Decentralized finance (DeFi) is in the midst of a user engagement renaissance, and on-chain loyalty staking programs are at the heart of this transformation. These innovative systems blend the transparency of blockchain with gamified rewards, giving users more reasons than ever to stay active and committed to their favorite DeFi protocols. As we move into 2025, savvy investors and community members are seeking out platforms that not only offer competitive returns but also foster genuine loyalty through creative incentives.

How On-Chain Loyalty Staking Programs Work

At their core, on-chain loyalty staking programs encourage users to lock up their tokens in smart contracts, often within liquidity pools that power lending, trading, or governance functions. In exchange for staking their assets, users receive loyalty rewards, these can range from native platform tokens to exclusive NFTs or even cross-platform benefits. The goal is simple: reward long-term commitment and active participation with tangible incentives.

This approach has proven especially effective in DeFi, where user retention can make or break a protocol’s success. By integrating staking reward programs with transparent distribution models on the blockchain, platforms ensure that every reward is verifiable and tamper-proof, a crucial factor for building trust in a rapidly evolving ecosystem.

Gamification: The Secret Sauce for DeFi User Engagement

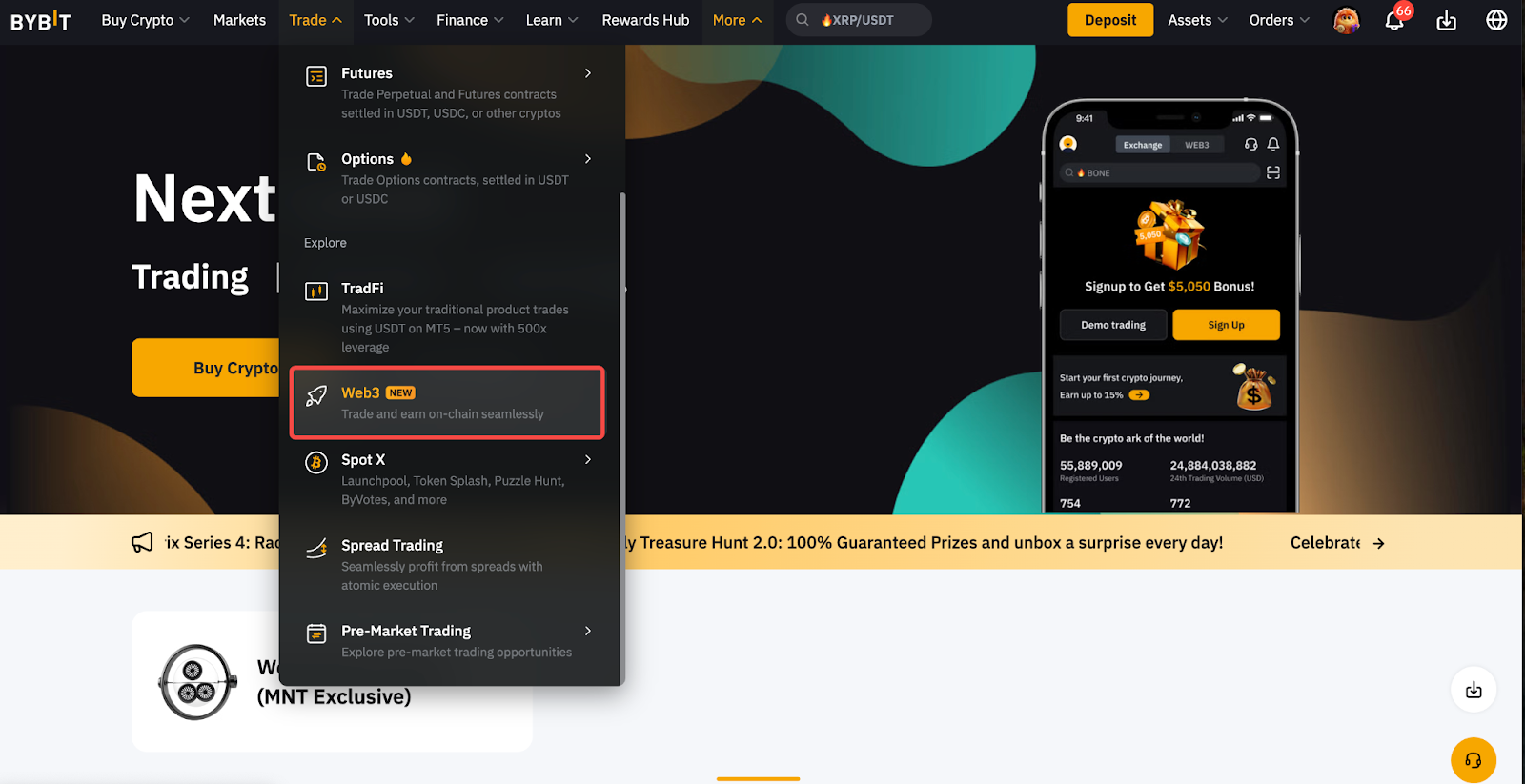

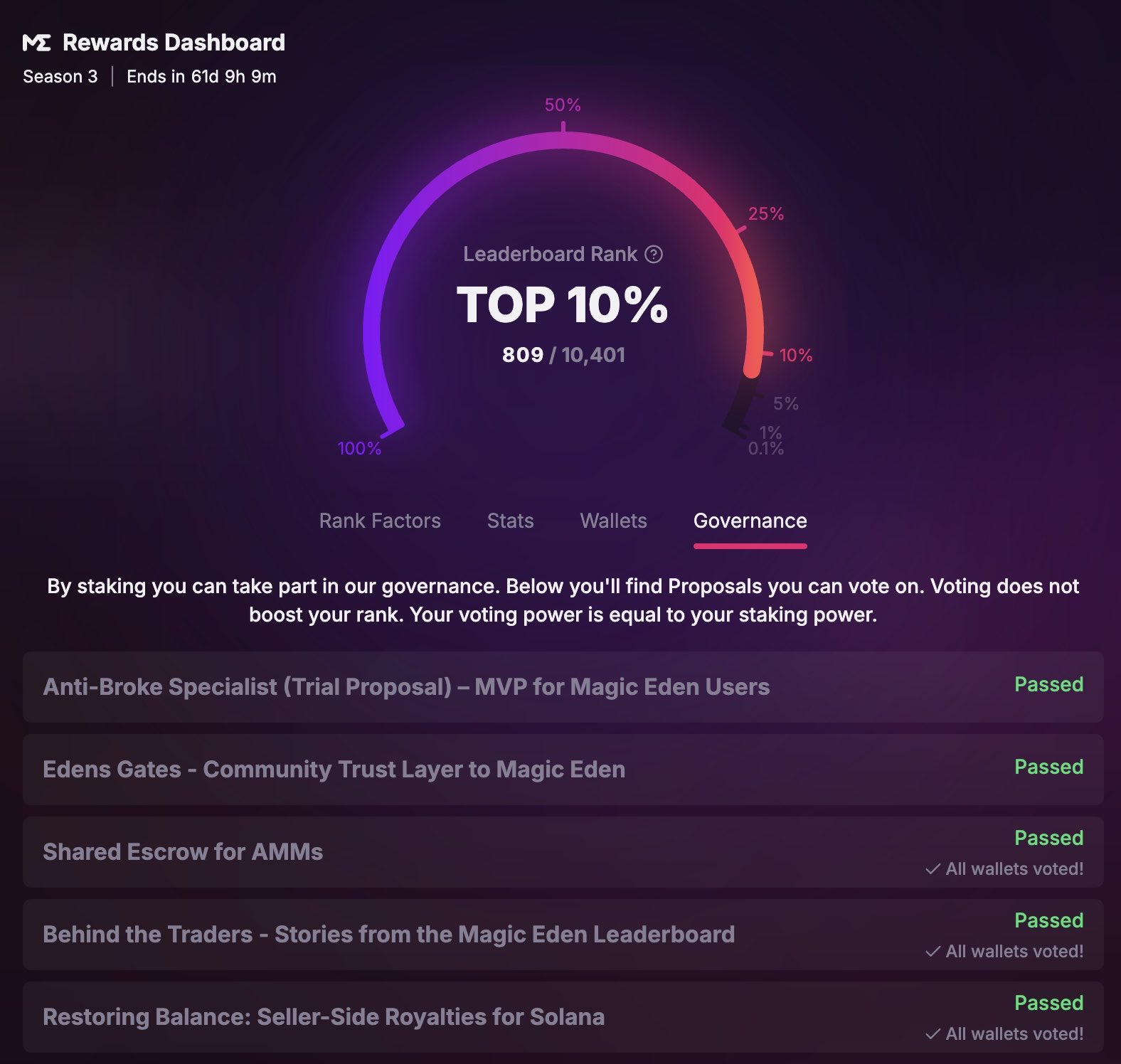

One of the most powerful trends driving engagement is gamification. Platforms like Magic Eden have introduced leaderboards that rank users by staking power, calculated based on both the amount staked and duration held. This not only encourages larger deposits but also incentivizes longer lock-up periods, creating a virtuous cycle of commitment and competition. Users climb ranks for higher yields or rare digital collectibles, transforming what was once passive income into an active, rewarding experience.

But gamification isn’t just about flashy graphics or badges, it’s about designing systems where every action feels meaningful. Transparency in how rewards are calculated and distributed keeps participants motivated while minimizing frustration or confusion. For those interested in real-world examples of these dynamics at play, see our deep dive on how on-chain loyalty staking drives community engagement in DeFi projects.

Personalized Communication: Keeping Users Informed and Engaged

Another game-changer for DeFi user engagement is personalized communication. Modern platforms leverage notification modules like MetaCRM’s to deliver real-time alerts about critical events, think position health updates, liquidation risks, or new reward opportunities, directly to users via email or messaging apps. This immediate feedback loop turns passive holders into active participants who feel connected to every movement within the protocol.

Key Benefits of Personalized Notifications in DeFi Staking

-

Real-Time Alerts on Position Health: Personalized notifications, such as those provided by MetaCRM’s Notification Module, instantly inform users about critical changes in their staking positions, including liquidation risks or collateral fluctuations. This enables users to take timely action and avoid unwanted losses.

-

Maximized Reward Opportunities: Tailored notifications alert users about new staking rewards, bonus periods, or increased APY offers on platforms like Lido and Magic Eden, ensuring users never miss out on maximizing their earnings.

-

Enhanced User Retention and Engagement: By delivering personalized updates across multiple channels (email, messaging apps), platforms like MetaCRM keep users informed and engaged, reducing churn and fostering long-term loyalty.

-

Improved Transparency and Trust: Notifications that provide clear, on-chain event tracking and reward distribution updates—such as those integrated by Alpha’s Web3 rewards engine—help build user confidence in the platform’s fairness and reliability.

-

Seamless Multi-Platform Experience: Personalized notifications can span across interoperable DeFi ecosystems, alerting users to staking events or opportunities on multiple chains and platforms, as seen with Alpha’s interoperable loyalty infrastructure.

This proactive approach ensures that users never miss out on opportunities to maximize returns or avoid pitfalls, a vital component as protocols become more complex and interconnected across multiple chains.

The Rise of Interoperable Loyalty Programs

The days of siloed rewards are fading fast as platforms invest in interoperable loyalty infrastructure. Engines like Alpha’s Web3 rewards layer allow users to earn points or tokens that can be redeemed across various chains and applications, not just within a single protocol. This cross-ecosystem utility transforms isolated communities into thriving networks where participation has compounding value.

For example, imagine earning loyalty incentives on one DApp and spending them seamlessly on another, whether it’s for governance voting rights, exclusive access to launches, or even real-world perks. Such composability amplifies both individual engagement and overall ecosystem growth.

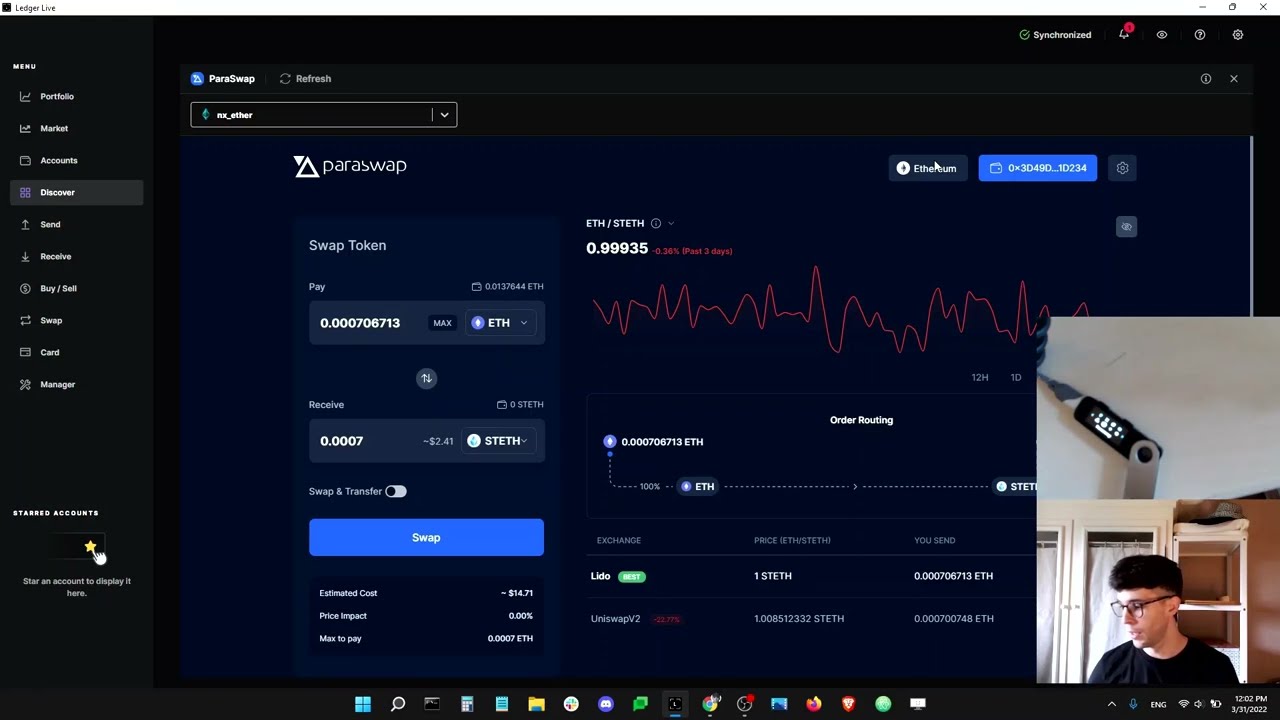

Liquid staking tokens (LSTs) are another innovation reshaping the DeFi loyalty landscape. Unlike traditional staking, which locks up assets and limits flexibility, liquid staking lets users earn rewards while maintaining liquidity. Protocols like Lido issue LSTs (such as stETH or wstETH), which can be freely traded or used as collateral in other DeFi applications. This dual utility means users are not forced to choose between earning staking rewards and participating in yield farming, lending, or governance elsewhere.

This flexibility is a major draw for today’s DeFi participants who expect both high returns and seamless experiences across platforms. By integrating LSTs into their loyalty incentive structures, protocols empower users to maximize their capital efficiency without sacrificing engagement or rewards.

Cross-Ecosystem Partnerships: Expanding the Value of Loyalty

What truly sets on-chain loyalty staking apart is its ability to transcend platform boundaries. Strategic partnerships between DeFi protocols and even real-world businesses are unlocking new ways for users to spend and benefit from their loyalty tokens. For example, collaborations might allow a user’s staked tokens on one platform to earn discounts on another DApp or even physical goods and services.

This cross-ecosystem approach not only boosts the utility of loyalty incentives but also fosters a sense of belonging within the broader crypto community. As more projects adopt interoperable standards and shared reward pools, user engagement becomes less about isolated transactions and more about long-term participation in a vibrant digital economy.

Key Features Enabling Cross-Ecosystem Utility in On-Chain Loyalty Staking

-

Interoperable Loyalty Rewards: Platforms like Alpha’s Web3 rewards engine enable users to earn and redeem loyalty rewards across multiple blockchains and DeFi applications, breaking down silos and expanding reward utility.

-

Liquid Staking Tokens (LSTs): Protocols such as Lido issue liquid staking tokens like stETH and wstETH, allowing users to stake assets while still utilizing them in other DeFi platforms, maximizing both flexibility and earning potential.

-

Cross-Platform Token Utility: Loyalty tokens designed for use across various decentralized applications (DApps) and even real-world scenarios—such as those promoted by TDeFi—increase the value and engagement potential for users.

-

Gamified Engagement Structures: Staking programs like Magic Eden employ gamification elements—such as leaderboards and tiered rewards—encouraging users to participate more actively and compete for enhanced benefits.

-

Personalized Notifications and Alerts: Tools like MetaCRM’s Notification Module deliver real-time, personalized updates on staking events and opportunities, helping users stay engaged and responsive across ecosystems.

Transparency and Trust: The Bedrock of Engagement

All these advances would be moot without the transparency that blockchain provides. Every reward calculation, distribution event, and partnership benefit is recorded immutably on-chain. This auditability reassures users that their efforts are recognized fairly, no hidden rules or opaque algorithms undermine trust.

Moreover, transparent systems make it easier for communities to propose improvements, vote on protocol upgrades, or suggest new reward structures. This open dialogue strengthens user retention by giving every participant a voice in shaping the future of their favorite platforms.

From Passive Holding to Active Participation

The shift from passive holding to active engagement is perhaps the most profound impact of modern on-chain loyalty staking programs. Through gamification, personalized communication, interoperability, liquid staking options, and cross-platform partnerships, DeFi projects now offer an experience that’s both rewarding and dynamic.

For those ready to dive deeper into optimizing participation strategies, and learn how early adopters have benefited, explore our guide on how on-chain loyalty staking maximizes rewards for DeFi users.

Knowledge is the gateway to financial freedom: By embracing transparent systems and innovative incentives, every user can unlock new levels of engagement, and shape the future of decentralized finance.