In 2026, Ethereum hovers at $1,956.95, a slight dip of $15.35 or 0.78% over the past 24 hours, yet this volatility masks a booming era for long-term DeFi HODLers. On-chain loyalty staking has matured into a powerhouse, blending DeFi HODL rewards with seamless yield generation. Platforms now reward unwavering holders not just with base APYs, but through composable mechanisms that amplify returns without sacrificing liquidity. Forget idle wallets; today’s crypto holder rewards turn commitment into compounded gains.

For the strategic investor, this shift demands attention. Traditional staking locked assets in silos, but innovations like liquid staking tokens (LSTs) from Lido and Rocket Pool change the game. Stake ETH, receive stETH or rETH, and deploy them across DeFi for layered yields: lending on Aave, liquidity on Uniswap, or collateral in credit protocols. This composability, central to 2026’s DeFi landscape, lets HODLers earn staking rewards while chasing long-term staking incentives. In my eight years bridging forex and crypto, I’ve seen few strategies match this capital efficiency.

LSTs: The Backbone of Loyalty Token Staking

LSTs automate reward accrual via smart contracts, calibrated to holding duration and volume. Platforms prioritize on-chain loyalty staking by tiering benefits: base APY for entry-level locks, escalating to premium yields for multi-year commitments. Take Lido’s stETH; it mirrors ETH’s staking rewards but trades freely, avoiding the staking starvation of on-chain credit markets noted by Galaxy Research. Holders sidestep opportunity costs, as LSTs fuel lending liquidity that scales DeFi further.

Yet, opinion divides on risks. Reddit discussions highlight how concentrated staking swells holder supply, potentially sidelining active chain users. I counter: diversified LST adoption mitigates this, fostering broader participation. Figment’s institutional-grade staking underscores the appeal for serious HODLers, putting tokens to work securely.

Yield Optimizers Redefining HODLer Strategies

Enter Stakeledger. io, a non-custodial unifier slicing through multi-chain complexity. It auto-optimizes yields across Ethereum, Bitcoin DeFi, and beyond, delivering loyalty token staking without manual rebalancing. For HODLers eyeing 2026, this means tapping networks like RootstockCollective, where staked tokens fund Bitcoin builders directly. Rewards compound via ecosystem grants, blending passive income with active network growth.

MEXC and Milk Road rank top platforms emphasizing liquidity and on-chain control, vital as APYs climb. PixelPlex notes staking as the base for wallet rewards, unlocking tiers for high-value holders. Track meticulously, per Onchain Accounting, to maximize growth and tame taxes. My take: ignore these tools at your peril; they turn HODLing from speculation to strategy.

Ethereum (ETH) Price Prediction 2027-2032

Projections under On-Chain Loyalty Staking Rewards for Long-Term DeFi HODLers, Factoring LST Yields and Market Cycles (Baseline: 2026 Avg $1,957)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,500 | +115% |

| 2028 | $3,500 | $5,800 | $9,000 | +38% |

| 2029 | $4,500 | $7,500 | $12,000 | +29% |

| 2030 | $6,000 | $10,000 | $16,000 | +33% |

| 2031 | $8,000 | $13,000 | $21,000 | +30% |

| 2032 | $10,000 | $16,500 | $27,000 | +27% |

Price Prediction Summary

Ethereum (ETH) is forecasted to experience robust growth from 2027 to 2032, propelled by loyalty staking rewards, LST composability (e.g., stETH, rETH), and DeFi adoption. Average prices are projected to rise from $4,200 in 2027 to $16,500 by 2032, with maxima up to $27,000 in bullish scenarios driven by institutional inflows and network upgrades, and minima reflecting potential bearish corrections amid regulatory or competitive pressures.

Key Factors Affecting Ethereum Price

- Enhanced LST adoption (stETH, rETH) for yield optimization and DeFi composability

- Institutional staking platforms like Figment and Stakeledger boosting liquidity

- Ethereum scalability upgrades enabling higher throughput and lower fees

- Market cycles post-Bitcoin halvings amplifying ETH bull runs

- Regulatory clarity fostering long-term HODLing and DeFi participation

- Competition from L1 rivals and staking yield fluctuations

- Broader DeFi trends toward loyalty rewards for sustained holders

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Risks in High-Yield Loyalty Programs

High APYs, from 100% and touted by DeFi innovators, lure but demand scrutiny. AMBCrypto’s top 2026 platforms balance custody simplicity with DeFi flexibility, yet slashing risks and impermanent loss persist. CLS Blue Sky Blog champions on-chain units for precise, automated disbursements tied to equity-like holding. For long-term players, the edge lies in protocols rewarding consistency over speculation. See how on-chain loyalty staking maximizes DeFi rewards; it’s engineered for endurance.

Bitcoin DeFi’s rise adds layers. Rootstock enables staking that backs developers, yielding both tokens and influence. As ETH stabilizes near $1,956.95, these incentives position HODLers to capture macro shifts I’ve long tracked: from traditional markets to blockchain loyalty engines.

Strategic HODLers layer defenses: diversify across LSTs, monitor slashing via dashboards, and hedge with stablecoin positions. Onchain Accounting’s best practices shine here, automating reward tracking to streamline taxes and spotlight underperformers. In volatile times, with ETH at $1,956.95, this precision separates winners from sidelined holders.

Tiered Incentives: Unlocking Premium DeFi HODL Rewards

2026’s protocols tier long-term staking incentives aggressively. Base APYs lure newcomers, but loyalty ladders reward veterans: 6-month locks yield 4-6%, scaling to 12-20% for two-year vows, per Milk Road benchmarks. PixelPlex wallets exemplify this, basing tiers on locked volume to crown high-value participants. RootstockCollective innovates further, channeling stakes into Bitcoin DeFi grants; backers earn yields plus governance sway, turning passive holding into ecosystem fuel.

Opinion: This gamifies commitment without veblen excess. I’ve advised traders ditching spot holds for these structures, capturing 2-3x multipliers absent in plain HODLing. Platforms like Stakeledger. io automate cross-chain tiering, dodging silos that plagued 2024.

Top 5 Loyalty Staking Strategies

-

LST Layering: Stake ETH at $1,956.95 via Lido for stETH, then deploy in Aave or Uniswap for compounded DeFi yields.

-

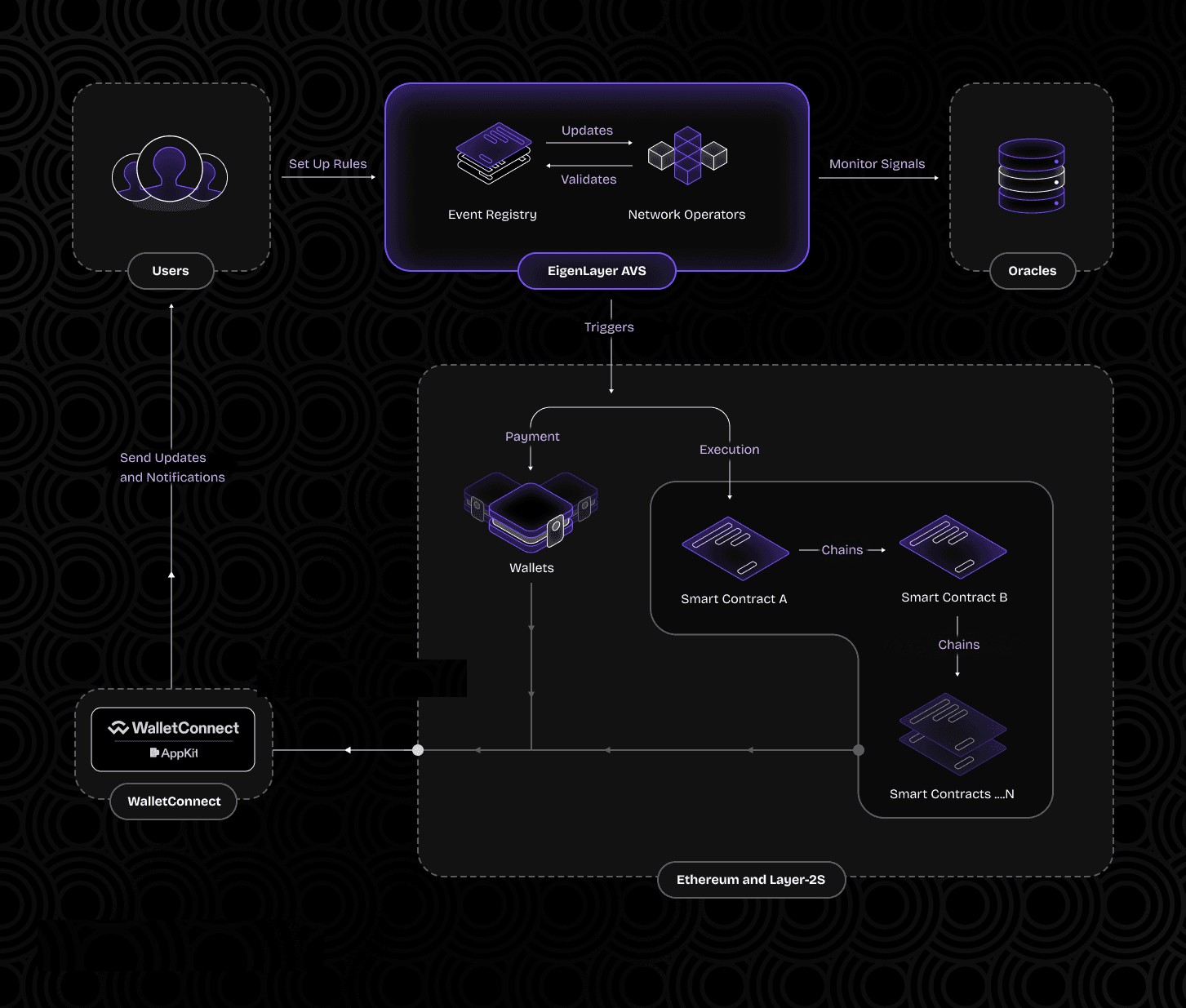

Restaking: Use EigenLayer to restake LSTs like stETH, securing AVSs for extra rewards beyond base staking APY.

-

Tiered Locks: Lock assets longer on Rocket Pool (rETH) or Lido for boosted APYs, rewarding HODL commitment.

-

veToken Boosts: Lock CRV as veCRV on Curve for voting power and up to 2.5x gauge reward multipliers.

-

Bitcoin DeFi Backing: Stake BTC via RootstockCollective to fund builders, earning on-chain loyalty rewards.

Building Your 2026 Loyalty Staking Portfolio

Assemble with intent. Allocate 40% to ETH LSTs for core stability, 30% to multi-chain optimizers like Stakeledger, 20% to Bitcoin DeFi stakes via Rootstock, and 10% to experimental high-APY pools vetted by MEXC lists. Rebalance quarterly, eyes on Galaxy’s stake-lending tensions; LSTs resolve this by injecting liquidity precisely where DeFi hungers.

Figment’s institutional lens appeals to scale players, securing idle tokens against retail pitfalls. Track via unified dashboards, compounding crypto holder rewards into flywheels. As ETH holds $1,956.95 amid dips, these portfolios weather storms, poised for macro reversals I’ve forecasted from forex parallels.

AMBCrypto’s January rankings spotlight hybrids blending custody ease with DeFi composability, ideal for HODLers scaling beyond silos. Business of Business flags 1000% APYs in nascent projects, but I urge restraint: chase audited yields over hype.

The Road Ahead for Loyalty-Driven DeFi

Expect evolution. On-chain units, per CLS Blue Sky, will standardize equity-like rewards, automating disbursements for ironclad loyalty. Reddit’s supply concentration fears? Mitigated by LST liquidity, ensuring active users thrive alongside stakers. On-Chain Loyalty Staking cements as the DeFi retention engine, boosting engagement as detailed here.

For HODLers, 2026 mandates adaptation: stake smart, layer yields, claim tiers. Platforms reward the steadfast, transforming ETH’s $1,956.95 base into exponential engines. My philosophy holds: adapt to change, capitalize on opportunity. Position now; the compounding awaits.