In the fast-paced DeFi landscape, where short-term gains often steal the spotlight, on-chain loyalty staking renewal bonuses stand out as a smart strategy for those committed to the long haul. These incentives reward users who renew their stakes over extended periods, stacking cumulative APY DeFi boosts that can transform modest holdings into substantial yields. Imagine locking your tokens not just once, but repeatedly, each renewal unlocking higher long-term staking rewards and loyalty token incentives that centralized platforms like Kraken’s 8% APY or Coinbase’s 14% can’t match.

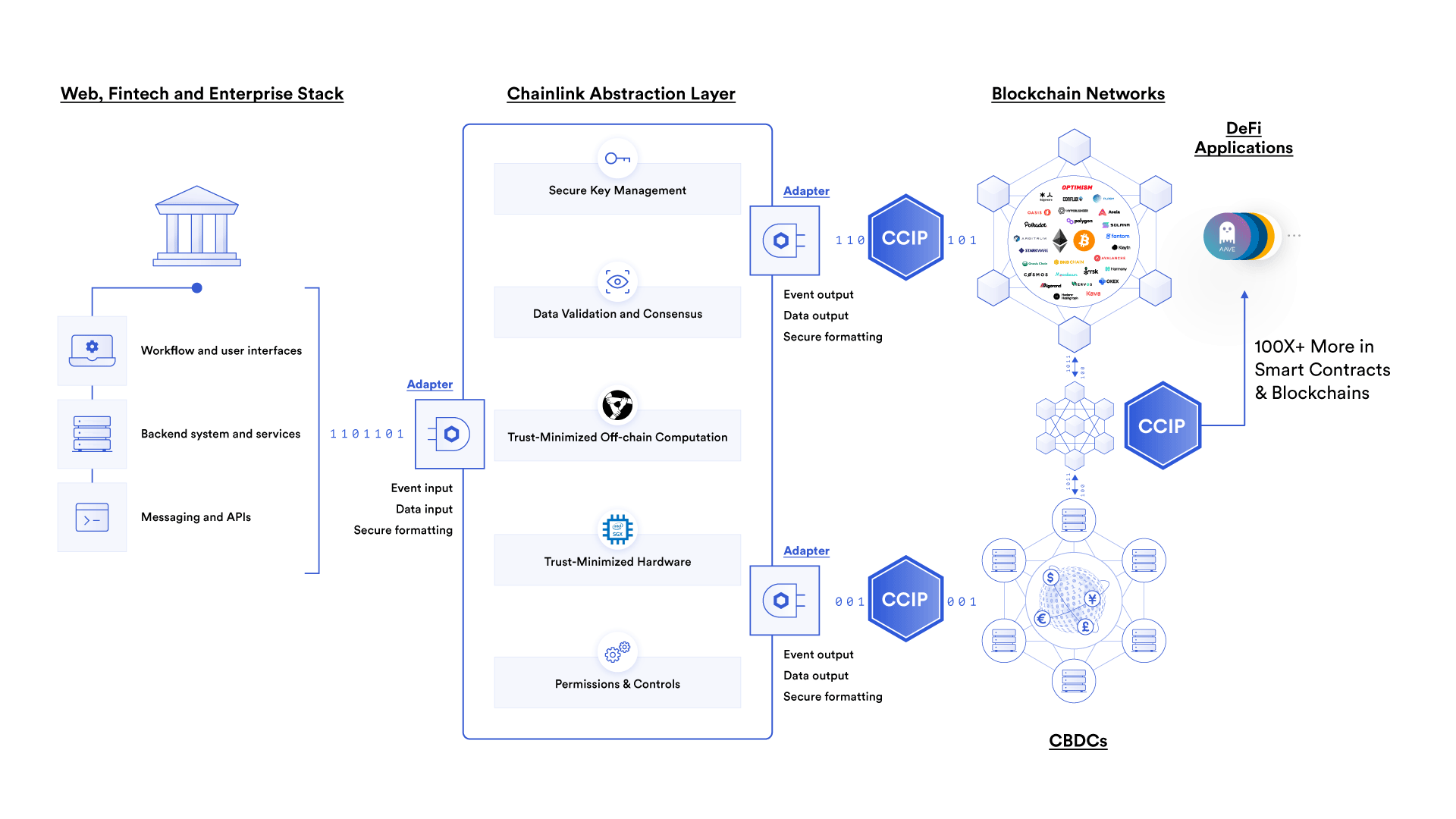

What makes these bonuses compelling is their alignment with network health. By encouraging prolonged commitments, protocols foster stability, reduce sell pressure, and amplify security; much like Chainlink stakers bolstering cryptoeconomic safeguards. I’ve seen firsthand how such mechanisms turn casual participants into dedicated holders, optimizing portfolios in ways traditional staking falls short.

Unlocking Higher Yields Through Staking Renewal Bonuses

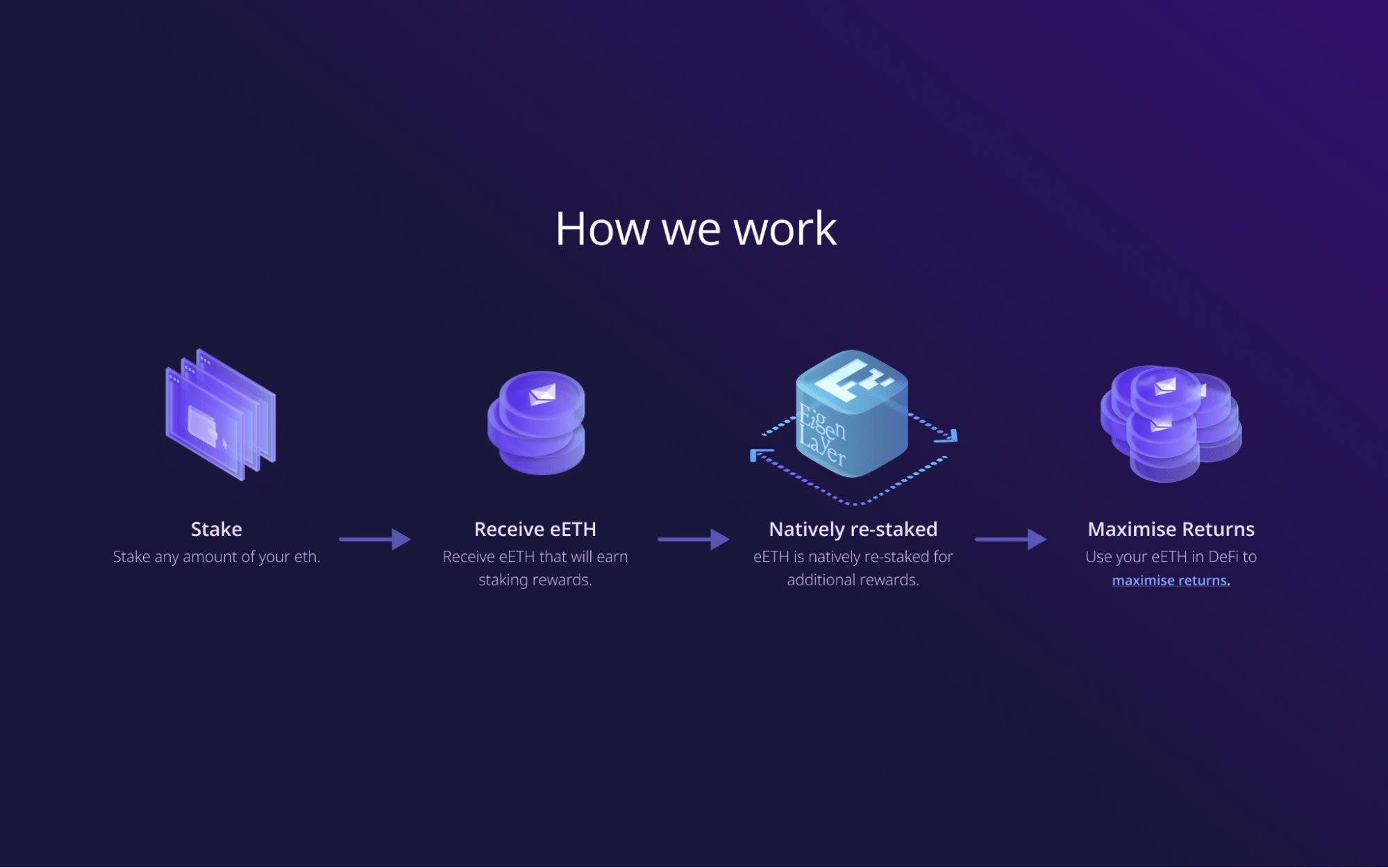

At their core, staking renewal bonuses operate on a tiered system, where each renewal period compounds rewards. Platforms layer base APYs with multipliers for loyalty; for example, extending from 12 to 48 months might double or triple returns. This isn’t mere hype; it’s a calculated nudge toward sustained engagement, echoing Avalanche’s BOOST program that juices liquidity incentives for key protocols.

Consider the mechanics: upon renewal, smart contracts automatically apply bonus multipliers based on cumulative lock-up time. This creates a flywheel effect, where longer holds yield exponentially better APY, deterring impulsive exits during market dips. As a portfolio manager, I advocate this approach because it merges fundamental loyalty with technical precision, far surpassing generic yield farming seen on De. Fi listings.

Top Loyalty Staking Benefits

-

Higher Compounded APY for renewals: FLOKI offers 39.44% APY on 48-month stakes, boosting long-term yields.

-

Enhanced Network Security via long locks: Extended staking like Chainlink’s secures the network with timely alerts and rewards.

-

Exclusive Loyalty Tokens: Platforms reward renewals with bonus tokens, as in Avalanche BOOST incentives for key protocols.

-

Reduced Volatility Exposure: Long-term locks shield holders from market swings while earning steady APY up to 14% on Coinbase.

-

Tiered VIP Perks: Brainedge’s Diamond tier delivers 144% APY equivalent, unlocking elite protocol benefits.

These bonuses shine brightest for DeFi investors eyeing real yield over speculative flips. Platforms like those highlighted in Binance’s top staking lists integrate them seamlessly, letting users ladder stakes for optimized cash flow without constant monitoring.

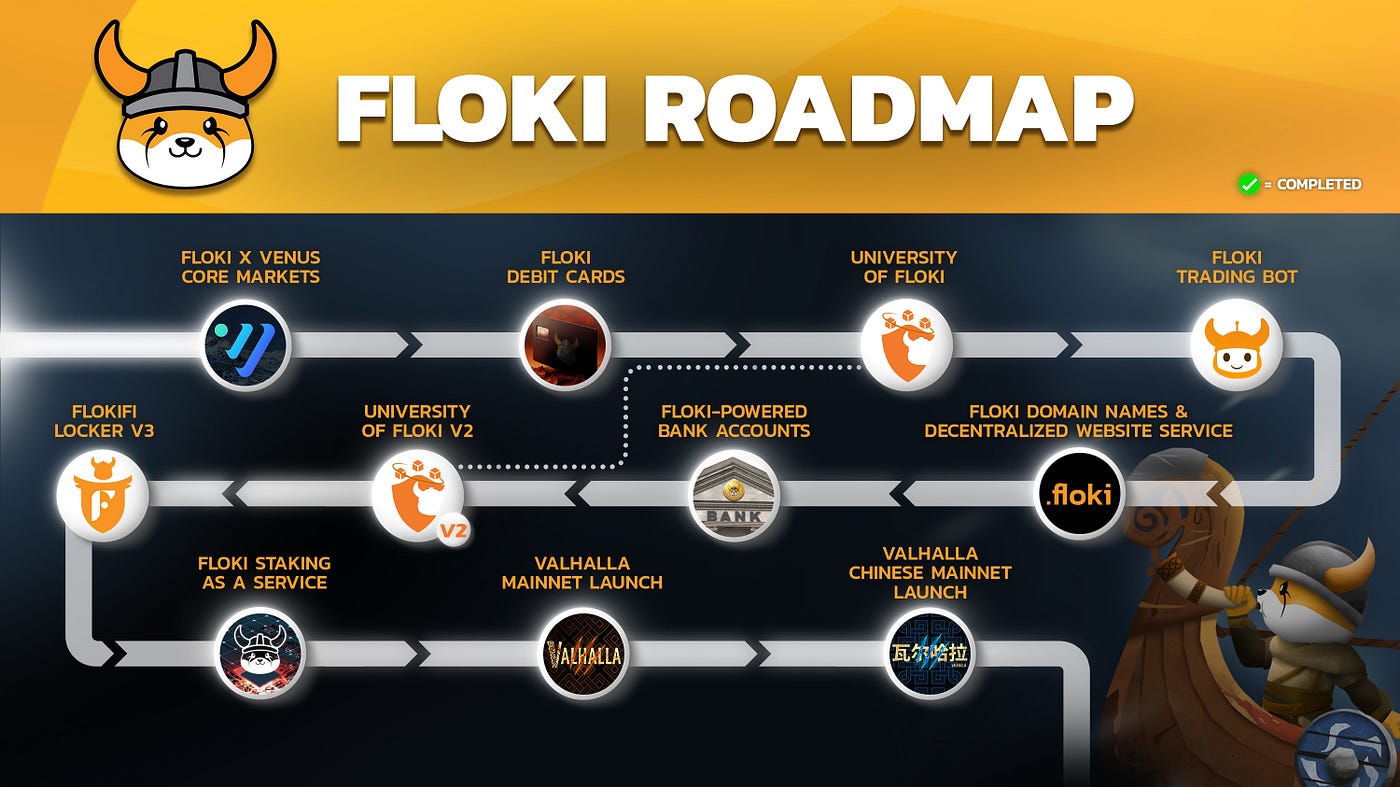

Real-World Protocols Leading the Loyalty Charge

Leading the pack, FLOKI’s staking protocol exemplifies excellence with its tiered rewards: a staggering 39.44% APY for 48-month commitments. This isn’t an outlier; it’s a blueprint for on-chain loyalty staking that prioritizes endurance. Similarly, Brainedge’s Diamond bonus tier delivers the equivalent of 144% APY for escalating lock intervals, drawing high-value holders who value depth over breadth.

Longer commitments don’t just pad your wallet; they fortify the ecosystem, creating a virtuous cycle of growth and resilience.

Compare this to P2P. org’s staking-as-a-business model or PixelPlex’s wallet rewards, where base APYs form the foundation but lack the renewal punch. On-Chain Loyalty Staking elevates this by embedding bonuses directly into the protocol, ensuring transparency via blockchain verifiability. For projects, it’s a retention powerhouse; check out how on-chain loyalty staking boosts user retention for DeFi projects.

Crafting Your Strategy for Cumulative APY Gains

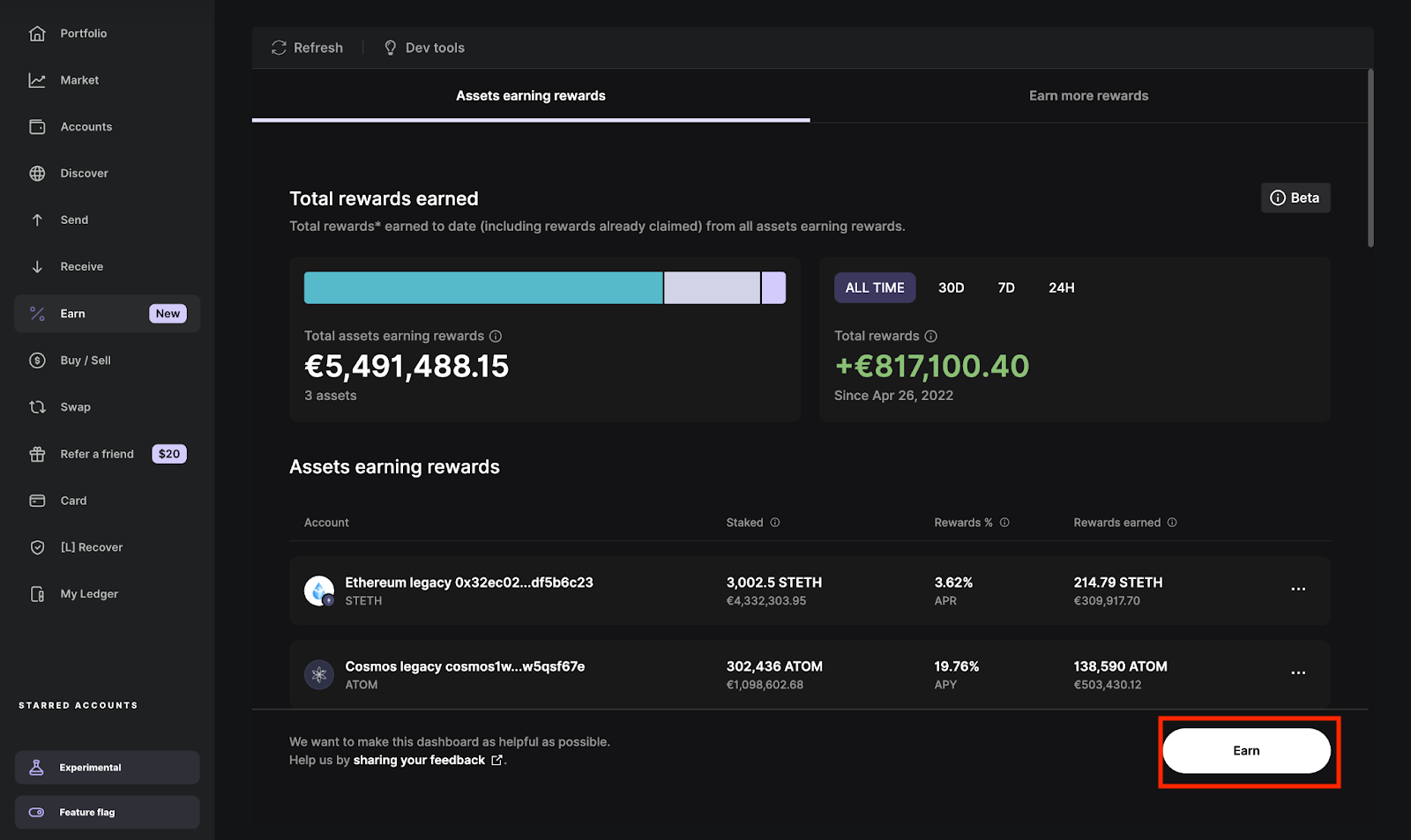

To harness these staking renewal bonuses, start by assessing your risk tolerance and project conviction. Select protocols with proven track records, like those offering audited smart contracts and clear tier ladders. Diversify across chains; Avalanche’s higher staking rewards, up to 50% above peers per Milk Road, pair well with loyalty boosters.

Opinion: Skip the FOMO-driven farms peddled on Crypto Adventure lists. True alpha lies in patient plays where renewals compound quietly. Learn more on how on-chain loyalty staking maximizes DeFi rewards for long-term crypto holders. Position yourself early, renew strategically, and watch your yields soar as loyalty pays dividends, literally.

Layer in tools like automated renewal scripts or dashboards from platforms akin to De. Fi for tracking tier progress without daily oversight. This hands-off approach lets cumulative APY DeFi work its magic, turning time into tangible gains.

Navigating Risks and Maximizing Renewal Success

Every yield chase carries hurdles, and on-chain loyalty staking is no exception. Impermanent loss in liquidity pools or smart contract vulnerabilities top the list, yet audited protocols with renewal bonuses mitigate these through proven resilience. I’ve managed portfolios through 2022’s crypto winter; those locked in long-term stakes emerged stronger, their loyalty token incentives buffering downturns better than spot holders.

Smart risk management means allocating no more than 20-30% per protocol, staggering renewal dates to capture liquidity during upswings. Platforms echoing Chainlink’s security model or Coinbase’s boosted rewards via memberships offer guardrails, but on-chain versions outpace them with decentralized purity. Opinion: Renewal bonuses aren’t gambles; they’re insurance against FUD-driven sells, rewarding conviction with outsized long-term staking rewards.

Comparison of Top Protocols’ Staking Renewal Bonuses

| Protocol | Max Lock Period | Peak APY | Bonus Multiplier |

|---|---|---|---|

| FLOKI | 48 months | 39.44% | Tiered Loyalty Boost |

| Brainedge | Diamond Tier | 144% (equiv.) | Diamond Tier Bonus |

| Avalanche BOOST | Varies | Up to 1.5x base (50% higher) | Liquidity Incentives |

| Chainlink | N/A | Varies | Security Rewards |

Transparency reigns supreme here. Every bonus accrual lives on-chain, verifiable by anyone, unlike opaque CeFi yields. This verifiability builds trust, pulling in institutions eyeing DeFi’s maturation. For community-driven projects, it’s a game-changer; explore how on-chain loyalty staking maximizes rewards for DeFi users.

The Future of Loyalty-Driven DeFi Yields

Looking ahead, renewal bonuses will evolve with cross-chain interoperability, letting you ladder stakes across ecosystems for hyper-optimized yields. Imagine porting FLOKI-like 39.44% APYs to Avalanche’s boosted pools seamlessly. Trends from PixelPlex and P2P. org hint at this: staking as loyalty’s backbone, evolving into business-grade tools for protocols.

Patient capital doesn’t just survive bull and bear markets; it shapes them, fueling the DeFi renaissance through unwavering support.

Projects adopting these mechanics see retention soar, as Binance’s staking rankings underscore. Users gain not just yields, but status: VIP access, governance weight, airdrop priorities. As a blockchain educator, I urge you to dive in. Start small, renew boldly, and let staking renewal bonuses propel your portfolio toward financial sovereignty.

Equip yourself with knowledge, stake with purpose, and thrive in DeFi’s loyalty economy. Your commitment today compounds into tomorrow’s freedom.