Decentralized finance (DeFi) staking has evolved far beyond simple token lockups and passive yield. The latest wave of innovation centers on reputation staking points, a mechanism that multiplies loyalty rewards by tying them to users’ long-term engagement, governance behavior, and positive contributions. This approach is rapidly transforming the way DeFi platforms incentivize participation, creating a dynamic ecosystem where both capital and credibility drive returns.

Reputation Staking Points: Powering Next-Gen Loyalty Rewards

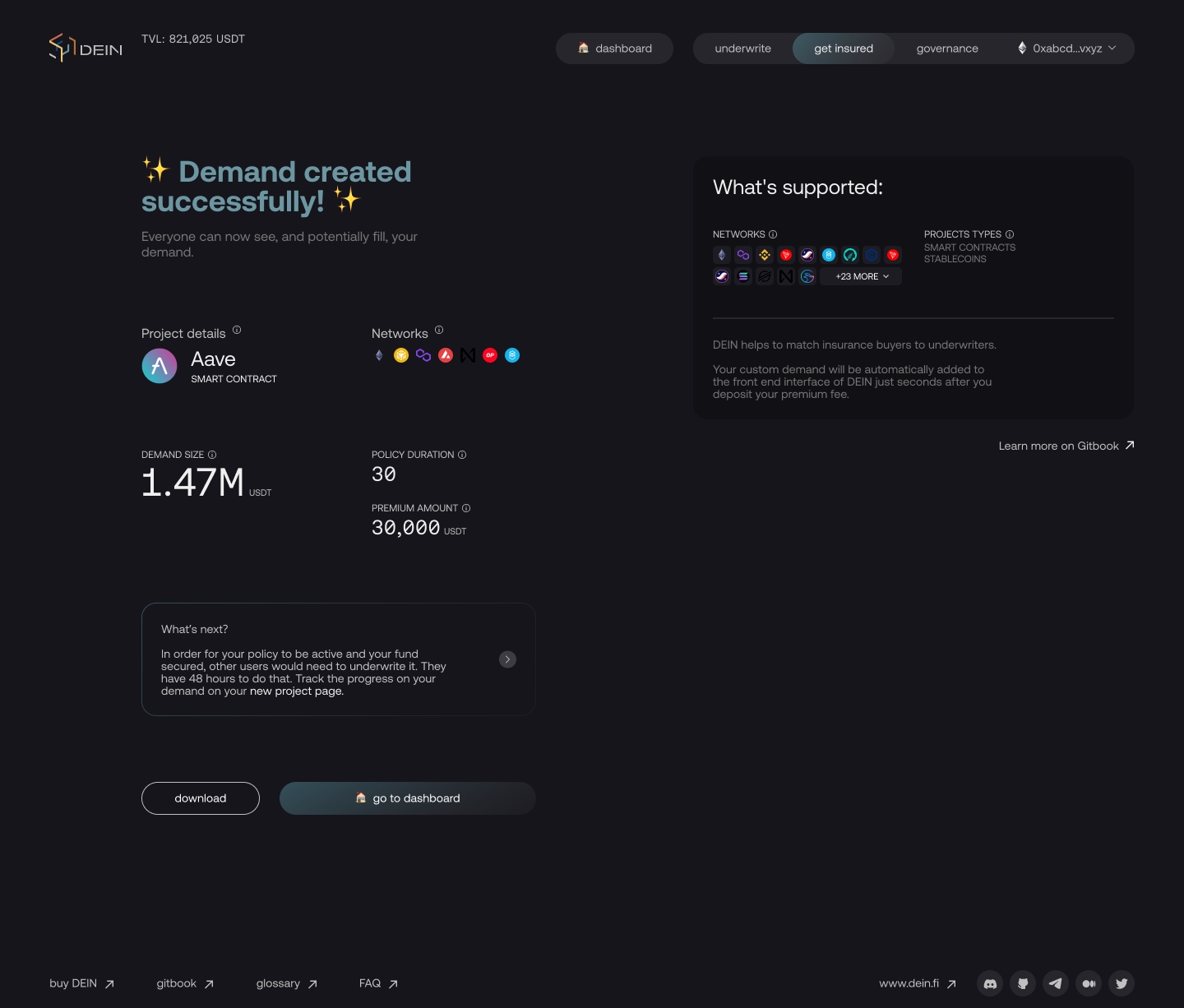

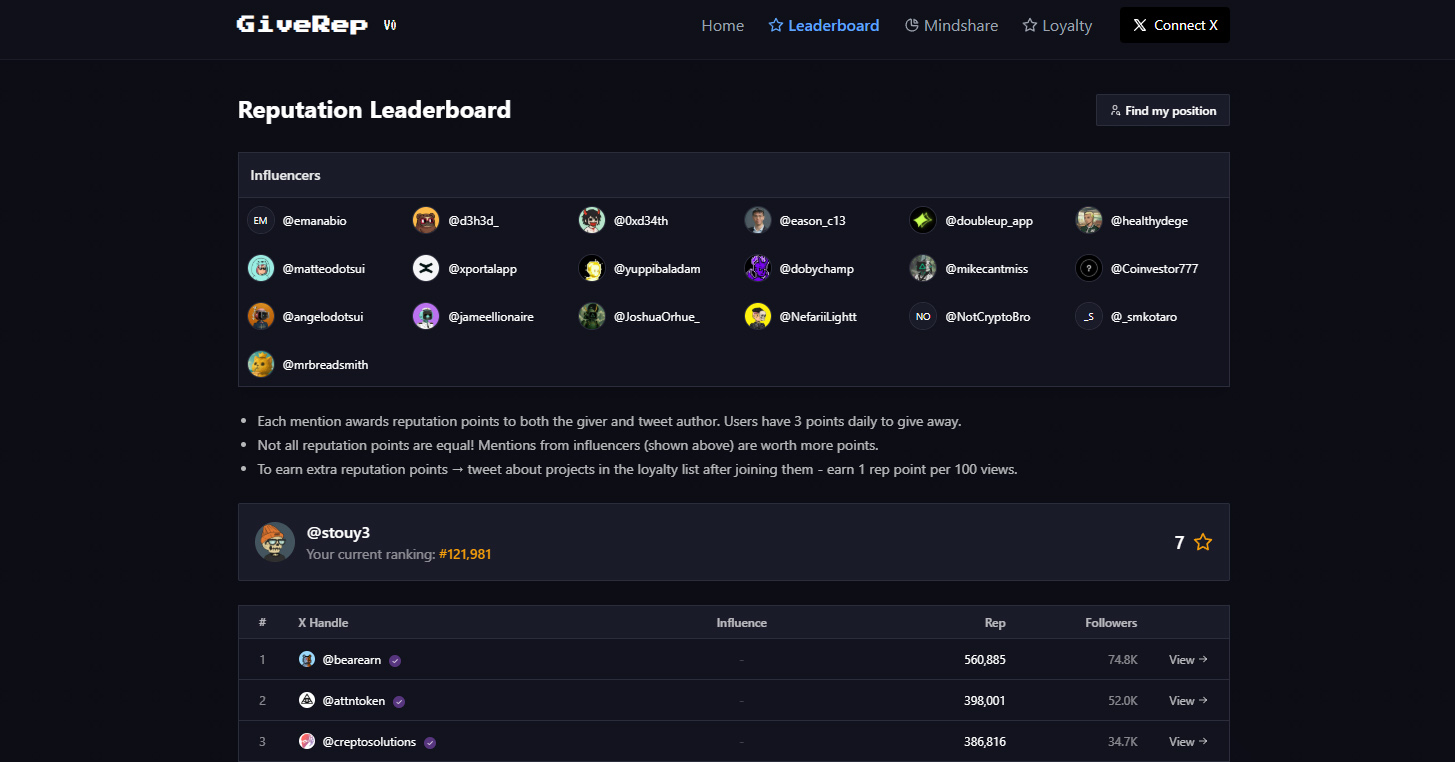

At the core of this shift is a simple premise: not all stakers are created equal. Platforms like Ether. fi, DEIN Finance, and GiveRep have introduced sophisticated systems that reward users based on more than just the amount or duration of their stake. Instead, they layer in staking multipliers, loyalty points, and social reputation to create a multidimensional incentive structure.

Ether. fi’s StakeRank program exemplifies this trend with its eight-tier system. Here, users climb ranks by maintaining longer staking periods, every 240 hours unlocks a new level. As participants ascend through the ranks, their loyalty point multipliers increase accordingly, directly boosting their share of platform rewards and eligibility for exclusive perks such as airdrops or governance privileges (see details). This design compels users to think beyond short-term gains and commit to the platform’s growth.

Multipliers in Action: From Loyalty Points to Airdrop Eligibility

The impact of these systems is especially visible during high-stakes events like crypto airdrops. For instance, Ether. fi’s recent campaign required over 150,000 loyalty points from staking to qualify for Season 2 rewards, up from just 1,000 in Season 1 (source). These rapidly escalating thresholds underscore how platforms are leveraging staking for airdrops as both carrot and stick: only those who demonstrate sustained commitment via reputation points reap the full benefits.

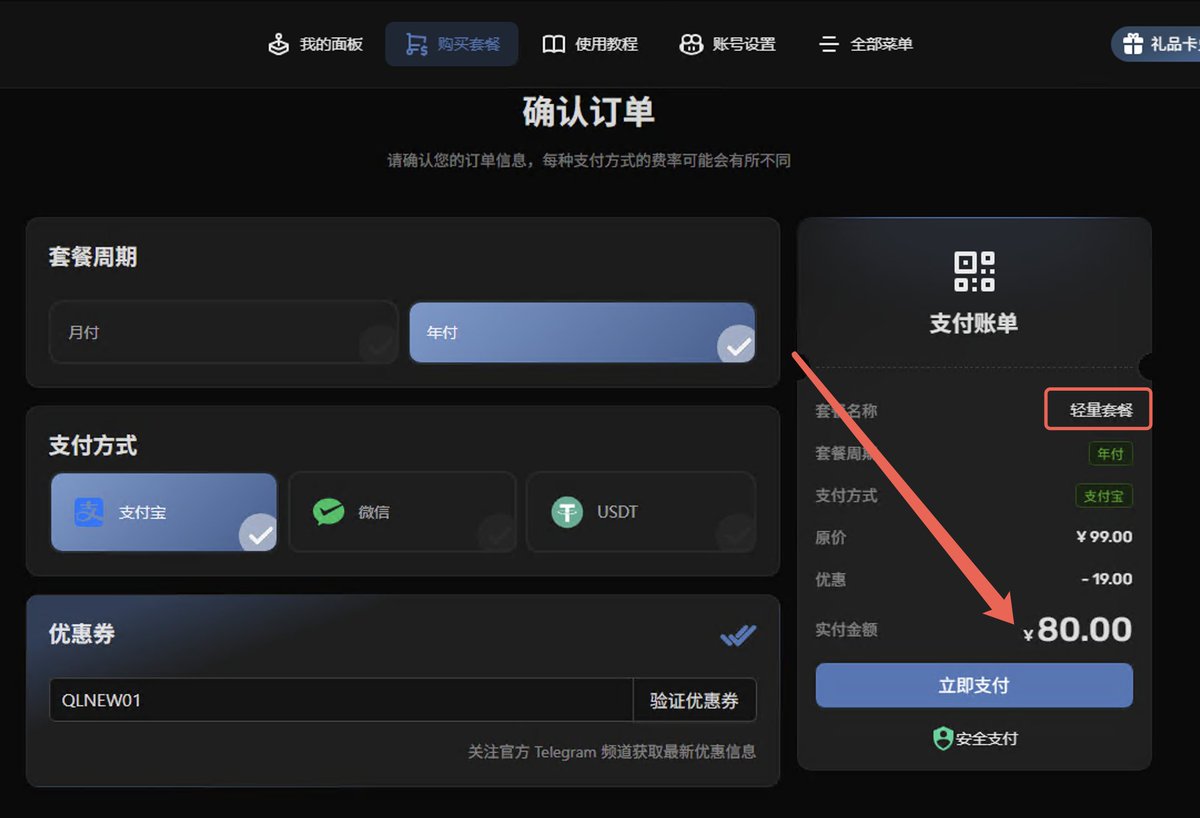

This model isn’t limited to financial incentives. DEIN Finance’s Reputation and Rewards System adds an additional layer by factoring in governance participation. Users start at a baseline 1.0x multiplier but can move between 0.1x and 3.0x depending on whether their voting aligns with majority sentiment or not (details here). Those who act in good faith see their influence, and rewards, increase; those who don’t face penalties. The result is an ecosystem that prizes both active involvement and constructive behavior.

Top Ways Reputation Staking Points Multiply DeFi Loyalty Rewards

-

Tiered Multipliers for Long-Term Stakers: Platforms like Ether.fi’s StakeRank program reward users with higher loyalty point multipliers as they stake for longer periods. Advancing through eight ranks—one every 240 hours—unlocks progressively greater XP and reward boosts, incentivizing sustained engagement.

-

Enhanced Rewards Through Governance Participation: DEIN Finance ties reputation points to governance activity. Users who participate in voting and align with the majority receive reputation boosts and increased DEIN token rewards, with multipliers up to 3.0x based on their reputation and staked amount.

-

Access to Exclusive Loyalty Pools and Airdrops: GiveRep utilizes a social staking model where users can stake reputation points to unlock high-yield pools, exclusive NFT drops, and selective airdrops. This system transforms reputation into a tradable asset, directly multiplying loyalty rewards for positive community contributions.

-

Dynamic XP Multipliers Based on Stake Duration: Many DeFi platforms, such as those highlighted by Defi App, allow stakers to activate up to a 3x multiplier on XP gains depending on how long assets are locked. This directly increases the rate at which users earn loyalty points and future rewards.

-

Increased Airdrop Eligibility and Reward Size: By accumulating reputation points through staking, users on platforms like Ether.fi and Harmonix Finance can surpass loyalty thresholds required for exclusive airdrops, as seen in Ether.fi’s Season 2 where >150,000 loyalty points were needed to qualify for higher-tier rewards.

The Social Layer: Turning Credibility into Tangible Value

The utility of reputation staking points extends into community-driven initiatives as well. GiveRep takes this one step further by allowing users to stake their hard-earned reputation for access to high-yield pools, exclusive NFT drops, or curated airdrops (read more here). By making reputation itself tradable, and valuable, platforms encourage quality contributions such as educational content or thoughtful governance proposals.

This evolution signals an important shift in DeFi loyalty campaigns: rewards are no longer just about capital locked but about trust built over time. By weaving together financial incentives with reputational metrics, projects foster resilient communities where long-term value creation takes precedence over short-term speculation.

For users, these developments mean that maximizing DeFi loyalty rewards now requires a more holistic strategy. It’s not just about locking tokens and waiting for yield; it’s about demonstrating consistent engagement, participating in governance, and contributing positively to the ecosystem. Platforms are increasingly transparent with their reputation algorithms, allowing users to track their own progress and plan actions that will optimize both their multipliers and overall returns.

Consider the compounding effect: a user who stakes long-term on Ether. fi, votes responsibly on DEIN Finance, and actively contributes to GiveRep’s community can potentially unlock loyalty multipliers across multiple platforms simultaneously. This interconnected approach amplifies the user’s earning power, turning reputation into a powerful asset alongside capital.

Risk and Reward: What Users Should Know

While the benefits of reputation staking points are clear, users should also be aware of the inherent risks. Multipliers can work both ways: just as positive actions increase rewards, negative behaviors, such as voting against consensus or withdrawing early, can reduce reputation scores and even result in token penalties. This creates a dynamic environment where preparation and informed decision-making are essential for sustained success.

Security remains paramount. As more value flows into these incentive structures, smart contract vulnerabilities or manipulation of reputation metrics could have outsized impacts. Platforms like Ether. fi and DEIN Finance have prioritized transparency in their algorithms and robust auditing practices to mitigate these risks, but users should always conduct due diligence before committing significant capital or time.

Actionable Takeaways:

- Engage consistently: Long-term staking combined with active governance participation unlocks higher multipliers.

- Track your reputation: Use platform dashboards to monitor score changes after each action.

- Diversify involvement: Contribute in multiple ways, staking, voting, content creation, to maximize cross-platform rewards.

- Stay informed: Follow platform updates on thresholds for loyalty campaigns or airdrops to ensure eligibility.

- Assess risk: Understand penalty mechanisms before taking actions that could affect your multiplier or staked tokens.

The next generation of DeFi loyalty incentives is already here, and it’s powered by more than just capital. Reputation staking points transform every interaction into an opportunity for greater rewards while building trust within the ecosystem. As projects continue refining these systems, those who embrace active participation will be best positioned to capture outsized returns, and play a pivotal role in shaping the future of decentralized finance.