Decentralized finance (DeFi) projects face a relentless challenge: keeping users engaged for the long term. In an ecosystem where switching costs are low and new protocols launch daily, user retention has become the true battleground for sustainable growth. On-chain loyalty staking is rapidly gaining traction as a sophisticated solution, leveraging blockchain’s transparency and programmability to reward commitment, build trust, and create network effects that are difficult to replicate elsewhere.

![]()

Token Utility: The Engine of DeFi User Retention

Gone are the days when token speculation alone was enough to keep users loyal. Today’s DeFi projects recognize that staking rewards for loyalty must be grounded in genuine utility. By allowing users to stake tokens and earn passive income, participate in governance, or unlock exclusive features, these platforms incentivize deeper engagement. For example, some protocols grant stakers early access to new product launches or exclusive governance votes, turning passive holders into active community members.

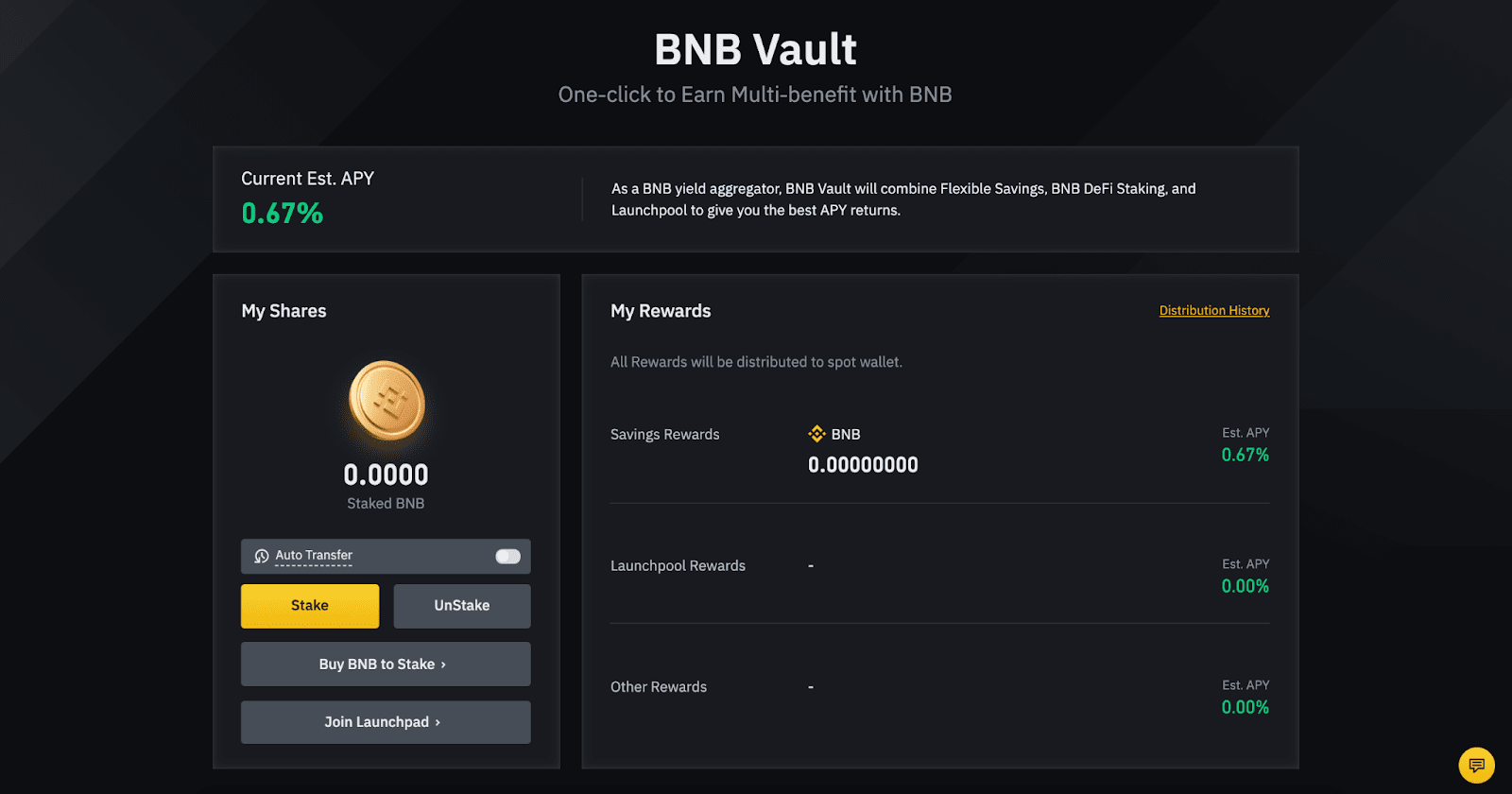

This approach is supported by recent findings on on-chain growth analytics, which reveal that users who interact with multi-utility tokens are significantly more likely to remain engaged over time (see further analysis). The evolving utility of tokens like BNB, which started with trading fee discounts and now powers a suite of DeFi services, exemplifies how utility-driven staking can anchor user loyalty amid a sea of alternatives.

Community Incentives and Gamified Loyalty Programs

Retention in DeFi is as much about social capital as financial incentives. The integration of token-gated communities and gamified loyalty programs is redefining what it means to be a loyal user. By tracking engagement through on-chain experience points (XP) or similar metrics, platforms reward not just capital but also positive behaviors: community support, referrals, governance participation, and content creation.

These gamified systems often feature tiered rewards and visible status symbols, which foster healthy competition and reinforce a sense of belonging. For instance, users who consistently participate in DAO votes or contribute to community forums may unlock higher staking yields or unique NFT badges. This blend of material and social recognition is proving highly effective at reducing churn and cultivating advocates who evangelize the protocol.

Collaborative Yield Campaigns: Aligning Incentives for Long-Term Growth

Staking programs are evolving beyond individual rewards toward collaborative yield farming campaigns that benefit both the user and the protocol. By structuring rewards around ecosystem-supportive actions, such as providing liquidity or participating in governance, these campaigns encourage behaviors that drive on-chain growth. Dual reward models (e. g. , distributing both native tokens and partner tokens or NFTs) create layered incentives for users to diversify their engagement across multiple facets of the ecosystem.

Crucially, these strategies align user interests with project health, ensuring that rewards are not just short-term giveaways but catalysts for sustainable participation. As observed in recent analyses, platforms that structure their loyalty programs around collaborative actions see higher retention rates compared to those relying solely on one-off incentives or airdrops.

Transparency, Reputation, and Trust: The On-Chain Advantage

The transparent nature of blockchain technology offers a unique edge for blockchain loyalty programs. Every interaction, staking, voting, providing liquidity, is immutably recorded, allowing protocols to build sophisticated reputation systems. Such systems enable projects to recognize genuine engagement over time, rewarding not just token balances but also positive behavioral patterns.

Projects like Galxe have pioneered hybrid on-chain/off-chain reputation models, integrating wallet activity with off-chain contributions to DAOs or NFT communities. This holistic view of user engagement enables more precise targeting of rewards and fosters a culture of accountability, key ingredients for lasting loyalty in DeFi.

Visibility and trust are further amplified when DeFi projects integrate with aggregator platforms such as DeFiLlama or DappRadar. These integrations provide users with real-time analytics on total value locked (TVL), protocol activity, and reward distributions, metrics that are critical for informed decision-making and long-term engagement. When users can independently verify a platform’s health and transparency, their confidence to participate and stake increases, reinforcing retention through trust.

Top 5 On-Chain Loyalty Staking Features in DeFi

-

Token-Backed Rewards and Utility: Leading DeFi platforms like Binance and Aave offer staking programs where users earn passive income, governance rights, and exclusive perks by holding and staking native tokens such as BNB or AAVE. This tangible utility drives long-term engagement and user retention.

-

Collaborative Yield Farming Campaigns: Protocols such as Curve Finance and SushiSwap run collaborative yield farming events that reward users for providing liquidity or staking, aligning incentives with ecosystem growth and encouraging users to stay active over time.

Education is another pillar underpinning robust user retention. Many leading DeFi protocols now produce step-by-step guides, explainer videos, and interactive AMAs to demystify complex concepts like staking, yield farming, and governance. This content not only lowers the barriers to entry for new users but also empowers existing participants to maximize their rewards and deepen their engagement. A well-informed community is more likely to remain loyal and advocate for the protocol, driving organic growth from within.

Designing Frictionless Staking Experiences

Reducing friction in the staking process is vital to maximizing user participation. Platforms that offer seamless wallet integrations, clear reward tracking, and intuitive user interfaces consistently outperform those with cumbersome onboarding or opaque reward structures. For example, single-click staking, transparent APY displays, and instant reward withdrawals are now expected features that materially impact user satisfaction. The easier it is for users to participate, and understand their benefits, the more likely they are to stay engaged over time.

Gamified loyalty systems continue to set new standards for engagement. By assigning experience points (XP) across diverse actions, such as product usage, governance voting, or community support, platforms transform routine participation into an ongoing quest for status and recognition. Unlike traditional rewards that may dwindle over time, XP-based systems build lasting engagement by tapping into users’ intrinsic motivations for achievement and belonging.

The impact of these strategies is clear: protocols that invest in transparent, multi-faceted loyalty programs consistently report higher rates of user retention and community advocacy. As competition intensifies across the DeFi landscape, the projects that thrive will be those that treat loyalty not as a one-time transaction but as a dynamic relationship built on utility, transparency, and shared success.

Looking ahead: On-chain loyalty staking is not just a trend, it’s a blueprint for sustainable growth in decentralized finance. By aligning incentives, fostering social capital, and embracing transparency, DeFi projects can transform fleeting users into lifelong participants.

For a deeper dive into how these mechanisms are reshaping community dynamics and maximizing rewards, explore our detailed analysis on how on-chain loyalty staking maximizes rewards for DeFi users.