Bear markets are notorious for testing the patience and resolve of even the most seasoned crypto investors. While prices slide and trading volumes dry up, smart capital doesn’t sit idle. Instead, it goes to work through on-chain loyalty staking, a strategy that transforms dormant tokens into a source of consistent, passive crypto income, regardless of market sentiment.

Why Staking Outperforms HODLing in Bear Markets

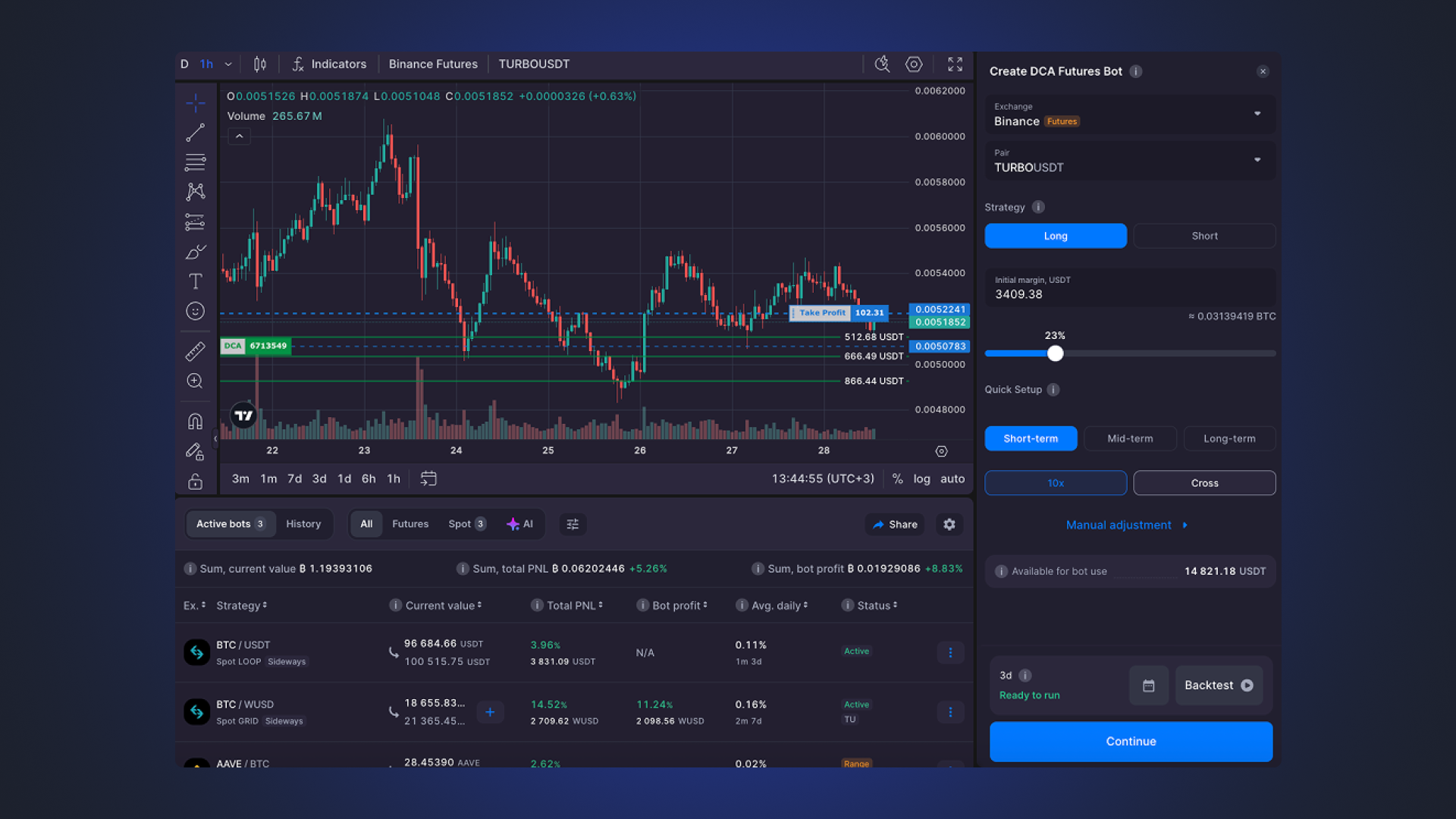

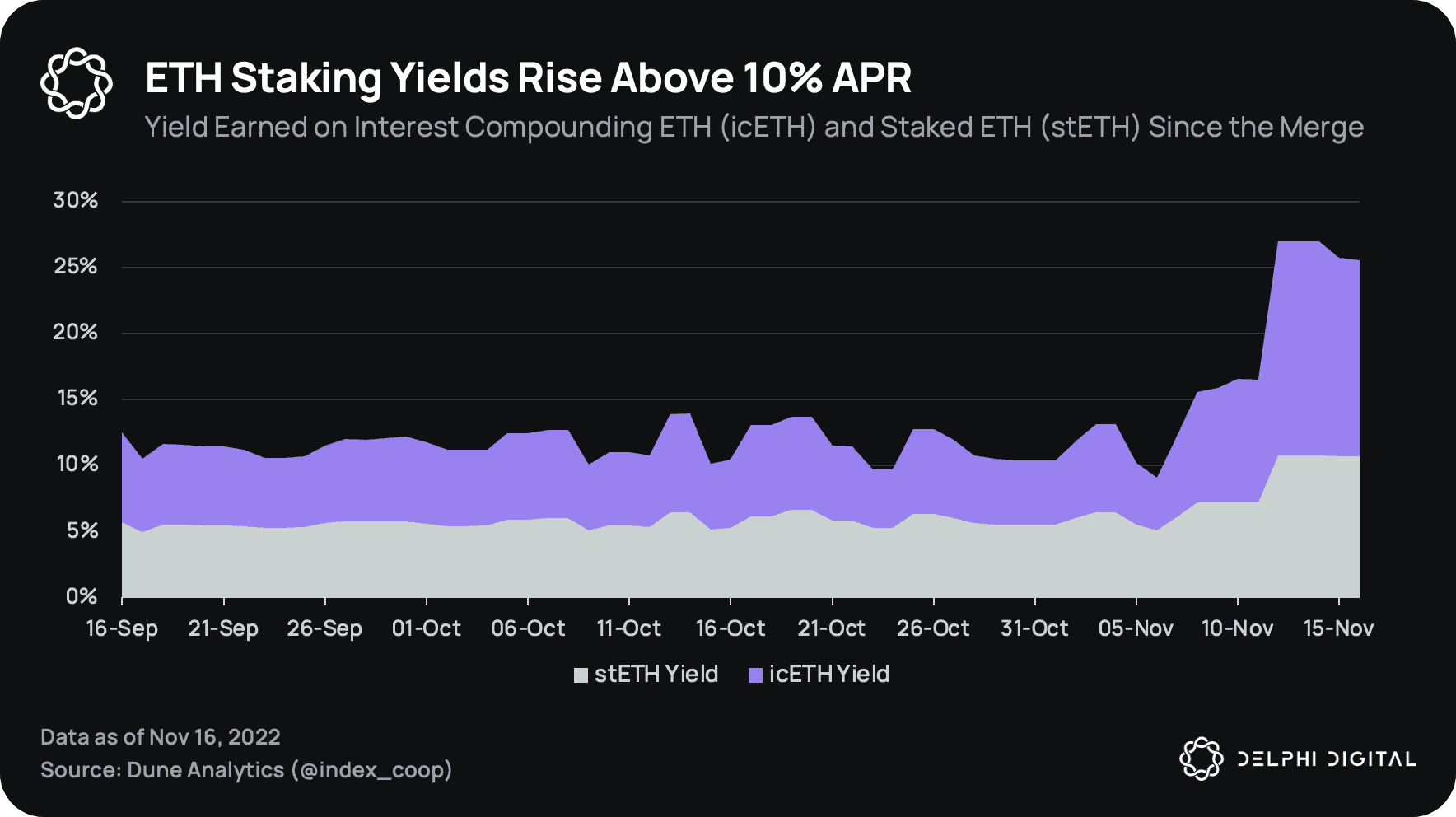

Let’s face it: simply holding your assets through a downturn can feel like watching paint dry as your portfolio value erodes. Staking flips this narrative by putting your tokens to productive use. Platforms like On-Chain Loyalty Staking offer APYs ranging from 5% to 15%, allowing you to earn new tokens even as the broader market cools off (see how DeFi enthusiasts maximize rewards).

This isn’t just about surviving the bear; it’s about compounding your future upside. By consistently reinvesting staking rewards, you harness the power of compound interest, a force that quietly snowballs your holdings over time. When the bulls return, stakers often find themselves holding significantly more tokens than those who simply waited on the sidelines.

The Mechanics: How On-Chain Loyalty Staking Works

On-chain loyalty staking involves locking up your digital assets within a blockchain network to support its security and operations. In return, you receive regular token-based incentives, essentially earning yield for being loyal to the protocol.

- Consistency: Unlike volatile trading strategies, staking delivers predictable returns that can help offset price declines during bearish phases.

- Ecosystem Impact: Your participation strengthens network security and decentralization, staking isn’t just passive profit; it’s active contribution.

- Loyalty Rewards: Many protocols now offer additional bonuses for long-term or early stakers, creating extra layers of incentive beyond base APY rates.

Battling Bearish Sentiment with Compounding Returns

The beauty of on-chain loyalty staking lies in its synergy with compounding returns. Every reward cycle presents an opportunity: automatically restake earned tokens and watch their impact multiply over time. This approach can dramatically boost your total holdings, even when token prices are flat or trending down.

If you’re using top platforms like Ethereum (ETH), Cardano (ADA), Solana (SOL), or Binance Coin (BNB), you’re not only earning but also positioning yourself for explosive gains when markets recover. The key is discipline: keep those rewards working for you instead of cashing out prematurely.

Curious about how these mechanisms empower NFT holders? Dive deeper into NFT-focused loyalty staking strategies here.

Mitigating Risk: What to Watch Out For

While staking is a game-changer for passive crypto income, it’s not without its trade-offs. Lock-up periods can limit your flexibility, especially if you need to react quickly to market shifts. Some protocols require assets to be staked for weeks or even months, which means you won’t be able to instantly liquidate if the market takes a sharp turn. That’s why it pays to research each staking platform’s terms and understand the liquidity profile before you commit.

Another factor: validator performance. If you’re delegating tokens, your rewards hinge on the reliability and honesty of third-party validators. Poor performance or misbehavior can eat into your returns. Choose platforms with robust validator vetting and transparent performance metrics, this is where on-chain analytics and community reputation become invaluable tools.

Maximizing Returns: Smart Strategies for Bear Markets

The most successful stakers take a proactive approach. Here are some dynamic strategies to help you squeeze maximum value from on-chain loyalty staking during downturns:

- Diversify Staked Assets: Don’t put all your eggs in one basket, stake across multiple top-performing networks like ETH, ADA, SOL, and BNB for risk-adjusted returns.

- Auto-Compound Rewards: Use platforms that support automatic compounding so your earnings grow exponentially without manual intervention.

- Monitor APY Fluctuations: Yields can change as more users stake or as network parameters shift. Stay agile and rebalance if better opportunities arise.

- Pounce on Loyalty Bonuses: Many DeFi projects offer extra incentives for long-term or early stakers, these bonuses can significantly boost your overall yield.

Why Bear Markets Are Prime Time for Loyalty Staking

Bull markets get all the headlines, but bear phases are where disciplined investors quietly stack their bags. By staking during periods of low sentiment, you accumulate more tokens at lower opportunity costs, and often benefit from less competition for protocol rewards. When momentum shifts and prices rebound, those who staked through the storm are best positioned to capitalize.

The bottom line? On-chain loyalty staking isn’t just about weathering downturns, it’s about turning them into an advantage. With smart strategy and a focus on secure platforms, you earn consistent passive crypto income while supporting network health. And when the next bull run arrives, those compounded rewards could deliver serious alpha compared to passive HODLers or sidelined traders.

If you want to explore how these concepts apply specifically to DeFi power users and community leaders, check out our insights on maximizing DeFi rewards for top crypto community members.