Decentralized finance has always thrived on innovation. In 2025, the emergence of social staking platforms like StakerDotFun is redefining what loyalty means in DeFi. By blending token-based incentives with social engagement, these platforms are unlocking new levels of user participation and retention that go far beyond traditional yield farming.

The Evolution: From Liquid Staking to On-Chain Social Engagement

Historically, DeFi staking revolved around financial rewards. Platforms such as Lido and Ankr pioneered liquid staking tokens (LSTs), allowing users to earn staking rewards while maintaining liquidity for use in other protocols. This model catalyzed a surge in DeFi activity by making capital more efficient and flexible, as detailed in recent analyses from sources like Calibraint and Milk Road.

But as competition intensified, platforms began searching for ways to build deeper relationships with their communities. Enter social staking: a paradigm where users lock tokens not only for APY but also to access exclusive content, participate in governance, or elevate their reputation within a project’s ecosystem. StakerDotFun exemplifies this movement by fusing financial incentives with on-chain social engagement mechanisms.

What Sets Social Staking Platforms Apart?

Social staking platforms are more than just places to park your assets. They’re vibrant ecosystems where loyalty is multidimensional:

Top Features Distinguishing Social Staking Platforms

-

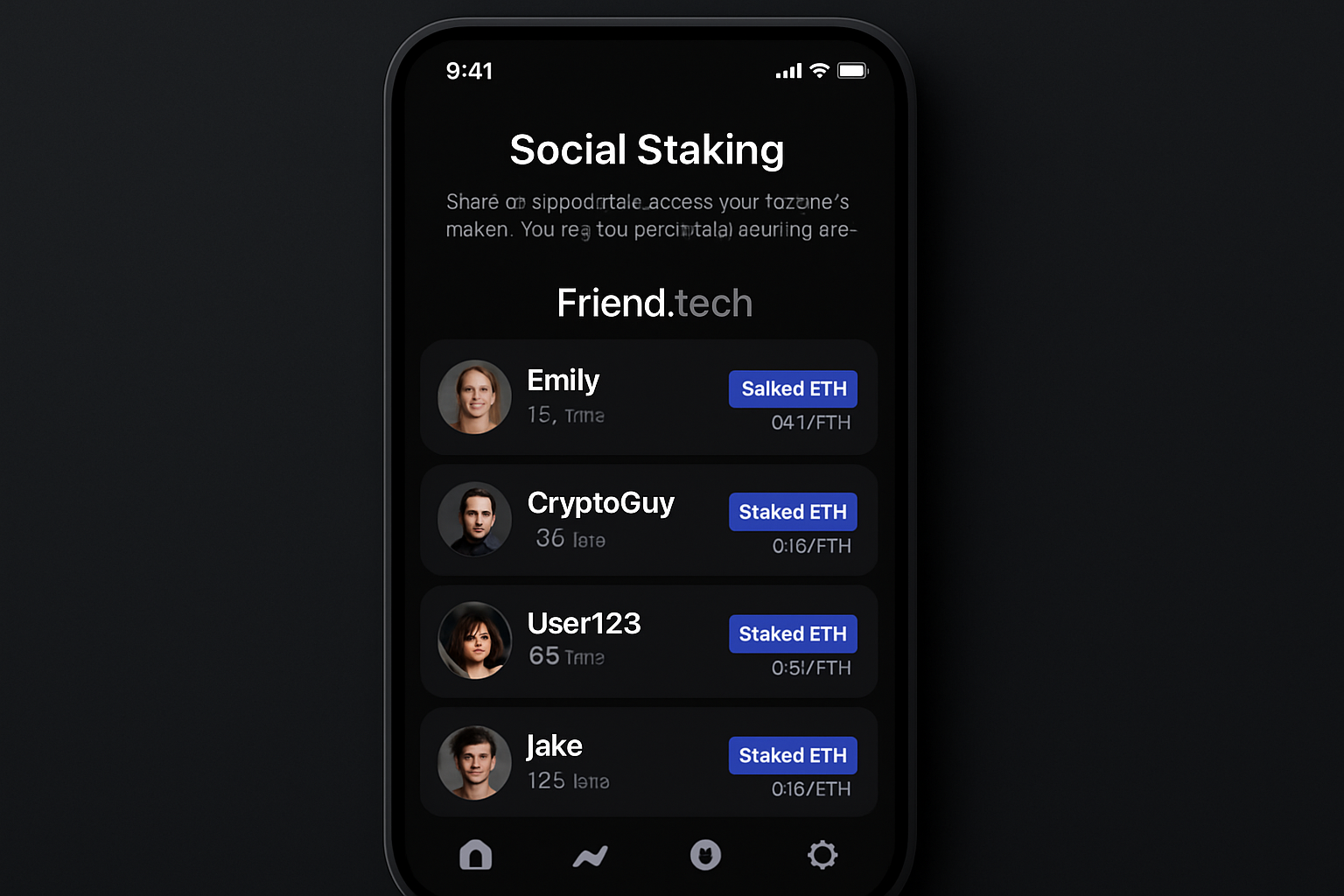

Integrated Social Engagement: Platforms like Friend.tech let users stake tokens to unlock exclusive content, events, and direct creator interactions, merging financial incentives with vibrant community participation.

-

Liquid Staking Flexibility: Solutions such as Lido and EigenLayer issue liquid staking tokens (LSTs), allowing users to earn staking rewards while retaining the ability to use their assets across DeFi protocols.

-

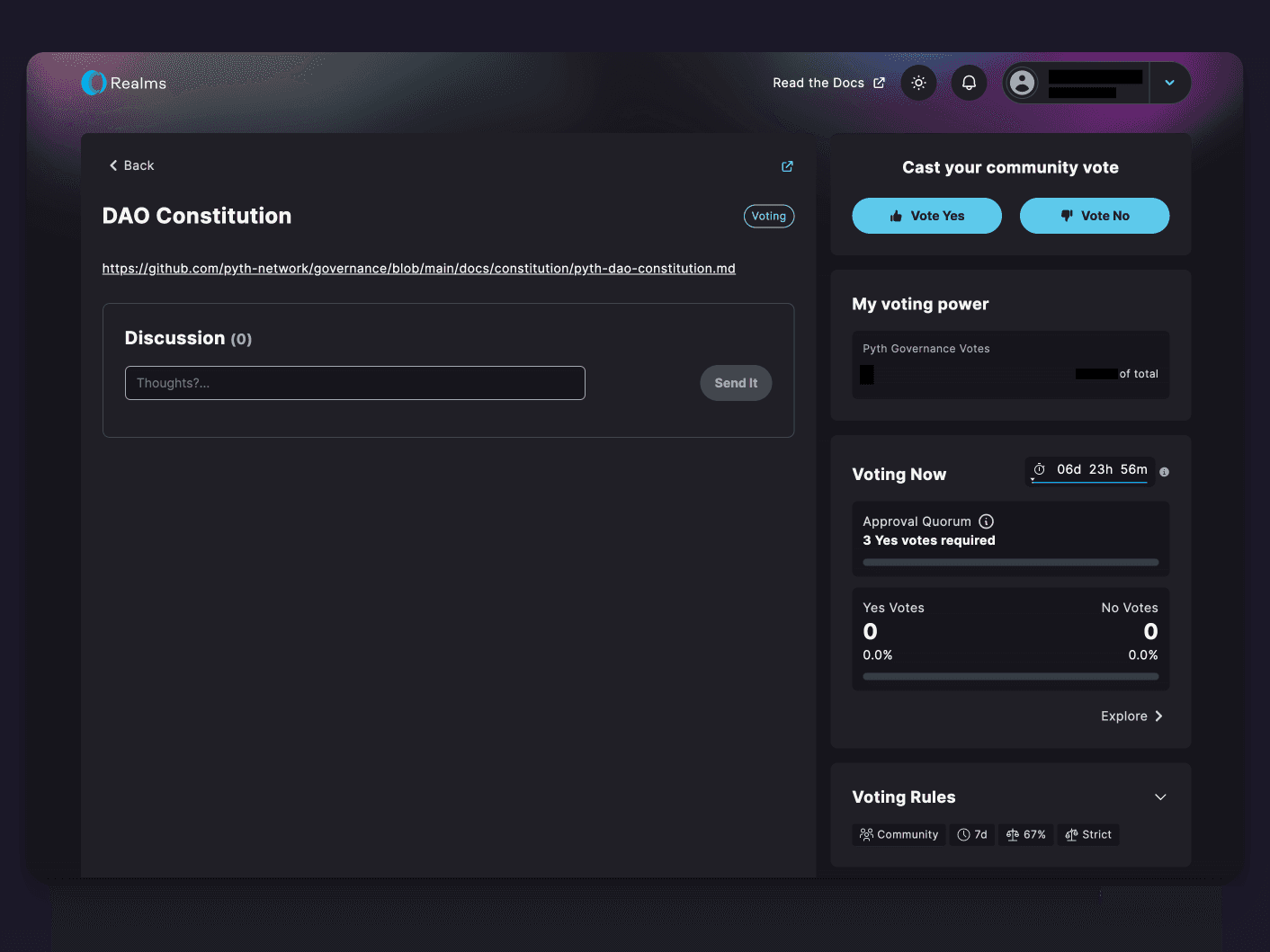

Community-Driven Governance: Social staking platforms empower users to participate in protocol governance, giving stakers voting rights on key decisions and fostering a sense of ownership within the ecosystem.

-

Exclusive Access & Social Capital: By staking tokens, users gain access to private groups, communication channels, or early product releases, building social capital and deeper loyalty—an approach pioneered by platforms like Friend.tech.

-

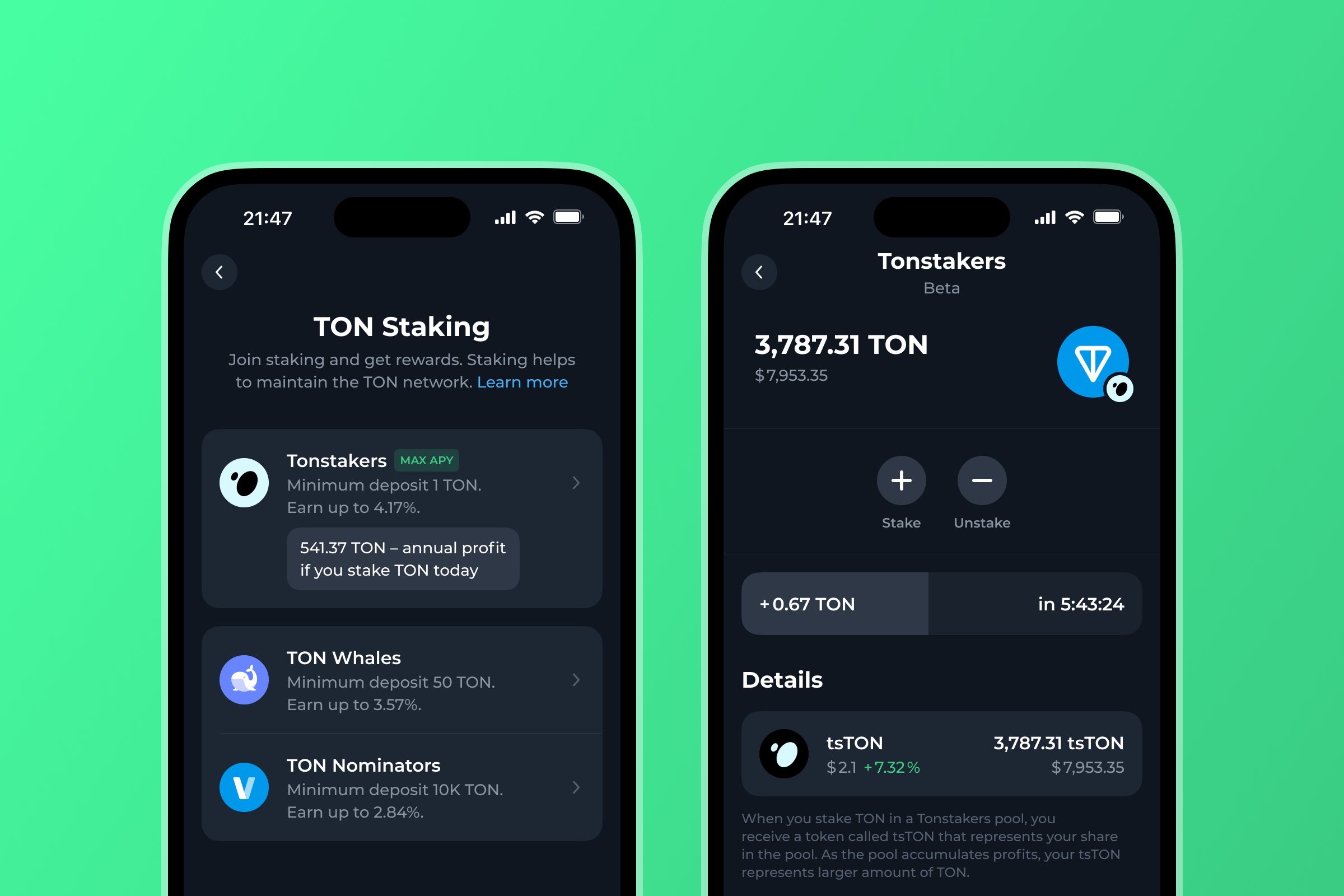

Non-Custodial Staking Options: Platforms such as Tonstakers on The Open Network (TON) offer non-custodial staking, letting users retain control of their assets while earning rewards and receiving liquid tokens like tsTON.

This hybrid model addresses two critical challenges facing DeFi today: user churn and shallow engagement. By rewarding both financial commitment and community participation, platforms like StakerDotFun create powerful network effects that benefit projects and users alike.

Case Study: How StakerDotFun Is Leading the Charge

StakerDotFun stands out by integrating staking mechanics with exclusive access privileges. Users can lock tokens not only to earn competitive rewards but also to unlock gated content, participate in exclusive events, or acquire voting rights within the community. This approach borrows from models seen on Friend. tech and extends them with robust DeFi infrastructure.

The platform’s seamless interface allows users to stake tokens, receive liquid representations for use elsewhere in DeFi, and simultaneously build their standing within the project’s ecosystem. It’s a win-win scenario that aligns incentives across all stakeholders.

“We’re seeing a shift from passive yield farming to active community building, ” notes one industry analyst. “Social staking gives users skin in the game beyond just financial returns. ”

The Expanding Universe of Liquid Staking Tokens (LSTs)

The integration of LSTs remains central to this evolution. By issuing liquid representations of staked assets – like tsTON on Tonstakers – users retain flexibility while maximizing their earning potential across multiple protocols. This composability is what enables seamless movement between financial incentives and social capital accumulation.

Unlike earlier iterations of DeFi, where staking was largely a solitary and transactional activity, social staking platforms foster ongoing participation and community-driven value creation. The ability to use liquid staking tokens (LSTs) in governance, access exclusive channels, or even influence platform development is transforming passive holders into active stakeholders. This shift is not just theoretical – it’s evident in the surging engagement metrics and retention rates reported by leading platforms.

Why DeFi Loyalty Rewards Are Stronger Than Ever

The next wave of DeFi loyalty rewards is about more than just high annual percentage yields. Social staking platforms like StakerDotFun are pioneering mechanisms that reward users for a spectrum of actions: from voting on proposals to contributing content or referring new participants. This multidimensional approach deepens user commitment and drives organic growth.

For projects, this means a more resilient user base and stronger network effects. For users, it’s an opportunity to leverage both financial and social capital for outsized returns. The result? A virtuous cycle where loyalty is continually reinforced through on-chain activity.

Consider also the composability of these systems: LSTs earned on one platform can often be utilized across the broader DeFi ecosystem, compounding yields and expanding utility. This interoperability enhances the attractiveness of participating in social staking programs versus traditional lock-up models.

Risks and Considerations

No innovation comes without its challenges. While liquid staking tokens have improved capital efficiency, they introduce smart contract risk and potential exposure to underlying protocol vulnerabilities. Users must also be aware that social staking models may require greater diligence regarding governance processes and community dynamics.

Nevertheless, established protocols like Lido, Tonstakers, and StakerDotFun continue to invest heavily in security audits and transparent governance frameworks – a trend likely to accelerate as competition heats up.

What’s Next for On-Chain Social Engagement?

The convergence of DeFi incentives with on-chain social engagement signals a new phase for blockchain communities. Expect further integration with NFT-based access passes, tiered rewards structures, and cross-platform loyalty programs that blur the lines between finance, entertainment, and digital identity.

“The future of DeFi loyalty isn’t just about APY – it’s about building lasting relationships between protocols and their users, ” says a prominent DeFi strategist.

If you’re seeking more than just yield from your crypto holdings – if you want influence within your favorite projects or access to unique experiences – social staking platforms represent the cutting edge. Platforms like StakerDotFun are not only maximizing returns but also redefining what it means to be loyal in decentralized finance.