Decentralized finance has long been associated with the idea that bigger wallets win bigger rewards. Yet, as the DeFi landscape matures, a new paradigm is taking shape: on-chain loyalty pools that reward consistent user engagement rather than just capital size. This subtle but significant evolution is not only democratizing access to DeFi incentives but also fostering healthier, more sustainable ecosystems.

Rethinking DeFi Incentives: Beyond Capital Size

The earliest DeFi yield programs were simple: provide liquidity or stake tokens, and reap proportional rewards. While effective for bootstrapping protocols, this approach often led to short-term farming and mercenary capital flows. Large holders could dominate pools, extracting outsized returns while providing little in the way of genuine ecosystem growth or engagement.

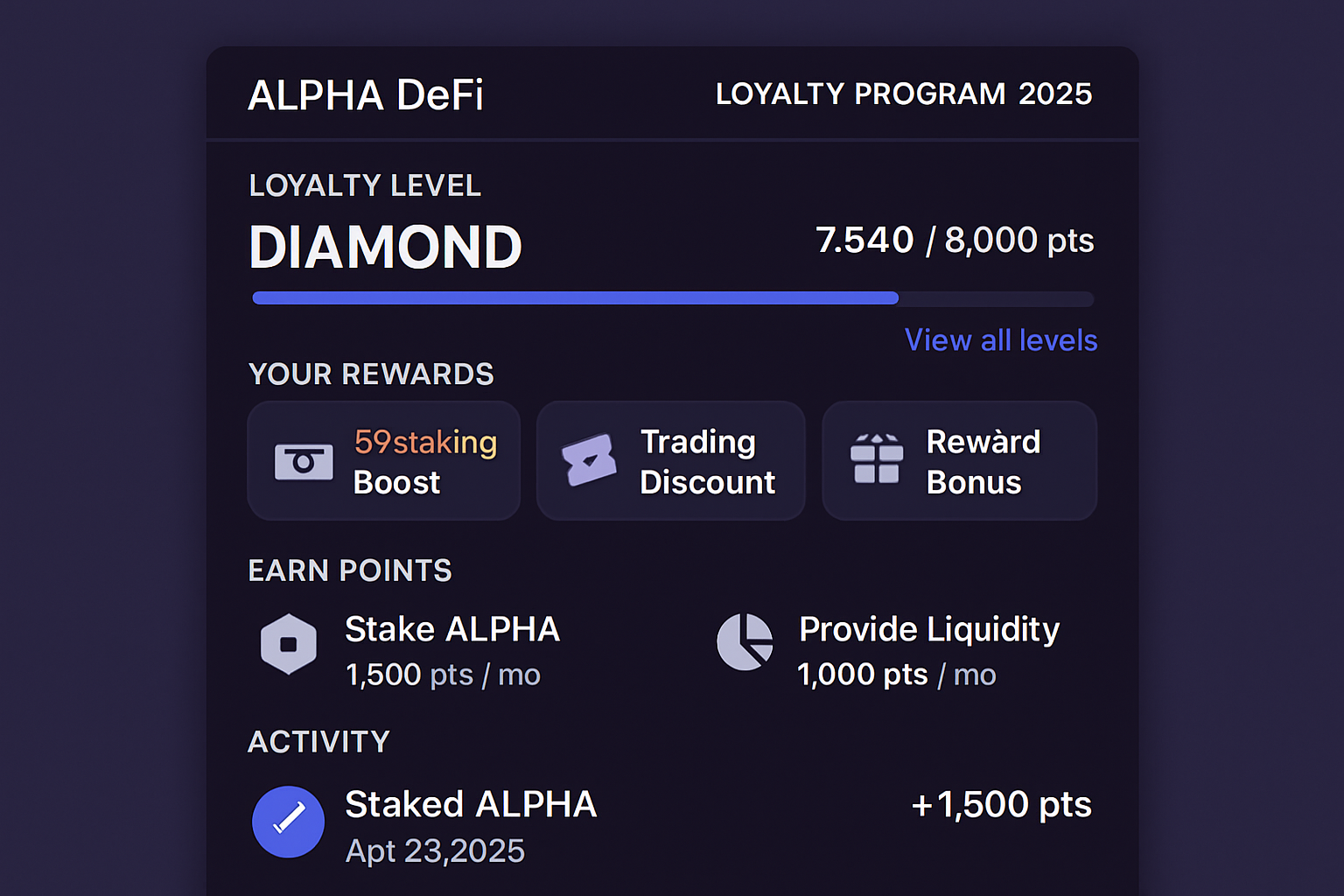

Today’s most forward-thinking platforms are flipping this model. By leveraging on-chain data and behavior analytics, they’re able to track not just how much you stake but how you participate. This shift toward activity-based staking incentives is exemplified by projects like Alpha, which use object-centric data structures to issue non-transferable loyalty points tied directly to real user actions.

The Mechanics of On-Chain Loyalty Pools

So how do these loyalty pools actually work? The key lies in their ability to reward consistent user behavior. Instead of simply distributing tokens based on wallet size or time staked, modern protocols monitor actions such as regular transactions, participation in governance, completion of quests, or even helping onboard new users.

This behavioral approach enables a range of innovative mechanisms:

- Behavior-Based Rewards: Platforms can issue non-tradable points for specific actions – think voting in DAO proposals or providing liquidity during volatile periods.

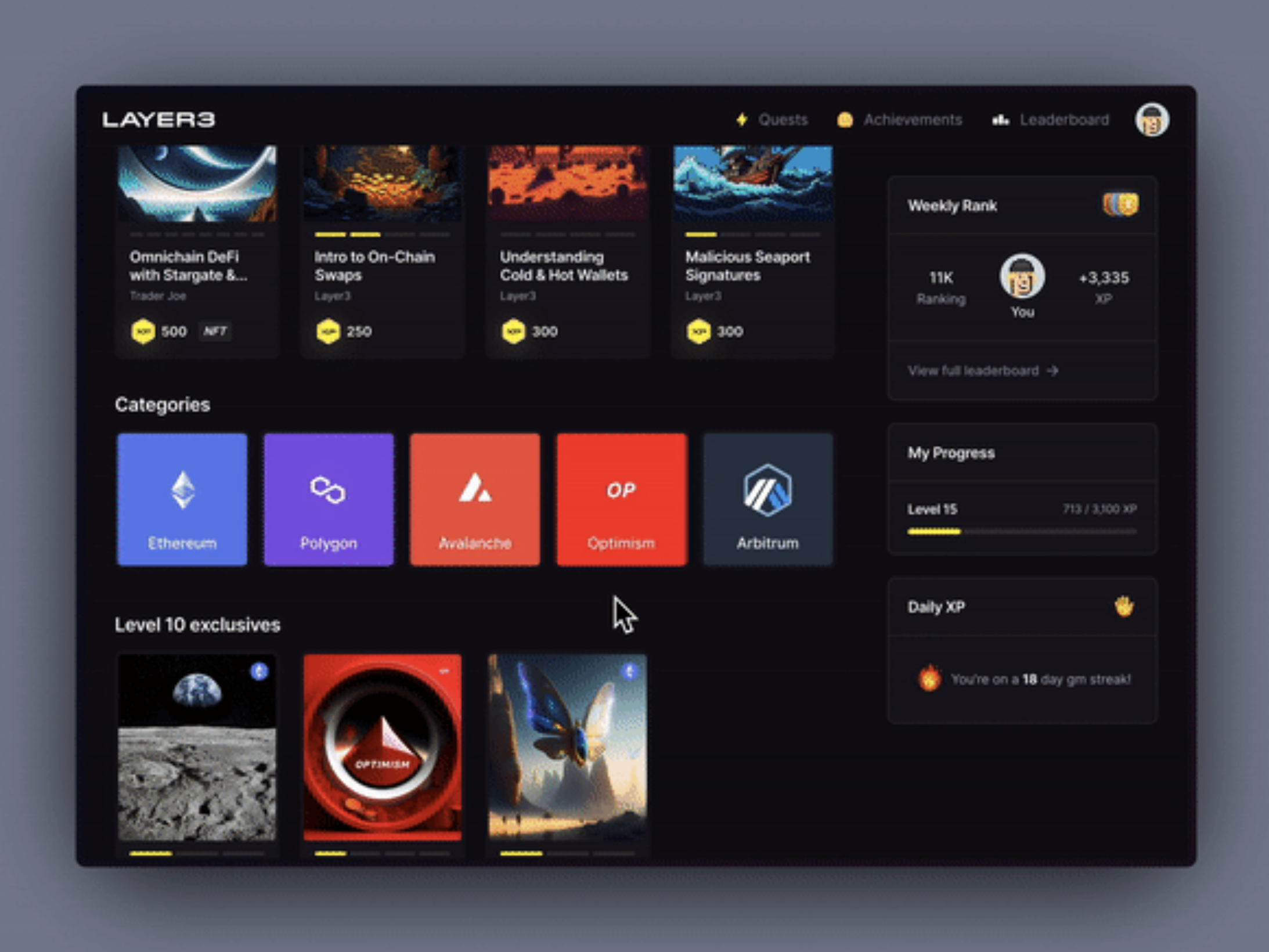

- Gamified Incentives: Quests and achievements encourage ongoing engagement and make earning rewards more interactive and fun. For example, completing a weekly challenge might unlock bonus points redeemable across partner dApps.

- Cross-Platform Composability: Loyalty points are increasingly interoperable; users can earn in one protocol and redeem in another, expanding the utility of their participation beyond a single silo.

- Sustainable Yield Distribution: Rather than relying solely on inflationary token emissions (which can dilute value), some protocols now share actual revenue streams with loyal participants – as seen with Cross-Chain Bridge allocating 70% of bridging fees back to its community.

This multifaceted approach helps align incentives between users and platforms while discouraging short-term farming strategies that can destabilize markets. For a deeper dive into maximizing your rewards as an active participant (not just a big wallet), see our guide on how On-Chain Loyalty Staking maximizes rewards for DeFi users.

The Value Proposition: Why Consistency Matters More Than Size

The benefit of rewarding consistent participation is twofold. First, it broadens access to meaningful DeFi returns by recognizing effort over mere capital allocation – a crucial step toward financial inclusion within crypto communities. Second, it creates stronger alignment between user interests and protocol health; loyal users are more likely to provide valuable feedback, help secure networks through governance or staking, and evangelize the platform organically.

This shift toward democratized DeFi rewards, where engagement trumps wallet size, is already yielding results across leading protocols. Enhanced user retention rates and more robust ecosystems point toward a future where sustainable growth is driven by active contributors rather than fleeting capital inflows.

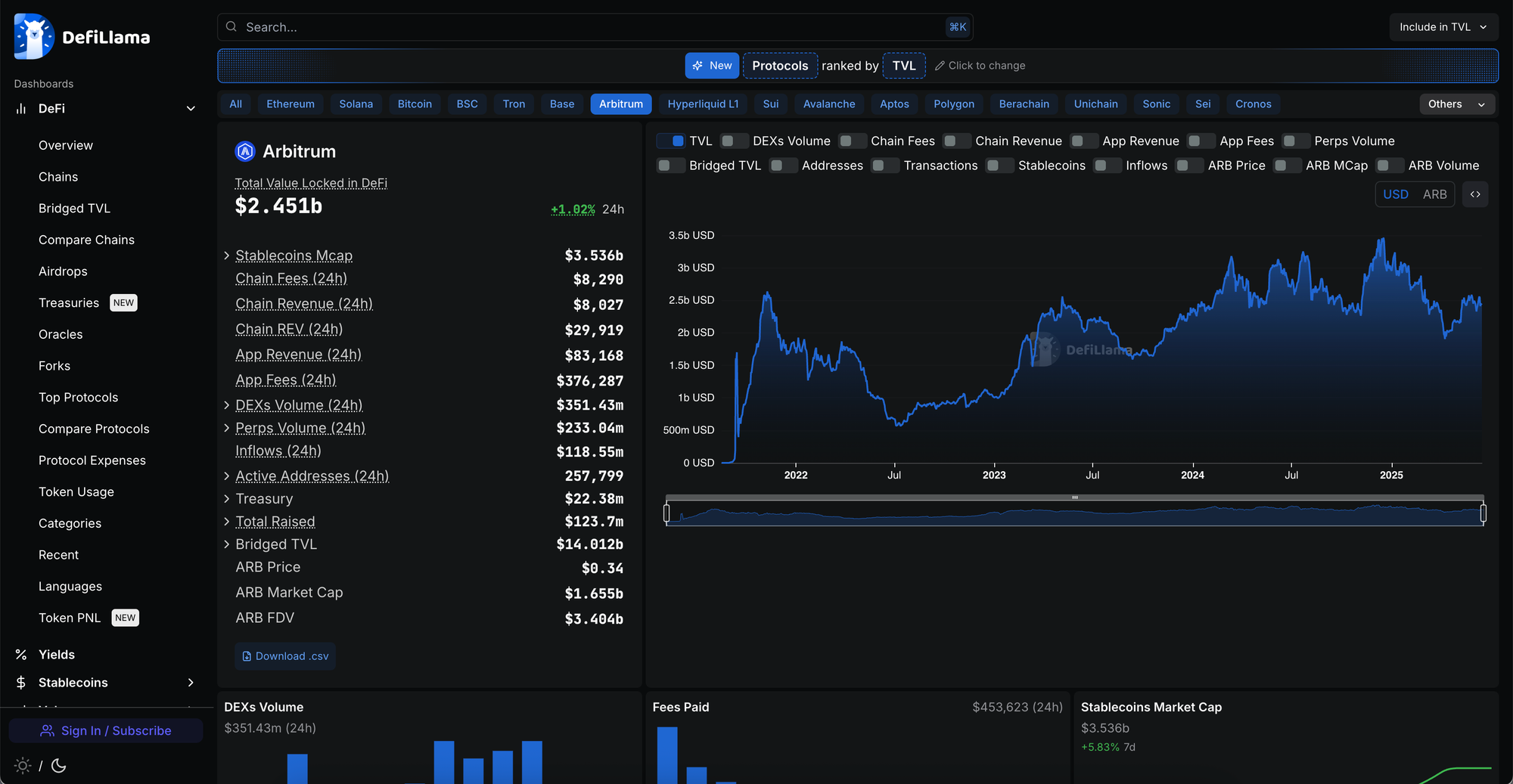

Importantly, these DeFi engagement incentives are not just theoretical. Recent data shows that protocols prioritizing consistent user rewards see higher retention and deeper community involvement compared to those relying on traditional, capital-weighted models. By focusing on metrics like daily active users, completed quests, and governance participation, platforms are able to identify and nurture their most valuable contributors, regardless of the size of their wallets.

One of the most compelling aspects of activity-based staking incentives is their role in mitigating short-term farming. When rewards are tied to ongoing behaviors instead of one-off deposits, the incentive for mercenary capital diminishes. This leads to a more stable Total Value Locked (TVL) and healthier protocol growth over time. The result? Protocols can weather market volatility with greater resilience, while users benefit from a more predictable and meaningful reward structure.

Practical Examples: Activity-Based DeFi Loyalty in Action

Top DeFi Protocols Using Non-Capital-Based Loyalty Pools (2025)

-

Alpha: Utilizes behavior-based, non-transferable loyalty points that reward users for consistent engagement and on-chain actions, not wallet size. Features gamified quests and achievements for deeper participation.

-

Cross-Chain Bridge: Distributes 70% of bridging fees as real yield to users participating in loyalty pools, with rewards based on consistent usage rather than capital deposited.

-

Galxe: Implements on-chain loyalty programs where users earn non-tradable points and NFT badges for completing regular tasks and quests across multiple DeFi platforms, emphasizing sustained engagement.

-

Layer3: Offers cross-protocol quests and achievement systems that reward users for ongoing activity and learning, rather than for the amount of capital they deploy.

-

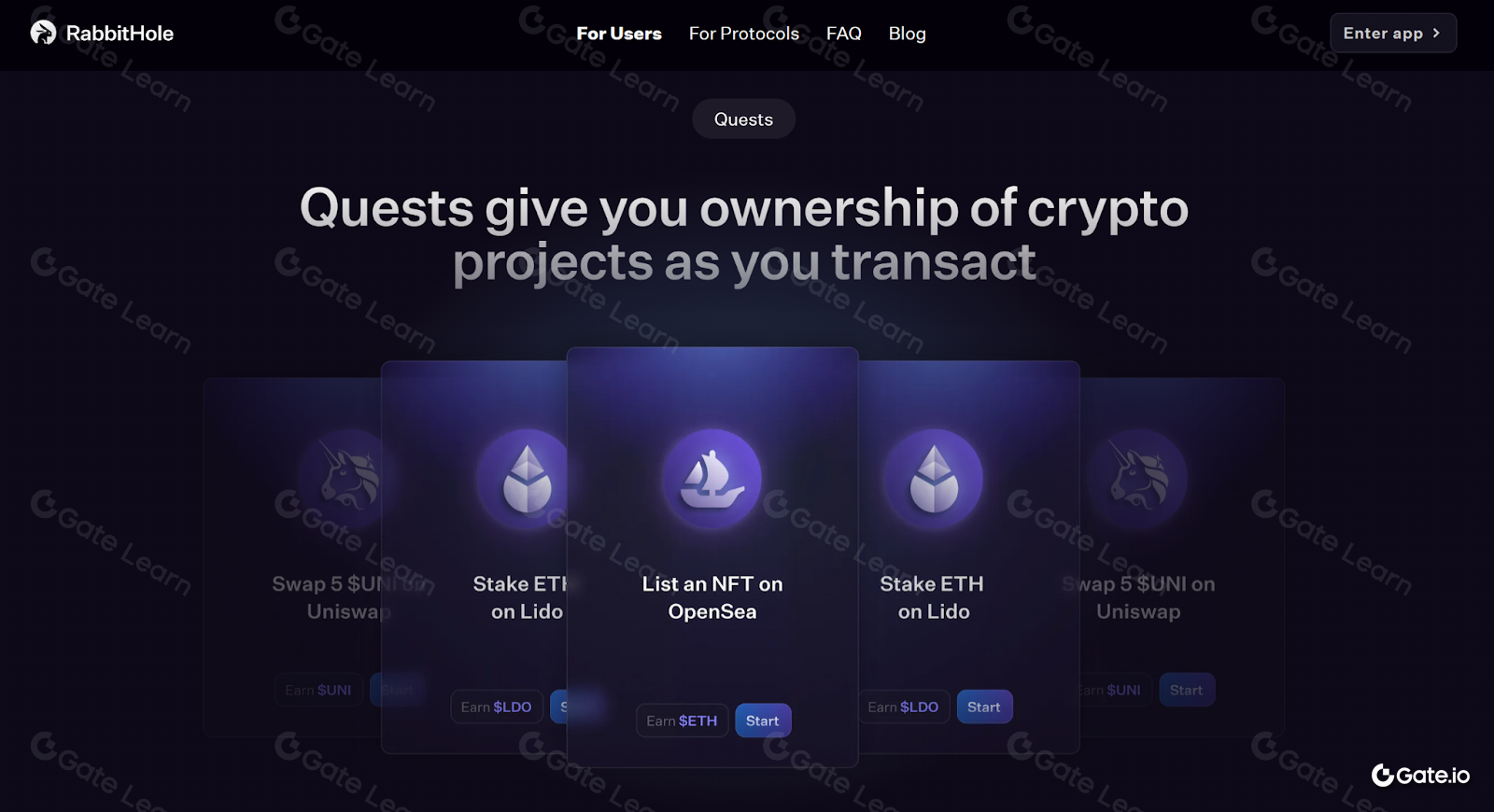

RabbitHole: Focuses on rewarding consistent participation in on-chain tasks and learning modules, issuing non-capital-based rewards such as NFT badges and platform points.

Consider the evolution seen at Alpha and Cross-Chain Bridge. Alpha’s quest-driven loyalty engine not only encourages regular engagement but also empowers users to shape their own reward journey, whether by completing governance tasks or participating in educational events. Meanwhile, Cross-Chain Bridge’s real-yield model distributes tangible value back to loyal users by allocating a significant portion of protocol revenue directly into reward pools. These examples demonstrate how consistent user rewards DeFi programs can be both sustainable for projects and genuinely rewarding for participants.

For crypto enthusiasts who may have felt sidelined by traditional staking models, this is a welcome change. Now, even those with modest holdings can compete on equal footing by demonstrating commitment and engagement over time. As composability becomes more widespread, expect loyalty points to function as interoperable assets, usable across diverse dApps and ecosystems for everything from fee discounts to exclusive governance rights.

Building Sustainable DeFi Communities

The broader implication is clear: on-chain loyalty pools are laying the groundwork for more inclusive, resilient digital communities. Instead of chasing fleeting whales or inflating token supplies, protocols can cultivate long-term relationships with users who actively contribute to platform health and innovation.

This approach doesn’t just benefit individual protocols; it strengthens the entire decentralized finance ecosystem by encouraging best practices around transparency, fair distribution, and active participation. For those eager to dive deeper into how these mechanisms boost user engagement at scale, our article on how On-Chain Loyalty Staking boosts user engagement in DeFi projects offers further insights.

The future of DeFi is not about who has the deepest pockets, it’s about who shows up consistently, contributes meaningfully, and helps build a better system for all participants. As we continue to refine these models and expand cross-platform interoperability, expect democratized rewards to become the norm rather than the exception.