Decentralized finance (DeFi) is in the midst of a fundamental shift. Gone are the days when simple, inflationary token rewards were enough to keep users engaged and loyal. Today, dual token reward systems are emerging as the new standard for on-chain loyalty staking, offering a more nuanced, sustainable, and user-centric approach to incentives. These mechanisms do more than just boost APRs; they reimagine how governance, utility, and community participation intersect in DeFi ecosystems.

Why Dual Token Rewards Are Gaining Traction

The concept is elegantly simple: instead of relying on a single token to fulfill every role within a protocol, dual token models separate utility from rewards or governance. This division solves some of the most persistent challenges in DeFi incentive models, namely runaway inflation, governance apathy, and short-term speculation.

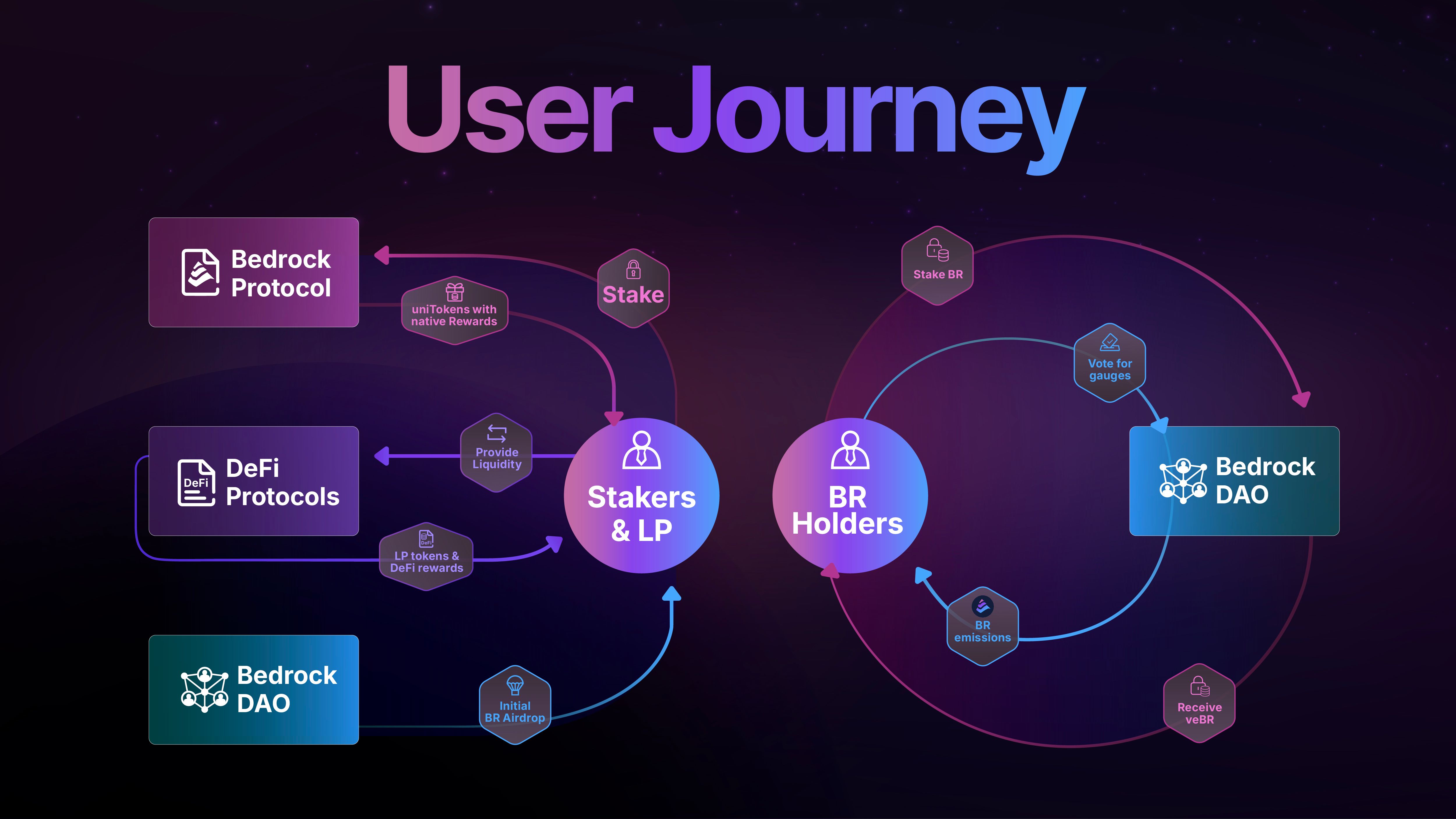

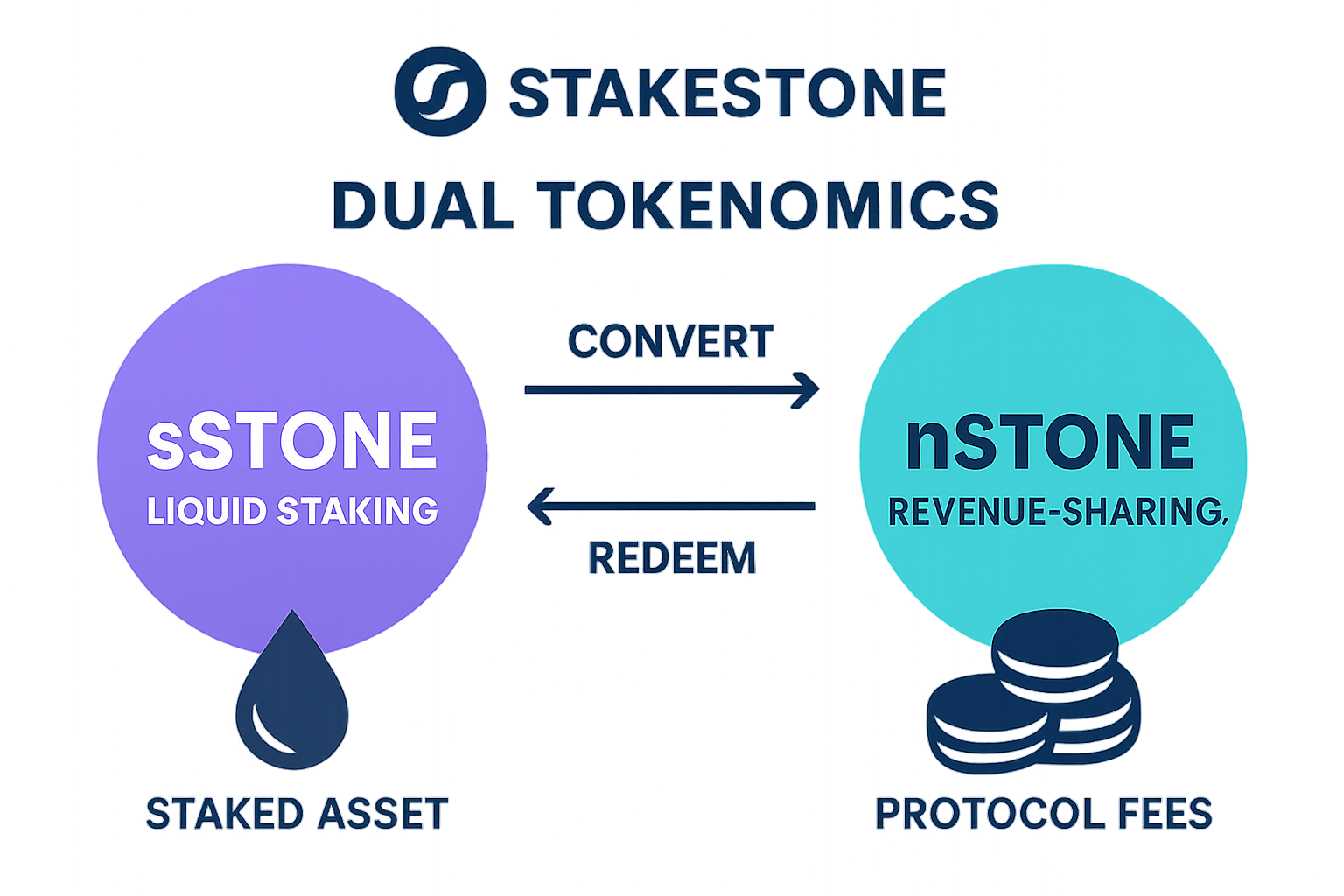

For example, protocols like StakeStone have introduced a dual-token structure with STO (utility/governance) and veSTO (dividend/reward). STO holders participate in governance and can earn rewards by locking their tokens for veSTO, which boosts yields and voting power. This creates an ecosystem where active participation is rewarded over mere speculation.

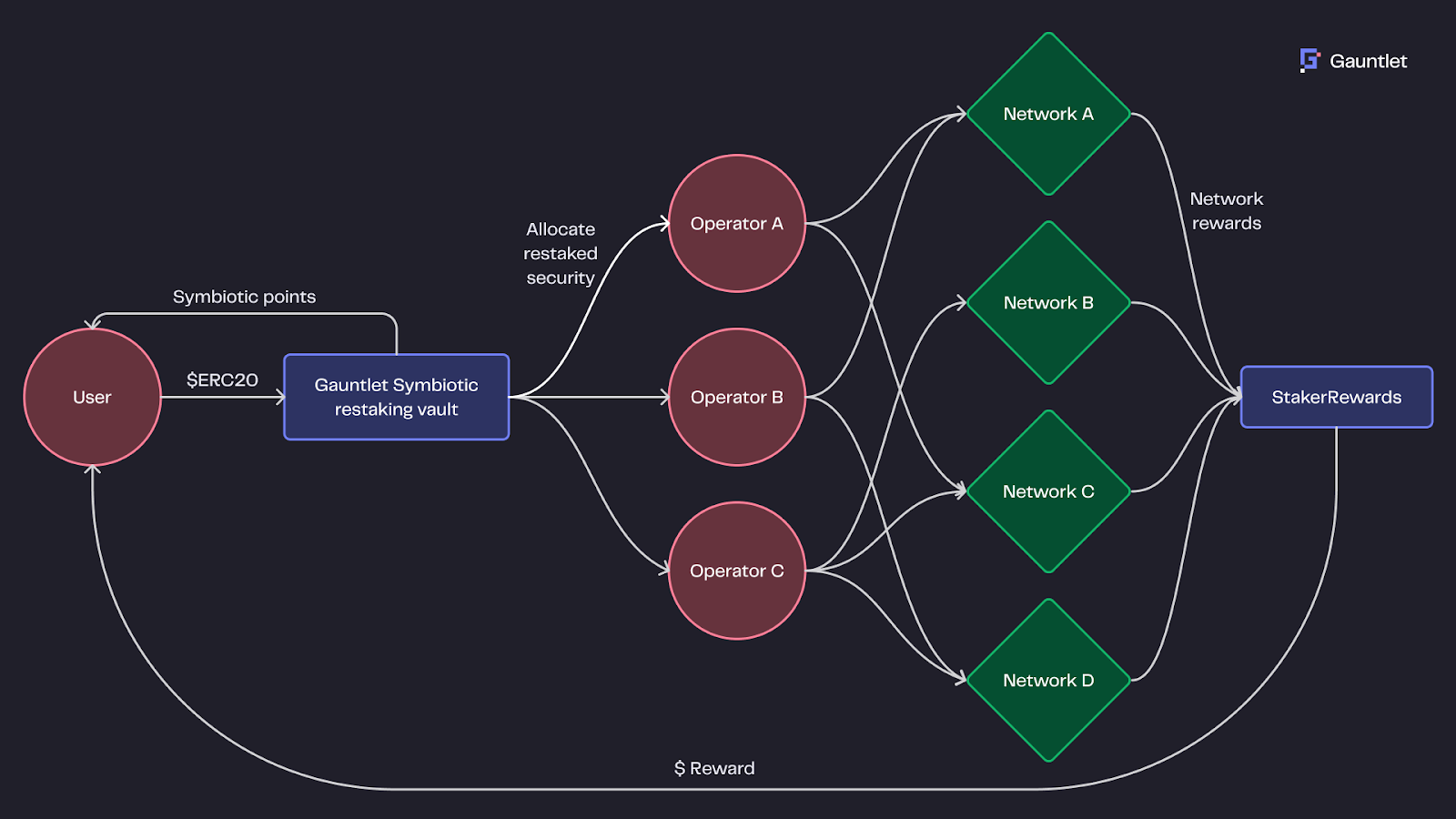

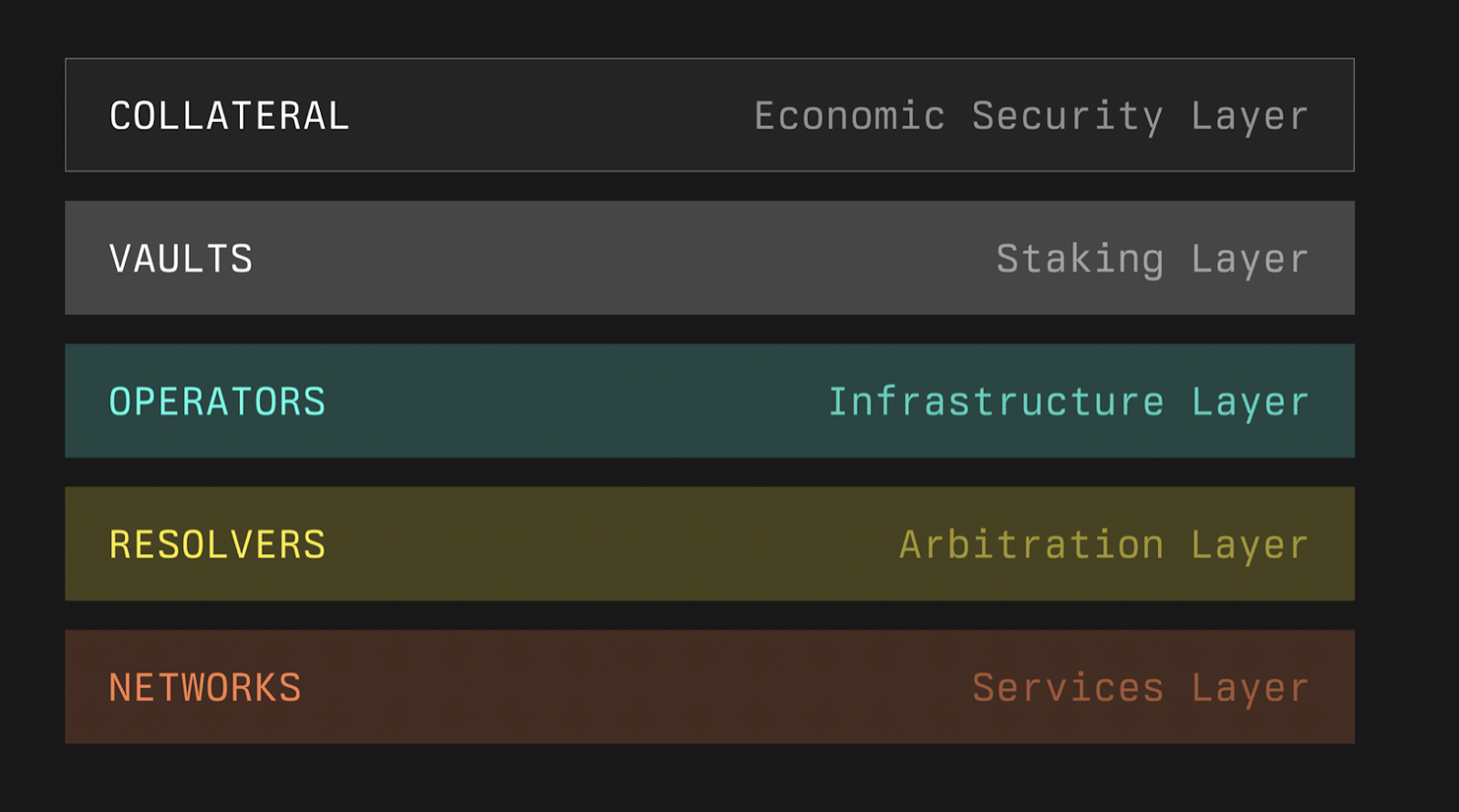

Similarly, Symbiotic’s External Rewards mechanism lets protocols distribute native tokens directly to stakers while also awarding Symbiotic Points, a precursor to their own ecosystem token. This hybrid approach streamlines decentralized security and aligns incentives across multiple networks without requiring each project to build custom staking infrastructure.

“Imagine rewarding users with not just one, but two distinct tokens. Governance tokens empower them to shape the platform’s future through voting. . . “

The Mechanics: How Dual Token Systems Work

At their core, these systems typically revolve around two distinct assets:

- Governance or Utility Token: Grants voting rights or access to protocol features, think of it as your membership card with real influence.

- Reward or Dividend Token: Distributed as staking yield or loyalty bonuses; often accrues value through protocol revenue or special events.

This separation allows protocols to fine-tune incentives. For instance, StakeStone’s deflationary mechanism requires other projects to purchase and burn STO for access to liquidity, directly tying ecosystem health to demand for the governance token. Meanwhile, users who lock STO for veSTO are rewarded with higher yields and increased say in protocol development.

The flexibility doesn’t stop there. Dual Finance’s Staking Options (SOs) introduce yet another layer by rewarding users with options rather than direct tokens, enabling creative applications in liquidity mining and loyalty lockups while reducing sell pressure on native assets.

Sustainable Tokenomics Meets Community Engagement

The biggest win for dual token reward systems? They align long-term interests between teams and users. By decoupling governance from rewards, protocols can foster deeper user engagement while mitigating inflationary risks that plagued earlier DeFi models. Users are incentivized not just to stake but also to participate actively in shaping the platform’s trajectory.

This evolution is reflected across top DeFi platforms heading into 2025, from eETH’s combination of staking rewards and loyalty points within a dual-token vault mechanism (read more here) to SushiSwap’s blend of $SUSHI incentives with partner tokens or NFTs. The message is clear: Diversified incentives create healthier ecosystems.

As dual token reward systems proliferate, the DeFi landscape is witnessing a renaissance in user loyalty and protocol sustainability. These models are not just theoretical improvements; they’re actively shaping user behavior and platform economics today. By offering distinct tokens for governance and rewards, protocols can calibrate incentives for both immediate participation and long-term commitment, reducing the churn that often plagues single-token systems.

Consider how Symbiotic’s External Rewards mechanism lets protocols distribute their native tokens alongside Symbiotic Points. This approach has proven especially effective for cross-chain projects seeking to unify incentives without fragmenting liquidity or overcomplicating staking flows. Meanwhile, StakeStone’s deflationary twist, requiring other projects to burn STO, ensures that governance tokens capture real value as the ecosystem expands.

Real-World Impact: What Users Are Experiencing

For users, the benefits are tangible. Stakers now enjoy:

Key Benefits of Dual Token Rewards for DeFi Stakers

-

Enhanced User Engagement: Dual token systems like Symbiotic combine native token rewards with loyalty points (e.g., Symbiotic Points), attracting and retaining stakers through diverse, layered incentives.

-

Sustainable Tokenomics: Platforms such as StakeStone separate utility and reward tokens (STO and veSTO), helping to manage inflation and align long-term incentives, which supports a healthier, more stable ecosystem.

-

Empowered Governance Participation: Utility tokens in dual systems often grant voting rights, as seen with StakeStone’s STO token, enabling stakers to influence protocol decisions and fostering decentralized governance.

-

Flexible and Customizable Rewards: Protocols like Dual Finance use staking options (SOs) to deliver rewards tailored to specific use cases, such as liquidity mining or loyalty lockups, increasing user choice and protocol adaptability.

-

Reduced Sell Pressure on Core Tokens: By distributing rewards in a secondary token or loyalty points, dual systems can minimize immediate sell pressure on the primary token, supporting price stability and long-term growth.

-

Interoperable and Liquid Staking Assets: Universal staking protocols like Symbiotic allow users to earn rewards across multiple networks, providing liquid restaked assets and enhancing flexibility for stakers.

Protocols like Dual Finance further innovate by rewarding users with options contracts rather than direct emissions, giving participants exposure to upside without flooding the market with new supply. This creative use of financial primitives is helping DeFi mature beyond speculation into robust, utility-driven ecosystems.

Transparency and flexibility are also taking center stage. With clear separation between governance and reward functions, users can make informed decisions about how deeply to engage, whether locking tokens for higher yields or actively voting on key proposals. This layered approach not only improves user experience but also builds trust in protocol mechanics.

The Road Ahead: What’s Next for On-Chain Loyalty Staking?

The momentum behind dual token reward systems shows no sign of slowing as we head deeper into 2025. Expect even more nuanced incentive structures, think loyalty NFTs tied to reward multipliers or cross-protocol partnerships where staked assets earn yields from multiple sources simultaneously. The integration of liquid staking derivatives and composable reward vaults will further blur the lines between staking, lending, and governance.

Ultimately, these innovations are empowering users to become true stakeholders rather than passive speculators. As more projects adopt dual token models, we’ll likely see increased experimentation with vesting schedules, dynamic yield curves, and gamified loyalty programs, all designed to foster enduring participation and vibrant communities.

If you’re looking to maximize your returns while supporting your favorite protocols, it’s time to explore platforms embracing this new wave of on-chain loyalty staking. The future belongs to those willing to engage, and dual token rewards are setting the standard for what sustainable DeFi looks like.