Decentralized finance (DeFi) has made remarkable strides in recent years, but one persistent challenge remains: keeping users engaged for the long haul. While early DeFi platforms relied heavily on short-term yield incentives, a new wave of innovation is transforming user retention through on-chain loyalty staking programs. By blending blockchain transparency, gamified engagement, and liquid staking mechanics, these programs are rewriting the playbook for sustainable ecosystem growth.

From Siloed Points to Tokenized Loyalty: Ownership in the Digital Era

Traditional loyalty programs have always struggled with fragmented ecosystems and unredeemed rewards. In contrast, blockchain loyalty programs deliver users genuine digital ownership of their rewards. Tokenized incentives, such as NFTs or fungible tokens, can be verified on-chain, traded across platforms, and even integrated into broader DeFi protocols for added value. For example, Starbucks’ Web3 loyalty initiative leverages NFT stamps on Polygon to unlock exclusive merchandise and experiences, turning passive customers into active digital collectors.

This shift towards verifiable ownership not only builds trust but also creates a more dynamic relationship between projects and their communities. Users are no longer just participants; they become stakeholders whose engagement directly influences their potential returns.

The Power of Gamification: Experience Points (XP) and Social Engagement

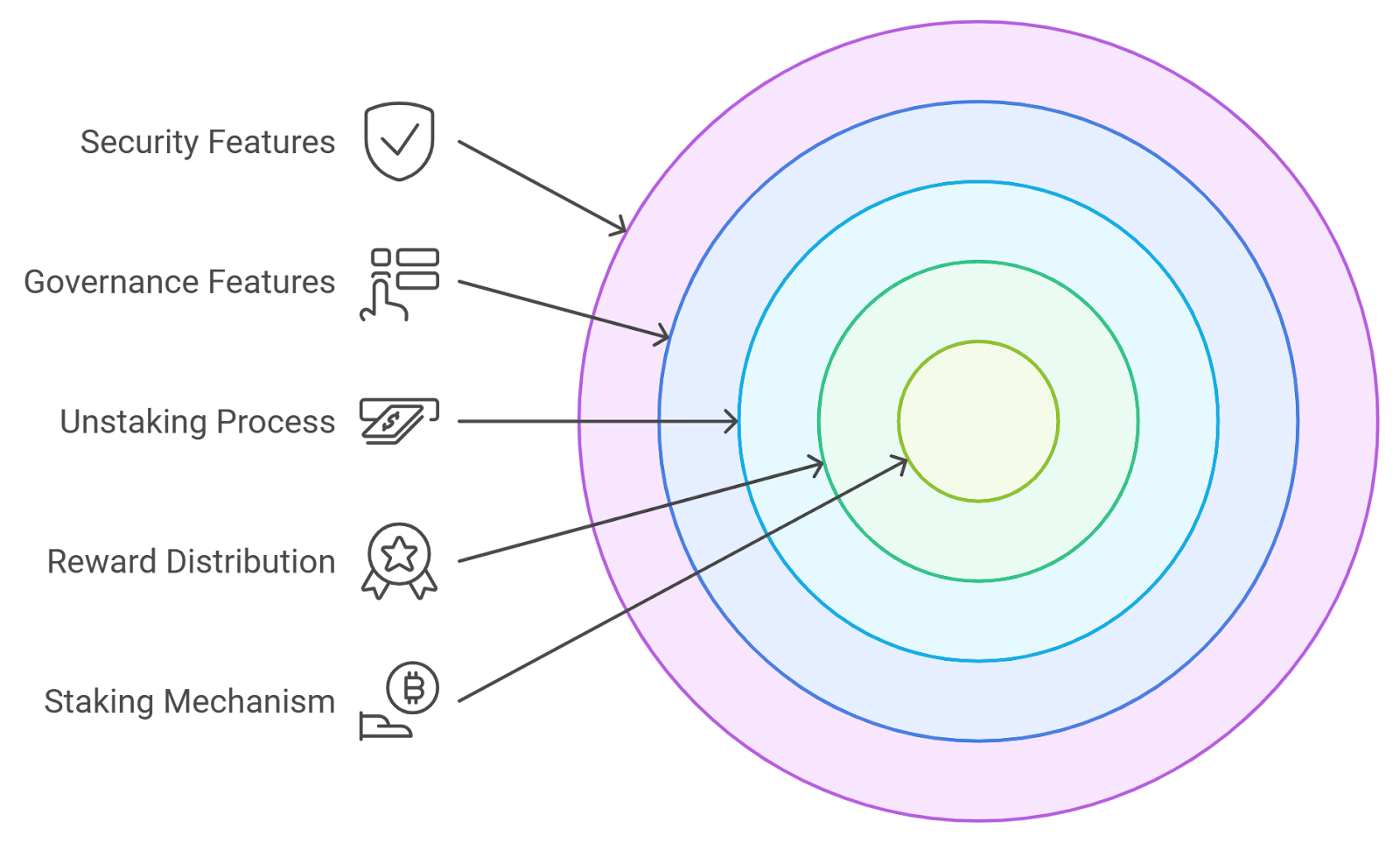

Loyalty isn’t built overnight, it’s cultivated through repeated positive interactions. Leading DeFi platforms now use gamification to deepen this bond by rewarding users with Experience Points (XP). Unlike static points systems, XP tracks a wide array of actions: staking tokens, joining governance votes, referring friends, or contributing to community forums. Over time, XP accumulates and can unlock tiered rewards or exclusive access within the ecosystem.

This approach transforms the user journey into an engaging quest rather than a transactional experience. As highlighted by industry research on on-chain engagement history, XP-based systems encourage intentional participation instead of fleeting speculation, fostering ambassadors who amplify social proof and drive organic growth.

Unlocking Liquidity with Liquid Staking Tokens (LSTs)

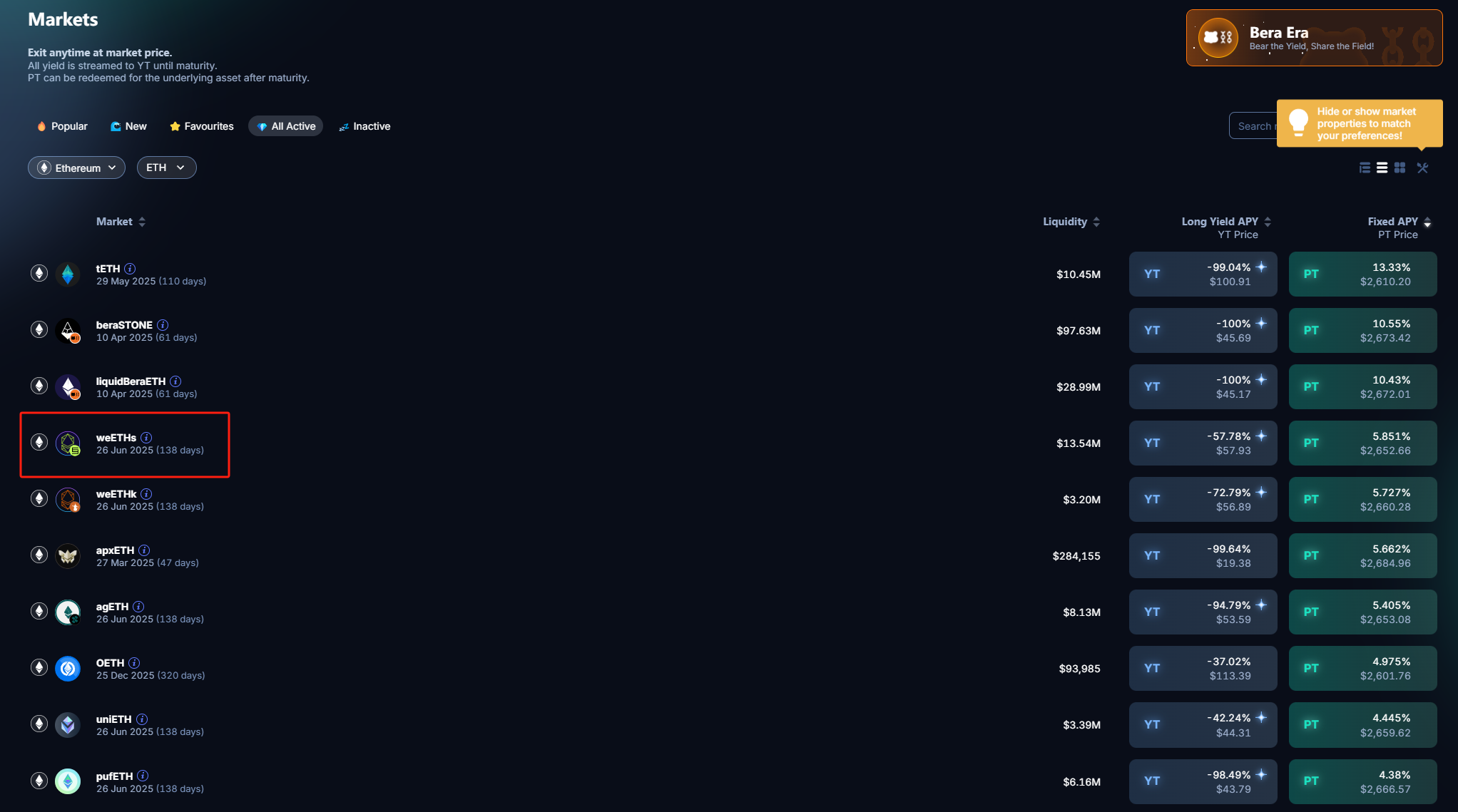

A critical breakthrough in staking rewards DeFi is the advent of liquid staking tokens (LSTs). Traditionally, staked assets were locked up, users earned yield but lost flexibility. LSTs solve this by issuing tradable tokens representing staked positions (like weETH from Ether. fi), allowing users to simultaneously earn staking rewards and deploy those assets across other protocols for additional yield.

This innovation creates a powerful flywheel effect: as more users participate in liquid staking, overall platform liquidity increases, which in turn enhances reward opportunities and deepens user commitment. The result? Higher asset retention rates and a more vibrant ecosystem where capital efficiency aligns perfectly with long-term engagement goals.

Building Interoperable Loyalty Ecosystems

The next frontier for on-chain loyalty staking is interoperability, enabling users to earn and spend rewards seamlessly across multiple dApps and blockchains. Platforms like Alpha are pioneering Web3 rewards engines that transcend individual silos; every new partner app or merchant extends the value network for all participants.

This interconnected model stands in stark contrast to traditional walled gardens. As each node in the network grows stronger, so does overall user utility, fueling tens of thousands of cross-app interactions that reinforce both individual brand loyalty and collective ecosystem health.

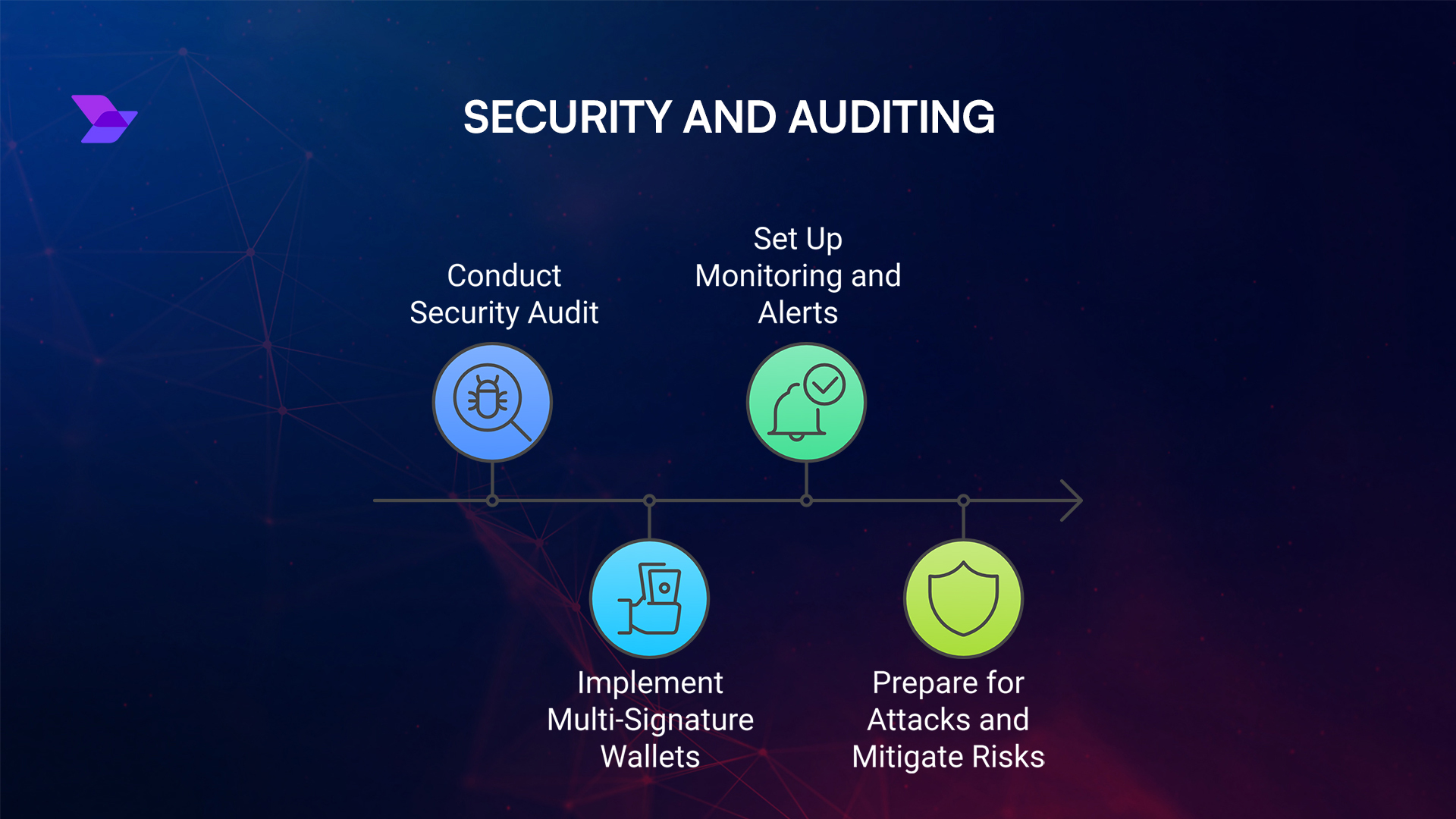

Privacy and transparency are often seen as opposing forces in blockchain, but the latest privacy-preserving incentive protocols are proving otherwise. Protocols like Boomerang leverage zero-knowledge proofs to let users accumulate rewards and demonstrate their engagement without revealing sensitive personal data. This innovation is a game-changer for on-chain loyalty staking: users can confidently build their engagement history while maintaining control over their identity and activity. The result is a trust-minimized environment where both projects and participants benefit from open yet respectful data practices.

What does all this mean for the future of DeFi user retention? It’s not just about bigger yields or flashier tokens. The most successful platforms are those that harness a holistic suite of tools, tokenized rewards, XP gamification, liquid staking, interoperability, and privacy, to create genuinely sticky ecosystems. When users feel like true stakeholders rather than passive speculators, they’re far more likely to stay engaged through market cycles.

Case Studies: Loyalty Staking in Action

Let’s look at real-world impact. Alpha’s interoperable rewards engine has driven tens of thousands of cross-app user actions, with each new partnership compounding value for all members. Starbucks’ NFT-based loyalty program has seen high redemption rates and repeat participation, demonstrating how digital collectibles can foster real-world engagement. Meanwhile, liquid staking protocols like Ether. fi have reported surges in asset retention as users capitalize on both yield generation and portfolio flexibility.

Top DeFi Platforms Excelling at On-Chain Loyalty Staking

-

Starbucks Odyssey — Starbucks’ Web3 loyalty program issues NFT stamps on the Polygon blockchain, granting users digital collectibles that unlock real-world perks like exclusive merchandise and events. This gamified approach empowers users with verifiable, tradable rewards.

-

Ether.fi — A leading liquid staking protocol offering weETH, an Ethereum-based liquid staking token (LST). Users can stake ETH, earn rewards, and retain liquidity for further DeFi activities, maximizing yield and retention.

-

Alpha — The Alpha Web3 Rewards Engine powers interoperable loyalty programs across multiple apps and blockchains. Users earn and redeem points ecosystem-wide, driving engagement and network growth beyond siloed rewards.

-

Boomerang Protocol — This privacy-preserving incentive system leverages cryptographic accumulators and zero-knowledge proofs to securely track and reward user engagement, ensuring transparency and privacy for DeFi loyalty programs.

-

Polygon — As a scalable blockchain platform, Polygon enables numerous DeFi projects to launch on-chain loyalty and staking programs, offering fast, low-cost transactions and a thriving ecosystem for user retention initiatives.

The numbers speak for themselves: platforms integrating robust on-chain loyalty mechanisms consistently outperform peers on metrics like daily active users, asset retention rates, and social engagement scores. These outcomes aren’t accidental, they’re the product of intentional design choices focused on transparency, ownership, and community incentives.

Rethinking Loyalty Metrics for Web3

The shift to on-chain engagement history also transforms how we measure success. Instead of tracking only transactions or wallet balances, advanced analytics now capture nuanced behaviors, governance participation, streaks of activity across dApps, referral influence, that reflect deeper commitment. This richer data empowers projects to refine their rewards models continually and adapt to evolving community needs.

If you’re building or investing in DeFi today, it’s clear that on-chain loyalty staking isn’t just a trend, it’s the foundation for enduring growth. By empowering users with true ownership, rewarding meaningful participation, enabling liquidity without compromise, and respecting privacy by design, these programs are setting new standards for what digital loyalty can achieve in decentralized finance.