On-chain loyalty staking is reshaping the DeFi landscape, creating a new paradigm where loyalty and engagement are as valuable as capital. For DeFi enthusiasts, this means that simply being an active participant now translates into maximized returns through a blend of traditional staking yields and innovative loyalty rewards. As the ecosystem matures, platforms are racing to deliver seamless, secure, and lucrative experiences for users who want to put their assets – and their commitment – to work.

Enhanced Reward Structures: Beyond Basic Staking Yields

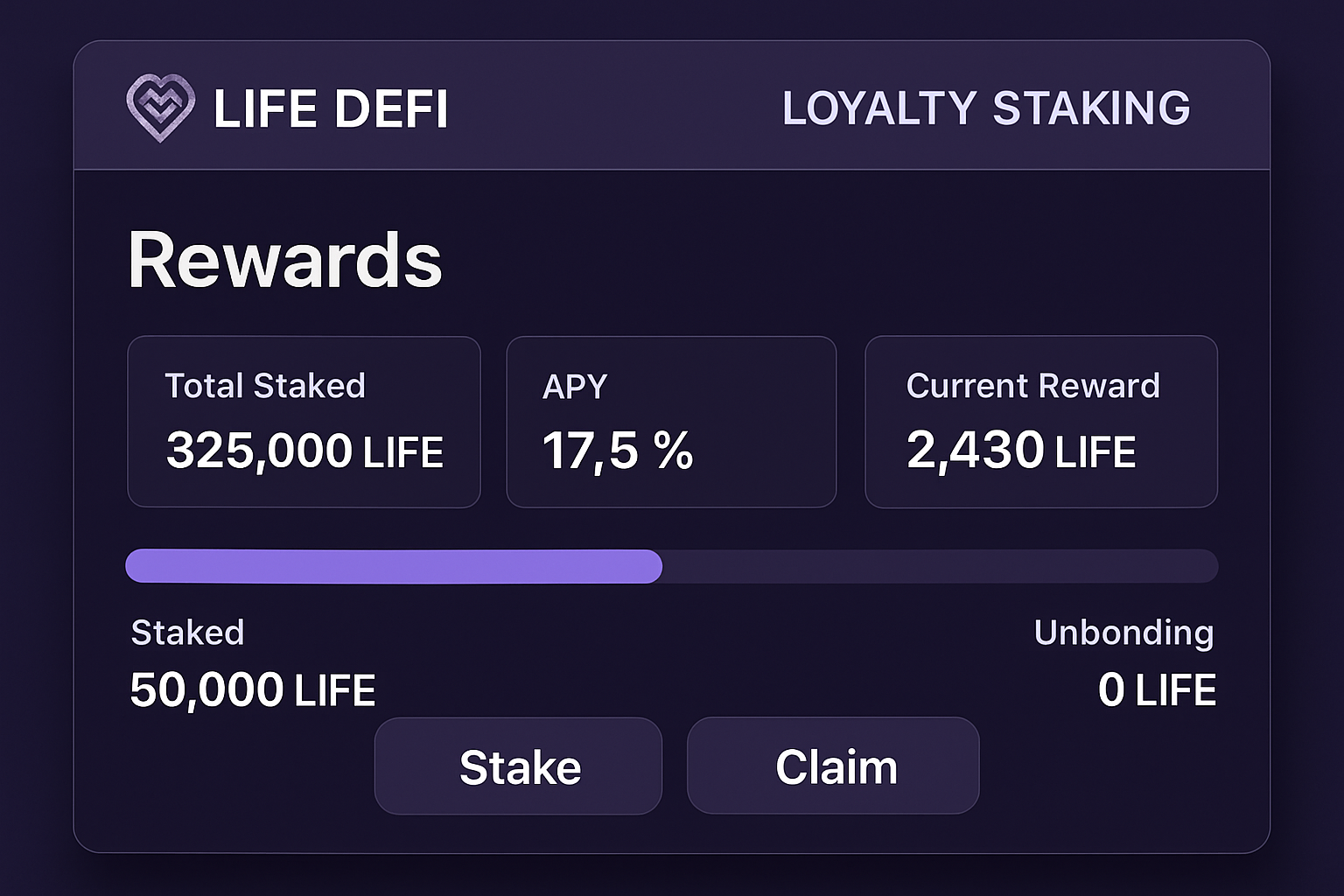

At its core, on-chain loyalty staking leverages the mechanics of proof-of-stake but adds a strategic layer of incentives tied to user behavior. Platforms like Life DeFi have pioneered native loyalty systems that reward not just for asset lockup, but also for actions such as referring friends or engaging with app features. This creates a dynamic where holding specific tokens or participating in community activities leads to multiplied earning potential.

This evolution is critical for DeFi investors seeking more than just passive income. By intertwining token incentives with gamified engagement, these platforms foster deeper user retention and network effects. In practice, this means your stake is working harder: earning validator rewards while simultaneously accruing loyalty points that can be redeemed or amplified based on your level of involvement.

DeFi Platforms with User-Friendly Loyalty Staking

-

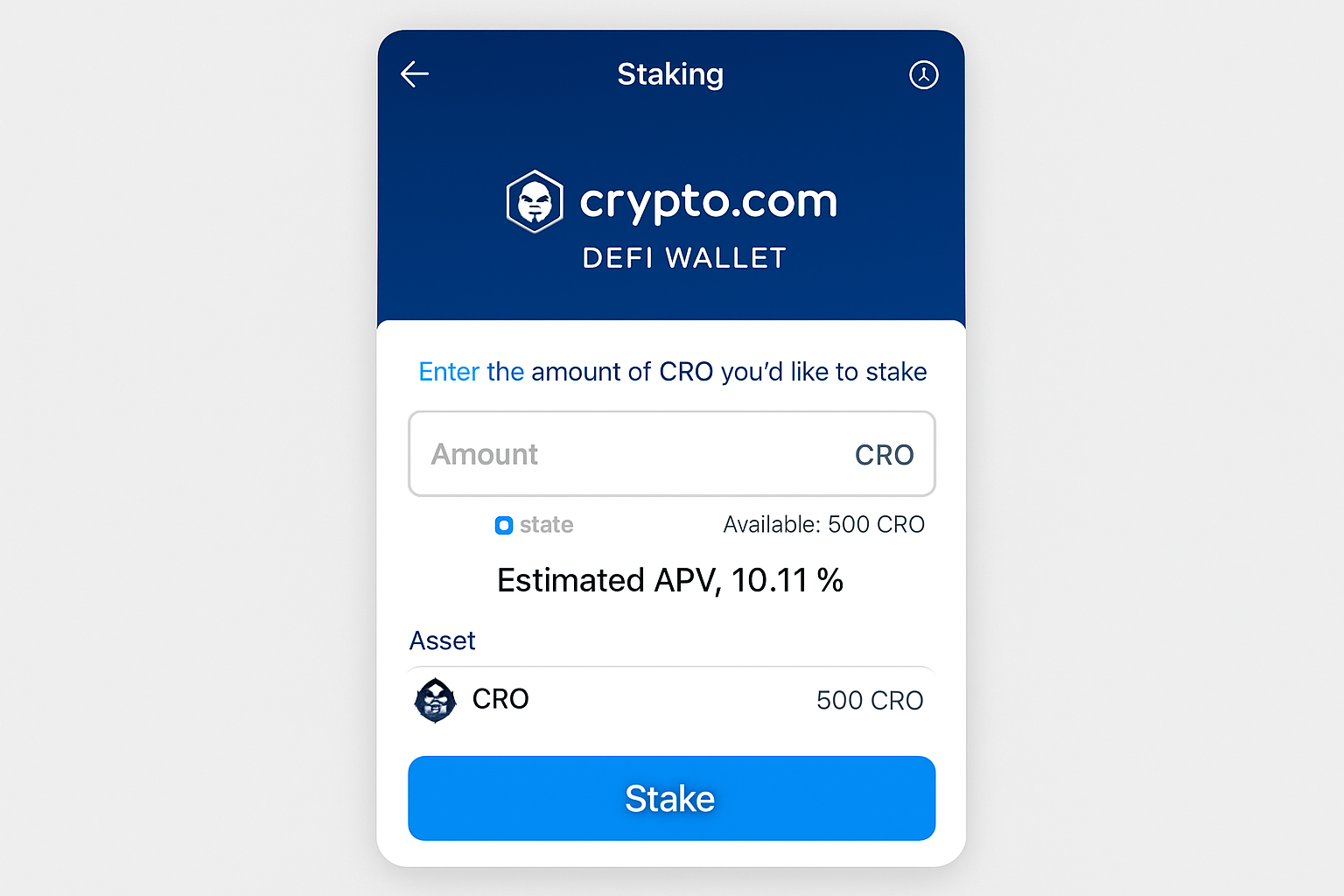

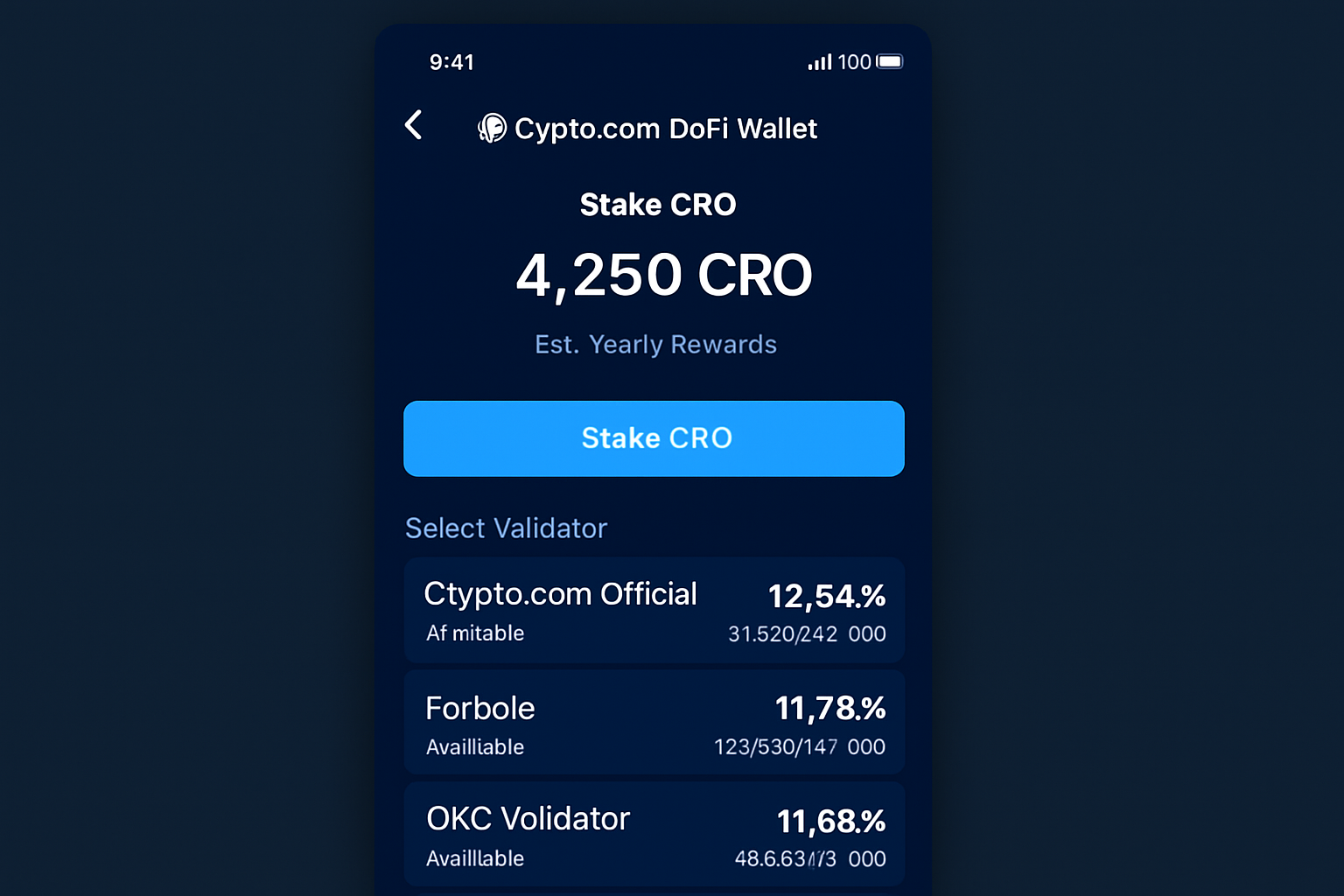

Crypto.com DeFi Wallet: Seamless mobile staking for assets like MATIC and ETH, featuring a streamlined interface and in-app guides that enable users to stake and manage rewards with just a few taps.

-

Life DeFi: Integrated native loyalty system that rewards users for engagement (e.g., inviting friends, exploring features), with multipliers for holding specific tokens and a visually intuitive dashboard for tracking points and rewards.

-

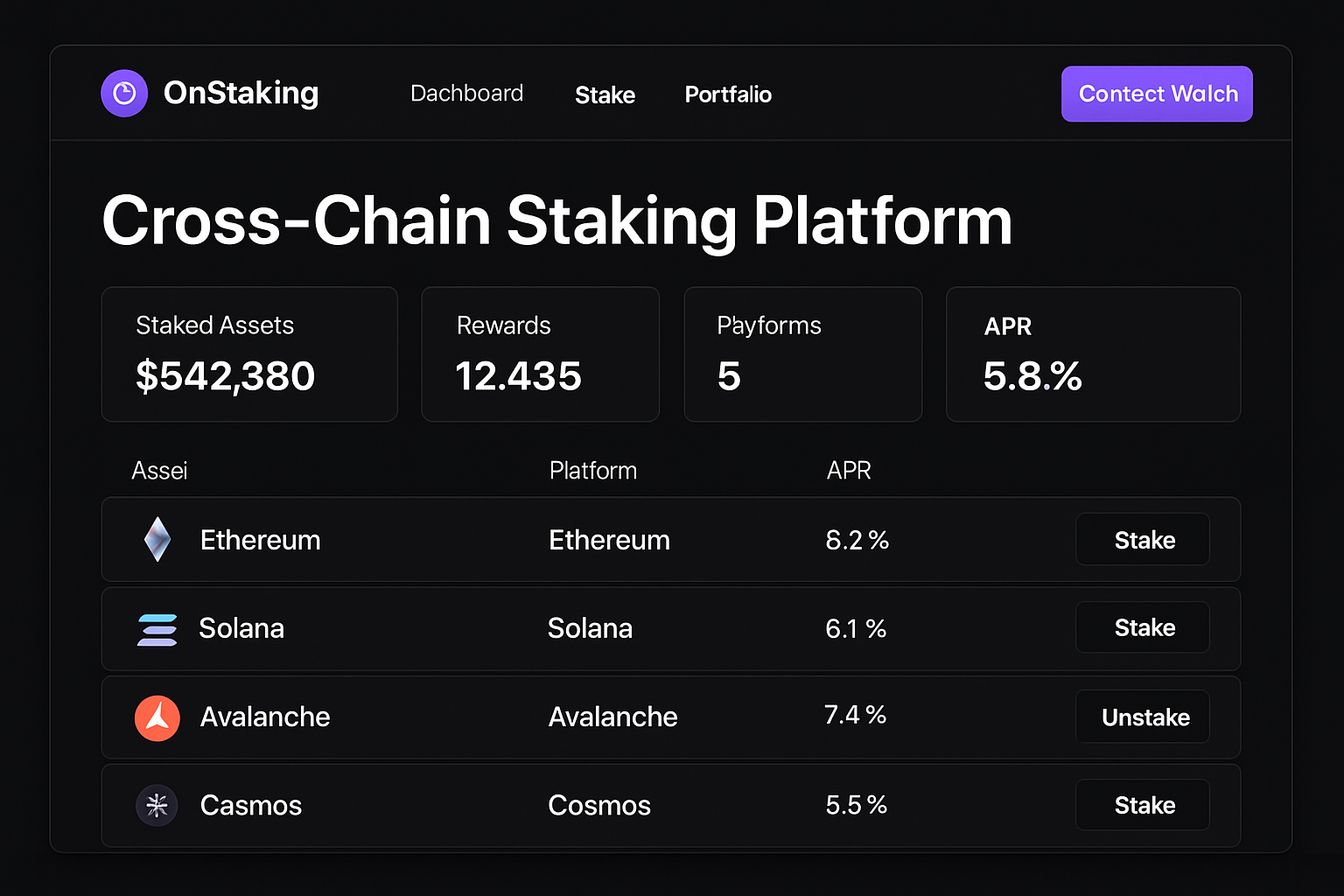

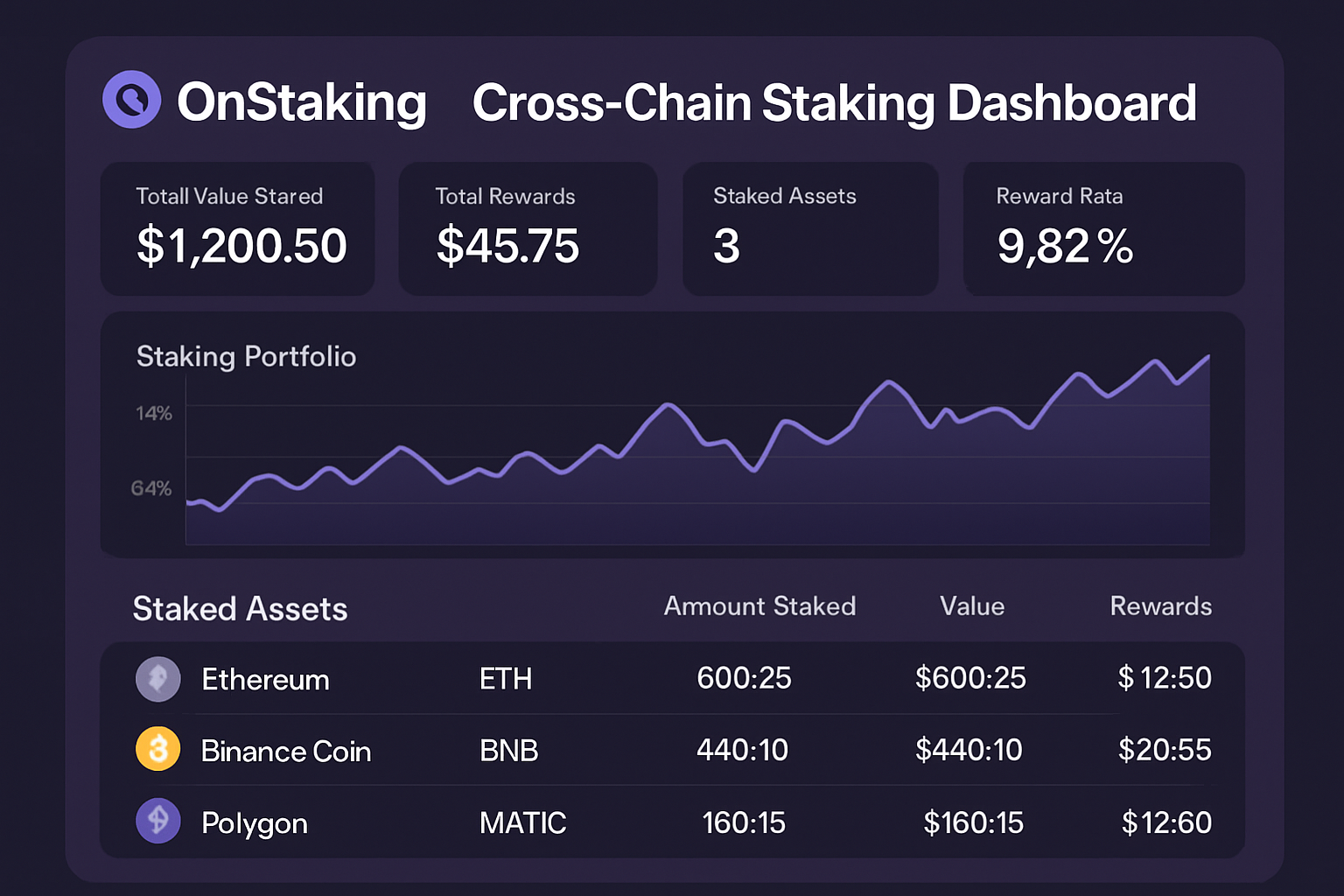

OnStaking: Cross-chain staking platform supporting Ethereum 2.0, Polkadot, and Solana, offering a unified dashboard that simplifies multi-asset staking and optimizes reward generation across ecosystems.

-

Huobi Wallet: Features the HClaimer tool, allowing users to collect staking rewards from multiple DeFi projects with a single click, enhancing convenience and reducing friction for active stakers.

Cross-Chain Opportunities: Diversification Meets Optimization

The next frontier in blockchain loyalty programs is cross-chain staking. Platforms like OnStaking are breaking down silos by enabling users to stake assets across multiple networks – Ethereum 2.0, Polkadot, Solana – all from a single dashboard. This unlocks portfolio diversification without sacrificing reward optimization.

Diversification has always been a pillar of prudent investing; in DeFi staking, it now comes with automated tools that monitor yields and shift allocations dynamically. For savvy investors chasing optimal returns across volatile markets, this multi-chain approach is both strategic and efficient.

Top Benefits of Cross-Chain On-Chain Loyalty Staking

-

Enhanced Reward Structures: Platforms like Life DeFi integrate native loyalty systems, multiplying staking rewards with activity-based points and token holdings.

-

Simplified Staking Processes: User-friendly solutions such as Crypto.com DeFi Wallet make staking assets like MATIC and ETH seamless, encouraging broader participation.

-

Cross-Chain Staking Opportunities: Platforms like OnStaking allow users to stake across multiple blockchains—such as Ethereum 2.0, Polkadot, and Solana—maximizing yield and portfolio diversification.

-

Automated Reward Collection: Features like Huobi Wallet’s HClaimer enable one-click collection of staking rewards from multiple DeFi projects, streamlining user experience.

-

Security and Transparency: The use of smart contracts and NFTs, as seen in zero-trust validator models, ensures users maintain control and visibility over their staked assets and earned rewards.

Automated Reward Collection: Streamlining User Experience

No one wants to chase down dozens of smart contracts just to collect earned rewards. Modern solutions like Huobi Wallet’s HClaimer function allow users to aggregate rewards from multiple projects with one click – turning what was once an arduous process into a seamless experience.

This automation not only saves time but also ensures that no yield goes unclaimed due to technical oversight or lapsed attention spans. As more platforms adopt similar features, expect automated reward collection to become an industry standard for serious stakers.

Security remains paramount as on-chain loyalty staking matures. With the proliferation of smart contracts and the integration of NFTs as trustless validators, platforms are providing users with more granular control over their assets and rewards. This shift toward zero-trust deployments means participants can verify and interact directly with protocols, reducing reliance on centralized intermediaries and minimizing counterparty risk.

Transparency is equally central. Every staking action, reward distribution, and loyalty point accrual is recorded immutably on the blockchain. This not only bolsters user confidence but also creates an auditable trail for both project teams and regulators, a crucial factor as DeFi continues to attract mainstream attention.

Maximizing Loyalty Rewards: Strategic Participation Pays Off

For DeFi enthusiasts aiming to extract maximum value from on-chain loyalty staking, a strategic approach is essential. Engaging with platforms that offer layered incentives, such as bonus rewards for early adopters, multipliers for holding governance tokens, or exclusive access to new pools, can significantly amplify yield. Staying active in community governance or participating in promotional campaigns often unlocks further advantages.

The most successful stakers today are those who treat their involvement as more than passive investment. By tracking platform updates, leveraging cross-chain opportunities, and optimizing engagement with gamified elements, users can consistently outperform simple stake-and-forget strategies.

Key Takeaways: Why On-Chain Loyalty Staking Is the Future

- Enhanced earning power: Layered incentives mean every action, staking, engaging, referring, boosts your total yield.

- User-centric design: Simplified interfaces and automated reward collection remove friction for both newcomers and power users.

- Diversification at scale: Cross-chain support enables risk-managed portfolios without sacrificing returns.

- Security-first architecture: Smart contracts and NFTs deliver trustless participation with transparent auditability.

The convergence of token incentives, gamified engagement, seamless automation, and robust transparency is positioning on-chain loyalty staking at the center of next-generation DeFi strategies. For investors seeking more than just yield, for those who want to shape the future of decentralized finance while earning meaningful rewards, this model offers both opportunity and advantage.

If you’re ready to deepen your engagement or refine your strategy even further, explore related insights on how gamified incentives can supercharge your DeFi rewards.