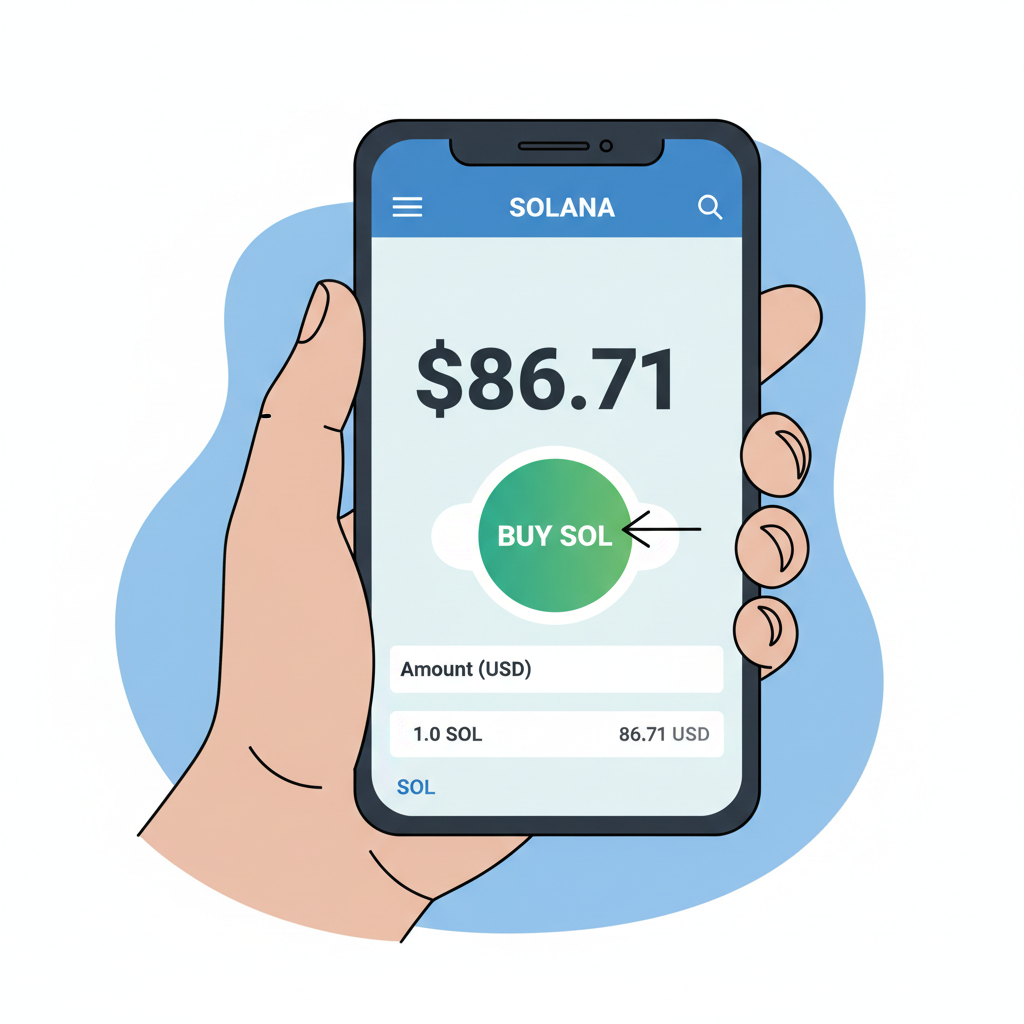

In the evolving landscape of DeFi, on-chain loyalty staking on Solana stands out by blending network security with tangible user incentives. Imagine staking your SOL, currently trading at $86.71 after a 24-hour gain of and $6.96, and earning not just the standard 5-7% annual rewards but an additional 10% cashback on token upgrades. This mechanism transforms passive holding into a dynamic rewards engine, particularly appealing as Solana’s ecosystem surges with innovations like Raise Network’s SmartCards and Sanctum’s creator coins.

Solana’s staking model delegates SOL to validators, securing the high-throughput network while distributing rewards. Data from platforms like Kraken and Coinbase peg base yields at 4.13% to 5.88% APR, but Solana loyalty rewards elevate this through layered incentives. On-Chain Loyalty Staking introduces cashback directly tied to token upgrades, where users receive 10% back in native tokens or stablecoins for participating in protocol enhancements. This isn’t mere yield farming; it’s a loyalty flywheel that rewards long-term commitment amid Solana’s price stability at $86.71.

Solana’s Edge in DeFi Cashback Staking

What sets Solana apart in DeFi cashback staking? Its sub-second finality and low fees enable seamless on-chain interactions, crucial for real-time loyalty programs. Traditional staking locks capital for security; here, liquidity remains accessible via liquid staking tokens, as seen in Sanctum’s creator coins. Holders earn yield plus loyalty points redeemable for exclusive perks, amplifying returns beyond the baseline 5.88% APR.

Recent data underscores the momentum. As of February 14,2026, Binance-Peg SOL hit a 24-hour high of $87.21, reflecting ecosystem growth. Raise Network’s partnership launches programmable gift cards with $RAISE token incentives, channeling consumer spending into on-chain loyalty. This convergence of staking and rewards creates passive income DeFi staking opportunities that outpace centralized alternatives, where cashback often dilutes to 1-2%.

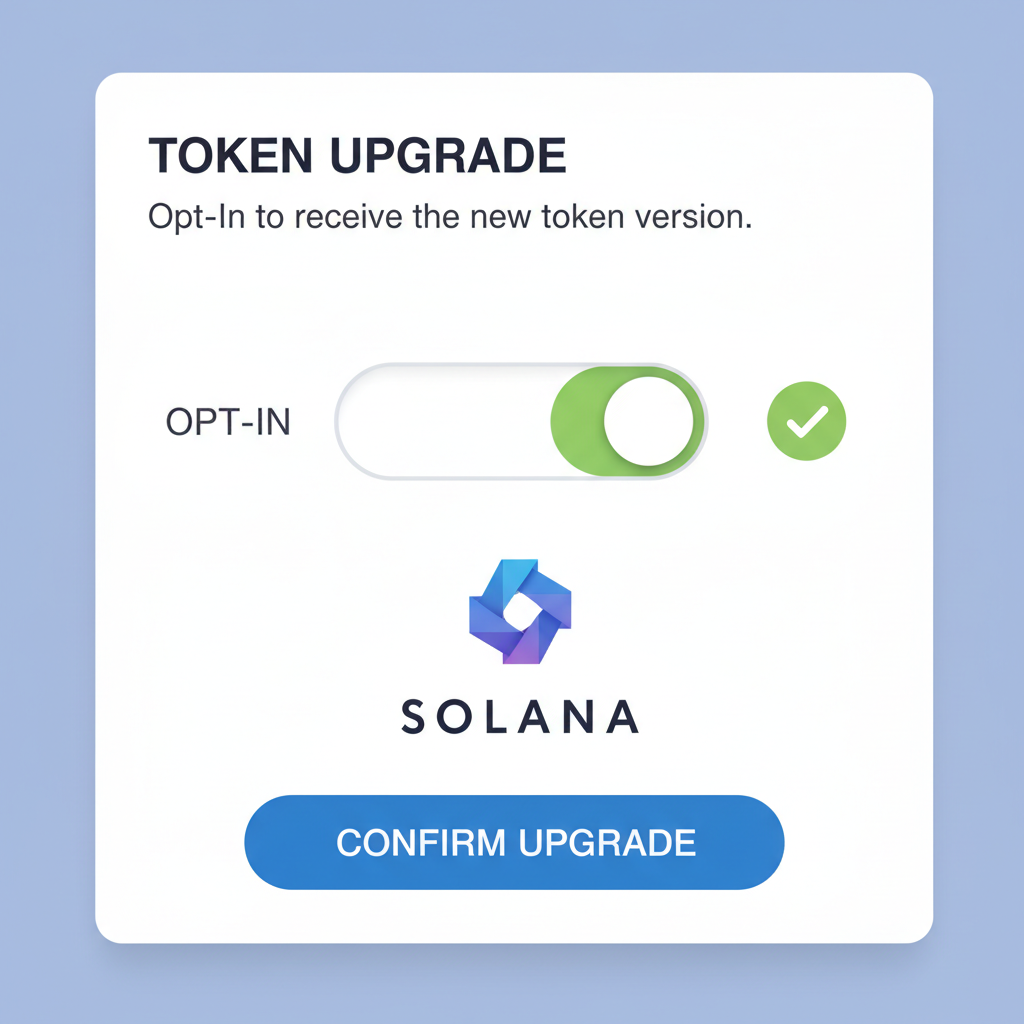

How Token Upgrade Rewards Work on Solana

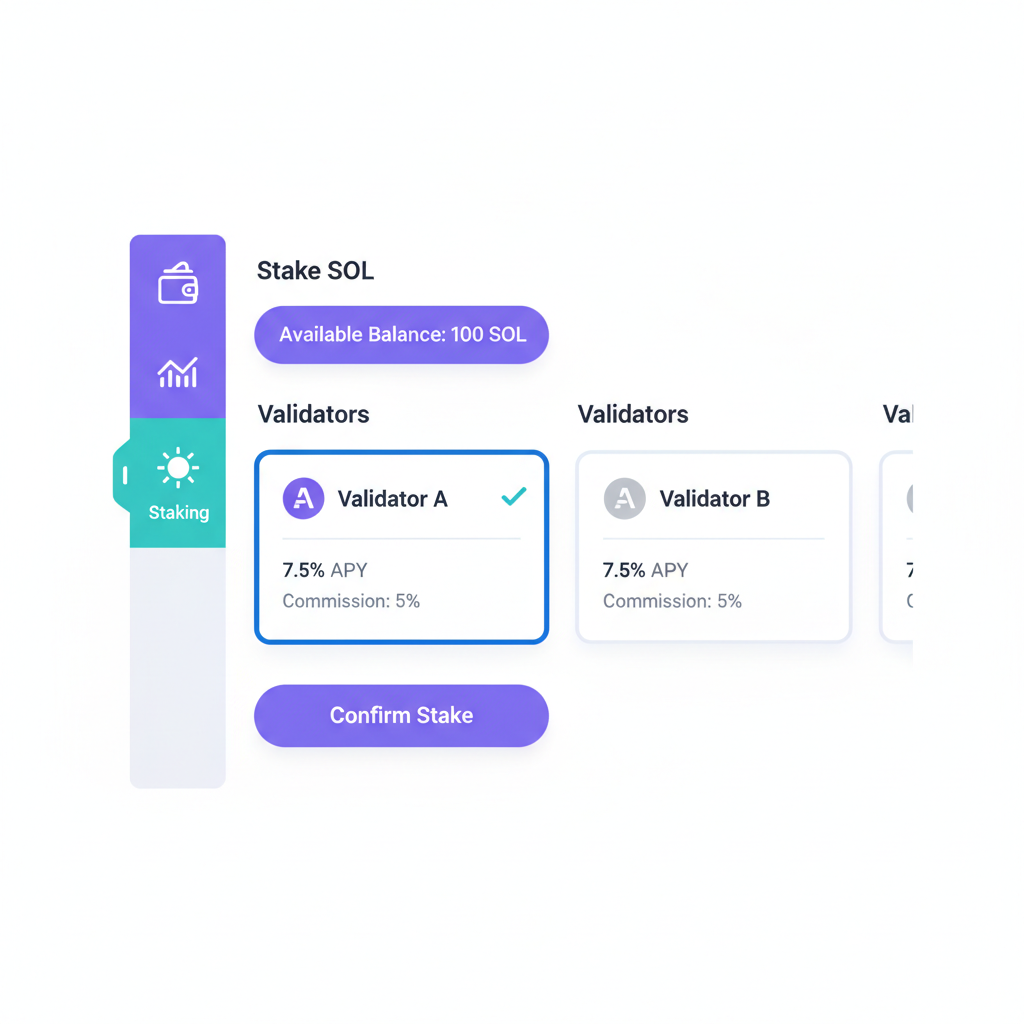

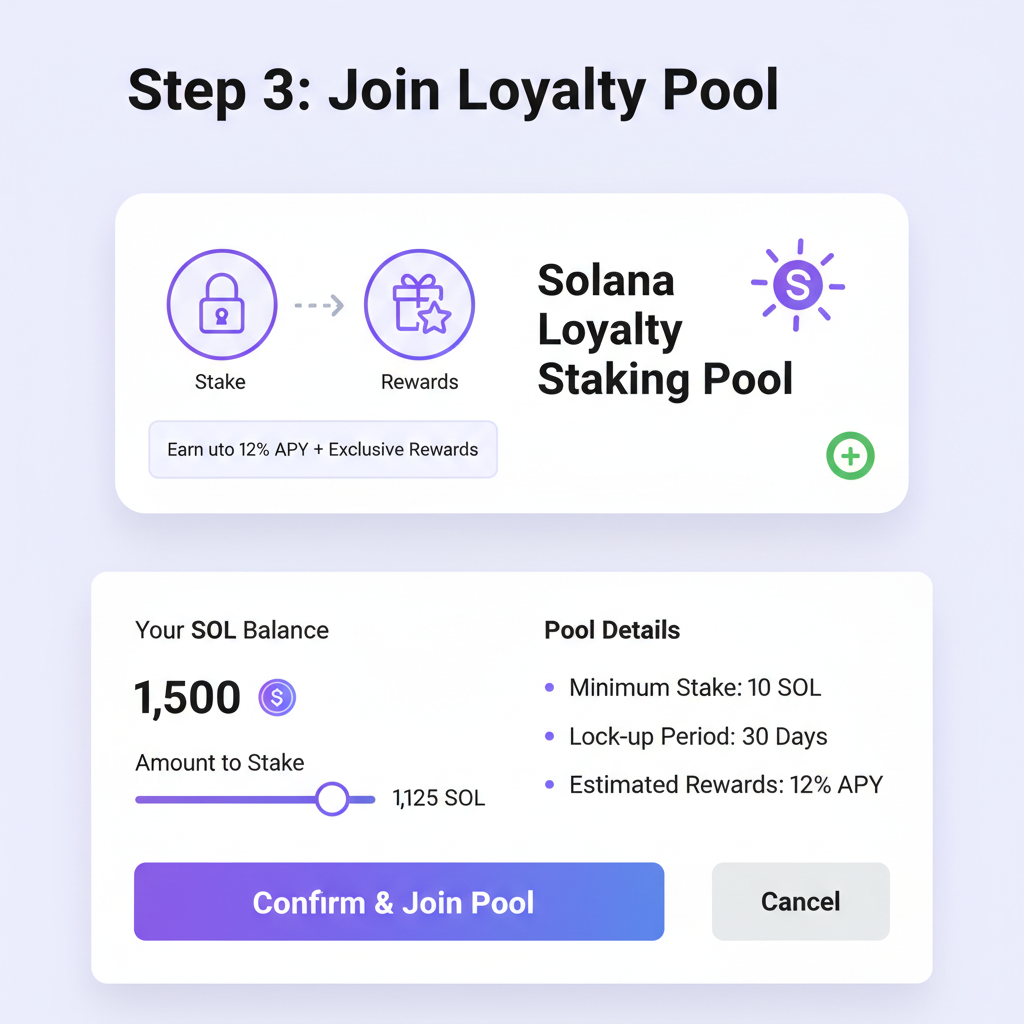

At the core of token upgrade rewards lies a smart contract-driven process. Users stake SOL or ecosystem tokens into loyalty pools. When protocols roll out upgrades, like enhanced validator delegation or yield optimizers, stakers opting in trigger cashback distribution. For every $1,000 staked, a 10% rebate on upgrade fees equates to $100 in rewards, claimable instantly.

Mechanically, it’s validator delegation amplified. Solana’s proof-of-stake requires bonding SOL epochs ahead, but loyalty staking wrappers unbond liquidly. Yields compound: base staking at ~5.5%, plus cashback, potentially hitting 15% effective APR. Insightfully, this model mitigates slashing risks through diversified pools, drawing from Tramplin’s premium redistribution inspired by bonds.

Quantitative edge? Solana’s 50,000 and TPS dwarfs competitors, minimizing gas wars during reward claims. With SOL at $86.71, staking 10 SOL yields ~0.55 SOL annually base, plus upgrade cashback scaling with activity. Early adopters in programs like DePlan’s Rewards Card already net significant subscription cashback, portending broader loyalty staking Solana adoption.

Solana (SOL) Price Prediction 2027-2032

Forecast based on staking growth, on-chain loyalty programs, and ecosystem advancements as of 2026 (current price ~$87)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $110 | $200 | $350 | +130% |

| 2028 | $160 | $320 | $550 | +60% |

| 2029 | $220 | $450 | $750 | +41% |

| 2030 | $320 | $650 | $1,100 | +44% |

| 2031 | $450 | $900 | $1,500 | +38% |

| 2032 | $600 | $1,200 | $2,000 | +33% |

Price Prediction Summary

Solana (SOL) is poised for substantial growth from 2027-2032, fueled by staking yields (5-7% APR), innovative on-chain loyalty rewards (e.g., Raise Network, Sanctum), and ecosystem expansion. Average prices are projected to rise from $200 in 2027 to $1,200 by 2032 (CAGR ~43%), with bullish maxima exceeding $2,000 in adoption-driven cycles and bearish minima reflecting market corrections.

Key Factors Affecting Solana Price

- Rising staking participation and loyalty cashback programs boosting holder retention

- Solana’s scalability advantages in DeFi, NFTs, and real-world rewards ecosystems

- Market cycle alignment with Bitcoin halvings and broader crypto bull runs

- Regulatory progress supporting staking and on-chain incentives

- Technological upgrades improving network reliability and throughput

- Competitive positioning against Ethereum L2s through speed and cost efficiency

- Macro adoption trends in Web3 loyalty and programmable rewards

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Unlocking Value in Solana’s Loyalty Ecosystem

Diving deeper, on-chain loyalty staking integrates with wallets blending DeFi yields, cashback, and points, as PixelPlex envisions. Crypto Council data details delegation: select validator, bond SOL, earn proportional rewards minus commission. Loyalty layers add gamification; hold creator coins, accrue points for fan perks.

Market context bolsters the case. SOL’s 24-hour low of $79.75 and recovery to $86.71 signal resilience, fueling staking inflows. Platforms like Crypto. com simplify on-chain staking in taps, now supercharged with 10% cashback hooks. This isn’t hype; it’s a data-backed shift where loyalty staking Solana captures routine crypto activities into compounded gains.

Quantifying the upside, consider a $10,000 stake in SOL at $86.71 per token, roughly 115 SOL. Base rewards at 5.5% APR deliver about $550 yearly, but layering on 10% cashback from token upgrades could add $200-500 more, depending on protocol activity. This passive income DeFi staking model scales with Solana’s velocity, where high TPS ensures frequent, frictionless claims.

Navigating Risks in Loyalty Staking

No DeFi play lacks hazards, yet Solana’s design tempers them effectively. Slashing events, rare at under 0.1% historically, get cushioned by diversified validator pools in loyalty wrappers. Smart contract audits, standard for platforms like Sanctum, minimize exploits. Impermanent loss? Negligible in pure staking versus LP positions. With SOL rebounding from $79.75 to $86.71 in 24 hours, volatility fuels rather than erodes confidence, as stakers lock in yields during dips.

Opinion: Traditional finance cashback caps at paltry percentages; Solana flips the script by tying rewards to network utility. Raise Network’s SmartCards exemplify this, converting everyday spends into $RAISE tokens and loyalty points, all stakable for compounded gains. Data from Coinbase shows 4.13% baseline, but ecosystem multipliers push effective rates higher, rewarding savvy holders over speculators.

Maximizing Returns: Strategies for Token Upgrade Rewards

To optimize token upgrade rewards, prioritize pools with high upgrade frequency, like those tied to DePlan or Tramplin-inspired mechanisms. Delegate to top validators via Crypto. com’s taps for 5.88% base, then layer loyalty staking. Track epochs; unbonding takes three days, but liquid tokens bridge gaps. Hybrid approach: 70% core SOL staking, 30% creator coins for Sanctum points, netting diversified 12-18% APR projections.

Insight from macro trends: As Solana’s TVL climbs with 2026 launches, cashback accrues faster. At $86.71, each SOL staked amplifies; a 10% price uptick to $95 boosts principal yields geometrically. This isn’t gambling; it’s engineered retention, where loyalty staking Solana turns users into stakeholders.

Brands benefit too. Projects deploy Solana loyalty rewards to boost retention 3x over airdrops, per industry benchmarks. Fans stake creator coins, earn yield plus perks like exclusive drops, fostering virality. PixelPlex’s wallet vision materializes: one app for staking, cashback, miles. Kraken’s 5.88% underscores accessibility, now turbocharged.

The Road Ahead for DeFi Cashback Staking

By mid-2026, expect $RAISE integrations and Sanctum expansions to standardize 10% and cashback across Solana dApps. Yields could stabilize at 6-8% base amid competition, but loyalty premiums persist for sticky capital. Data-driven holders positioning now, with SOL at $86.71 post its $87.21 high, capture the inflection. Platforms evolve from mere staking to ecosystems where every interaction pays dividends.

Stakeholders win big: security contributions yield personal profit, upgrades enhance protocols, cashback cements loyalty. Solana’s fusion of speed, yields, and incentives redefines DeFi participation. With resilience proven from $79.75 lows, the flywheel spins faster, drawing capital into sustainable growth.