As Solana’s ecosystem thrives with Binance-Peg SOL trading at $84.17, up $0.69 in the last 24 hours, DeFi users have a prime opportunity to lock in rewards through on-chain loyalty staking. This approach blends traditional staking with loyalty incentives, letting you earn passive yields while supporting projects you believe in long-term. In 2026, Solana’s high-speed blockchain makes it ideal for these strategies, where liquid staking tokens (LSTs) keep your capital working across DeFi without sacrificing staking rewards.

Solana staking starts simple: delegate SOL to validators for base rewards around 5-7% APY, but loyalty staking elevates this by layering project-specific incentives. Protocols reward consistent holders with bonus tokens, airdrops, or boosted yields, turning holders into advocates. With SOL at $84.17, even modest stakes compound impressively over time, especially when paired with DeFi composability.

Why Liquid Staking Tokens Are Key to Solana Loyalty Strategies

LSTs like JitoSOL and STKESOL redefine staking by providing liquidity. Stake SOL, receive an LST, and deploy it in lending, trading, or vaults while earning staking rewards. JitoSOL stands out, capturing MEV for extra yields that often exceed 8% APY, integrating seamlessly with Raydium and Orca. This liquidity fuels DeFi loyalty rewards 2026, as projects use LSTs for gated access to exclusive pools or multiplier boosts for loyal stakers.

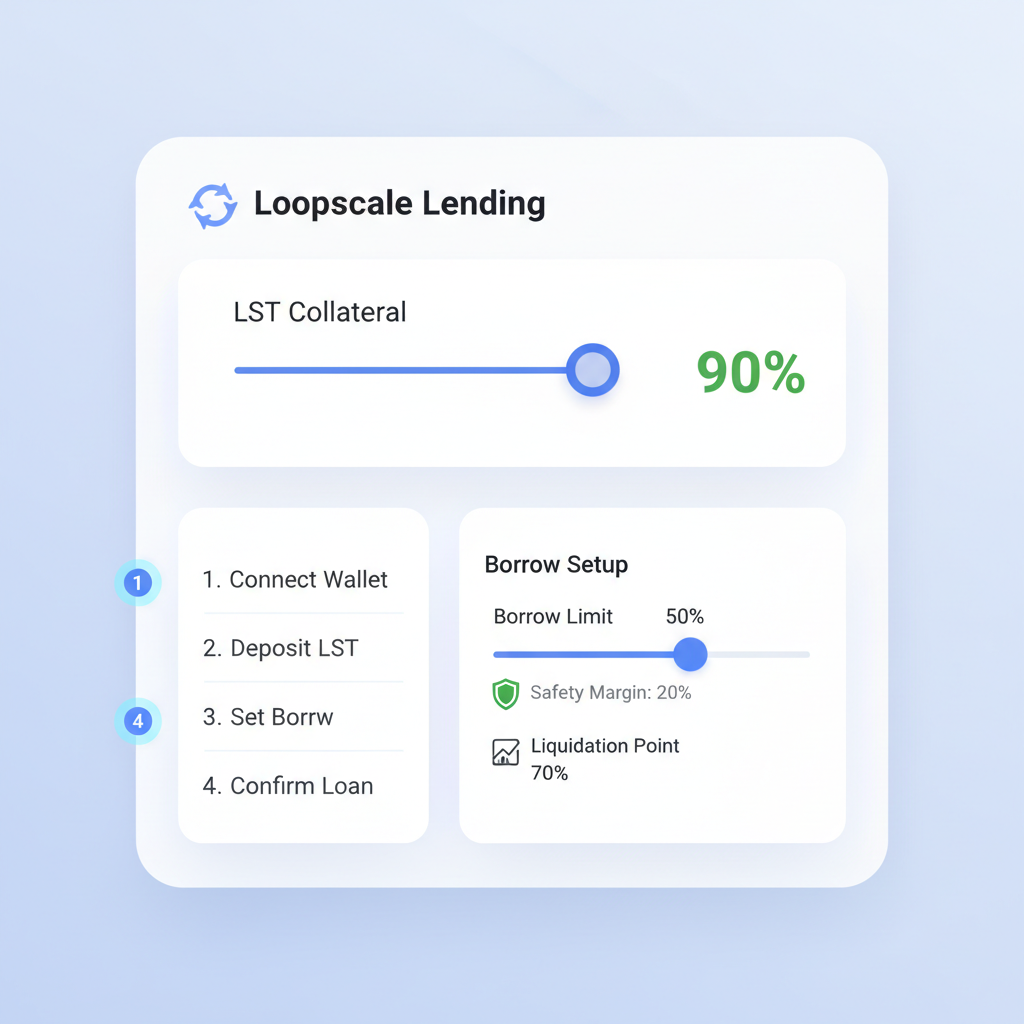

Consider STKESOL from SOL Strategies: over 500,000 SOL staked at launch, now collateral on Kamino and Loopscale. Users borrow against it or join yield strategies, maximizing capital efficiency. Forward Industries’ fwdSOL targets institutions but benefits retail too, offering stable yields amid volatility. These tools address the tension between staking lockups and DeFi opportunities, narrowing the yield gap as noted in recent Galaxy Research.

Leveraging Kamino Finance for Automated Loyalty Yields

Kamino Finance shines for hands-off users. Its vaults automate liquidity provision, rebalancing for optimal returns. Deposit LSTs into ‘set-and-forget’ strategies, earning from fees, rewards, and lending simultaneously. In 2026’s top DeFi apps, Kamino ranks high for yield optimization, perfect for Solana staking incentives.

Picture this: stake SOL to JitoSOL ($84.17 entry), supply to Kamino vault, and watch compounded rewards roll in. Loyalty comes via points systems or partner airdrops, rewarding long-term commitment. Hylo’s acceleration of Solana DeFi adds momentum, with roadmap features enhancing cross-protocol staking.

| LST | Key Feature | Integration |

|---|---|---|

| JitoSOL | MEV Boost | Raydium, Orca |

| STKESOL | High TVL | Kamino, Loopscale |

| fwdSOL | Institutional | Borrowing Markets |

This table spotlights why LSTs dominate top Solana liquid staking lists. Delegation-based native staking secures the network, but LSTs unlock crypto loyalty programs staking.

Crafting Long-Term DeFi Staking Strategies with Loyalty Focus

For sustained gains, prioritize protocols with governance tokens that accrue value to stakers. JUP and BONK from the ecosystem complement LST positions, but focus on LST-centric plays. Combine with on-chain credit markets: borrow against LSTs at low rates, deploy elsewhere for arbitrage. Reduced inflation narrows DeFi-staking spreads, making hybrid strategies compelling.

Start small: allocate 20% portfolio to LSTs, monitor via dashboards. As SOL holds $84.17 amid gains, timing favors bulls. Platforms like those in top 2026 staking lists emphasize liquidity and control, aligning with long-term DeFi staking strategies. Check Solana loyalty lessons for retention tactics projects use, mirroring user benefits.

Solana (SOL) Price Prediction 2027-2032

Bullish outlook driven by DeFi staking growth, liquid staking innovations, and ecosystem expansion from 2026 baseline (~$84)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $130.00 | $200.00 | $350.00 | +100% |

| 2028 | $220.00 | $380.00 | $650.00 | +90% |

| 2029 | $320.00 | $580.00 | $950.00 | +53% |

| 2030 | $450.00 | $820.00 | $1,350.00 | +41% |

| 2031 | $620.00 | $1,100.00 | $1,800.00 | +34% |

| 2032 | $800.00 | $1,400.00 | $2,300.00 | +27% |

Price Prediction Summary

Solana’s price is projected to experience substantial growth from 2027 to 2032, fueled by on-chain loyalty staking strategies, liquid staking tokens (LSTs) like STKESOL and JitoSOL, and DeFi integrations. Average prices could rise from $200 in 2027 to $1,400 by 2032, reflecting bullish market cycles, increased adoption, and capital efficiency improvements, with min/max ranges accounting for bearish corrections and optimistic surges.

Key Factors Affecting Solana Price

- Rapid expansion of Solana DeFi apps (e.g., Kamino, Hylo) and liquid staking protocols boosting TVL and yields

- Institutional adoption via LSTs like fwdSOL and STKESOL, enhancing liquidity and collateral use

- Network upgrades reducing inflation, narrowing DeFi-staking yield gaps, and improving scalability

- Bullish market cycles post-2026 recovery, regulatory clarity, and competition with Ethereum L2s

- Macro factors: Bitcoin halving cycles, global crypto adoption, and Solana’s high TPS for real-world use cases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Hybrid approaches shine brightest, where loyalty staking meets automated vaults. Kamino’s structured products let you deposit JitoSOL or STKESOL, capturing fees from swaps alongside staking yields. This setup often pushes total APY past 10-12% in bull markets, far outpacing plain delegation. I favor these because they reward patience: hold longer, unlock multipliers via points or governance votes. Solana’s top ecosystem tokens like JUP amplify this, as liquidity mining pairs well with LST collateral.

Risks and Mitigation in High-Yield Loyalty Plays

No strategy thrives without addressing downsides. Smart contract vulnerabilities top the list, though audited protocols like Jito and Kamino minimize exploits. LST depegging risks exist if redemption pressures mount, but with SOL steady at $84.17 and TVL surging, stability holds. Inflation tweaks narrow staking-DeFi spreads, per Galaxy insights, so diversify across LSTs to hedge validator slashing or MEV volatility. Overcollateralize borrows on Loopscale, keeping loan-to-value under 50% for safety.

Opinion: Skip custodial platforms; on-chain control defines true DeFi loyalty. Top 2026 staking pools emphasize this, blending security with flexibility. Forward’s fwdSOL proves institutions validate the model, trickling benefits to retail via deeper liquidity.

Top Solana LST Yields #3

| LST | Est. APY | Risk Level |

|---|---|---|

| JitoSOL | 8-12% | Low 🚀 |

| STKESOL | 7-10% | Medium ⚠️ |

| fwdSOL | 6-9% | Low 📈 |

Monitor these metrics weekly. Tools from eco. com’s DeFi app guide help track real-time performance, ensuring your on-chain loyalty staking Solana stays optimized.

Implementing Your 2026 Loyalty Staking Blueprint

Solana’s delegation roots make entry barrier-free, but mastery demands layering. Pair LSTs with Kamino vaults for passive compounding, then stake governance tokens for loyalty bonuses. Hylo’s 2026 roadmap promises interoperability boosts, letting one stake fuel rewards across apps. With Binance-Peg SOL at $84.17 after a 0.008270% 24-hour gain, capital deployment now compounds quickest.

Follow this, and you’ll capture base staking, MEV, fees, and project airdrops. I’ve seen users double effective yields this way, turning $10,000 SOL stakes into $1,500 and annual rewards at current rates. Explore DeFi user maximization tactics for deeper dives.

Projects innovate too: loyalty buybacks mirror user incentives, retaining holders via tokenomics. Read project retention strategies to spot protocols emulating this. BONK and Raydium integrations hint at ecosystem-wide shifts, where Solana staking incentives evolve into full loyalty ecosystems.

Ultimately, on-chain loyalty staking transforms passive holding into active allegiance. With SOL’s resilience at $84.17, high from $81.84 and peaking $85.27 recently, 2026 favors the prepared. Dive into liquid staking lists, automate via Kamino, and layer incentives relentlessly. Your portfolio will thank you as rewards compound in Solana’s thriving DeFi frontier.