In 2025, NFT holders are discovering a powerful way to turn their digital collectibles into income-generating assets through on-chain loyalty staking NFTs. Imagine staking your prized Moriusa NFTs not just to hold value, but to rack up loyalty points, exclusive badges, and hourly rewards that deepen your ties to the community. This isn’t some fleeting airdrop; it’s a sustainable DeFi mechanism rewarding commitment, much like the innovative vaults on Yay! Dashboard. As projects like Moriusa lead the charge, NFT staking loyalty points are becoming the gold standard for engagement in the blockchain space.

Why On-Chain Loyalty Staking Transforms NFT Ownership

Traditional NFT holding often feels passive, a bet on future flips or cultural hype. But on-chain loyalty staking flips the script by layering DeFi incentives atop your NFTs. Holders lock in their assets on secure, audited smart contracts, earning tokens or points proportional to stake size and duration. This creates NFT staking loyalty points systems that mimic elite membership clubs: the longer you stay, the richer the perks.

Take the broader DeFi landscape in 2025. Platforms like Lido Finance and EigenLayer dominate liquid staking for tokens, but NFT-specific vaults are the next frontier. They blend scarcity with utility, turning one-of-a-kind art into yield-bearing badges. I see this as a game-changer for collectors; it’s not about selling at peaks anymore, but building lasting value through participation.

Key Benefits of NFT Loyalty Staking

-

Flexible No-Lock Periods: Stake and unstake NFTs anytime without penalties, as offered by Moriusa on Yay! Dashboard.

-

Hourly Rewards: Earn Yay! Gold and Moriusa Loyalty Points every hour based on staked NFTs for steady passive income.

-

Triple Bonuses for Rare NFTs: Get 3x Moriusa Loyalty Points for top 51 rare NFTs ranked on OpenSea.

-

Audited Security on Ethereum: Smart contracts audited by Beosin on Ethereum Mainnet ensure safe, reliable staking.

These mechanics encourage holders to think long-term. In my experience managing portfolios, such strategies outperform spot trading by fostering genuine community alignment. Projects gain loyal advocates, while you pocket rewards without selling your soul collection.

Moriusa NFT Staking Rewards: The Blueprint for 2025

Moriusa set a benchmark on September 16,2025, launching the first NFT staking vault on Yay! Dashboard. Ethereum Mainnet users can now stake their Moriusa NFTs with zero lock-in, unstaking anytime for ultimate flexibility. Audited by Beosin, the contracts prioritize security, a non-negotiable in today’s DeFi world.

Rewards flow hourly: Yay! Gold scales with staked NFT count, while Moriusa Loyalty Points appear in your Assets and Points tab. The real kicker? Rare NFTs, those top-51 ranked on OpenSea, snag a 3x loyalty points bonus. Check the collection page to spot eligibles; it’s like wearing a VIP badge that pays dividends.

This Moriusa NFT staking rewards model exemplifies how on-chain loyalty staking empowers NFT holders. Holders aren’t just spectators; they’re active earners, boosting project vitality while padding their wallets.

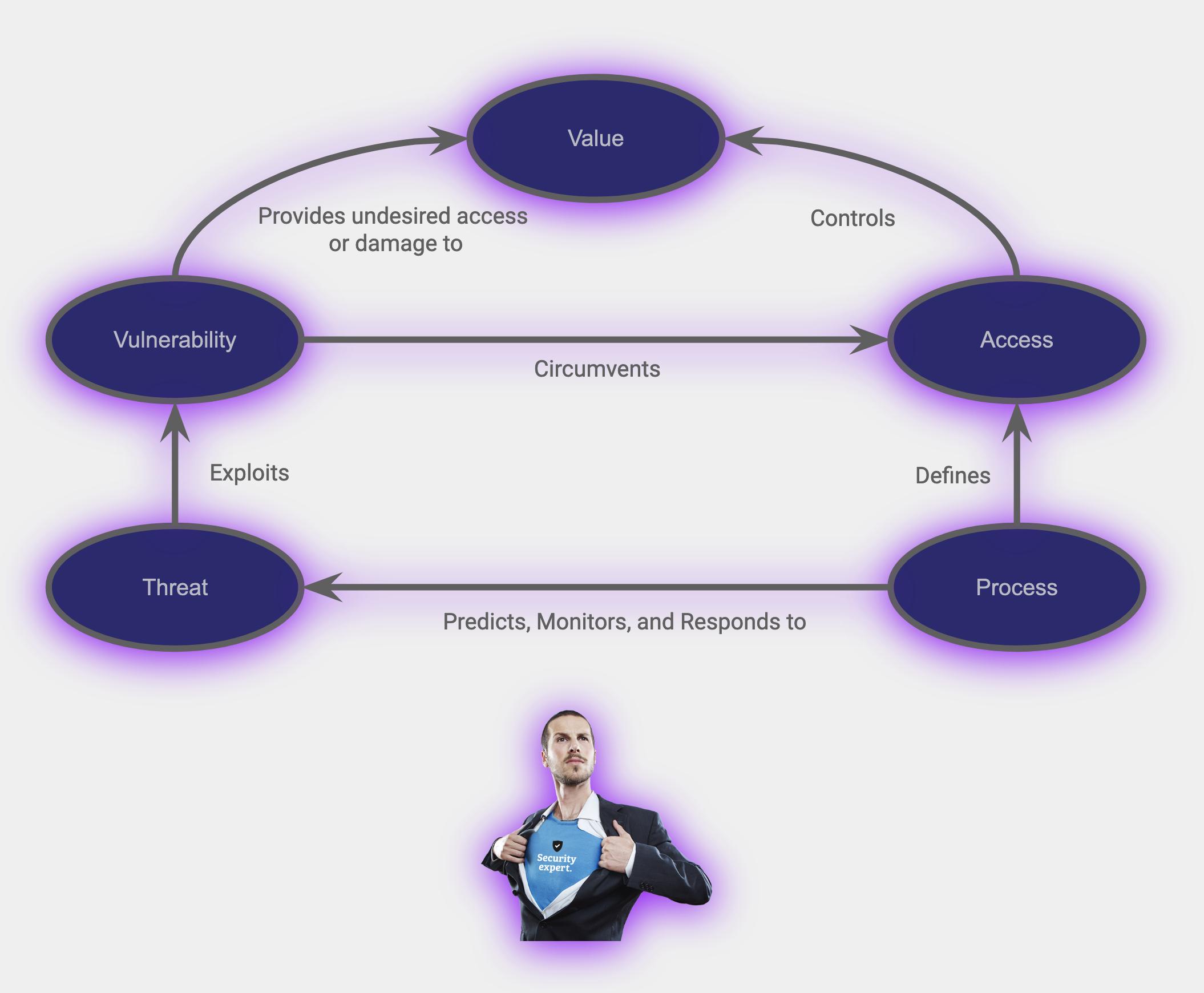

Mechanics and Incentives Driving DeFi Loyalty Badges Staking

At its core, DeFi loyalty badges staking leverages smart contracts to track stake time and rarity. Stake multiple NFTs for compounded hourly drips, viewable in real-time dashboards. No more opaque point systems; everything’s transparent on-chain.

Moriusa’s approach mirrors rising trends. Nearby, Moca Network’s MocaPortfolio, backed by Animoca Brands, allocates $20 million in tokens to MOCA Coin and Mocaverse holders. Q4 2025 kicks off with Magic Eden token drops, vesting for sustained gains. These aren’t gimmicks; they’re engineered to reward early, consistent participants.

From my vantage as a blockchain educator, this shift personalizes crypto. Badges evolve into governance keys or access passes, far beyond points. Stake your NFT, earn a badge signaling elite status, and unlock ecosystem exclusives. It’s inclusive finance at work: newcomers stake small, veterans scale up, all thriving together. As 2025 DeFi platforms like Pendle and Ether. fi evolve, expect NFT loyalty to integrate deeper, maximizing returns for savvy holders.

Projects thrive when holders commit, and these staking vaults prove it. Dive into one, and you’ll see your portfolio pulse with new life.

Ready to stake? The beauty lies in simplicity, yet the rewards compound with intention. Let’s break down the NFT staking loyalty points process using Moriusa as our guide, then compare it against the 2025 DeFi landscape.

Stake Your NFTs Like a Pro: Moriusa on Yay! Dashboard

Once staked, your dashboard lights up with real-time metrics. Track Moriusa NFT staking rewards accruing hourly, and if you’ve got a rare top-51 OpenSea piece, watch those points triple. This frictionless entry lowers barriers for newcomers, while pros layer strategies across vaults. In my portfolio work, I’ve seen holders double effective yields by rotating rares strategically, all without impermanent loss headaches.

Security stands out too. Beosin audits mean exploits are history; Ethereum Mainnet adds liquidity and trust. Pair this with broader DeFi tools like Pendle for yield trading or EigenLayer for restaking, and your NFTs become portfolio anchors, not sidekicks.

| Platform | Asset Type | Rewards | Lock-in | Bonus Features |

|---|---|---|---|---|

| Moriusa on Yay! | NFTs | Hourly Yay! Gold and Loyalty Points | None | 3x for top-51 rares |

| MocaPortfolio | MOCA Coin/Mocaverse NFTs | $20M token allocations (e. g. , ME) | Vesting | Animoca-backed exclusives |

| Lido Finance | ETH/Tokens | Liquid staking derivatives | Flexible | High liquidity |

| EigenLayer | Restaked ETH | AVS points and yields | Variable | Actively validated services |

This snapshot shows Moriusa’s edge in NFT-specific perks, outshining token-heavy giants with gamified bonuses. Yet integration is key; forward-thinking projects blend these for hybrid plays.

Risks, Rewards, and Maximizing DeFi Loyalty Badges Staking for NFT Holders

| Category (Risks/Rewards/Maximizing) | Details | Examples (Moriusa-focused) |

|---|---|---|

| ⚠️ **Risks** | Smart contract bugs can lead to losses, though **audits minimize** risks | Moriusa staking audited by Beosin for security on Ethereum Mainnet |

| ⚠️ **Risks** | Opportunity costs from staking (e.g., missing NFT floor dips or trades) | Staked Moriusa NFTs unavailable for quick flips if floor price dips |

| 🏆 **Rewards** | **Loyalty badges** unlock airdrops, governance votes, exclusive merch | Moriusa **Loyalty Points** for community perks and tighter engagement |

| 🏆 **Rewards** | Points earn event access, foster stronger communities | Hourly **Yay! Gold** + **Moriusa Loyalty Points**; 3x bonus for top 51 rare NFTs on OpenSea |

| 🚀 **Maximizing** | Diversify across protocols & stake long-term holds | Combine Moriusa flexible staking with other NFT loyalty programs like MocaPortfolio |

| 🚀 **Maximizing** | Follow 2025 trends: Ether.fi fluid positions, OSMO high APRs | Pair Moriusa no-lock-in staking with Ether.fi liquid positions for optimal yields |

| 🚀 **Maximizing** | Position for Q4 surges (e.g., Moca ME token drop via allocations) | MocaPortfolio’s $20M token pool for Mocaverse NFT holders, first event Q4 2025 |

| 💡 **11-Year Finance Insight** | Prioritize audited, flexible **DeFi Loyalty Badges Staking** for outperformance in volatile markets | Moriusa’s hourly rewards + no-lock-in exemplify sustainable gains over short-term hype |

On-Chain Loyalty Staking embodies this future, offering vaults tailored for NFT enthusiasts. Stake your collection, earn points that evolve into badges of honor, and watch engagement – yours and the project’s – skyrocket. Your NFTs deserve more than a wallet slumber; put them to work in 2025’s loyalty revolution.