In the ever-evolving DeFi landscape, where short-term speculation often overshadows sustained commitment, on-chain loyalty staking emerges as a game-changer. This innovative approach rewards long-term holders not just for locking assets, but for renewing their stakes with escalating bonuses, fostering genuine user retention over fleeting hype. Platforms are shifting from generic yield farming to sophisticated DeFi loyalty rewards that mirror real-world loyalty programs, yet leverage blockchain’s transparency to ensure fair distribution.

Traditional staking in proof-of-stake networks secures the chain and yields rewards based on holdings and duration. However, it treats all participants equally, ignoring the value of steadfast supporters who weather market volatility. Enter on-chain loyalty staking: a mechanism where renewal bonuses scale with consecutive stake periods. Stake once, earn base APY. Renew without interruption, unlock tiered multipliers – think 1.2x for the second cycle, 1.5x for the third, and beyond. This isn’t mere gimmickry; it’s a calculated incentive aligning user behavior with protocol longevity.

Why Renewal Bonuses Outpace Standard Yield Strategies

DeFi’s yield-chasing culture leads to mercenary capital – funds that migrate at the slightest APY bump elsewhere. Renewal bonuses disrupt this by introducing staking renewal bonuses that compound loyalty. Data from recent programs underscores the impact: ether. fi’s Member Rewards initiative, distributing 7.5 million ETHFI tokens from June to August 2025, prioritizes renewals to bolster engagement amid competitive restaking wars. Users who extend stakes receive amplified shares, turning passive holders into active advocates.

Key Advantages of On-Chain Loyalty Staking

-

Escalating renewal bonuses for consecutive periods incentivize long-term holding, as in ether.fi‘s Member Rewards program allocating 7.5M ETHFI tokens (June-Aug 2025).

-

Transparent on-chain verification enables immutable proof of loyalty via blockchain data, exemplified by ElevateFi‘s audited Polygon framework.

-

Reduced sell pressure from committed holders stabilizes markets by encouraging prolonged asset locks in loyalty programs.

-

DAO-governed adjustments empower communities to refine rewards dynamically, as implemented in ElevateFi‘s governance model.

-

Synergy with automated compounding boosts yields through seamless reward reinvestment, core to ElevateFi‘s yield optimization.

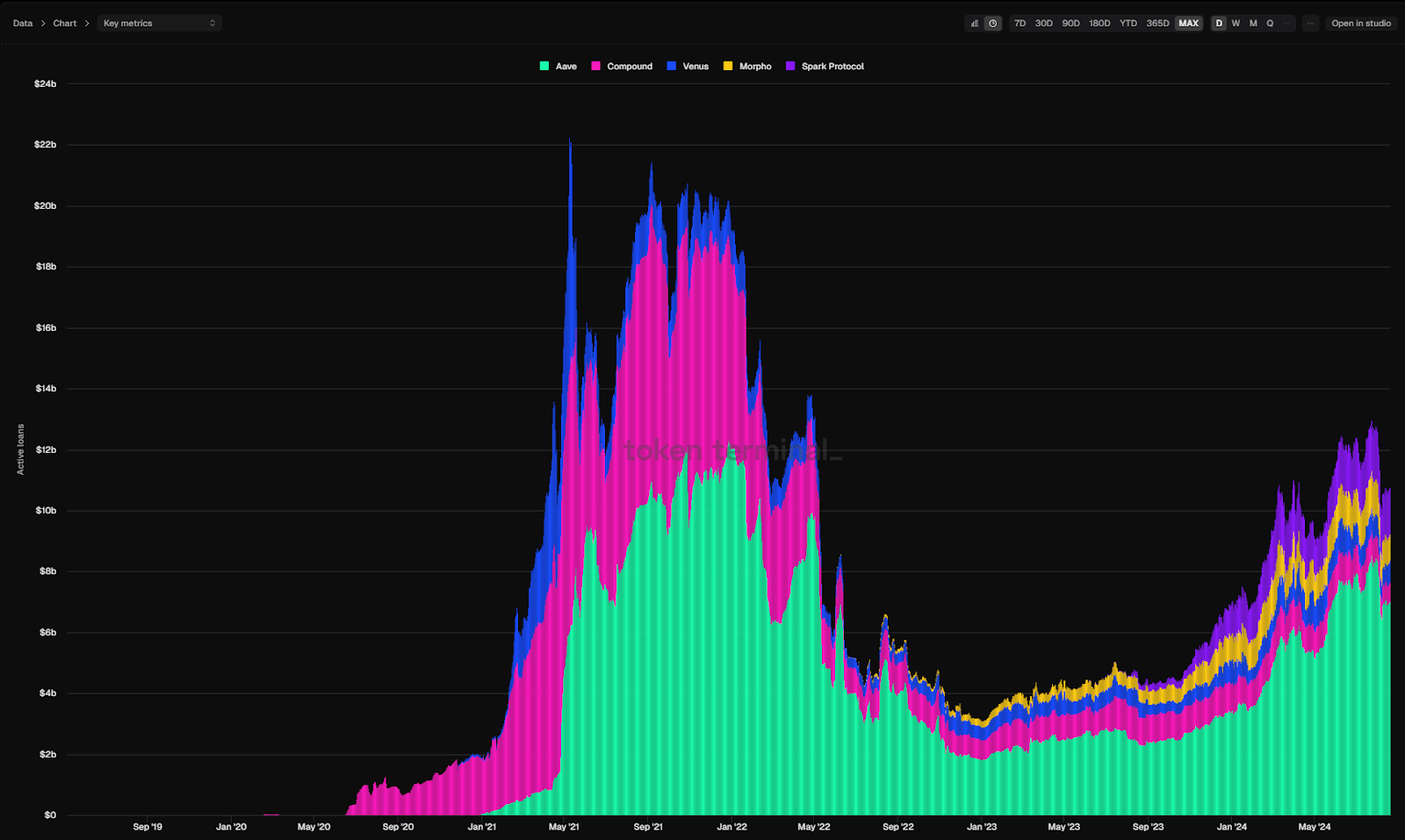

Contrast this with platforms like Aave or Kraken’s DeFi Earn vaults, where rewards fluctuate with market conditions but lack loyalty premiums. On-chain loyalty staking platforms such as ElevateFi on Polygon integrate dynamic inflation controls and leadership incentives, audited for security. Their model compounds yields automatically while rewarding extended commitments, addressing opaque emissions that plague many protocols. Fuul takes it further, enabling projects to customize points or token rewards based on stake size and duration, democratizing incentive design.

Unpacking the Tokenomics of Long-Term Staking Incentives

At its core, long-term staking incentives rely on vested emissions schedules tied to renewal events. Smart contracts track uninterrupted stake histories via on-chain merkle proofs or NFT badges representing loyalty tiers. This verifiable persistence prevents gaming, unlike off-chain points systems prone to manipulation. For protocols, it slashes acquisition costs: retaining one loyal staker costs less than onboarding five churners. Formo’s analysis of DeFi incentives reveals campaigns with renewal hooks drove 30-50% higher retention, fueling organic growth.

“Understand the why before the buy: loyalty staking isn’t about max APY today, but sustainable alpha tomorrow. ” – Tessa Rowland

Consider the math. Base stake yields 10% APY. A renewal bonus adds 5% per cycle, capped at 25%. After five seamless renewals, effective yield hits 35% – all while securing the network. Risks persist – impermanent loss in LP staking variants, smart contract vulnerabilities – but audited frameworks like ElevateFi’s mitigate these. Platforms now blend this with governance: long-term stakers earn amplified voting power, embedding loyalty into decision-making.

Case Studies: Platforms Pioneering Token Loyalty Programs

Ether. fi’s pivot from seasonal drops to Member Rewards exemplifies the trend. By targeting renewals, they counter restaking fragmentation, collaborating with partners for cross-protocol bonuses. ElevateFi’s Polygon deployment introduces DAO-voted inflation curves, where community proposals fine-tune renewal multipliers based on TVL thresholds. Fuul’s toolkit lets any project launch custom token loyalty programs, rewarding stakers with project-specific points redeemable for airdrops or fee shares. These aren’t isolated; they’re part of a DeFi renaissance prioritizing depth over breadth. For more on retention impacts, explore how on-chain loyalty staking boosts user retention for DeFi projects.

Investors eyeing these opportunities should scrutinize emission sustainability. Unsustainable token dumps erode trust; loyalty models counter this by velocity-dampening mechanics. As DeFi matures, expect hybrid variants merging loyalty staking with liquid restaking tokens, amplifying composability without sacrificing commitment rewards.

Hybrid models like these could redefine token loyalty programs, where loyalty NFTs unlock cross-chain yields or governance multipliers. Picture staking on one chain, renewing on another, with bonuses accruing seamlessly via layer-zero protocols. This composability addresses DeFi’s silos, drawing in sophisticated capital that values persistence over pumps.

Navigating Risks in Loyalty-Driven DeFi Staking

Renewal bonuses sound irresistible, yet DeFi demands vigilance. Smart contract exploits remain the elephant in the room – even audited code like ElevateFi’s isn’t bulletproof against novel attacks. Impermanent loss hits harder in volatile LP positions tied to loyalty stakes, while token dilution from emissions can undercut real yields if governance falters. I’ve seen protocols inflate rewards short-term, only to crash user confidence when unlocks flood markets.

Standard DeFi Staking vs On-Chain Loyalty Staking

| Feature | Standard (e.g., Aave) | Loyalty (e.g., ether.fi/ElevateFi) |

|---|---|---|

| Base APY | Variable, market-driven yields | Variable base + loyalty multipliers |

| Renewal Bonuses | ❌ None | ✅ Yes, e.g., ether.fi Member Rewards (7.5M ETHFI tokens, Jun-Aug 2025) |

| Retention Boost | Limited | High 🚀 via duration-based incentives & automated compounding |

| Governance Perks | Basic token voting (if applicable) | Enhanced DAO governance & leadership incentives |

| Risk Profile | Smart contract risks, volatility | Similar; mitigated by audits, dynamic inflation controls |

That said, loyalty staking’s on-chain verifiability trumps opaque systems. Platforms mitigate risks through timelocks on bonuses, slashing for early exits, and insurance integrations. Fuul’s customizable incentives let projects tie rewards to proven metrics like consecutive epochs, filtering out speculators. My take: prioritize protocols with battle-tested treasuries and active DAOs. Short-term yields dazzle, but long-term staking incentives build empires.

Regulatory shadows loom too. As staking blurs into securities territory, jurisdictions may scrutinize renewal-locked tokens. Yet blockchain’s pseudonymity and global access keep DeFi resilient. Investors should diversify across chains – Polygon for ElevateFi’s efficiency, Ethereum for ether. fi’s liquidity – balancing exposure without overcommitting.

Getting Started: Your Path to DeFi Loyalty Rewards

Embarking on on-chain loyalty staking starts with wallet setup: MetaMask or WalletConnect to a platform like ether. fi. Deposit eligible tokens, select stake duration, and monitor renewals via dashboard. Automate with bots for seamless extensions, claiming bonuses at cycle ends. Track via explorers like Etherscan for merkle proofs confirming your tier. Pro tip: start small, test renewals, then scale as multipliers kick in. For enthusiasts chasing peak returns, check how on-chain loyalty staking maximizes DeFi rewards for long-term crypto holders.

Tools like Zapper or DeFiLlama aggregate loyalty metrics, revealing top performers. Pair with hardware wallets for security, and always simulate unstakes to grasp penalties. This methodical approach turns abstract incentives into tangible alpha.

The Road Ahead for Staking Renewal Bonuses

Looking to 2026, expect AI-optimized renewals predicting optimal cycles, or social-fi layers where community referrals boost personal bonuses. Protocols will integrate with RWAs, staking fiat yields alongside crypto for hybrid loyalty. Fuul’s flexibility positions it as infrastructure kingpin, powering bespoke programs across ecosystems.

DeFi’s mercenary days wane as loyalty staking proves its mettle. Ether. fi’s 7.5 million ETHFI allocation isn’t anomaly; it’s blueprint. Platforms rewarding conviction over churn will dominate TVL charts, nurturing ecosystems where holders thrive long after hype fades.

Stake smart, renew stronger. In DeFi, loyalty isn’t just rewarded – it’s engineered for outperformance.