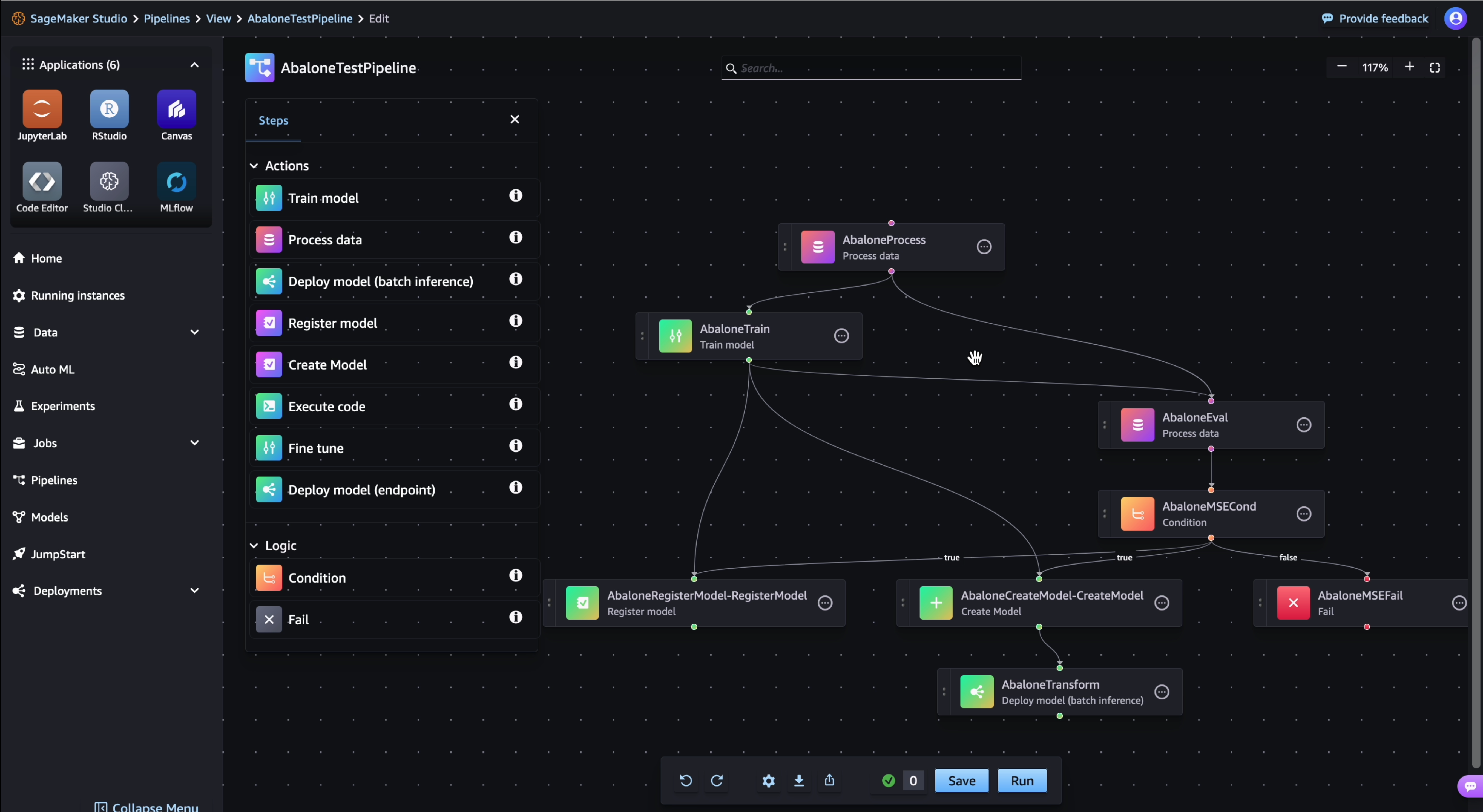

On-chain referral programs are reshaping the DeFi landscape, enabling platforms to supercharge user loyalty and engagement across multiple blockchain networks. By leveraging smart contracts for fully automated tracking, transparent reward distribution, and eligibility verification, these programs eliminate friction and build trust. The result? A new era of DeFi loyalty incentives that are not only efficient but also borderless and composable.

How On-Chain Referral Rewards Drive Multi-Chain Growth

Traditional referral programs often struggle with manual processes, opaque reward systems, and limited interoperability. In contrast, on-chain referral programs harness the power of blockchain to offer:

- Automated reward distribution: Smart contracts instantly and fairly allocate crypto rewards to both referrers and referees, removing the need for intermediaries.

- Enhanced transparency: Every referral and payout is recorded immutably on-chain, so users can independently verify their rewards and eligibility.

- Cross-chain compatibility: Many DeFi protocols now deploy referral systems that work seamlessly across multiple blockchains, allowing users to earn and redeem on-chain referral rewards regardless of the network they use.

This shift is not just theoretical. Platforms like Chainspot, Linear Finance, and Merkl have already implemented robust on-chain referral mechanisms that set new standards for transparency and user empowerment.

Notable Multi-Chain Referral Program Implementations

Top DeFi Projects With Innovative On-Chain Referral Programs

-

Chainspot Family Loyalty Program: Chainspot’s on-chain loyalty system rewards users with Experience Points (XP) for cross-chain activity and referrals. Members can claim tradable NFTs at each level, and the referral structure offers up to 50% of Chainspot fees and up to 10% cashback, all automated via smart contracts.

-

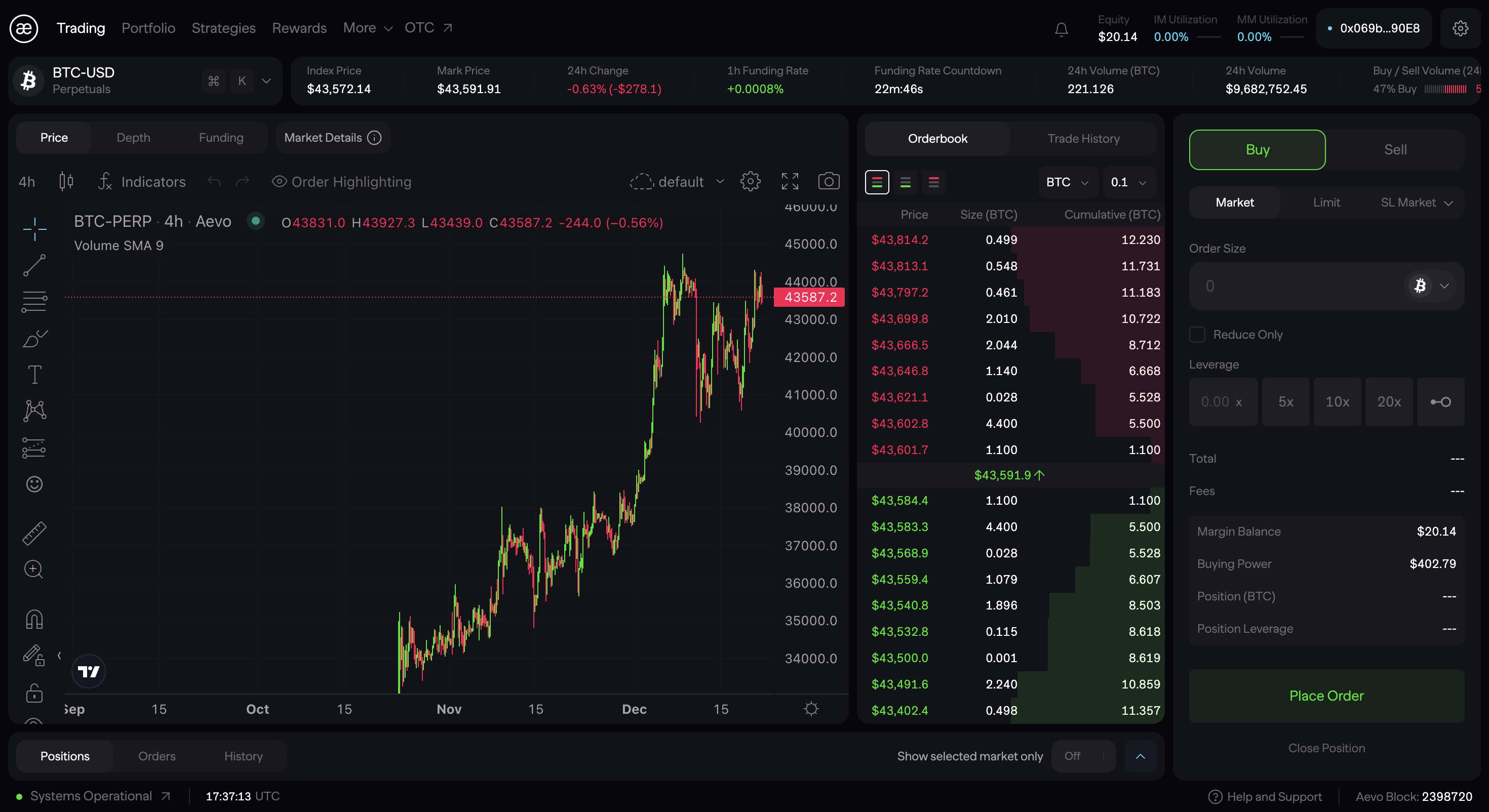

Linear Finance Affiliate Program: Linear Finance offers a high-paying, fully on-chain affiliate program for its PerpDEX platform. Referrers earn a share of trading fees from every trade made by their invitees, with lifetime commissions, customizable rewards, and support for multiple referral codes.

-

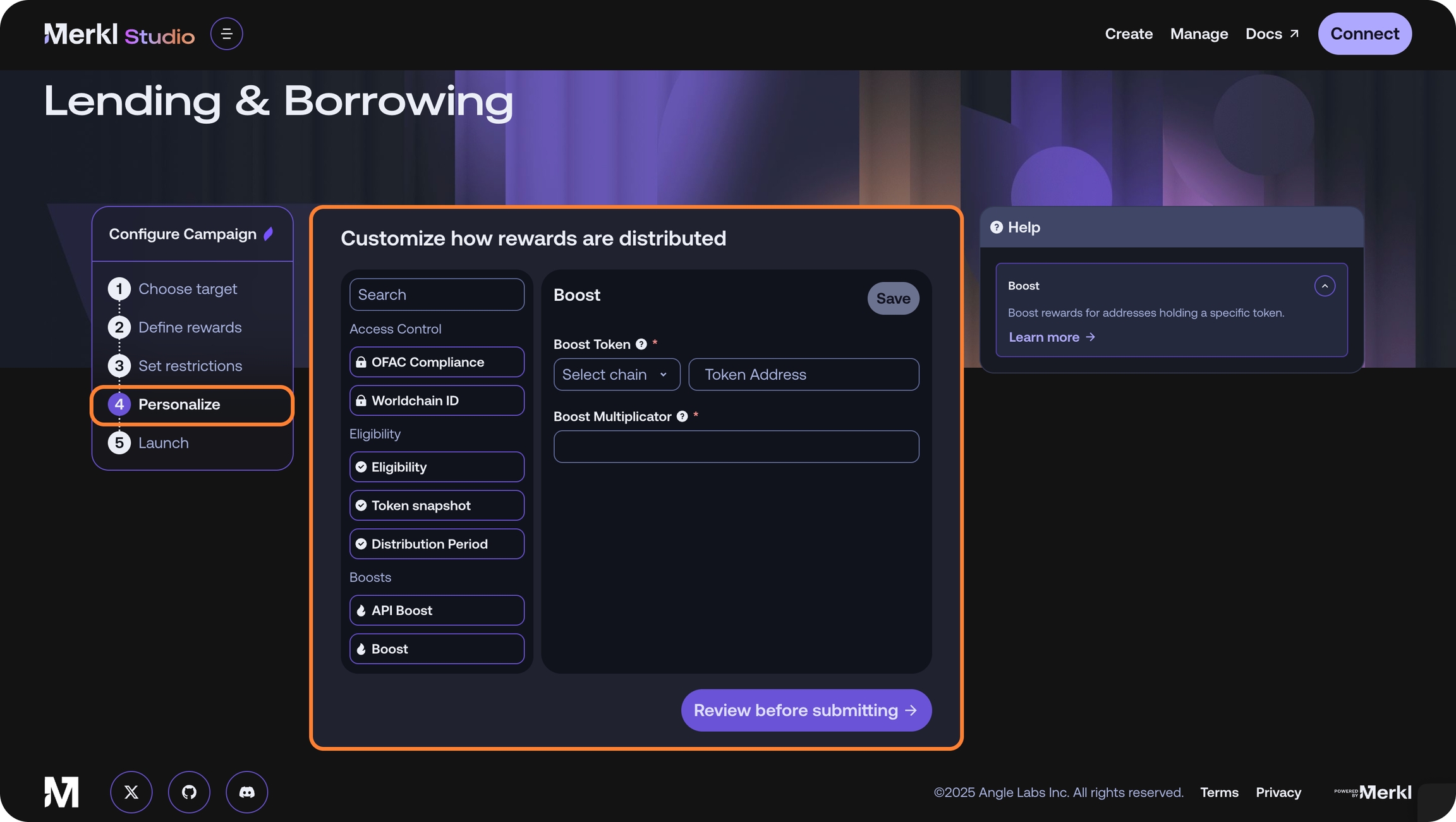

Merkl On-Chain Referral Program: Merkl’s viral, community-driven referral system lets users generate unique referral codes. Both the referrer and referee receive a 5% reward boost (based on the lower deposit), promoting fair and proportional incentives for liquidity providers.

-

Lido Finance Referral Program: Lido, a leading liquid staking platform, has implemented on-chain referral incentives to boost user acquisition and liquidity. Referrers and referees receive token rewards for successful onboarding, with transparent tracking and automated distribution.

-

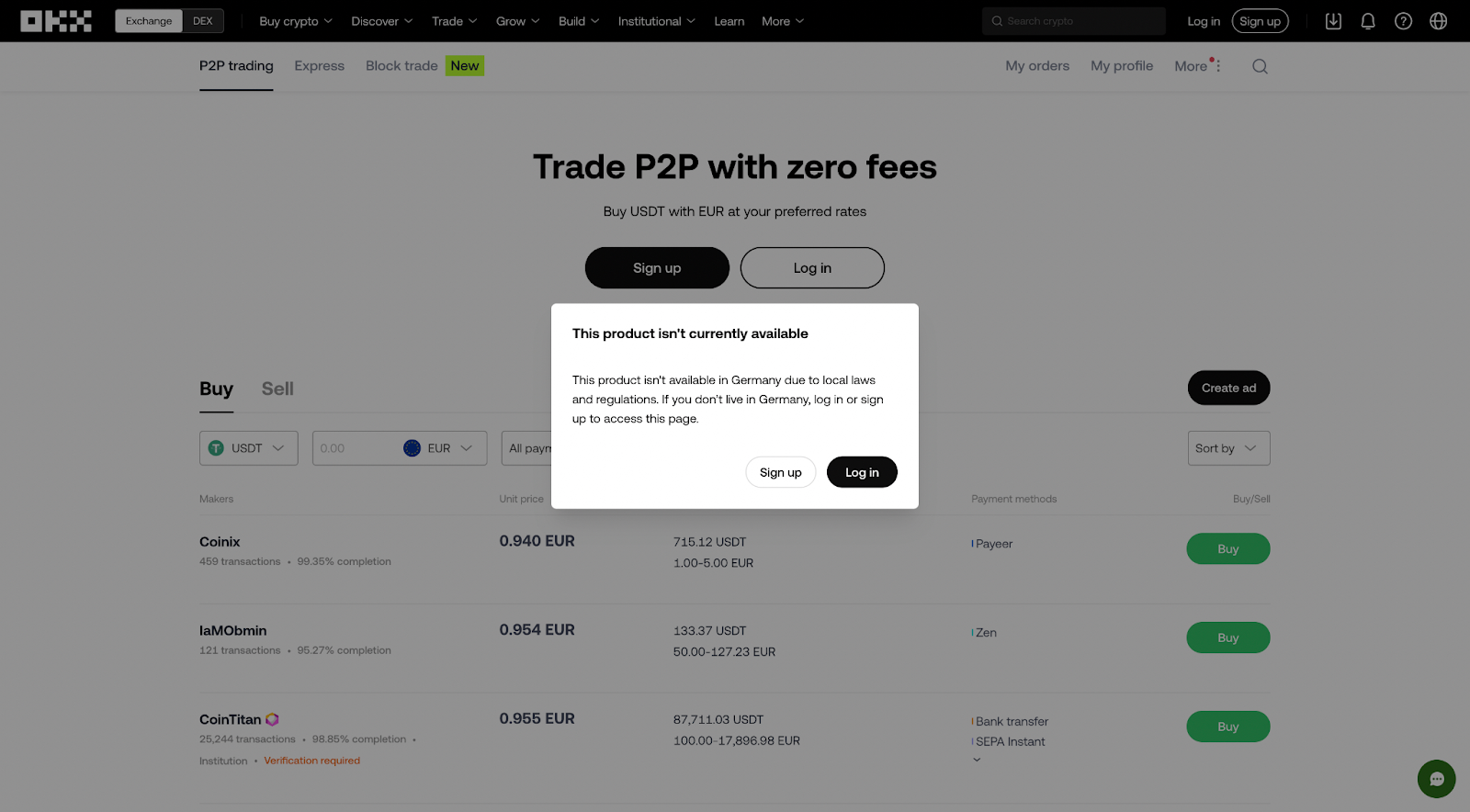

OKX DEX Onchain Referrals: OKX DEX integrates on-chain referrals with real-time, automated rewards for users who bring new traders to the platform. The system leverages smart contracts for transparent tracking and instant payouts across multiple networks.

Let’s break down a few leading examples:

- Chainspot Family Loyalty Program: Users earn Experience Points (XP) for engaging in cross-chain swaps. XP unlocks higher user levels, tradable NFTs, and up to 50% referral payouts from Chainspot fees, plus 10% cashback. The program’s NFTs are even tradable on secondary markets, adding a gamified, liquid layer to loyalty.

- Linear Finance Affiliate Program: With one of the highest-paying structures in PerpDEX, referrers earn a share of trading fees with every trade their invitees make. Features include customizable codes, lifetime commissions, and multi-chain support, making it a magnet for power users and influencers alike.

- Merkl’s On-Chain Referral: Users create unique referral codes on-chain. Both parties receive a 5% reward boost (based on the smaller deposit), incentivizing organic, viral growth and deepening liquidity across the ecosystem.

These examples showcase how multi-chain referral programs are moving beyond simple bonuses to become core engines of community-led growth and liquidity aggregation.

Key Benefits: Transparency, Security, and Real-Time Crypto Commissions

Why are on-chain loyalty staking and referral programs so effective at maximizing rewards? The answer lies in their structural advantages:

- Self-custodial rewards: Users retain full control of their assets, with no need to trust third parties for reward distribution or payout accuracy.

- Real-time crypto commissions: With smart contracts, rewards are distributed instantly upon meeting eligibility criteria, creating immediate positive feedback loops.

- Sybil resistance and fair play: Advanced on-chain logic deters fraudulent or duplicate referrals, ensuring that only genuine community contributions are rewarded.

This combination of transparency, automation, and security is why top DeFi staking platforms in 2025 are prioritizing on-chain referral and loyalty modules as must-have features for user growth and retention. For more insights into how these systems drive deeper engagement, explore this deep dive on referral-driven DeFi growth.

As DeFi continues to evolve, expect on-chain loyalty staking and referral programs to become even more sophisticated, with dynamic incentives tailored to user behavior and cross-network activity. In the next section, we’ll explore how these systems are transforming user acquisition, liquidity depth, and project sustainability in the evolving Web3 economy.

Evolving User Acquisition: From One-Time Bonuses to Lifelong Loyalty

Unlike legacy affiliate programs that reward a single action, modern multi-chain referral programs are engineered for ongoing engagement. With features like lifetime commissions and tiered loyalty levels, users are incentivized to remain active, not just onboard new participants. This approach transforms users into long-term stakeholders rather than transient promoters.

For example, Chainspot’s XP-based system and Linear Finance’s perpetual fee-sharing both nudge users toward deeper platform involvement. Merkl’s dual-sided 5% deposit boost means both referrer and referee have skin in the game, encouraging authentic network growth. These models illustrate how real-time crypto commissions can fuel compounding network effects, every successful referral increases the value of future participation.

Liquidity Depth and Community-Led Growth

The impact of on-chain loyalty staking isn’t limited to user numbers, it directly strengthens liquidity pools and project stability. By rewarding both referrers and referees for providing liquidity or trading volume, platforms see not only a surge in TVL (Total Value Locked), but also greater stickiness among liquidity providers.

This is particularly powerful in a multi-chain environment where capital is mobile. Referral incentives that work across chains minimize friction for users moving assets between networks, making it easier to attract, and retain, liquidity wherever it’s needed most. As a result, projects can bootstrap cross-network ecosystems while ensuring rewards remain transparent and tamper-proof.

The Future of On-Chain Loyalty Staking Programs

Looking ahead, expect on-chain loyalty staking systems to integrate even more nuanced incentive structures, think NFT-based status tiers, dynamic APYs based on network contributions, or collaborative quests that reward collective milestones. Enhanced self-custody solutions will further empower users by giving them direct control over their earned rewards across multiple networks.

Platforms are also experimenting with gamified experiences that blend DeFi mechanics with social engagement, creating viral loops where every new participant amplifies the value proposition for existing users. This is already visible in Chainspot’s NFT marketplace and Merkl’s viral code-sharing model.

How DeFi Projects Use On-Chain Loyalty Staking for Growth

-

Automated, Transparent Reward Distribution via Smart Contracts: Leading DeFi platforms like Chainspot use smart contracts to automate the tracking of referrals and the distribution of loyalty rewards. This ensures instant, tamper-proof payouts and eliminates manual intervention, boosting user trust and participation.

-

Cross-Chain Loyalty Incentives: Many projects design their staking and referral programs to work across multiple blockchain networks. For example, OKX DEX and Chainspot enable users to earn and redeem rewards regardless of the underlying chain, maximizing reach and liquidity for the platform.

-

Tradable Loyalty NFTs and Tiered Rewards: Programs like Chainspot Family Loyalty issue member NFTs to users as they reach new loyalty levels. These NFTs are tradable on secondary markets, creating additional value and engagement loops beyond staking rewards.

-

Continuous Earnings Through Affiliate Structures: Linear Finance and similar platforms offer lifetime commissions on trading fees for user referrals. This model incentivizes long-term user acquisition and ongoing platform usage, fueling sustainable growth.

-

Community-Driven Viral Referral Campaigns: Merkl empowers users to generate unique on-chain referral codes, rewarding both parties with boosted staking rewards. This viral, peer-to-peer approach amplifies network effects and encourages organic liquidity growth.

If you’re considering launching a project or maximizing your own rewards as a user, focus on protocols that combine transparency with flexibility: automated smart contract payouts, cross-chain compatibility, self-custodial controls, and robust Sybil resistance mechanisms should be non-negotiables. For an in-depth look at how these modules supercharge engagement for top crypto communities, check out this analysis of loyalty staking’s impact on DeFi user retention.

The bottom line? On-chain referral rewards aren’t just a marketing gimmick, they’re foundational infrastructure for the next wave of scalable DeFi ecosystems. Platforms that get this right won’t just attract users; they’ll build loyal communities whose incentives are fully aligned with long-term project success.