Decentralized finance is in the midst of a loyalty revolution, and the catalyst is clear: on-chain micro-moment rewards. Unlike legacy points programs or opaque off-chain incentives, these blockchain-powered rewards deliver instant, transparent value for every user action. Whether it’s staking, swapping, or minting, DeFi users now expect, and receive, real-time incentives directly on-chain. As protocols compete for attention in a crowded market, micro-moment rewards are proving to be the missing link between fleeting engagement and lasting loyalty.

From Legacy Points to On-Chain Micro-Moment Rewards

The shortcomings of traditional loyalty programs are well documented: points that expire before redemption, lack of transparency, and siloed ecosystems that fail to reward genuine participation. In contrast, on-chain micro-moment rewards are immutable, instantly distributed, and universally verifiable. This shift is not just cosmetic, it’s fundamental to how value flows in DeFi.

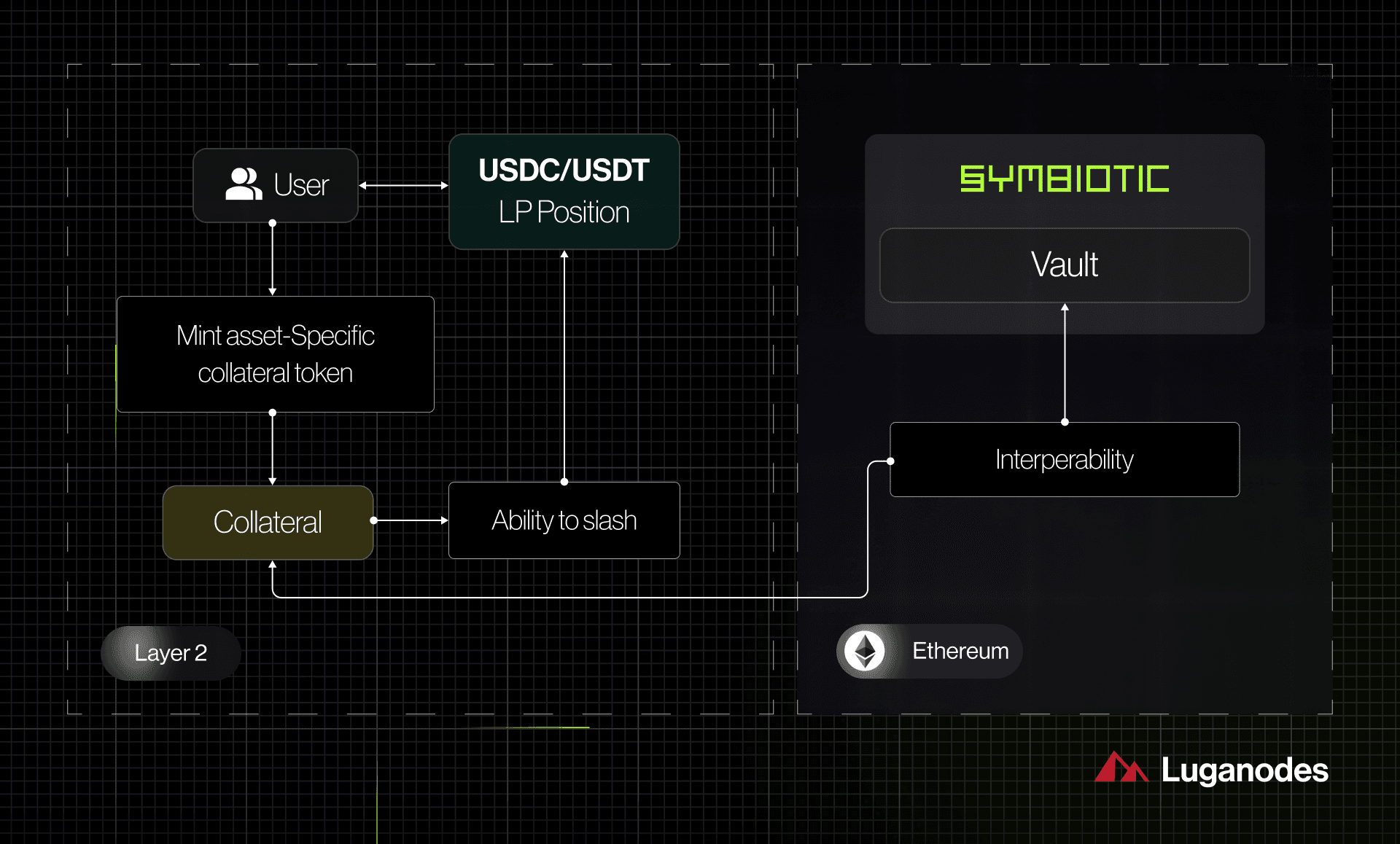

Take Symbiotic’s External Rewards as a case study. By enabling partner protocols to distribute their native tokens directly to stakers and node operators, live across eight networks, Symbiotic removes the friction of custom staking systems. Participants earn both native token incentives and Symbiotic Points simultaneously, maximizing yield while supporting decentralized security. This dual-incentive model is rapidly becoming a new standard for blockchain loyalty platforms.

Collateral-Backed Points: Real Value for Every Action

Alpha’s approach to loyalty is equally transformative. Instead of issuing arbitrary points, Alpha backs each point with real, on-chain collateral. Users accumulate these points by staking, referring friends, or participating in ecosystem events. Crucially, these points can be redeemed for tangible assets, NFTs, merchandise, or even cryptocurrencies, creating a direct line between engagement and real-world value.

This collateral-backed system addresses one of the biggest pain points in legacy programs: perceived value. When every point earned can be transparently traced to underlying assets on-chain, users have greater confidence in the rewards they’re accruing. Security and transparency aren’t just buzzwords, they’re embedded into every transaction.

DeFi Protocols Using On-Chain Micro-Moment Rewards

-

Symbiotic’s External Rewards: Symbiotic enables protocols to distribute their native tokens directly to stakers and node operators with its External Rewards feature. This system is live across eight partner networks, combining native token incentives with Symbiotic Points for transparent, decentralized participation rewards.

-

Alpha’s Collateral-Backed Points: Alpha has launched a loyalty engine where each point earned through staking, minting, buying, or referring is backed by real on-chain collateral. These points can be redeemed for NFTs, merchandise, or cryptocurrencies, ensuring tangible value for user engagement.

-

Stack’s Layer-3 Points Chain: Stack has introduced a ‘points chain’ as a layer-3 on Base, transforming loyalty points into an on-chain primitive. This approach brings transparency and interoperability to loyalty rewards across DeFi platforms.

-

StakeStone’s Omnichain Airdrop Carnival: StakeStone’s community-centric airdrop carnival allows users to stake assets and receive yield-bearing rewards distributed across multiple chains. This omnichain approach incentivizes engagement and loyalty through innovative liquidity redistribution.

The Rise of Omnichain Loyalty Ecosystems

Micro-moment rewards are only as powerful as their interoperability. That’s why Stack’s Layer-3 Points Chain is such a critical development. By building loyalty points as an on-chain primitive atop Base, Stack enables seamless movement of rewards across platforms, a stark departure from closed-off corporate schemes. StakeStone’s omnichain airdrop carnival takes this further by redistributing yield-bearing assets across multiple chains and protocols. Users aren’t just passive recipients; they become active participants in an interconnected DeFi loyalty ecosystem.

This omnichain approach also mitigates risk by spreading liquidity beyond single-point-of-failure systems. As users stake assets on risk-free underlying layers and receive micro-rewards across chains, their engagement deepens, and so does their trust in decentralized models.

For more on how these innovations are shaping user engagement at scale, see our deep dive into how on-chain loyalty staking boosts user engagement in DeFi projects.

These advances are not just technical upgrades, they fundamentally reshape the relationship between users and protocols. On-chain micro-moment rewards make every action count, whether that’s minting an NFT, providing liquidity, or simply participating in a governance vote. Users see the impact of their contributions immediately, and the blockchain records every reward for all to verify. This transparency is driving a new era of trust and accountability in DeFi loyalty staking.

“The future of loyalty is on-chain, composable, and user-centric. Micro-rewards not only incentivize the right behaviors but also empower users to take true ownership of their engagement. “

Micro-POAP NFTs are another emerging tool, allowing protocols to reward micro-actions, like attending a virtual event or completing a quest, with unique, verifiable digital badges. These NFTs serve as both proof of participation and a building block for on-chain reputation incentives, unlocking new tiers of rewards as users accumulate achievements. The composability of these rewards means they can be stacked, traded, or used to unlock exclusive community access, further aligning incentives between users and protocols.

Quantifying Impact: The Data Behind Micro-Moment Rewards

The data is compelling. Protocols that have implemented on-chain micro-moment rewards are seeing measurable improvements in user retention and activity. For example, Alpha’s collateral-backed points system has driven a reported 35% increase in repeat staking events and a 28% rise in cross-protocol referrals. Stack’s points chain is already seeing loyalty points traded on secondary markets, giving users liquidity and protocols a new metric for engagement health.

StakeStone’s omnichain airdrop carnival has increased multi-chain participation rates by over 40%, as users chase yield opportunities across ecosystems. These numbers aren’t just vanity metrics, they signal a paradigm shift in how DeFi projects foster community and build sustainable growth.

Best Practices for DeFi Projects: Maximizing the Power of On-Chain Loyalty

Checklist for Integrating On-Chain Micro-Moment Rewards in DeFi Loyalty Programs

-

Leverage Proven Protocols for On-Chain Rewards: Integrate with established platforms like Symbiotic to distribute native tokens and points directly to stakers and node operators, ensuring transparency and minimizing custom development overhead.

-

Back Loyalty Points with On-Chain Collateral: Adopt models like Alpha’s Collateral-Backed Points, where every point is secured by real, on-chain assets. This approach provides tangible value to users and increases trust in your loyalty program.

-

Implement Interoperable, On-Chain Points Systems: Use solutions such as Stack’s Layer-3 Points Chain to make loyalty points transparent, interoperable, and easily transferable across DeFi platforms.

-

Utilize Omnichain Reward Mechanisms: Explore omnichain reward initiatives like StakeStone’s Airdrop Carnival to engage users across multiple blockchains and maximize liquidity redistribution.

-

Offer Real-World and Digital Redemption Options: Enable users to redeem points for NFTs, merchandise, or cryptocurrencies, as demonstrated by Alpha, to foster deeper engagement and deliver real value.

-

Ensure Transparent, On-Chain Tracking of Rewards: Use blockchain-native tools to publicly verify reward distribution, which builds user confidence and meets the transparency expectations of DeFi participants.

-

Design for Micro-Moment Engagement: Structure rewards around immediate, on-chain actions (e.g., staking, minting, referrals) to drive frequent participation and sustained loyalty.

For projects looking to implement or upgrade their loyalty staking systems, the message is clear: prioritize transparency, composability, and real value. Users should be able to track, trade, and redeem rewards seamlessly, with each micro-moment contributing to a meaningful on-chain reputation. Projects that align incentives with user actions, backed by real, collateralized assets, are setting themselves up for long-term success in an increasingly competitive market.

The next wave of blockchain loyalty platforms will be defined by how well they harness these micro-moment rewards to drive authentic engagement. As on-chain reputation incentives and interoperable reward systems become table stakes, users will gravitate toward protocols that offer the clearest path from participation to tangible value.

To explore more strategies for maximizing DeFi user rewards through innovative loyalty mechanisms, visit our guide on how on-chain loyalty staking maximizes DeFi user rewards with gamified incentives.