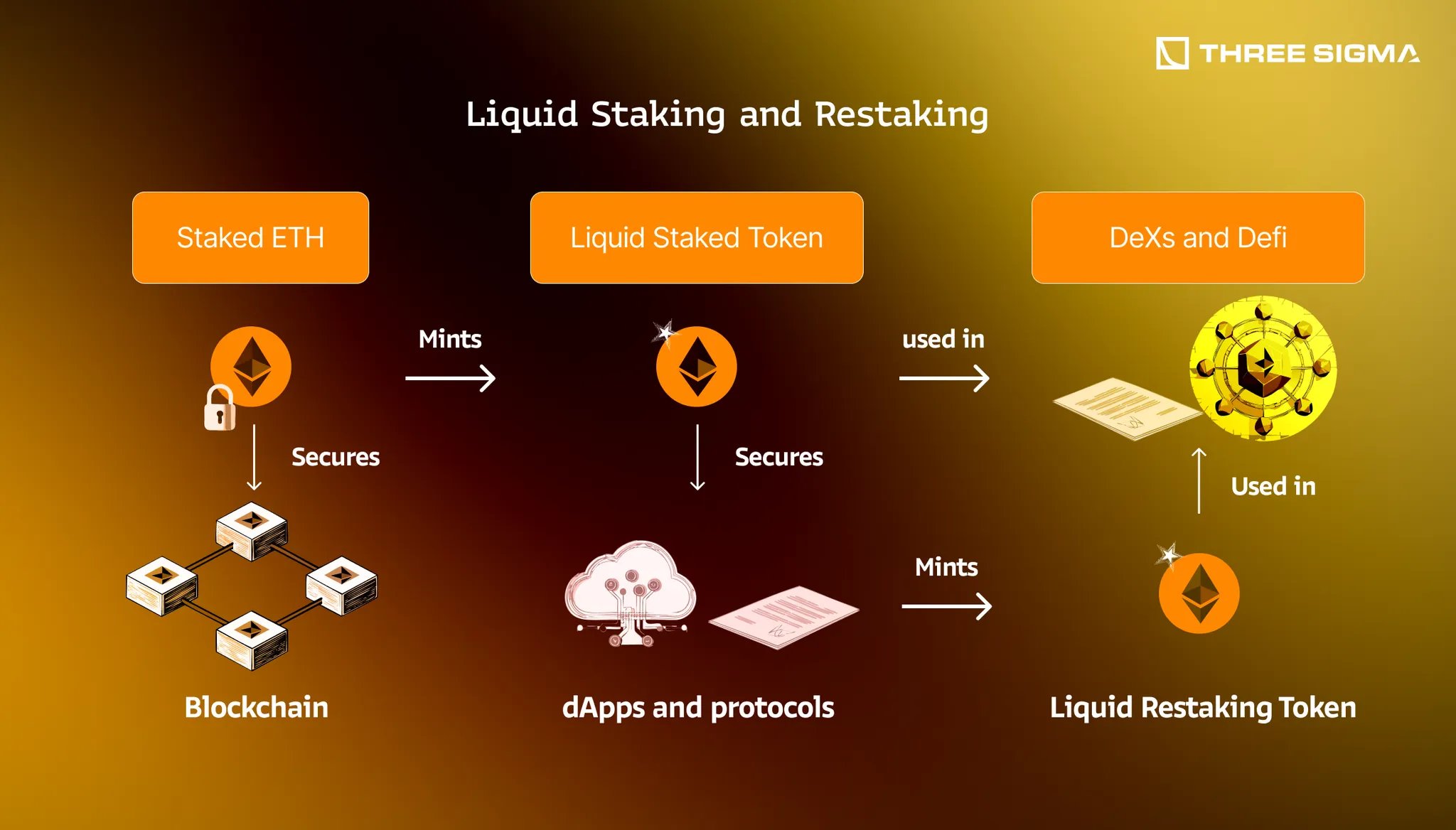

Liquid staking tokens (LSTs) are reshaping the DeFi landscape, offering a sophisticated solution for users who want to earn staking rewards without sacrificing liquidity. In traditional staking models, assets like Ethereum (ETH) are locked up to secure the network, effectively sidelining capital and limiting its utility. LSTs address this fundamental inefficiency by issuing derivative tokens, such as stETH for staked ETH, that remain liquid, tradeable, and deployable across the decentralized finance ecosystem.

How Liquid Staking Tokens Work: Unlocking Capital Efficiency

At their core, LSTs enable users to stake assets on proof-of-stake (PoS) blockchains while receiving a 1: 1 representation of their staked holdings. These derivatives accrue the same staking rewards as the underlying asset but can be freely traded or used within DeFi applications. This dual functionality is what makes LSTs a game-changer in crypto capital management.

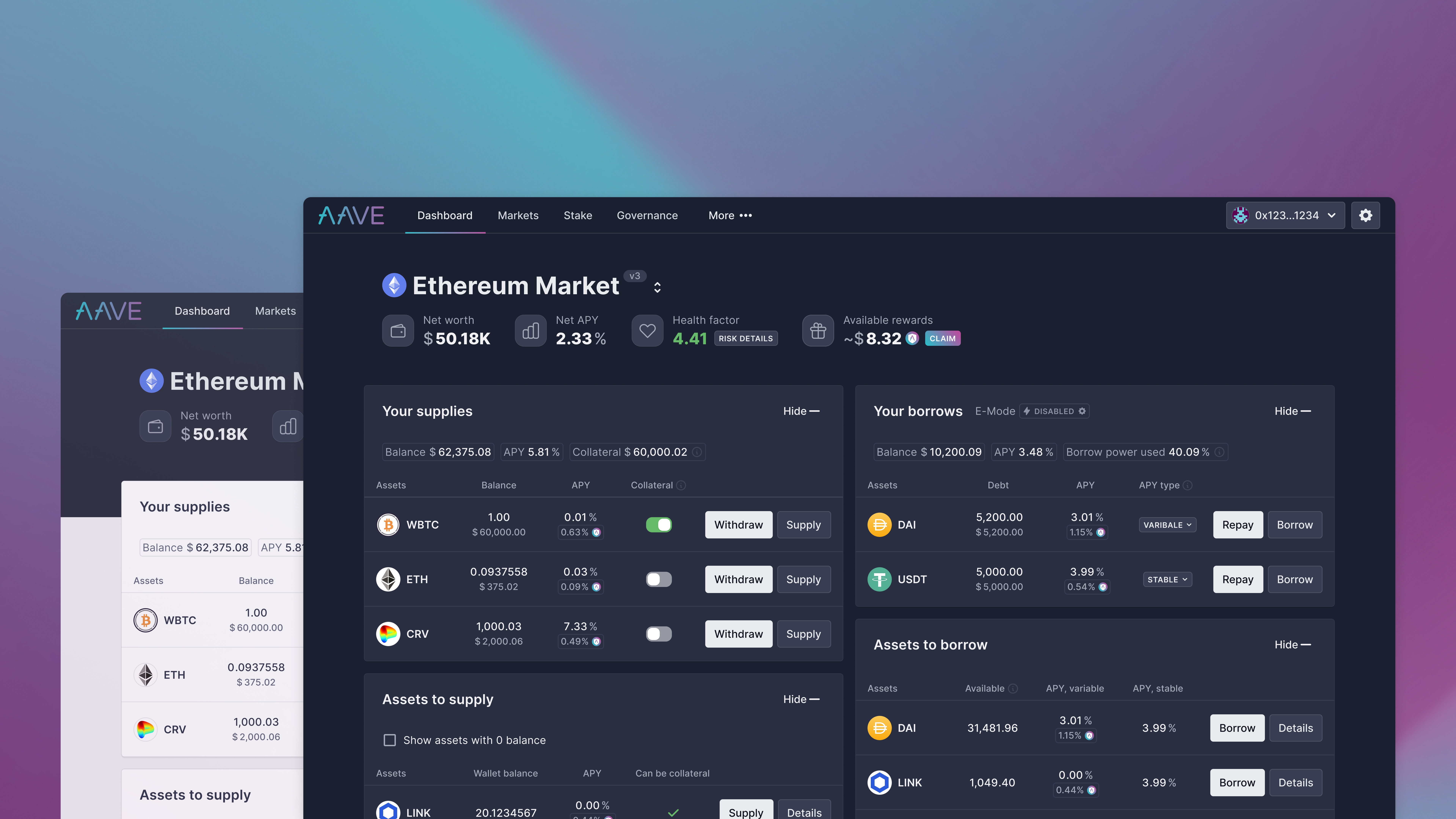

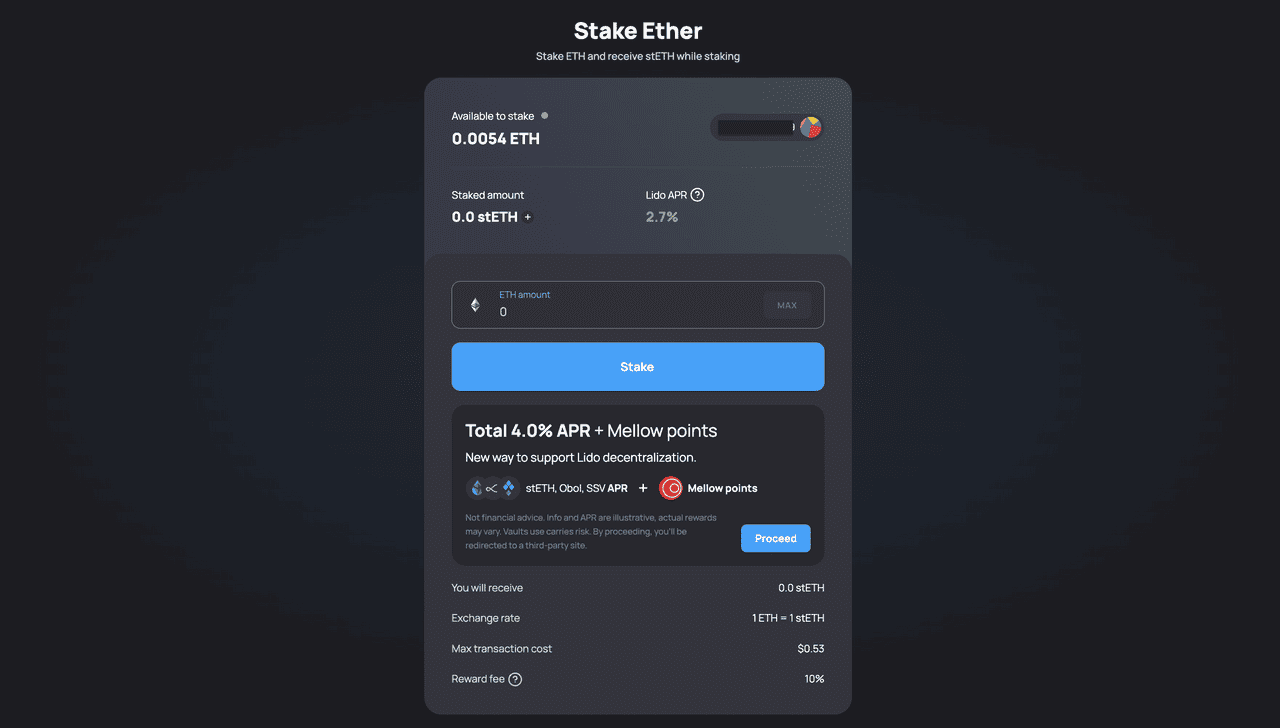

For example, when you stake ETH through a liquid staking protocol, you receive an equivalent amount of stETH. This token not only earns you ongoing staking rewards but can also be deposited into liquidity pools, used as collateral for loans, or actively traded, effectively multiplying your earning potential without ever having to unstake your original assets.

The Mechanics Behind Double Yield Staking

The concept of double yield emerges from the ability to earn both base-layer staking rewards and additional yields from deploying LSTs in various DeFi protocols. Here’s how the mechanics break down:

Key Advantages of Double Yield with Liquid Staking Tokens

-

Simultaneous Staking Rewards and DeFi Earnings: Liquid staking tokens (LSTs) such as stETH (Lido) or rETH (Rocket Pool) allow users to earn native staking rewards while also deploying these tokens in decentralized finance (DeFi) protocols for additional yield.

-

Enhanced Liquidity Without Unstaking: LSTs maintain liquidity for staked assets, enabling users to trade, transfer, or utilize them as collateral across DeFi platforms without needing to unstake from the original network.

-

Access to Multiple Yield Streams: By integrating LSTs into DeFi activities like liquidity provision on Uniswap or lending on Aave, users can earn trading fees, interest, and incentives on top of staking rewards.

-

Participation in On-Chain Loyalty Programs: Many protocols now reward LST holders with loyalty points, airdrops, or exclusive benefits, further increasing the total potential yield for active participants.

-

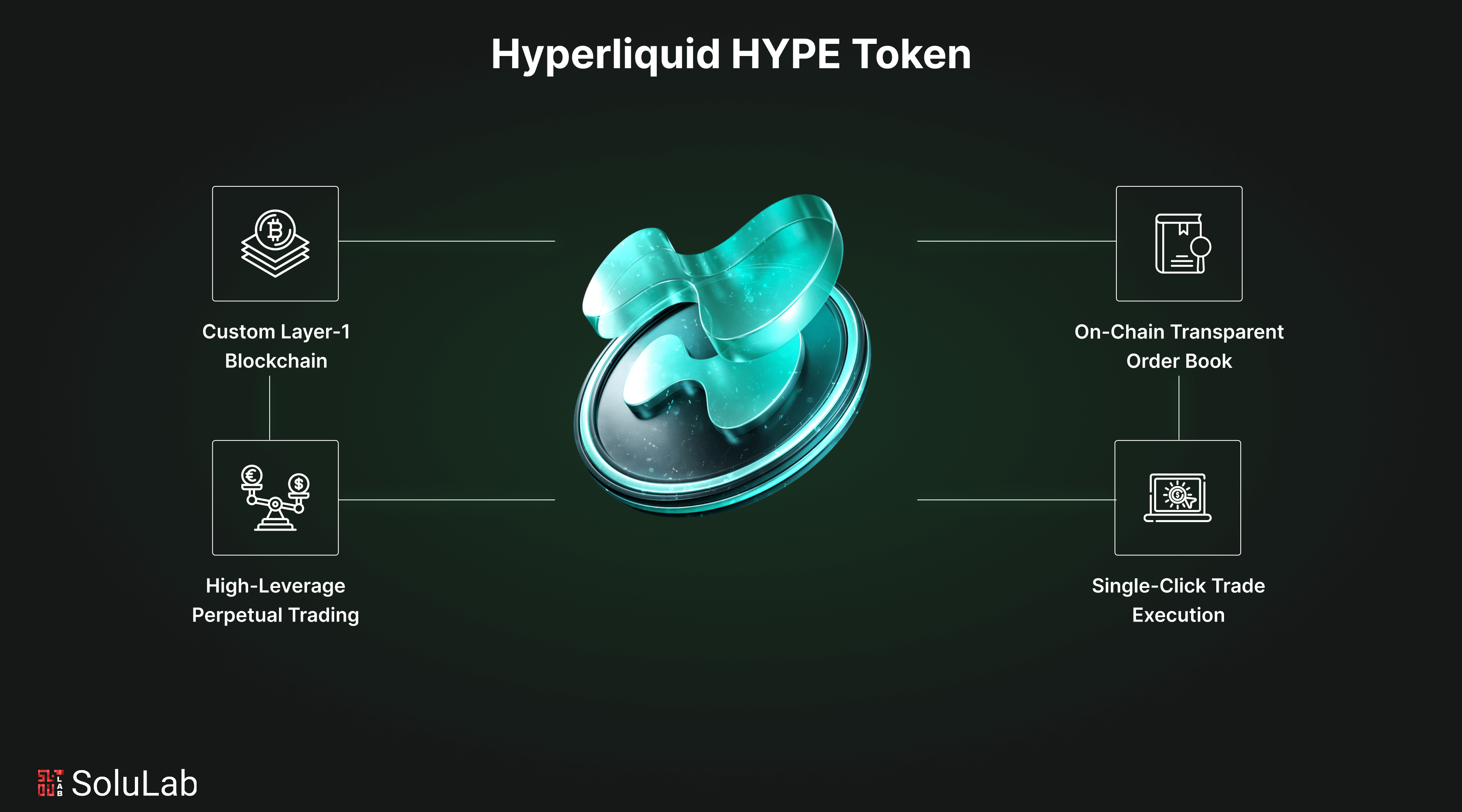

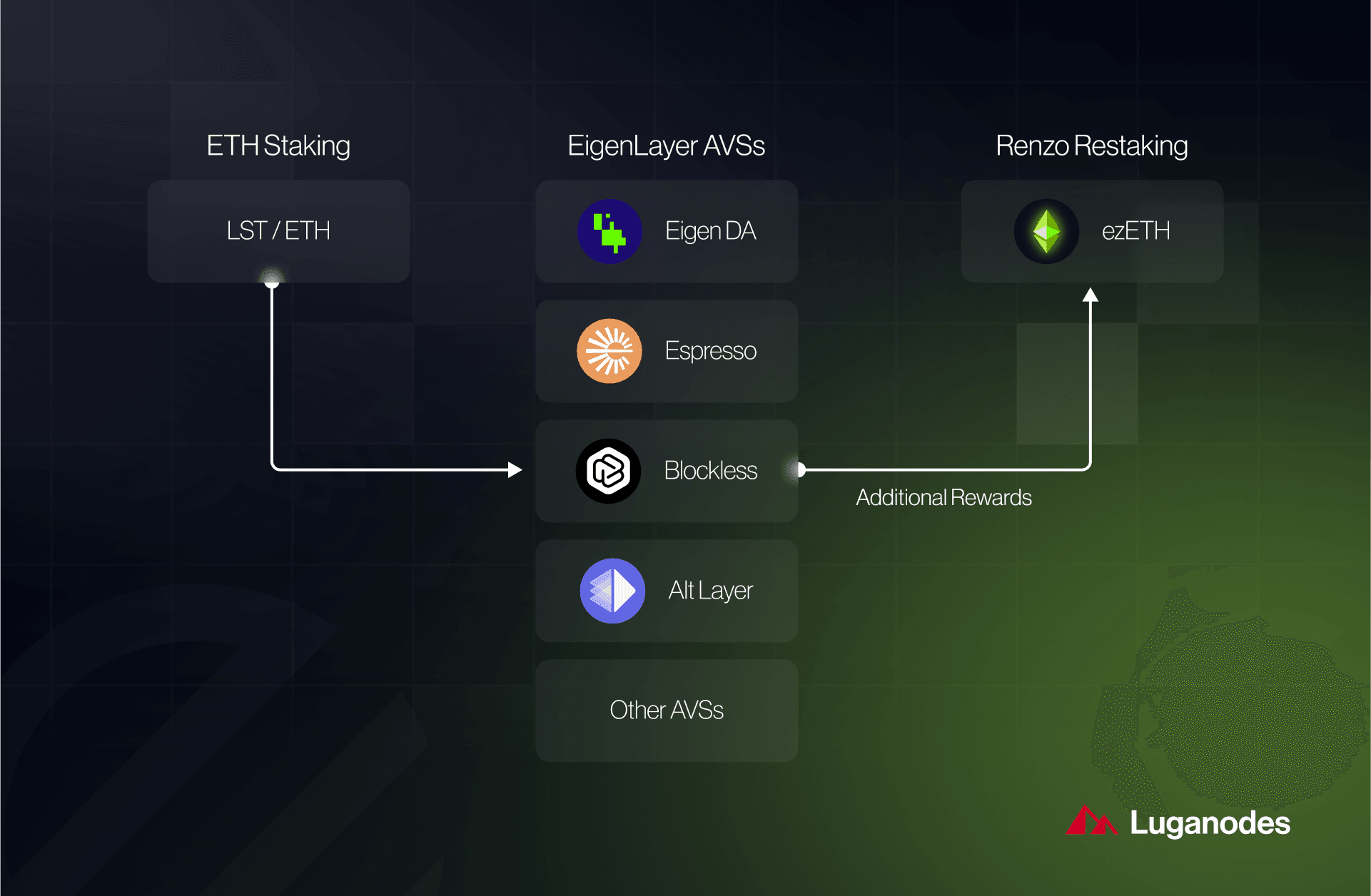

Restaking for Additional Rewards: Platforms like EigenLayer enable users to restake their LSTs to secure Actively Validated Services (AVSs), layering extra rewards on top of traditional staking and DeFi yields.

Primary Yield: By participating in network consensus through staking, users receive periodic rewards, these are typically distributed in the native asset (like ETH). This foundational yield is what most long-term holders seek when they lock up their coins.

Secondary Yield: The true innovation arrives when these liquid derivatives are put to work elsewhere. LSTs can be supplied as liquidity on decentralized exchanges (DEXs), earning trading fees and incentives; they can also serve as collateral within lending platforms or be involved in yield farming strategies that layer on additional token rewards. As highlighted by Chainlink’s education hub (source), this unlocks value that would otherwise remain dormant.

Loyalty Programs Meet Liquid Staking: The Next Evolution

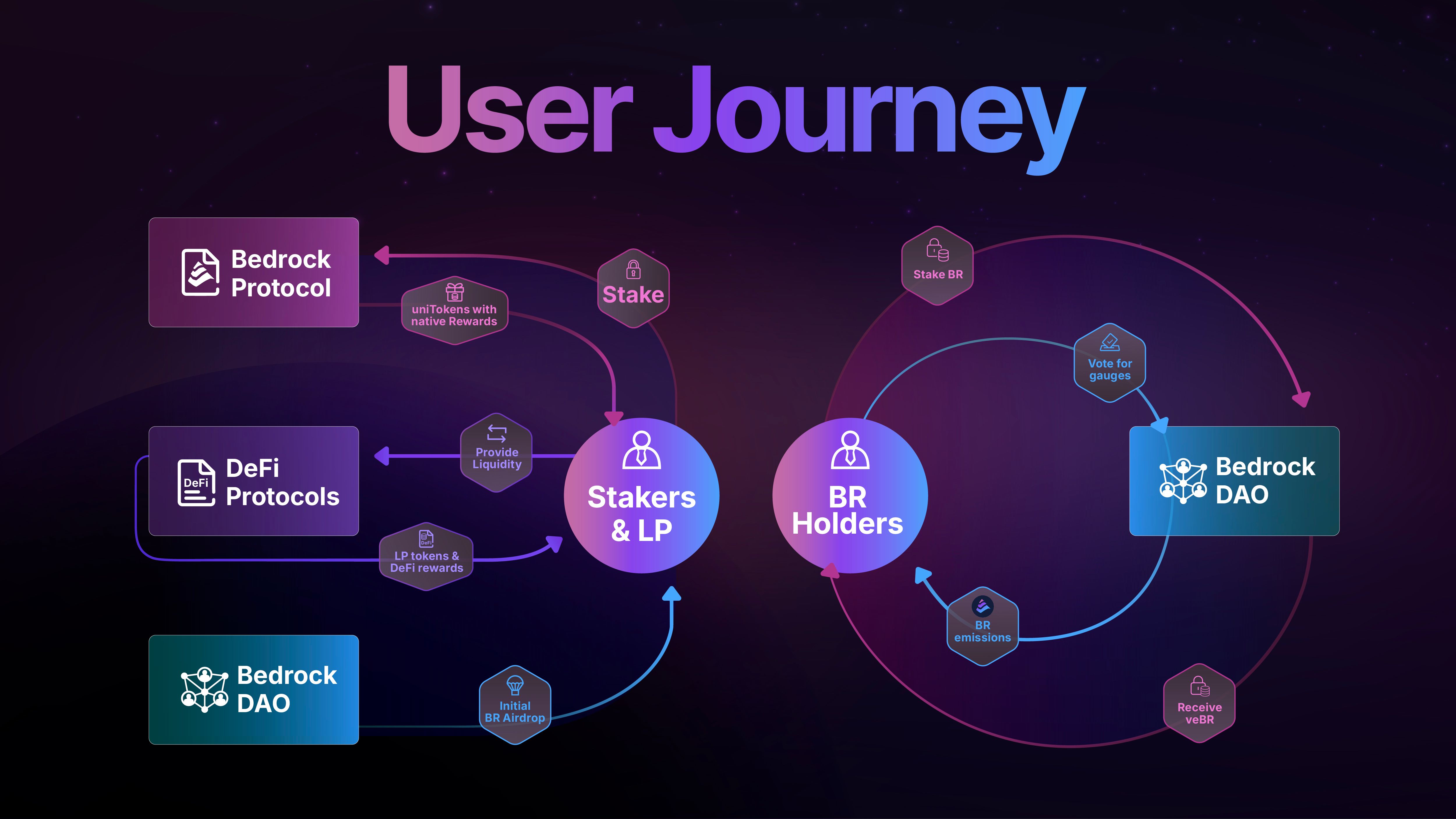

The integration of LSTs into on-chain loyalty programs marks a significant evolution in user engagement strategies for blockchain projects. Instead of simply rewarding participants with static tokens or points, these programs now allow users to amplify returns by leveraging their staked assets across multiple layers of DeFi activity.

This synergy is especially evident in protocols like EigenLayer, where restaking mechanisms allow users to secure additional decentralized services, known as Actively Validated Services (AVSs): with their existing LST positions. The result is a compounding effect: not only do participants earn base staking rewards and DeFi yields, but they also accrue loyalty points or bonus tokens for supporting network growth and security (source). These points may later be redeemed for exclusive benefits or tradable assets within the loyalty program’s ecosystem.

As the DeFi landscape matures, on-chain loyalty programs are evolving from mere marketing gimmicks to powerful engines of user retention and capital efficiency. By embedding liquid staking tokens (LSTs) into these frameworks, projects can incentivize deeper engagement while users unlock new layers of yield. The interplay between LSTs and loyalty rewards is transforming how crypto communities interact with protocols, and how value is distributed across ecosystems.

Strategic Considerations for Maximizing Double Yield

While the promise of double yield staking is compelling, realizing its full potential requires a methodical approach. Here are several practical strategies and considerations for participants looking to optimize their returns with LSTs in on-chain loyalty programs:

Best Practices for Maximizing LST Double Yield in DeFi

-

Choose Reputable Liquid Staking Platforms: Opt for established protocols like Lido, Rocket Pool, or Stader to ensure security, robust auditing, and consistent rewards when minting LSTs such as stETH or rETH.

-

Participate in Restaking for Enhanced Rewards: Engage with restaking protocols such as EigenLayer to restake your LSTs and earn additional rewards by securing Actively Validated Services (AVSs), effectively layering yields.

-

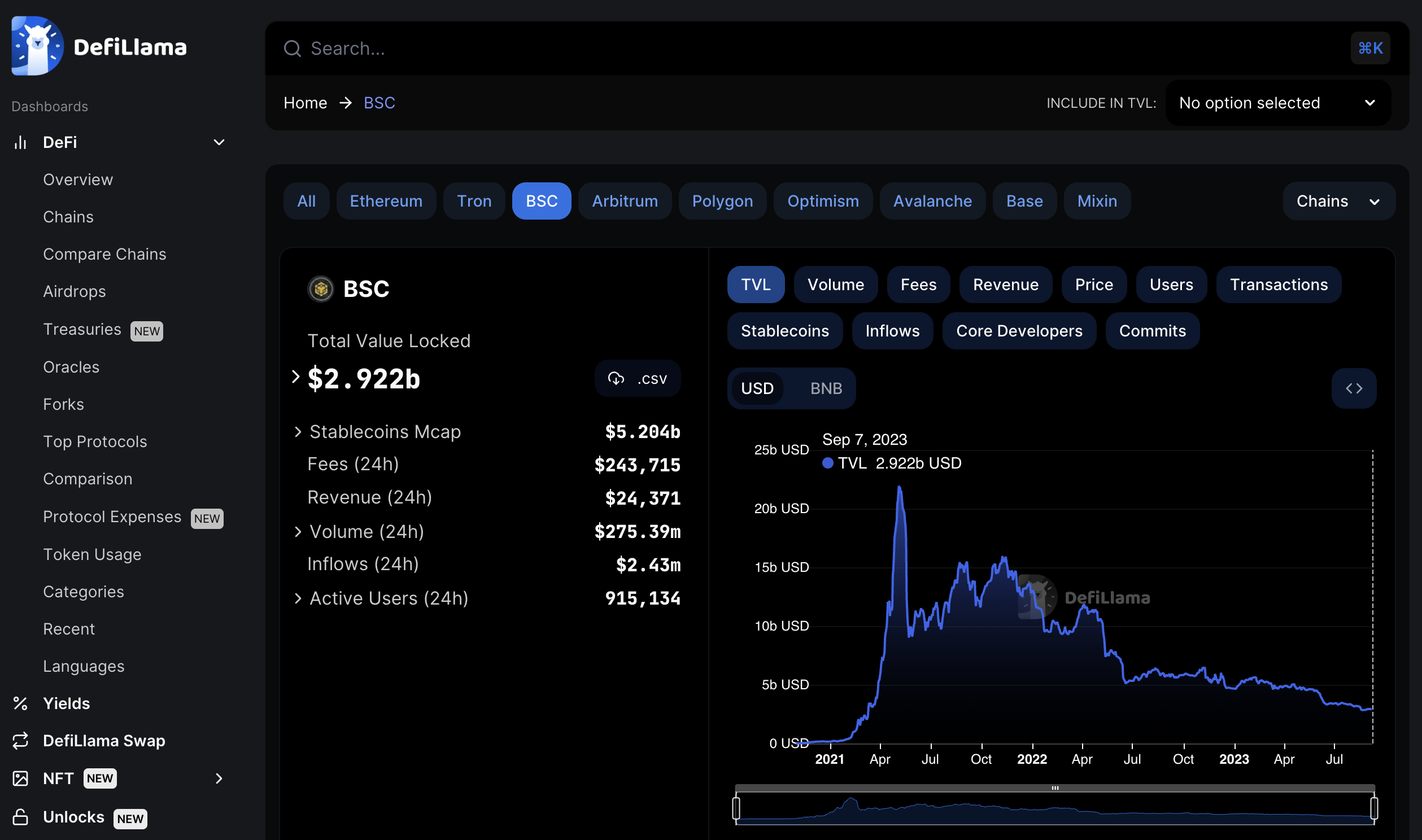

Actively Manage Risk and Monitor Smart Contracts: Regularly review the security status and audits of all protocols you interact with. Use tools like DeFiLlama to track protocol TVL and risk metrics, and stay informed about potential smart contract vulnerabilities or market liquidity risks.

- Diversify Protocol Exposure: Avoid overconcentration in a single DeFi or staking protocol to mitigate smart contract risk.

- Monitor Liquidity: Check pool depths and exit liquidity for your chosen LSTs, especially during periods of high volatility, to avoid slippage or forced losses.

- Understand Reward Structures: Loyalty programs can differ significantly. Some offer points convertible to governance tokens, others grant tiered benefits or access to exclusive pools. Scrutinize the terms before committing capital.

- Stay Updated on Protocol Upgrades: Many liquid staking protocols evolve rapidly, introducing new features like restaking or AVS integrations that can affect your yield profile.

Risks Unique to Liquid Staking in Loyalty Programs

LSTs introduce an additional layer of complexity compared to traditional staking. Users must remain vigilant about the following:

- Smart Contract Vulnerabilities: Engaging with multiple protocols compounds exposure.

- LST Depegging: In rare events, derivative tokens may temporarily lose parity with their underlying asset, impacting returns if you need to exit quickly.

- Loyalty Program Centralization Risks: Some programs may have admin keys or centralized control over reward distribution; always check for transparent governance mechanisms.

The most effective DeFi strategies balance ambition with prudence. Never chase yield blindly; instead, build positions that align with your risk tolerance and long-term goals.

– Liam Hartley, CFA and FRM

The Road Ahead: Future-Proofing On-Chain Loyalty with LSTs

The integration of liquid staking tokens into on-chain loyalty frameworks is still in its early innings. As protocols like EigenLayer continue to innovate, with restaking and Actively Validated Services (AVSs) at the forefront, the opportunities for compounding rewards will only expand. Expect increased interoperability between protocols, more sophisticated reward structures, and even cross-chain loyalty initiatives leveraging BTC liquid staking as well as ETH-based assets.

This landscape will favor not just early adopters but also those who approach it with discipline and insight. Thorough due diligence, active monitoring of liquidity dynamics, and an understanding of both technical risks and incentive mechanisms will distinguish successful participants from those who fall prey to market exuberance or protocol failures.

The bottom line: Liquid staking tokens are more than just a capital efficiency tool, they are rapidly becoming the backbone of next-generation on-chain loyalty programs. By combining foundational network security incentives with flexible DeFi integrations and innovative reward schemes, LSTs empower users to earn attractive yields while deepening their engagement within blockchain ecosystems. For those willing to do their homework and manage risk carefully, the era of double yield is just beginning.