In the rapidly evolving world of decentralized finance, on-chain loyalty staking is emerging as a transformative force. By blending transparent blockchain mechanics with gamified incentives, DeFi platforms are not just rewarding users for their participation, they’re fundamentally reshaping how loyalty and engagement are cultivated. The era of passive staking is giving way to dynamic, interactive systems where loyalty is measured not only by capital but also by active involvement and community contribution.

Gamified Incentives: The Engine Behind DeFi User Engagement

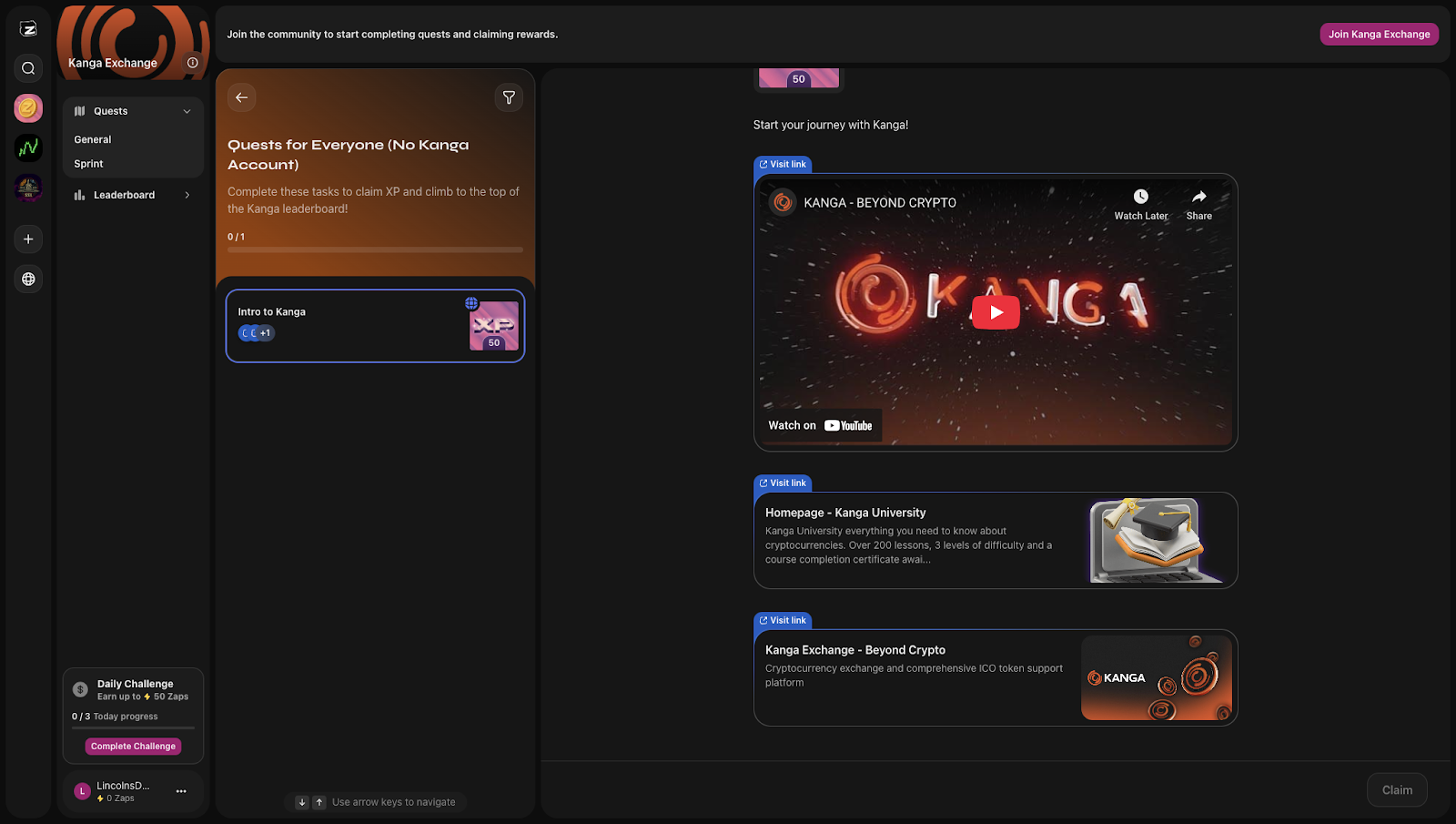

Traditional staking models have long attracted users seeking yield, but the latest wave of DeFi gamified incentives goes far beyond simple token rewards. Platforms are now integrating features like XP multipliers, interactive quests, and tiered bonuses to create a more immersive experience. For example, the recent $HOME staking upgrade offers a 50% bonus for early participants, coupled with 3x XP multipliers and accelerated bonus unlocks, a clear signal that user retention is now driven by both financial upside and engaging gameplay mechanics.

The heart of on-chain loyalty staking lies in its ability to turn every interaction into an opportunity for growth and recognition.

This shift is mirrored across the industry: DeFi Land’s single-sided staking provides per-second rewards claimable weekly, while DeFcor’s points system incentivizes longer commitments with escalating multipliers. These innovations ensure that loyalty isn’t just rewarded, it’s celebrated and amplified through transparent, on-chain mechanisms.

How Gamification Maximizes Rewards in On-Chain Loyalty Staking

The introduction of game-like elements into DeFi staking achieves several critical outcomes for both platforms and users:

Key Benefits of Gamified Incentives in On-Chain Loyalty Staking

-

Enhanced User Engagement: Gamification introduces interactive elements such as XP systems, quests, and leaderboards, making staking more enjoyable and motivating users to participate actively. Platforms like DeFcor report increased retention as users strive to earn rewards and recognition.

-

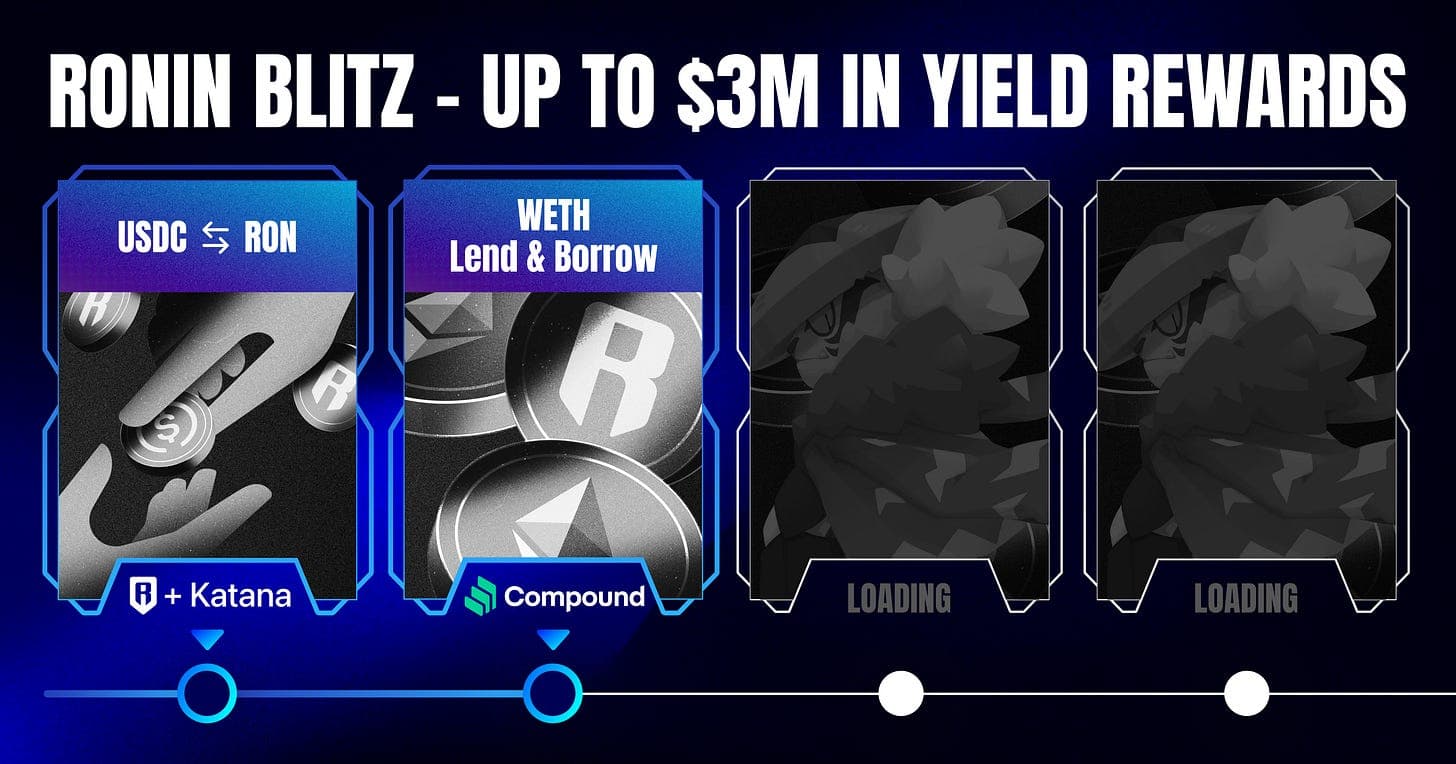

Increased Liquidity and Ecosystem Stability: Game-like challenges and tiered rewards, as seen on DeFi Land, incentivize users to lock tokens for longer periods. This boosts liquidity pools, stabilizing the DeFi platform and supporting higher APYs for committed participants.

-

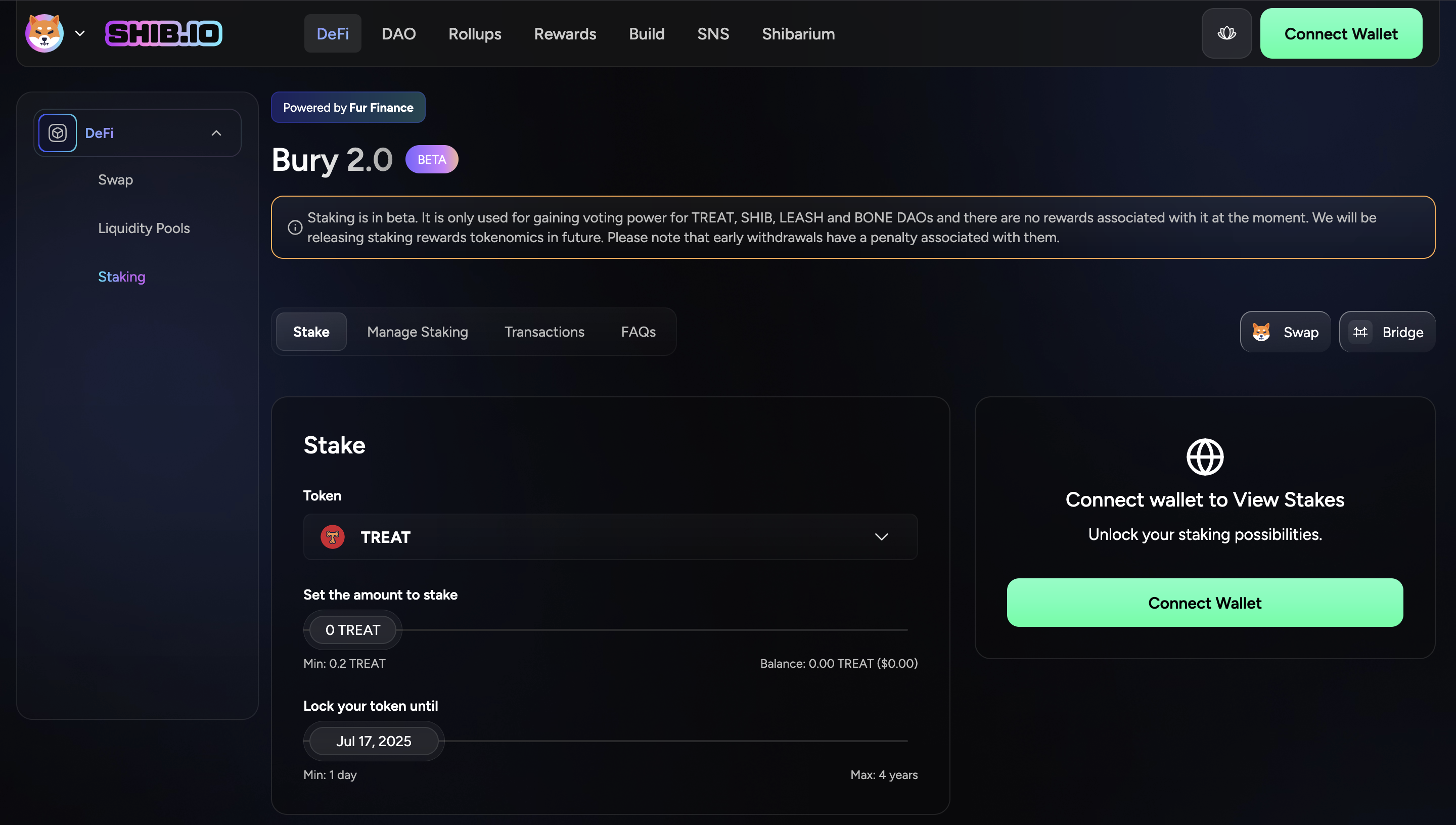

Long-Term Commitment and Loyalty: Dynamic staking programs with escalating rewards—such as higher multipliers or exclusive NFTs for longer lock-ups—encourage users to remain invested. Ethereum 2.0‘s high staking participation rate demonstrates the effectiveness of these loyalty incentives.

-

Flexible and Diverse Reward Structures: Gamified DeFi platforms offer a range of incentives, from token bonuses (like the $HOME 50% bonus) to XP multipliers and unique NFTs. This flexibility appeals to a broader user base, allowing participants to choose rewards that best fit their goals.

Enhanced user engagement is perhaps the most visible result, platforms report up to 35% higher retention rates when quests, leaderboards, or social challenges are introduced. Instead of simply locking tokens for APY, users become active participants in a broader ecosystem. For instance, completing specific quests or referring friends can unlock unique NFTs or grant access to exclusive governance proposals.

Increased liquidity follows naturally as more users compete for top-tier rewards or rare digital assets. Longer lock-up periods become attractive when paired with escalating APYs or bonus structures that reward patience and sustained involvement. Notably, Ethereum 2.0’s model has seen over 65% participation rates thanks to its progressive reward structure for long-term stakers.

The Mechanics Behind Staking XP Rewards and Token Bonuses

At the core of these innovations are robust staking rewards mechanics. Users accumulate XP (experience points) by performing actions such as providing liquidity, voting in governance polls, or holding tokens over specific durations. These points often scale dynamically, the longer you stake or the more you engage with platform activities, the greater your multiplier becomes.

This approach isn’t just about maximizing yield; it’s about fostering a sense of progression akin to leveling up in a game. As users amass XP or complete milestone quests, they climb reward tiers that might grant higher APYs, exclusive token drops, or even governance privileges within the protocol itself.

- Tiers and Multipliers: Escalating levels unlock proportionally better rewards

- NFT and Token Drops: Special achievements trigger unique digital asset distributions

- Community Quests: Collaborative goals drive collective action and deeper engagement

The net effect? A self-reinforcing cycle where user activity directly contributes to platform growth, all tracked transparently on-chain. This synergy between individual incentive and collective security underpins why on-chain loyalty staking is gaining traction among both retail investors and sophisticated crypto communities alike.

Building on these mechanics, leading DeFi protocols are increasingly adopting token bonus DeFi models that reward not just capital commitment, but also social and educational participation. For example, users who engage in platform tutorials or contribute to community discussions may receive bonus tokens or XP boosts, further blurring the line between financial investment and active contribution. This multidimensional approach to rewards is a profound departure from the one-size-fits-all yield strategies of the past.

Importantly, these systems are not limited to early adopters or whales. By democratizing access to bonuses and multipliers through transparent criteria, such as streak-based staking, event participation, or successful referrals, platforms ensure that both new and long-term users have meaningful pathways to maximize returns. The result is a more inclusive ecosystem where loyalty is recognized in all its forms.

Real-World Impact: User Retention and Community Growth

The impact of gamified loyalty staking on DeFi user retention cannot be overstated. As users compete for leaderboard spots or collaborate on community quests, they form stronger bonds with both the protocol and fellow participants. This sense of belonging translates into organic advocacy, users become ambassadors, driving word-of-mouth growth that no marketing budget can replicate.

Furthermore, the transparency of on-chain rewards distribution builds trust. Every bonus payout, XP milestone, or NFT drop is immutably recorded, reducing disputes and reinforcing confidence in platform integrity. This has proven especially valuable as DeFi matures; projects with robust on-chain loyalty staking frameworks consistently outperform peers in both TVL (total value locked) and active wallet growth.

Top Strategies for Maximizing DeFi Staking Rewards

-

Leverage Tiered Reward Systems on Major Platforms: Many leading DeFi platforms, such as DeFi Land and Ethereum 2.0, offer tiered staking rewards that increase with longer lock-up periods or higher staked amounts. By committing assets for extended durations, users can unlock higher APYs, bonus tokens, and exclusive NFTs, maximizing overall returns.

-

Participate in Gamified Points and XP Programs: Platforms like DeFcor and DeFi App have integrated XP multipliers and points systems that reward users for staking, completing quests, and maintaining long-term engagement. These points can be redeemed for bonus rewards, tier upgrades, and governance rights, providing both financial and participatory incentives.

-

Engage in Interactive Quests and On-Chain Challenges: DeFi protocols increasingly offer interactive quests—such as liquidity provision, governance voting, or educational quizzes—that grant token rewards, NFTs, or whitelist access. Completing these challenges not only boosts earnings but also deepens user involvement in the ecosystem.

-

Utilize Social Engagement and Referral Incentives: By participating in community activities—like referring friends, sharing on social media, or joining Discord quests—users can earn bonus points, XP, and token rewards. Platforms such as DeFcor and Blockchain App Factory have demonstrated that social incentives significantly enhance loyalty and retention.

-

Take Advantage of Limited-Time Staking Promotions: Keep an eye out for bonus reward campaigns—for example, the recent $HOME staking upgrade with a 50% bonus until October 3. Participating during these events can substantially increase yields and provide early access to new features or assets.

What’s Next for On-Chain Loyalty Staking?

The road ahead points toward even deeper integration of crypto loyalty programs within DeFi platforms. Expect to see more sophisticated quest systems blending on-chain achievements with off-chain activities, think real-world events tied to NFT unlocks or cross-platform leaderboards spanning multiple protocols. As interoperability grows, so too will the range of experiences available to loyal stakers.

For crypto investors seeking to stay ahead of the curve, understanding these emerging mechanics is essential. Not only do they present new avenues for yield optimization, but they also offer a chance to shape governance decisions and influence protocol evolution from within. Engaged users aren’t just earning, they’re co-creating the future fabric of decentralized finance.

Loyalty in DeFi isn’t about locking up assets and waiting for passive rewards, it’s about participating, collaborating, and being recognized at every step along the way.

If you’re interested in learning more about how these systems drive engagement across top communities, or want actionable strategies for boosting your own returns, read our deep dive at How On-Chain Loyalty Staking Maximizes DeFi Rewards for Top Crypto Community Members.