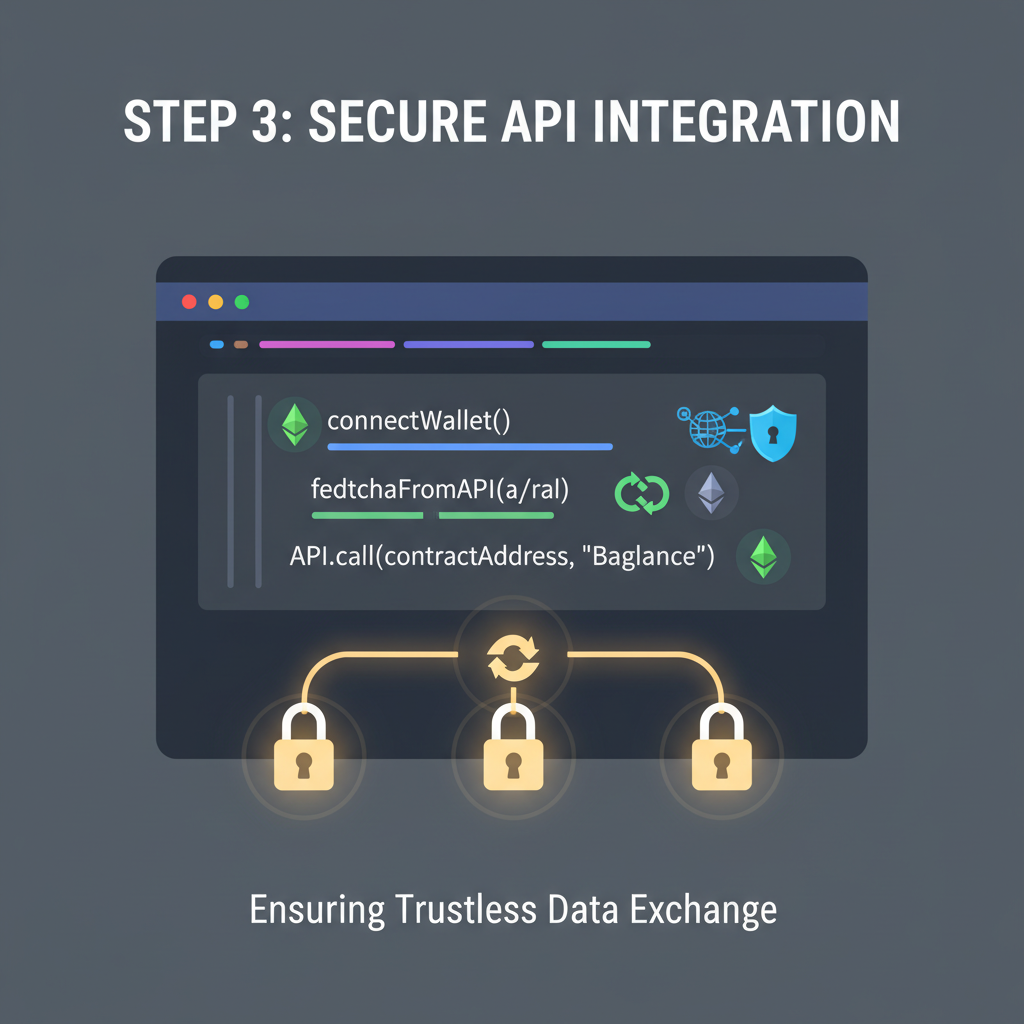

Consider the mechanics: users delegate to Validation Cloud’s validators, retaining exit keys. Rewards flow automatically, claimable on-chain for loyalty multipliers. It’s a far cry from opaque centralized platforms; here, every stake supports network security while amplifying project allegiance. As Ethereum matures post-Pectra, expect loyalty programs to standardize on such infrastructure, driving user retention through provable, high-yield commitments. For DeFi enthusiasts eyeing on-chain loyalty staking DeFi, this is where opportunity meets prudence.

Projects leveraging this see engagement soar, as stakers lock in for the long haul, their ETH working double duty: securing Ethereum and pledging loyalty. Validation Cloud’s platform, with on-demand staking and compliance baked in, positions it as the backbone for tomorrow’s reward ecosystems.

Integrating Validation Cloud’s infrastructure into on-chain loyalty staking DeFi setups unlocks scalable, compliant rewards without reinventing the wheel. Projects can white-label their staking pools, where users deposit ETH at today’s $2,938.34 valuation to earn baseline network yields plus loyalty multipliers. This dual-layer reward system – network fees plus project tokens – cements user commitment, turning one-time holders into steadfast supporters.

Once live, monitor performance through their dashboards: real-time yield tracking, slashing alerts, and automated compounding ensure rewards accrue efficiently. For a loyalty program targeting crypto enthusiasts, this means ETH stakers at $2,938.34 gain not just 3-5% APY from Ethereum but boosted tiers based on stake duration or referral activity. Validation Cloud’s SSV integration adds resilience, slashing Distributed Validator downtime risks to near zero, a boon for programs demanding uptime.

Advanced users layer on restaking via partners like EtherFi, but stick to native for purity. Here, non-custodial ETH staking rewards shine: no wrapped tokens, no oracle dependencies, just direct validator outputs claimable to your wallet. Institutions appreciate the SOC 2 Type II compliance, enabling seamless audits and regulatory nods as per the SEC’s staking clarification.

Distributed Validators via SSV aren’t hype; they fragment keys across nodes, making collusion attacks mathematically improbable while preserving non-custodial control.

This framework scales for blockchain loyalty programs staking. Imagine an NFT project where holders stake ETH to unlock exclusive drops, or a DeFi protocol vesting governance power proportional to staked loyalty. Validation Cloud handles the heavy lifting – bulk deployments, Starknet expansion for multi-chain – letting creators focus on community.

Maximizing Returns in a Volatile Market

With ETH dipping 0.68% to $2,938.34 over 24 hours, staking provides a hedge: yields offset downside while loyalty bonuses amplify upside. Validation Cloud’s verified high yields, per Staking Rewards, consistently outperform solo staking’s variability. Pair this with Pectra’s efficiency gains – lower gas for validator ops, easier institutional entry – and loyalty programs position for yield spikes as TVL surges.

Risk management is baked in: set withdrawal credentials to your address, enable auto-compounding, diversify across chains like Starknet. For DeFi projects, this translates to higher retention; stakers locked in for rewards rarely churn, echoing successes in user engagement boosts via on-chain mechanisms akin to those detailed in how on-chain loyalty staking boosts user engagement in DeFi projects.

Forward thinkers will blend this with EigenLayer AVSs for extra premiums, but native remains the foundation. Validation Cloud’s on-demand platform empowers even small teams to offer enterprise-grade staking, fostering ecosystems where loyalty pays dividends – literally. As Ethereum evolves, so do the incentives tying users to projects, all secured by non-custodial precision.